chapter 30

advertisement

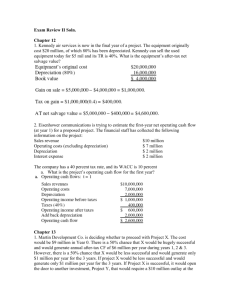

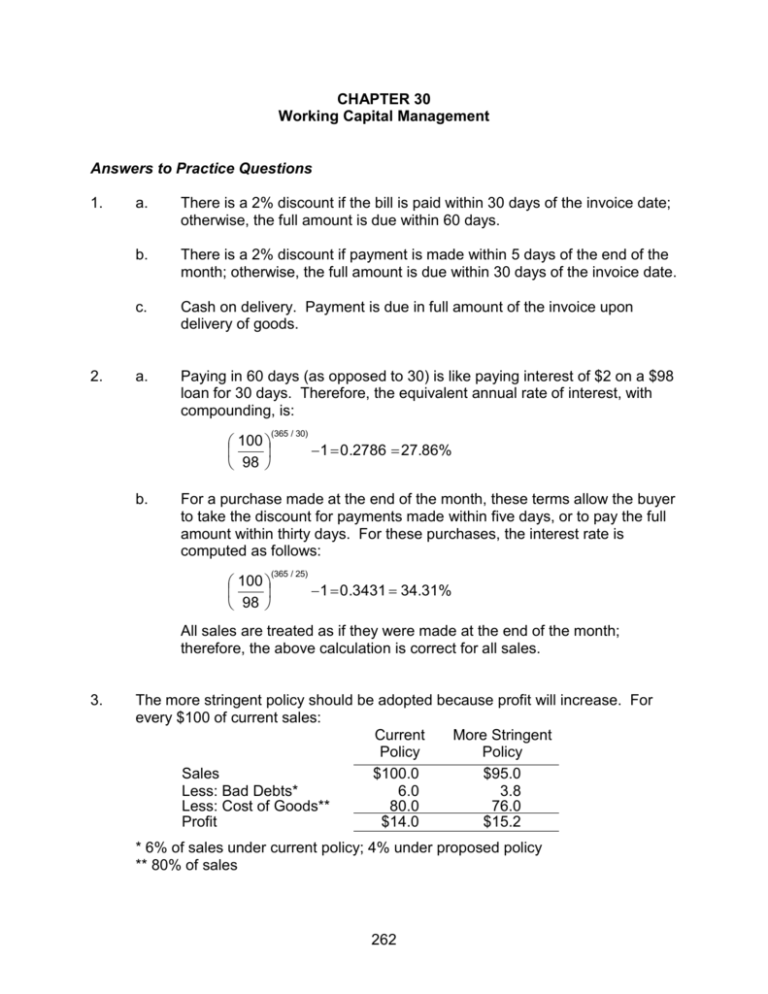

CHAPTER 30 Working Capital Management Answers to Practice Questions 1. 2. a. There is a 2% discount if the bill is paid within 30 days of the invoice date; otherwise, the full amount is due within 60 days. b. There is a 2% discount if payment is made within 5 days of the end of the month; otherwise, the full amount is due within 30 days of the invoice date. c. Cash on delivery. Payment is due in full amount of the invoice upon delivery of goods. a. Paying in 60 days (as opposed to 30) is like paying interest of $2 on a $98 loan for 30 days. Therefore, the equivalent annual rate of interest, with compounding, is: 100 98 b. (365 / 30) 1 0 .2786 27.86% For a purchase made at the end of the month, these terms allow the buyer to take the discount for payments made within five days, or to pay the full amount within thirty days. For these purchases, the interest rate is computed as follows: 100 98 (365 / 25) 1 0 .3431 34.31% All sales are treated as if they were made at the end of the month; therefore, the above calculation is correct for all sales. 3. The more stringent policy should be adopted because profit will increase. For every $100 of current sales: Current More Stringent Policy Policy Sales $100.0 $95.0 Less: Bad Debts* 6.0 3.8 Less: Cost of Goods** 80.0 76.0 Profit $14.0 $15.2 * 6% of sales under current policy; 4% under proposed policy ** 80% of sales 262 4. When the company sells its goods cash on delivery, for each $100 of sales, costs are $95 and profit is $5. Assume now that customers take the cash discount offered under the new terms. Sales will increase to $104, but after rebating the cash discount, the firm receives: 0.98 $104 = $101.92 Since customers pay with a ten-day delay, the present value of these sales is: $101.92 $101.757 1.06 (10/365) Since costs remain unchanged at $95, profit becomes: $101.757 – $95 = $6.757 If customers pay on day 30 and sales increase to $104, then the present value of these sales is: $104 $103.503 1.06 (30/365) Profit becomes: $103.503 – $ 95 = $8.503 In either case, granting credit increases profits. 5. Consider the NPV (per $100 of sales) for selling to each of the four groups: Classification NPV per $100 Sales 1 85 100 (1 0) $13.29 1.15 45 / 365 2 85 100 (1 0 .02) $11.44 1.15 42 / 365 3 85 100 (1 0 .10) $ 3.63 1.15 40 / 365 4 85 100 (1 0.20) $ 7.41 1.15 80 / 365 If customers can be classified without cost, then Velcro should sell only to Groups 1, 2 and 3. The exception would be if non-defaulting Group 4 accounts subsequently became regular and reliable customers (i.e., members of Group 1, 2 or 3). In that case, extending credit to new Group 4 customers might be profitable, depending on the probability of repeat business. 263 6. By making a credit check, Velcro Saddles avoids a $7.41 loss per $100 sale 25 percent of the time. Thus, the expected benefit (loss avoided) from a credit check is: 0.25 $7.41 = $1.85 per $100 of sales, or 1.85% A credit check is not justified if the value of the sale is less than x, where: 0.0185 x = $95 x = $5,135 7. Original terms: NPV per $100 sales $80 $100 $17.70 1.12 75 / 365 Changed terms: Assume the average purchase is at mid-month and that the months have 30 days. NPV per $100 sales $ 80 8. 0.60 $98 0.40 $100 $17.27 1.12 30 / 365 1.12 80 / 365 For every $100 of prior sales, the firm now has sales of $102. Thus, the cost of goods sold increases by 2%, as do sales, both cash discount and net: NPV per $100 of initial sales = 1.02 × $17.27 = $17.62 9. Internet exercise; answers will vary. 10. a. Knob collects $180 million per year, or (assuming 360 days per year) $0.5 million per day. If the float is reduced by three days, then Knob gains by increasing average balances by $1.5 million. b. The line of credit can be reduced by $1.5 million, for savings per year of: $1,500,000 0.12 = $180,000 c. The cost of the old system is $40,000 plus the opportunity cost of the extra float required ($180,000), or $220,000 per year. The cost of the new system is $100,000. Therefore, Knob will save $120,000 per year by switching to the new system. 