STOCHASTIC OPTIMIZATION, INCLUDING CONDITIONAL VALUE

advertisement

STOCHASTIC OPTIMIZATION, INCLUDING CONDITIONAL

VALUE AT RISK CONSTRAINTS, OF LONG TERM ELECTRICITY TRADING

JESÚS M. VELÁSQUEZ BERMÚDEZ

DECISIONWARE LTDA.

jvelasquez@decisionware-ltd.com

presented in

SIMMAC XIII

INTERNATIONAL SYMPOSIUM ON MATHEMATICAL METHODS APPLIED TO THE SCIENCES

SUBMITTED TO THE SPECIAL VOLUME ON "OR MODELS FOR ENERGY POLICY, PLANNING

AND MANAGEMENT" OF ANNALS OF OPERATIONS RESEARCH

ABSTRACT

The necessary modeling to optimize electricity trading through standardized financial instruments and long

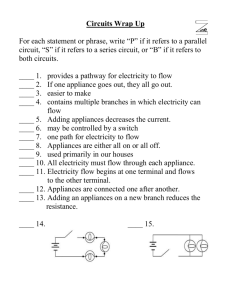

term bilateral contracts is analyzed based on the existing practical and theoretical developments in the area

of investment portfolios optimization. As a result, a linear stochastic optimization model is formulated.

Experimental results for a "simple" electricity market, integrated by a spot market and a non standardized

long term contracts market, are presented. The experiments compare different utility functions, including

Conditional Value-at-Risk constraints.

Keywords: Electricity Trading, Stochastic Optimization, Conditional Value-at-Risk Constraints

INTRODUCTION

The decisions associated with marketing electricity in the long run, through bilateral contracts or through

standardized financial instruments, as options and forwards, are equivalent to those which are taken when the

distribution portfolio is optimized. In the case of the electricity market exists, at least, an option of purchase,

or of sale, by each hour of the planning horizon.

The decision maker, buyer or seller, must face at least two risks: the price risk and the volumetric risk. The

combination of these two risks causes that the traditional tools oriented to the solution of simple cases will not

be effective upon facing this type of problems; more yet if we have in the mind that the relationship of the

previous risks with the hydro-meteorological processes, in the supply and in the demand side, establishes

strong and complex correlation structures. The decision process is complicated upon considering that the

negotiation modalities imply permanent commitments of purchase/sale electricity by long periods, what

increases the magnitude of the extreme risks.

The use of stochastic optimization models to support financial decisions is wide. Rachev and Tokat (2001)

present a summary of the different operations research methodologies that have been used to solve real

problems. Other paper that includes an overview is presented by Mulvey et al. (1997).

In electricity trading, the decisions are prices and quantities. The stochastic optimization models combined

with the appropriate measurement of the risks, as Value at Risk -VaR-, are an appropriate way for this, since

the primal variables are associated with the quantities, and the dual variables with the prices.

1.

MATHEMATICAL MODELING

In the following, it is considered a decision process in which the vector X represents the long term market

decisions, the vector Y the parameters associated with random scenario, the function f(X|Y) the income, or

costs, associated with a decision X since occurs the random condition Y, and p(Y) the probability distribution

function of Y.

1.1.

REFERENCE FRAMEWORK

A model to optimize the decisions of electricity trading is described. The modeling process must consider that

the regional regulatory entities have different conceptions about what "must be" a competitive electricity

market. Therefore, aspects of the models that depend on each specific market exist. In this document it is

assumed a "simple" market in which the agents can accomplish long term transactions under different

modalities and short term transactions in the spot market in which the agents should sell the surpluses, or buy

the shortages, of electricity that result as consequence of the transactions consolidation in the long term

market consider their supply and their demand.

In a long term commodity market the main factor of the decisions is the expectations about the future price of

the commodity in the spot market. If the probabilistic characteristics of the stochastic process that determines

the future spot price are known, it is possible to generate synthetic series of spot prices to use them in a

stochastic optimization model and thus to represent the random environment of the decision process.

