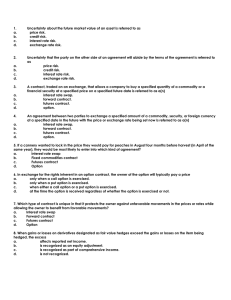

ppt

advertisement

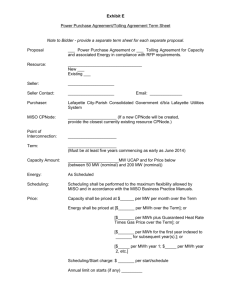

A Utility’s use of Financial Products Place your chosen image here. The four corners must just cover the arrow tips. For covers, the three pictures should be the same size and in a straight line. February 6, 2012 Derivative (Financial Product) A security whose price is dependent upon or derived from one or more underlying assets. A contract between two or more parties Common underlying assets Stocks Bonds Commodities Currencies Interest rates Market indexes Reference: Investopedia.com 2 Three Basic Uses of Derivatives 1. Speculation Attempts to make money based on predicted moves in the market 2. Arbitrage Arbitrage occurs when an investor can take a position for no cost, with no risk, and make a positive profit 3. Hedging Goal is Risk Minimization Company or individual already has a position in the market and uses forwards, futures, options, to minimize risk 3 Arbitrage Interstate Natural Gas Pipeline Capacity Locational spread Purchase in location “A” transport and sell in location “B” Natural Gas Underground Storage Time spread Purchase in time period “A” hold in storage and sell in time period “B” Power generator Tolling (spark spread) Purchase fuel and sell power Refinery Refining Spread (Crack spread) Purchase crude oil and sell refined products (heating oil, gasoline, jet fuel) 4 Effective Use of Derivatives First determine what are the risks. Are the risks quantifiable? timing and amount Make sure the hedge matches your risk or that you understand when and where it doesn’t match your risk. Shift risk to other market participants What are the costs to execute the hedge? 5 Futures vs. OTC New York Mercantile Exchange (NYMEX) Standardized natural gas futures and options contracts 10,000 dt per contract Priced for purchase or delivery at Henry Hub, LA No credit exposure; post margins Trade via Introducing Broker or directly with the floor Settled monthly on third to last business day Over-the-Counter Terms customized to individual customer needs Counterparty credit exposure Bilateral ISDA master agreements 6 Basic Financial Instruments Swaps, (Fixed price, Futures) A swap is an obligation on both parties’ part Options Puts (Floor) Calls (Ceiling or cap) An option is a right, but not an obligation for one party (buyer); and an obligation for the other party (seller) Options are price insurance Premiums are paid to purchase insurance 7 Financial Products Input graph of various derivative % 8 Absolute Price Risk Reduce price volatility Residential heating and electric customers Budget Certainty to future costs Maintain competitiveness Airlines Fertilizer manufacturers 9 Why use financial products? Standardized contracts Market liquidity Disconnect price from physical delivery Better pricing 10 Physical to Financial Correlation Input gas slide 11 Hedge Example with Swap On October 27th: Market is at $8.00 $8.00 $8.00 $6.00 $/dt • Buy a November 2012 swap contract for $6.00 settled against index. • Utility purchases gas from producers for delivery in November at index. $6.00 $4.00 $2.00 $2.00 $Physical Financial Net Market at $4.00 Results $8.00 Protected against adverse price movement $4.00 $4.00 $/dt Removed volatility from price $6.00 $6.00 $5.00 $Physical Financial Net $(2.00) $(2.00) 12 Natural Gas Physical and Financial Settlement Counterparty Pay Fix Price Receive Floating Price (NYMEX last day) Receive Physical Gas -$6.00 Gas Producer/ Supplier +$8.00 Utility -$8.00 Pay Floating Price (Index Price) 13 Swaps vs. Options Buying swaps commits you to fixed price Options give the buyer price security and also the benefit of potentially more favorable prices in the future. The party buying the insurance pays a premium because they receive something of value. Examples Calls are purchased to have the right to pay a fixed price but not the obligation. (Consumer calls) Puts are purchased to have the right to receive a fixed price but not the obligation. (Producer puts) 14 Option Terminology Strike Price - the price beyond which the buyer of the option benefits Premium - what the buyer pays for the option Pay off - the benefit received by the option buyer Difference between strike and settled price Note: The customer may specify either the strike price or the premium. Once you know one, the other is calculated based upon market levels. 15 Types of Option Settlements Options should match the physical and pricing aspects of your portfolio European – exercised only on the expiration date itself American – exercised any time up to the expiration date Asian – average price options Hedge Example with Call On October 27th, Market is at $8.00 $8.00 $8.00 $6.80 $6.00 $/dt • Buy November 2012 $6.00 Call option for $0.80 premium, settled against NYMEX last day (index). • Utility purchases gas from producers for delivery in November at index. $4.00 $2.00 less $0.80 $2.00 $Physical Financial Net Market at $4.00 Results $8.00 Protected against price spike $4.80 $4.00 $4.00 $/dt Participate in downward price moves. $6.00 $5.00 $Physical Financial Net $(1.00) $(0.80) 17 Hedge Example with Collar On October 27th, Market is at $8.00 • Buy November 2012 Collar: buy a $8.00 $8.00 $6.50 $6.00 Call option and sell a $5.00 Put for $0.50 premium. • Utility purchases gas from producers for delivery in November at index. • Results - Protected against price spike - Set floor price. $/dt $6.00 $4.00 $2.00 less $0.50 $2.00 $Physical Market at $5.25 $8.00 $6.00 $6.00 $5.75 $5.50 $4.00 $5.25 $4.00 $/dt $4.00 $/dt Net Market at $4.00 $8.00 $5.00 $- $5.00 $- Physical $(0.50) Financial Financial Loss of $0.50 Net Physical Financial Net $(1.50) Loss of $1.00 plus $0.50 18 Power Generation - Spark Spread A spark spread is the price difference between the fuel cost input and market price for electricity. Example Sell July power for $50/MWh Hedge $4/MMbtu natural gas fuel for July 2012, converted to $40/MWh* Power price $50/MWh Fuel price $40/MWh Spark Spread $10/MWh * Assumed heat rate of 10,000 Btu’s per MWh 19 Crude Oil Prices 20 Brent/WTI Spread 21 Dodd Frank Impact to Energy Industry No impact to exchange traded transactions executed on NYMEX Creation of swap repository Clear all transactions Margin requirements Real time reporting Increased recordkeeping Market participants to registration with CFTC End user exemption Provide financial security documentation Guarantee, LOC, credit support agreement, pledged asset Establish position limits 22