264 11. 12. a. An increase in interest rates should decrease cash balances, because an increased interest rate implies a higher opportunity cost of holding cash. b. A decrease in volatility of daily cash flow should decrease cash balances. c. An increase in transaction costs should increase cash balances and decrease the number of transactions. The cost of a wire transfer is €7, and the cash is available the same day. The cost of a check is €$0.50 plus the loss of interest for three days, or: €0.50 + [0.05 (3/365) (amount transferred)] Setting this equal to €7 and solving, we find the minimum amount transferred is €15,817. 13. Price of three-month Treasury bill = 100 – [(3/12) 10] = 97.50 Yield = (100/97.50)4 – 1 = 0.1066 = 10.66% Price of six-month Treasury bill = 100 – [(6/12) 10] = 95.00 Yield = (100/95.00)2 – 1 = 0.1080 = 10.80% Therefore, the six-month Treasury bill offers the higher yield. 14. The annually compounded yield of 5.18% is equivalent to a two-month yield of: 1.0518(2/12) – 1 = 0.008453 = 0.8453% The price (P) must satisfy the following: (100/P) – 1 = 0.008453 Therefore: P = $99.1618 The return for the month is: ($99.1618/$98.75) – 1 = 0.004170 The annually compounded yield is: 1.00417012 – 1 = 0.0512 = 5.12% 265 15. Price of the one-month bill is: 100 – [(1/12) 5] = 99.5833 Return over one month is: ($100/$99.5833) – 1 = 0.004184 = 0.4184% Yield (on a simple interest basis) is: 0.004184 12 = 0.05021 = 5.021% Realized return over two months is: ($99.5833/$98.75) – 1 = 0.0084 = 0.84% 16. Answers here will vary depending on when the problem is assigned. 17. In general, a strategy of investing in the financial markets would not generate a positive NPV. In efficient markets, investments in the financial markets are typically zero NPV investments. It is not advisable to invest excess cash in longmaturity debt. Even if debt securities are actively traded and can be sold on short notice, the risk of such an investment, in terms of price volatility, is high. Presumably, it is expected that this excess cash will be needed in the near future, perhaps in a matter of weeks or even days. The liquidity required for investment of excess cash over short periods of time is not simply a matter of the ability to sell a security on short notice; liquidity also requires that such a sale is made without loss of principal. 18. Let X = the investor’s marginal tax rate. Then, the investor’s after-tax return is the same for taxable and tax-exempt securities, so that: 0.0352 (1 – X) = 0.0244 Solving, we find that X = 0.3068 = 30.68%, so that the investor’s marginal tax rate is 30.68%. Numerous other factors might affect an investor’s choice between the two types of securities, including the securities’ respective maturities, default risk, coupon rates, and options (such as call options, put options, convertibility). 19. If the IRS did not prohibit such activity, then corporate borrowers would borrow at an effective after-tax rate equal to [(1 – tax rate) (rate on corporate debt)], in order to invest in tax-exempt securities if this after-tax borrowing rate is less than the yield on tax-exempts. This would provide an opportunity for risk-free profits. 