There are many alternatives to generate spot prices in an electricity market. One of them it is to consider that

in a hydrothermal system the spot price depends on the hydro-climatic conditions, the existing industrial

infrastructure, the demand level and the "market regulation" and to obtain synthetic series of spot prices as

functions of the marginal costs of the demand equation in a minimum cost hydrothermal dispatch model

(Velásquez and Nieto 1999, Pereira and Campodómico 1995). Another possibility is to use equilibrium

models more oriented to competitive markets. Also it is possible to generate synthetic series using statistic

models and/or artificial intelligence methodologies taking as reference the historical series. This document

does not has as objective to analyze the mathematical models that can be used to determine long run

projections of the spot price. Obviously, the generation of this type of series makes part of a deep formal

study since that the "optimal" decisions depend on the knowledge of the random environment; if this

knowledge is weak, we can not wait "good" decisions.

In the following sections is assumed that exist synthetic series of spot prices that represent the random

environment of the decision making process. Each synthetic series is associated to a possible future scenario

in a stochastic optimization model called as OPTMER (in Spanish "OPTmización del MERcadeo").

OPTMER is a stochastic linear optimization model that supports the decisions of an electricity generator, of a

distributor, of a trader and/or of a vertical integrated company. This document only consider the math formulation

for a trader that accomplishes purchase/sale transactions with multiple agents or clients. In the spot market the

trader purchase/sells the deficits/surpluses not covered in the long term market.

The agent attends a demand that it can be composed by regulated clients of mandatory attention and/or by

bilateral contracts subscribed with unregulated clients or with other agents. For simplicity, the math

formulation does not consider commercial differentiation factors between the clients, the contracts and/or the

agents.

According to the typical characteristics of the prices structure in the electricity markets the modeling is based

on the following concepts:

Planning Periods: one, or several months

Day Types: ordinary, Saturday and holidays.

Load Blocks: a hour or a group of hours

Contracts: Take or Pay and Options

Negotiation Modalities:

free blocks: irregular electricity sales for any load block

monthly blocks: electricity blocks for all hours of a month, or a period.

annual blocks: electricity blocks for all hours of the year, or the planning horizon.

1

monthly blocks modulated by a load curve: electricity blocks for all hours of a month as a percentage

of the buyer load curve

annual blocks modulated by a load curve: electricity blocks for all the hours of a year as a percentage

of the buyer load curve

monthly options: options of electricity blocks for all hours of a month

annual options: options of electricity blocks for all hours of a year

The previous negotiation modalities are some examples that can exist in the long term market. Each modality

implies a set of variables and restrictions especially oriented to describe the associated financial flows. To

include new modalities implies to include new equations and variables.

OPTMER can be used from two points of view:

Physical: to determine the quantities to buy or to sell of a set of offers

Economic: to determine prices and quantities to include in an offer that an agent will present to another agent.

In the first case the decisions are the quantities to contract in each hour under each negotiation modality, related

with the primal variables. In the second, the decisions are limits for the prices, called equilibrium prices, for those

which are convenient to accomplish the transactions, related with the dual variables. Based on a sensibility

analysis is possible to build agent's supply-demand curves for the long term market.

1.2.

MATH FORMULATION

To be short, the detailed math formulation is limited to present the parameters, the equations and the variables

related to purchase offers and ignores the possibility of sale offers, those which can be included using a

similar procedure to the described in the present document.

1.2.1.

DEFINITIONS

The index used in the model are t for period (month), d for type of day, b for load block, g for agent that sells

electricity and h for random scenario.

The parameters used in the model are (in cursive letter):

Deterministic parameters

Electricity prices ($/MWh)

PCBAg

Agent g price for annual blocks

PCBMt,g

Agent g price for monthly blocks in month t

PCLIt,d,b,g Agent g price for free blocks in month t type day d block b

PCMAg

Agent g price for modulate annual blocks

PCMMt,g

Agent g price for modulate monthly blocks in month t

PCOAg

Agent g price for annual options

PCSAg

Agent g strike price for annual options

PCOMt,g

Agent g price for monthly options in month t

PCSMt,g

Agent g strike price for monthly options in month t

Electricity quantities (MWh)

