Stage 2

advertisement

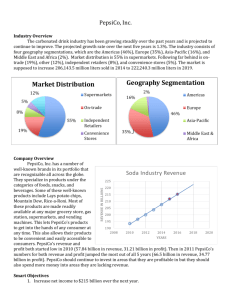

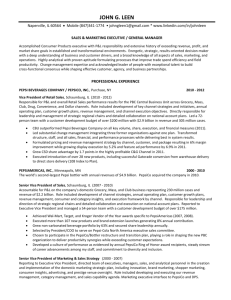

Gavin MacBrein Finance 331 Dr. Beach Stage2 Pepsi CO INC Summary of company activities The company’s principal activities are to manufacture, market, and sell salty, sweet and grain-based snacks, carbonated and non-carbonated beverages and food. The company is made up of four separate groups: Frito-lay North America, PepsiCo North America, Quaker foods North America and PepsiCo International. PepsiCo has facilities all across the United States and overseas, but their main headquarters is in Purchase, New York. The headquarters is a 144 acre complex, which has 11 acres of building space. PepsiCo’s mission is “To be the world's premier consumer Products Company focused on convenient foods and beverages. We seek to produce healthy financial rewards to investors as we provide opportunities for growth and enrichment to our employees, our business partners and the communities in which we operate. And in everything we do, we strive for honesty, fairness and integrity.” After reading mission statement like that you can see why this company is one of the biggest bottling companies in the world. Summary of Ratio Analysis Based on all the ratios produced by the PepsiCo and all the other averages produced from RMA, it looks like Pepsi is a better company than the average. Pepsi Co has a return on assets or an (ROA) of 16.3% which is 3% higher than its leading competitor Coke. The ROA of a company tells you what kind of investment you are getting from the invested capital of the company. As a company owner or an investor you want a high ROA. The higher the ROA number, the better, because the company is earning more money on less investment. Pepsi’s ROA is very stable and continues to grow at slow pace. Pepsi has a Return on Equity (ROE) of 23.6% which is slightly lower then its competitor Coke by 4%. ROE is a measure of a corporation's profitability that reveals how much profit a company generates with the money shareholders have invested. There are a few different ways to calculate the ROE of a company, so you have to be careful when looking to compare different companies. The ROA and ROE are both great fairly simple ways of comparing different companies that you might want to invest in. However you shouldn’t compare them with different companies in different industries because they might come out lopsided. Pepsi’s current ratio of 1.31 is much higher than the average ratio by .20, which tells us that it has more current assets than current liabilities. Compared to its competitor coke which only has a .92 current ratio, Pepsi seems to be doing much better. Pepsi also has a working capital of 2,398,000 which is impressive when you look at coca-cola’s which is -1,120,000. The company also has a lower than average debt ratio, but has a low cash ratio only recording 910,000 in the 2007, which fell from 1,651,000 in 2006 and 1,716,000 in 2005. The company also has a profit margin of 1.70% which is .10 higher than the RMA average and .32 above Coca-Cola. From my comparison of the ratios of Coke, Pepsi and the RMA averages I think it is safe to say that the PepsiCo is a very stable and profitable company to invest in. The PepsiCo has been growing ever since it was established. If you look at a linear graph of the growth of this company it would be a mellow upward line. Almost every year the PepsiCo has turned a profit and in the coming years they predict a major return on investments. PepsiCo states that they will probably record double digit bottom-line growth this year. This bottom-line growth is possible because of the strong volume growth and an expanding portfolio. The company’s financial strength is an A++, its stock price stability is 100 and its earning predictability is 100. What this means is that this company has very low risk stock it wont make you the next millionaire but it will make you money every year and more the next. In conclusion the PepsiCo is a great company to start with if you’re entering the stock market or you just want steady gains and great dividends.