266 20. For the individual paying 35 percent tax on income, the expected after-tax yields are: a. b. c. On municipal note: 7.0% On Treasury bill: 0.10 (1 – 0.35) = 0.065 = 6.5% On floating-rate preferred: 0.075 (1 – 0.35) = 0.04875 = 4.875% For a corporation paying 35 percent tax on income, the expected after-tax yields are: a. b. c. On municipal note: 7.0% On Treasury bill: 0.10 (1 – 0.35) = 0.065 = 6.50% On floating-rate preferred (a corporate investor excludes from taxable income 70% of dividends paid by another corporation): Tax = 0.075 (1 - 0.70) 0.35 = 0.007875 After-tax return = 0.075 – 0.007875 = 0.067125 = 6.7125% Two important factors to consider, other than the after tax yields, are the credit risk of the issuer and the effect of interest rate changes on long-term securities. 267 Challenge Questions 1. Research exercise; answers will vary 2. [Note: in the following solution, we have assumed an interest rate of 10%.] At a purchase price of $10, the sales of 30,000 umbrellas will generate $300,000 in sales and $47,000 in profit. It follows that the cost of goods sold is: ($300,000 - $47,000)/30,000 = $8.43 per umbrella Assume that, if Plumpton pays, it does so on the due date. Then, at a 10 percent interest rate, the net present value of profit per umbrella is: NPV per umbrella = PV(Sales price) – Cost of goods NPV per umbrella = [$10/(1.10)(60 /365)] – $8.43 = $1.41 (If Plumpton pays 30 days slow, i.e., in 90 days, then the NPV falls to $1.34) Thus, the sales have a positive NPV if the probability of collection exceeds 86 percent. However, if Reliant thinks this sale may lead to more profitable sales in Nevada, then it may go ahead even if the probability of collection is less than 86 percent. Relevant credit information includes a fair Dun and Bradstreet rating, but some indication of current trouble (i.e., other suppliers report Plumpton paying 30 days slow) and indications of future trouble (a pending re-negotiation of a term loan). Financial ratios can be calculated and compared with those for the industry. Debt ratio Net working capital / total assets Current ratio Quick ratio Sales / total assets Net profit margin Inventory turnover Return on total assets Return on equity 268 = = = = = = = = = 0.15 0.39 2.2 0.40 3.0 0.020 = 2.0% 2.9 0.059 = 5.9% 0.054 = 5.4% Some things the credit manager should consider are: i. ii. What does the stock market seem to be saying about Plumpton? How critical is the term loan renewal? Can we get more information about this from the bank or delay the credit decision until after renewal? iii. Is there any way to make the debt more secure, e.g., use a promissory note, time draft, or conditional sale? iv. Should Reliant seek to reduce risk, e.g., by a lower initial order or credit insurance? How painful would default be to Reliant? v. What alternatives are available? Are there better ways to enter the Nevada market? What is the competition? 3. a. For every $100 in current sales, Galenic has $5.0 profit, ignoring bad debts. This implies the cost of goods sold is $95.0. If the bad debt ratio is 1%, then per $100 sales the bad debts will be $1 and actual profit will be $4.0, a net profit margin of 4%. b. Sales will fall to 91.6% of their previous level (9,160/10,000), or to $91.6 per $100 of original sales. With a cost of goods sold ratio of 95%, CGS will be $87.0. Bad debts will be: (0.007 $91.6) = $0.64 Therefore, the profit under the new scoring system, per $100 of original sales, will be $4.0. Profit will be unaffected. c. There are many reasons why the predicted and actual default rates may differ. For example, the credit scoring system is based on historical data and does not allow for changing customer behavior. Also, the estimation process ignores data from loan applications that have been rejected, which may lead to biases in the credit scoring system. If a company overestimates the accuracy of the credit scoring system, it will reject too many applications. d. If one of the variables is whether the customer has an account with Galenic, the credit scoring system is likely to be biased because it will ignore the potential profit from new customers who might generate repeat orders. 269