DVBAg

Agent g availability for annual blocks

DVMMt,g Agent g availability for modulate monthly blocks in month t

DVBMt,g

Agent g availability for monthly blocks in month t

DVMAg

Agent g availability for modulate annual blocks

DVLIt,d,b,g Agent g availability for free blocks in month t type day d block b

DVOAg

Agent g availability for annual options

DVOMt,g

Agent g availability for monthly options

Random Parameters (components of the vector Yh)

DEMt,d,b,h Demand (regulated plus contracts) in the month t type day d block b under random

condition h

PSPt,d,b,h

Spot price in month t type day d block b under random condition h

2

t,h

t,h

Coefficient associated with the payment capacity of the spot market in month t random

condition h

Coefficient associated with payment time of the spot market in month t random condition h

The variables used in the model are (in normal letter) :

Long term market decisions (deterministic variables, components of X)

CLPt,d,b,g Total electricity bought to the agent g in month t type day d block b

CBAg

Electricity bought in annual blocks to the agent g

CBMt,g

Electricity bought in monthly blocks to the agent g in month t

CLIt,d,b,g Electricity bought in free blocks to the agent g in month t type day d block b

CMAg

Fraction of electricity demand bought in annual modulate blocks to the agent g

CMMt,g Fraction of electricity demand bought in monthly modulate blocks to the agent g in month t

COAg

Annual options of electricity blocks bought to the agent g

COMt,g Monthly options of electricity blocks bought to the agent g in month t

Simulated variables (random variables)

VMSt,d,b,h Sales in the spot market in month t type day d block b under random condition h

CMSt,d,b,h Purchases in the spot market in month t type day d block b under random condition h

1.2.2.

INCOME FUNCTION

The income are split into deterministic and stochastic. The deterministic part, d(X), does not dependent of the

random conditions and corresponds to commitments derived from the decisions in the long term market: the

costs of blocks of electricity and the costs of the options. d(X) can be expressed as

d(X) = g[ CBAg PCBA + COAg PCOAg + t CBMt,c PCBMt + COMt,g PCOMt,g +

db CLIt,d,b,g PCLIt,d,b,g + CMMt,g PCMMt,g DEMt,d,b + CMAg PCMAg DEMt,d,b ]

(1)

where X represents the decision vector related with long term market transactions. The stochastic income,

r(X|Yh), correspond to the purchases or sales in the spot market and to the exercise, or not, of the options.

They depend on the random condition h, and can be expressed as

COP(X|Yh): expenditures by exercises the options

COP(X|Yh)g t db Minimum (PCSAg ,PSPt,d,b,h) COAg + Minimum (PCSMt,g ,PSPt,d,b,h) COMt,g (2)

IMS(X|Yh): incomes by sales in the spot market

ISM(X|Yh) = t db Maximum(0, g CLPt,d,b,g - DEMt,d,b) PSPt,d,b,h t,h t,h

(3)

EMS(X|Yh): expenditures by purchases in the spot market

ESM(X|Yh) = t db Maximum(0, DEMt,d,b - g CLPt,d,b,g) PSPt,d,b,h

(4)

where Yh represents the random parameters vector associated with the condition h. The income and the

expenditures in the spot market are considered independently due to the fact that would exist asymmetry in the

spot market payment conditions (t,h and t,h). The previous financial movements are caused in the future and

represent the risk of the decision. Their net value is r(X|Yh)

r(X|Yh) = ISM(X|Yh) - COP(X|Yh) -ESM(X|Yh)

(5)

The total income, deterministic plus stochastic, is

f(X|Yh) = d(X) + r(X|Yh)

3

(6)

If a stochastic linear programming model is formulated, the variables contained within the Maximum function

must be represented by a set of linear equations using the process that is described below. The following

expression is considered

Maximum [ 0 , z ] P

(7)

where the variable z is not restricted and it is represented as the difference of two positive variables

z = z + - z-

(8)

based on the previous change of variables we have

Maximum [ 0 , z ] P = z+ P

(9)

For a correct representation, it should be to guarantee that one of the two z-variables will be equal to zero,

what is procured in linear programming due to the colineality between z+ and z-. Based on the foregoing, the

following definitions can be considered

zt,d,b,h = VMSt,d,b,h - CMSt,d,b,h = g CLPt,d,b,g - DEMt,d,b

(10)

where CLPt,d,b,g represents the total purchases of electricity to the agent g in month t type day d block b under

random condition h and it is defined by the sum of negotiation modalities

CLPt,d,b,g = CBAg + CBMt,g + COAg + COMt,g + CLIt,d,b,g + CMMt,g DEMt,d,b + CMAg DEMt,d,b

