Cola Wars Continue: Coke and Pepsi in 2006 - agec4433

advertisement

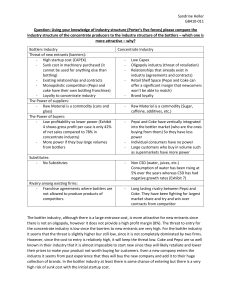

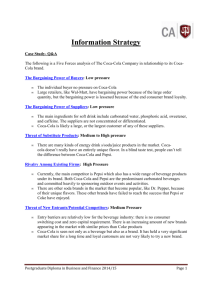

Cola Wars Continue: Coke and Pepsi in 2006 AGEC 4433 Group 7 Spring 2011 Background • John Pemberton creates Coca-Cola formula in 1886 • Imitation brands followed, along with the creation of Pepsi-Cola in 1893 • Increased consumption and concentration in the Carbonated Soft Drink (CSD) market. Company Goals • Boost the domestic demand for CSD products • Increase Coke’s market share of noncarbonated products in the U.S. • Capture uncharted markets not catered to by CSD companies. Central Problem • Flat growth in Coca-Cola’s market share – Waning demand for CSDs in domestic market – Coca-Cola is less competitive in non-carb market due to Pepsi’s successful pursuit of that market Constraints • Increased health information concerning obesity deterring consumers • Market for non-carbonated beverages is dominated by Pepsi • Untapped market segments reluctant to associate with Coca-Cola Competitive Analysis • Barriers to Entry Very High – Coke and Pepsi hold 75% of the market – Economies of Scale: Capital Intensive Industry – Limited bottling and distribution (all owned by existing concentrate producers) • Rivalry High – Pepsi and Coke in direct competition, push smaller competitors out Competitive Analysis • Threat of Substitutes Medium – Consumers tend to buy on price without differentiation – Coke and Pepsi market and price strategically to avoid that • Power of Buyers – Consumers High; price increases lead to reduced consumption – Bottlers Low; bottling contracts force them to take higher prices Competitive Analysis • Power of Suppliers High – Bottlers unable to negotiate, concentrate produces get pricing power – Door-to-store format allows Coke to monitor processes from beginning to end, gives little room for negotiation Alternatives • Increase CSD demand – Alternative 1: Marketing Coca-Cola’s socially conscious initiatives – Alternative 2: Innovating carbonated products to fit in with health and wellness trends – Alternative 3: Combined marketing and innovation approach Alternatives • Compete more aggressively in non-carb market – Alternative 4: Reformulate and position PowerAde to better compete with Pepsi’s Gatorade – Alternative 5: Market PowerAde towards college and professional sports markets – Alternative 6: New product development Solution • Alternative 3: Combined Innovation and Marketing Approach in CSDs – Develop “green” or natural formula for flagships (Coca-Cola and Diet Coke) – Advertise with eco-drive marketing strategy Implementation • Invest in reformulation for “green” CSD line – Replace high fructose corn syrup with real sugar, aspartame with stevia (natural no-calorie sweetener) – Substitute artificial dyes, flavors • New packaging – ‘Planbottle’ and biodegradable can – More visible recycling symbol • Eco-friendly marketing strategy – Bottle deposit stations (get demographic data) – Product premier on Earth Day