Annex 22 A: Admission Document

advertisement

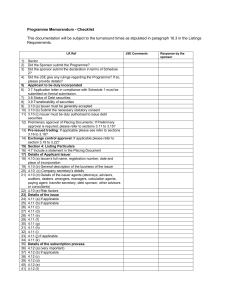

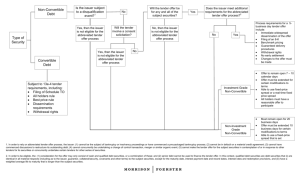

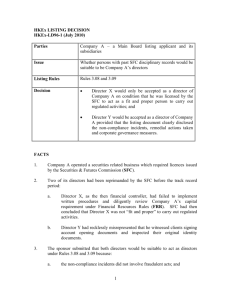

ANNEX 22Α THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR ATTENTION. If you need any explanations and / or any clarifications on this Admission Document you should consult an independent financial adviser who holds a license to provide investment advice by the SEC if you’re taking advice in Cyprus (or other suitably qualified independent financial advisor if you’re outside Cyprus). ISSUER NAME LOGOTYPO APPLICATION FOR ADMISSION OF MUNICIPALITY BONDS TO NON-REGULATED MARKET OF THE CSE [ΕMERGING COMPANIES MARKET (E.C.M)] METHOD ……………… Presentation of the Issuer (ADMISSION DOCUMENT) The Securities and Exchange Commission has not examined or approved the contents of this Admission Document (for cases that do not require the publication of the Prospectus). The Issuer undertakes full responsibility for the information contained in this Admission Document and certifies that the information contained therein is consistent with the facts and contains no omissions likely to affect its contents. The Municipal Counsellors collectively and individually accept full responsibility for the accuracy and correctness of the information and data contained in this Admission Document and ensure that there are no other essential facts, the omission of which would make any statement contained in this document misleading in any material respect. Throughout the course of processing the application for admission to the CSE the Nominated Advisor/ Underwriter is ……….…… The Nominated Advisor is properly licensed by the CSE and its role is to assist a non-regulated market issuer to meet its obligations under the institutional framework governing the operation and participation in an unregulated market, hence the Nominated Advisor is liable to the Issuer and the Cyprus Stock Exchange. WARNING: This document is NOT A PUBLIC OFFER and is not intended to raise capital. The securities of the Issuers in the E.C.M are not listed in the regulated market of the CSE. The Admission Document applies to the unregulated Emerging Companies Market of the CSE which is considered as Multilateral Trading Facility. The information that is published at the time of listing and after, is less than the information published in regulated markets. Potential investors should be aware of the risks on investment in those issuers and should decide to invest in them only after careful consideration of this Admission Document and if possible take independent financial advice. This private placement is carried out only in Cyprus and is addressed only to persons who may lawfully accept it. Specifically, and in compliance with relevant securities laws of the following countries, this private placement is not addressed in any way or form (written or otherwise), directly or indirectly, within or to the United States, Canada, Australia, South Africa or Japan or any other country ("the Excluded Territories"), in which according to its laws, the conduct of this private placement or the mailing / distribution of this Admission Document is illegal or violates any law, rule or regulation. For this reason, it is prohibited to transmit, distribute, post or otherwise promote copies of this Admission Document and any promotional and related to this private placement document or other material from any person to or from the Excluded Countries and other market shares from persons of the Excluded Territories. Copies of this Admission Document will be available free to the public during normal business hours at the offices of the issuer............................ .................................. for a period of one month from the date of issue of the Admission Document. dd/mm/yy AM/MG/D:\106752092.doc 1 A. KEY INFORMATION OF THE ISSUE Nominal Value of Bonds Quantity of Bonds Issue Date Maturity Date Interest Coupon Payment Date B. ADVISORS MUNICIPAL COUNCIL Name and address of the Mayor and the Members of the Issuer SECRETARY: ..................................................................... BANKERS: ..................................................................... AUDITORS: ..................................................................... ADVISOR OF THE ISSUER, INVESTMENT FIRMS, UNDERWRITERS: ......................... LEGAL ADVISORS ..................................................................... ISSUER’S CONTACT DETAILS Address, Telephone, Fax, Email, Website C. BRIEF DESCRIPTION OF THE POWERS/ SERVICES OF THE MUNICIPALITY AND THE REVENUE RESOURCES D. GENERAL LISTING REQUIREMENTS An issuer wishing to list its securities on any Stock Exchange market for the first time should give details of the following general requirements: Please state YES or NO It has the power to issue the specific securities in accordance with its memorandum and articles of association or any other document. The listing concerns all the securities of the same category issued or to be issued. It proposes the listing of freely transferable securities. If the issuer has securities listed on a foreign stock exchange, it fully complies with the terms and conditions of this stock exchange. It is not bound against anyone in a manner which is incompatible with the interests of the holders of its securities. It ensures the equal treatment of the beneficiaries of the securities of the same category. It ensures that any future issue shall be offered initially to the existing securities holders in proportion to the percentage that each one of them holds in the issuer’s capital. It proposes the listing of fully paid up securities. AM/MG/D:\106752092.doc Issuer’s comments (in case of failure to fulfill a requirement) 2 Please state YES or NO It is ready and able to submit its Register over to the Central Depository and Registry in electronic form in accordance with the CSE specifications. The Bonds are freely tradeable Issuer’s comments (in case of failure to fulfill a requirement) * Note.: The Council has the power to exempt the issuer from any of the general listing requirements, unless such requirement is provided by law E. SPECIAL LISTING REQUIREMENTS Please state YES or NO Issuer’s comments (in case of failure to fulfill a requirement) (a) It proposes for listing securities whose total value is greater than €200.000,00. Exemption may be given. (b) If the bonds are converted or exchanged into shares or options to acquire shares, the shares to which they refer should be listed on the Stock Exchange or a recognized stock exchange. Exemption may be given. (c) Appoints a competent person as a trustee for the protection of the interests and rights of the holders of bonds. (d) It has drawn and published a document* binding by law which provides that it is not possible to be amended unless the consent of the beneficiaries of 75% of total bonds is given and which the following is regulated or referred: 1. The rights and obligations of the issuer against the beneficiaries or representatives or trustees of the beneficiaries. 2. The relation between the rights of the beneficiaries and the rights of the beneficiaries of other securities and bonds of the same issuer or other issuer on which the issuer or its capital depends. 3. The reserves, the repayment procedure or other provisions relating to the amortization of the debt. 4. In the case of bonds whose repayment or partial repayment is guaranteed by a third party, a copy of the decision or the document providing such guarantee. 5. The name or names of the representatives or trustee for the representation and protection of the interests of the beneficiaries and the terms of his replacement and his responsibilities. * Please submit the binding document to the CSE AM/MG/D:\106752092.doc 3 F. RISKS – ADEQUATE QUARANTEES The Bonds of Local Authority Organization seeking to be listed, should provide adequate guarantees for the protection of investors (the Council with the agreement of SEC may exempt an issuer from the related article of the Law). In addition to the above the issuer should enclose the following: The Issuer’s shares are not a suitable investment for all investors: Each potential investor should assess the appropriateness of an investment in securities on a non regulated market known as the E.C.M. of the CSE, taking into account their specific characteristics. Specifically any potential investors should: • Have the necessary knowledge and experience so as to be able to carry out a meaningful evaluation and understanding of the risks inherent in such an investment, in the context of his/her economic situation, the investment in the shares of the company and the impact of such an investment in his/her total portfolio. • • • Have sufficient financial resources and liquidity in order to be able to bear all the risks of his investment. Acknowledge that he may not be able to sell his shares for a long time or at all and Be able to evaluate (either himself or through financial advisers) possible scenarios regarding the factors that may affect his investment like the wider economic environment, or other factors, and his ability to take risks contained in his investment. Changes in the stock price: Stock Markets worldwide may be affected at any times to significant changes in terms of stock prices and volume. The price of the issuer’s shares can fluctuate due to the aforementioned changes and not because these changes are connected directly with the business and prospects of the issuer. The general economic, political and stock market conditions, such as economic recession, fluctuations in interest and exchange rates, may significantly affect the price and demand for the shares of the issuer. G. GOALS/TARGETS - PROSPECTS - FUND RAISING (1) GOALS/TARGETS – PROSPECTS Include investment business plan, analyzing the performance of the issuer for the next years on the investments expected to be carried out by the issuer and the timing. The plan should include a detailed description of the means the issuer intends to use in order to achieve its development objectives. (2) ANALYSIS OF FUNDS RAISED Please specify the amount of funds raised and how they will be used ............................................................................................................................................................................... ............................................................................................................................................................................... H. TERMS OF ISSUE OF CORPORATE BONDS Size of issue, nominal value and split Registration and transfer Status of seniority (Subordination) Claims in case of winding up Deferred payment of interest Payment of interest (interest rate, date of interests payment, interest calculation basis) Alternative interest payment mechanism Exchange with secondary capital securities, change in terms, redemption Untimely payment AM/MG/D:\106752092.doc 4 Allocation of securities to non-permanent residents of Cyprus (if applicable) Trust Document Notices and announcements Additional issues Listing to the CSE and trading/transfer of titles The CSE Council has the power to request additional information or details. SIGNATURE …………………………. ..................................... …………………………….. Nominated Advisor Underwriter Authorised person on behalf of the Municipal Council AM/MG/D:\106752092.doc 5