Then

ISM(X|Yh)t db VMSt,d,b,h PSPt,d,b,h t,h t,h

(11)

(12)

ESM(X|Yh) = t db CMSt,d,b,h PSPt,d,b,h

(13)

The equations set {1, 2, 5, 6, 10, 11, 12, 13} constitute a linear system that describes the income/expenditures

that will have the agent and should make part of the optimization model; it will be called "the marketing

process constraints".

1.2.3.

OTHER CONSTRAINTS

1.2.3.1. LOAD MODULATION

The variables related to blocks modulated by a load curve are demand fractions and they should be ranged

between 0 and 1

CMMt,g

(14a)

CMAg

(14b)

1.2.3.2. AVAILABILITY TO SALE

Normally, the agents receive electricity offers in those which a price is associated to a quantity that the seller

is prepared to committing. This implies bounds for the quantities to buy

CBAg DVBAg

CBMt,g DVBMt,g

CMAg DVMAg

CMMt,g DVMMt,g

COAg DVOAg

COMt,g DVOMt,g

CLIt,d,b,g DVLIt,d,b,g

4

(15a)

(15b)

(15c)

(15d)

(15e)

(15f)

(15g)

1.2.3.3. FINANCIAL CONSTRAINTS

Having in mind that the decisions of long term electricity marketing have as purpose the financial risks

hedging, it can be necessary, and/or convenient, to include in the model constraints associated with these

flows. This topic is not studied in this document and the reader is referred to other specialized articles, for

example Cariño and Ziemba (1998).

1.3.

UTILITY FUNCTIONS

In a stochastic optimization model exists multiple possibilities to determine the decisions utility function. At

least two functions can be considered to measure the kindness of the decision (yield measure): the revenue

expected value and the regret due to the decision.

1.3.1. MAXIMIZE THE EXPECTED INCOME

In this case the objective of the optimization will be maximize the expected income. This is

Maximize d(X) + h r(X|Yh) /NE

(16)

where NE represents the number of random conditions. This approach does not imply the rationalization of

the of the risk management, and in many cases is equivalent to a deterministic model based on the expected

value of the random parameters (Yh).

1.3.2. MAXIMIZE THE MINIMAL INCOME

To maximize the minimal income can be expressed as

Maximize { d(X) + Minimumh [ r(X|Yh) ] }

(17)

The previous objective function can be represented by the following formulation

{ Maximize d(X) + Rmin | Rmin r(X|Yh) ; h=1,NE }

(18)

where Rmin is a not restricted variable that it should be substitute by the difference of two positive variables

{ Maximize d(X) + Rmin+ - Rmin- | Rmin+ - Rmin- r(X|Yh) ;

h=1,NE }

(19)

The previous problem join with the marketing process constraints is a linear programming problem.

1.3.3. MAXIMUM REGRET

The regret is the difference between the revenue of the decision X since occurred the random condition Yh

with the revenue associated with the optimum decision, X*(Yh), that must be taken if we a priori known that

Yh was going to occur. It can be expressed as

(X/Yh) = d(X*(Yh)) + r(X*(Yh)|Yh) - d(X) - r(X|Yh)

(20)

where d(X*(Yh)) + r(X*(Yh)|Yh) represents the maximum revenue under random condition h. X*(Yh) is the

solution to the deterministic problem of maximizing the revenue given the random condition h.

This case considers the minimization of the maximum regret, also known as Savage criterion (Raiffa 1968),

Minimize Maximumh [ (X/Yh) ]

The previous objective function must be represented based on a set of constraints

5

(21)

{ Minimize Rmax | Rmax d(X*(Yh)) + r(X*(Yh)|Yh) - d(X) - r(X|Yh) ; h=1,NE }

(22)

where Rmax is a positive scalar. The previous problem join with the marketing process constraints is a linear

programming problem.

