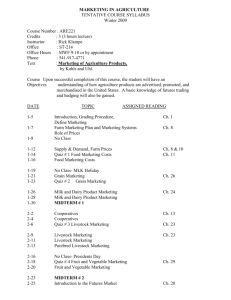

Model Specification for the Estimation of the Optimal Hedge Ratio

advertisement