1.3.4. EXPECTED INCOME AND CVaR INCOME CONTRAINTS

The introduction of a risk constraint gives rationality to the expected value utility function. The risk measure

more known is the Value at Risk -VaR- that corresponds to the superior limit of an interval for the losses

associated with a portfolio at a given probability level.

The introduction of VaR constraints has been studied widely (Anderson and Ursayev 1999, Uryasev 2000). It

has been demonstrated that the appropriate form to consider VaR constraints is using the Conditional Valueat-Risk (CVaR) risk measure. CVaR is the expected loss exceeding Value-at-Risk and it is also known as

Mean Excess, Mean Shortfall, or Tail VaR.

The basic problem can be formulated as

{ Maximize d(X) + h r(X|Yh) /NE | (X) }

(23)

where (X) represents for expected revenue since it is less than (X). (X) represents the income level that

it can be exceeded with a probability . is the lower bound for (X), that can be written as

(X) = (X) - (1-)-1 h=1,NE Maximum[0, (X)-f(X|Yh)]/NE

(24)

(X) can be expressed by a set of linear inequations

(X) = (X) - (1-)-1NEh=1,NE h

h(X) - f(X|Yh) h

h0 h

(25a)

(25b)

(25c)

where h represents the income deficit with respect to (X) if is taken the decision X and occurs the random

condition Yh. The model can be written as

{ Maximize d(X) + h r(X|Yh) /NE |

(X) - (1-)-1NEh=1,NE h

h(X) - d(X) - r(X|Yh) h

h0 h }

(26a)

(26b)

(26c)

(26d)

The previous problem join with the marketing process constraints is a linear programming problem.

1.4.

EQUILIBRIUM PRICES

The model generates information about the opportunity cost/benefit of the different negotiation modalities;

then it can be used to determine the equilibrium price of purchase/sale electricity for each modality. This price

corresponds to an indifferent price that maintains the utility level of the agent, and serves as reference to

establishes the convenience or not of a negotiation.

The prices, economic variables, are obtained from the dual variables of the model. It should be consider that

these prices are function of the quantity and that if we wished to have a demand curve it should be done a

sensibility analysis.

2.

EXPERIMENTAL RESULTS

6

Below it is presented a hypothetical case of a buyer agent that evaluates an electricity purchase competitive

process in which participate multiple seller agents. The planning horizon is one year and the numbers are

related with a "realistic" case in the Colombian Electricity Market. As additional condition, it is assumed that

the agent limits the total of annual purchases to his annual demand (which is assumed deterministic), that

implies

tdb CLPt,d,b tdb DEMt,d,b

2.1.

PARAMETERS

2.1.1.

ELECTRICITY DEMAND

(27)

In this case the demand is considered as a deterministic parameter. The buyer agent attends a demand that has

only one day type with the a typical load curve . Additionally it is known the aggregate monthly demand for

the planning horizon. The hourly demand is calculated combining the aggregate monthly demand with the

typical load curve. Alternatively, the hourly demand can be calculated taking into account the contracts that

attends the agent.

MW

270

1

260

0.5

250

0

240

1

7

13

19

01/01/00

05/01/00

09/01/00

Hour

Month

Figure 1. Normalized Load Curve

Figure 2. Aggregate Demand

2.1.2. OFFERS

The buyer agent has received quotes of eleven sellers in five modalities. The numerical details of the quotes

are omitted, but they are available in Velasquez (2001).

TABLE 1. OFFERS MODALITIES

2.1.3.

SELLER

Annual Blocks

Monthly Blocks

Annual Blocks

Modulated

Monthly Blocks

Modulated

CHBG

CHVG

CRLG

CTFG

EBSG

EEBG

EPMG

EPSG

GCLG

ISGG

TRMG

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Free Blocks

X

X

X

X

SPOT PRICE

The information about the future variability of the spot price is summarized in ten synthetic series. As

reference, the price average in the spot market is 53345 $/MWh (Colombian pesos by megawatt-hour),

superior to the price average in the long term offers, near to 40000 $/MWh.

7

$/MHh

175000

150000

125000

100000

75000

50000

25000

0

Figure 3. Spot Price Synthetic Series

2.2.

RESULTS

OPTMER is used to determine the optimum policy of agent purchases. The following utility functions were

analyzed: maximum cost, expected cost, maximum regret and expected cost with CVaR cost constraint. The

results are presented in two stages: initially some detailed results of two traditional utility functions, the

expected cost and the maximum cost, are compared; thereinafter, global results are presented for the others

utility functions.

2.2.1. MAXIMUM COST VERSUS EXPECTED COST

2.2.1.1. TOTAL COSTS

Below it is presented the comparative analysis of the results obtained for these cases. The monetary unit is

thousands of Colombian pesos ($**3)

TABLE 2. TOTAL COSTS ($**3)

LONG TERM

SPOT M ARKET

STATISTIC

TOTAL

PURCHASES

NET SALES

UTILITY FUNCTION: MAXIMUM COST

MEAN

77159.4

43632.3

33527.2

DEVIATION

0

5615.8

5615.8

MAXIMUM

77159.4

56835.2

37588.1

MINIMUM

77159.4

39571.3

20324.2

UTILITY FUNCTION: EXPECTED COST

MEAN

834960

1076067

-241107

DEVIATION

0

462877.7

462877.7

MAXIMUM

834960

1707938

455757

MINIMUM

834960

379203

-872978

Below the distributions of the costs are presented

%

100

MAXIMUM COST

75

50

25

0

-806541

EXPECTED COST

-540794

-275047

-9300

256447

$**3

Figure 4. Costs Distribution. Maximum Cost versus Expected Cost

8

An analysis of the previous graph concludes that the expected cost policy implies risk prone positions. In this

case, it can be verified that the results are equivalent to solve a deterministic optimization problem

using the expected spot price. Alternatively, minimizing the maximum cost the agent rationalizes his

purchases in the long term limiting them to the minimal possible risk, but it is a policy totally risk averse.

2.2.1.2. EQUILIBRIUM PRICES

The equilibrium prices, based on the dual variables, indicate balance prices, in the sense that produce an

utility equal to zero if negotiations are accomplished at that price in the indicated modality. The equilibrium

prices based on the expected cost permit to assume much more risk and therefore they are but large.

42000

MAXIMUM COST

$/MWh

$/MWh

80000

EXPECTED COST

EXPECTED COST

MAXIMUM COST

38000

50000

20000

34000

Ene-99

Mar-99

May-99

Jul-99

Sep-99

Nov-99

Ene-99

Figure 5. Equilibrium Prices - Monthly Blocks

Mar-99

May-99

Jul-99

Sep-99

Nov-99

Figure 6. Equilibrium Prices - Modulate Monthly Blocks

2.2.1.3. PURCHASES

Below the results related to the quantities to negotiate in some modalities are presented. The optimum

purchases for annual blocks are in Table 3.

AGENT

CHBG

EPMG

EPSG

ISGG

TABLE 3. OPTIMUM PURCHASES ANNUAL BLOCKS

OFFER

POWER PURCHASES

SHADOW PRICE

QUANTITY-PRICE

(MW)

($/MWh)

POWER

PRICE

MINI

EXPECTED

MINI

EXPECTED

(MW)

$/MWh

MAX

VALUE

MAX

VALUE

540

40960

0

540

950

41600

0

950

35211

55854

70

37800

0

70

100

39700

0

100

The equilibrium prices are established using the reduced costs, "simplex multipliers", associated with the

upper bound of the purchase variables. It is evident the greater arrangement to pay of the expected cost policy.

Below the quantities to negotiate for the modality annual modulate blocks are presented.

AGENT

CHBG

EBSG

EEBG

EPMG

GCLG

ISGG

TABLE 4. OPTIMUM PURCHASES MONTHLY BLOCKS

OFFER

PURCHASES

SHADOW PRICE

QUANTITY-PRICE

DEMAND PERCENTAGE (%)

($/MWh)

PERCENTAGE

PRICE

MINI

EXPECTED

MINI

EXPECTED

(%)

U$/MWh

MAX

VALUE

MAX

VALUE

50

44733

0

0

100

37154

0

0

60

41560

0

0

1324

1355

60

40332

0

0

100

37632

0

0

50

38612

0

0

9

The reason of the equilibrium prices so low is that this modality commits all annual demand of the buyer

agent, subtracting to him flexibility to capture earnings in other negotiation modalities in the long term market

and/or in the spot market. This is coherent with the principle that the portfolio optimality is the diversification

and not the concentration, unless the prices offered are totally outside of market.

2.2.2. OTHER UTILITY FUNCTIONS

Below the comparative results for all the studied utility functions are presented. The analysis is concentrated

in the comparison of the distribution of the total costs. Detailed results are available in Velasquez 2001.

2.2.2.1. MAXIMUM REGRET

Below it is presented the cost distribution when is used as decision criterion the maximum regret

%

30

20

10

0

-611235

-243451

124333

$**3

Figure 7. Cost Distribution. Utility Function: Maximum Regret

Table 5 contains the comparative analysis of the results obtained in the three cases. The monetary unit is

millions of Colombian pesos ($**6)

TABLE 5. COMPARATIVE ANALYSIS OF UTILITY FUNCTIONS

($**6)

REGRET

TOTAL COST

RANDOM

SCENARIO

OPTIMUM

COST

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

-885

-21

-16

31

16

-200

-18

-894

-445

-745

-318

390

31

-894

926

MEAN

DEVIATION

MAXIMUM

MINIMUM

RANGE

MINI

MAX

MAX

REGRET

EXPECTED

VALUE

MINI

MAX

MAX

REGRET

EXPECTED

VALUE

921

41

54

6

20

236

49

929

483

772

351

390

929

6

923

274

43

75

277

40

58

24

277

137

210

142

108

277

24

253

22

68

100

424

66

11

41

21

10

2

77

126

424

2

422

36

20

38

38

36

36

31

35

38

28

34

6

38

20

17

-611

22

59

308

56

-141

7

-618

-308

-534

-176

324

308

-618

926

-864

47

84

456

82

-189

24

-873

-435

-743

-241

463

456

-873

1329

10

The results indicate that the policy of the maximum regret is an intermediate point between the expected cost

and the maximum cost. However, in this case, the maximum regret presents a high propensity to the risk. The

equilibrium prices are coherent with the previous affirmation. The next graph compares the equilibrium prices

for monthly blocks.

MAXIMUM COST

MAXIMUM REGRET

EXPECTED COST

$/MWh

80000

50000

20000

Ene-99

Mar-99

May-99

Jul-99

Sep-99

Nov-99

Figure 8. Equilibrium Prices - Monthly Blocks

2.2.2.2. EXPECTED COST INCLUDING CVAR CONSTRAINT

The decision making process based in to minimize the expected cost including CVaR constraint to a given

probability level was studied. Experiments with several probability levels and several limits for the CVaR are

presented. The results obtained in four cases in those which CVaR limit is fixed in 50 millions of Colombian

pesos and the probability level of not to exceed this limit is varied are presented in the next table.

RANDOM

SCENARIO

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

MEAN

DEVIATION

MAXIMUM

MINIMUM

RANGE

TABLE 6. COMPARATIVE ANALYSIS WITH FIXED CVAR LIMIT

TOTAL COST ($**6)

CVAR LIMIT = 50 ($**6)

OPTIMUM

PROBABILITY OF NOT TO EXCEED LIMIT - -

COST

0.0

0.60

0.75

0.95

-885

-864

-295

-130

-13

-21

47

-12

-6

8

-16

84

-2

-1

10

31

456

186

102

50

16

82

28

23

29

-200

-189

-74

-38

8

-18

24

-13

-8

6

-894

-873

-298

-132

-14

-445

-435

-130

-45

13

-745

-743

-257

-123

-21

-318

-241

-87

-36

8

390

463

158

75

21

31

456

186

102

50

-894

-873

-298

-132

-21

926

1329

484

234

71

The results are coherent with the theory: the increase in the probability level reduces the cost volatility. The

solution for =0.0 corresponds to the case of minimizing the unrestricted expected cost. Below the

comparative analysis of six cases in those which is fixed the probability level and the CVaR limit is varied are

presented

11

TABLE 7. COMPARATIVE ANALYSIS WITH PROBABILITY LEVEL FIXED

TOTAL COST ($**6)

= 0.95

RANDOM

MINI

EXPECTED

CVAR LIMIT ($**6)

SCENARIO

MAX

VALUE

38

40

50

75

100

200

1988

36

34

22

-13

-85

-148

-372

-864

1989

20

14

14

8

5

8

7

47

1990

38

25

22

10

10

20

30

84

1991

38

38

40

50

75

100

200

456

1992

36

32

32

29

27

30

38

82

1993

36

30

26

8

-20

-39

-93

-189

1994

31

22

19

6

1

1

-3

24

1995

35

33

22

-14

-86

-149

-376

-873

1996

38

38

31

13

-24

-59

-179

-435

1997

28

26

15

-21

-87

-143

-332

-743

MEAN

34

29

24

8

-18

-38

-108

-241

DEVIATION

6

8

8

21

54

86

199

463

MAXIMUM

38

38

40

50

75

100

200

456

MINIMUM

20

14

14

-21

-87

-149

-376

-873

RANGE

17

24

26

71

162

249

576

1329

Again, the results are coherent with the theory, when the CVaR limit is reduced the solution tends to the

maximum cost solution, when the limit increases the solution tends to the expected cost solution.

3.

CONCLUSIONS

It can be concluded that:

The decisions based on the simple analysis of the expected cost put on serious danger the financial

stability of the agents. This fact includes the use of stochastic optimization models in the decision making

process.

The policy of minimizing the maximum cost seems to extremely risk averse.

The weakness of the policy of the maximum regret is that does not control the risk level, which it is a

result of the optimization process

The incorporation of CVaR constraints in the policy of optimizing the expected costs is an interesting

alternative, since it permits to integrate the optimization of the expected revenue of the decisions with the

risk level that the decision maker wishes and/or can to assume. It can be asserted that assigning the

appropriate parameters this alternative represents anyone of the others utility functions, and therefore

covers all the cases, since it handles explicitly the risk levels and the expected utility that imply the

decisions.

Finally, the results prove that the existing theory for the strategic managing of financial risks is valid and

coherent mathematically, and it can be extended to the electricity markets composed by a spot market and

a long term market.

REFERENCES

Andersson, F. and Uryasev, S. "Credit Risk Optimization with Conditional Value-at-Risk Criterion".

Research Report #99-9, Center for Applied Optimization, Dept. of Industrial and Systems Engineering,

University of Florida, 1999.

Cariño D. R. and Ziemba W. T. “Formulation of the Rusell-Yasuda Kasai Financial Planing Model”.

Operations Research Vol No. 4 (1998).

Edgeworth, F.Y., 1888, “The Mathematical Theory of Banking”, Journal of the Royal Statistical Society,

51/1, March, pp. 113-127

J.P.Morgan, 1996, “RiskMetrics™: Technical Document”, 4th ed., New York NY

Mulvey, J.M., Rosembaum, D.P. and Shetty, B. "Strategic Financial Risk Management and Operation

Research". European Journal of Operations Research 97 (1997) 1-16.

Pereira, M.V.F. y Campodómico N.V. “Modelo de Despacho HidroTérmico con Restricciones de

Transmisión. Technical Specifications. Agosto 1995.

12

Rachev, S. And Tokat, Y. "Asset and Liability Management: Recent Advances". Working Paper Institute of

Statistics and Mathematical Economics, School of Economics, University of Karlsruhe, Kollegium am

Schloss, Bau II, 20.12, R210, Post-fach 6980, D-76128, Karlsruhe, Germany. e-mail: rachev@lsoe.unikarls-ruhe.de. 2000.

Raiffa, H., (1968), Decision Analysis, Addison-Wesley, Reading, Mass.

Uryasev, S. "Conditional Value-at-Risk: Optimization Algorithms and Applications". Working Paper. Dept.

of Industrial and Systems Engineering, University of Florida, 2000.

Velásquez, J. y Nieto P., G. “Sistema SHTG/COLOMBIA. Despacho Integrado de Electricidad y Gas.

Versión Colombia”. Mundo Eléctrico Colombiano (Enero 1999), (http://www.decisionware-ltd.com).

Velásquez, J. "Optimización del Mercado de Energía a Largo Plazo". Documento de Trabajo DW-035-01.

2001 (http://www.decisionware-ltd.com).

13