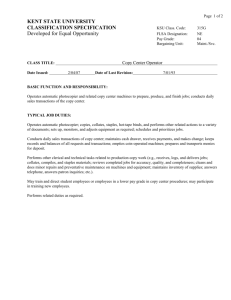

Associate Treasurer - Kent State University

advertisement

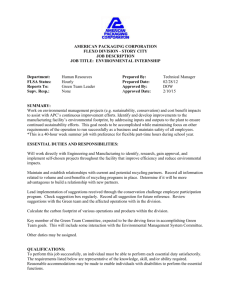

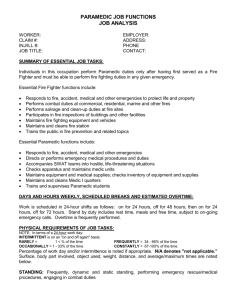

KENT STATE UNIVERSITY JOB DESCRIPTION - UNCLASSIFIED Developed for Equal Opportunity CLASS TITLE: Associate Treasurer DATE ISSUED: KSU Class Code: 11/26/03 DATE OF LAST REVISION: UAE38 EEO Code: 3A FLSA: Exempt 10/8/07 Pay Grade: 10 BASIC FUNCTION: Provide overall management of the treasury, risk management and tax compliance functions at the university. Direct and oversee all investment activities and cash management. Serve as the primary interface between the University’s bank and other financial institutions. Serve on the IUC Casualty Pool management committee. CHARACTERISTIC DUTIES AND RESPONSIBILITIES: Manage property, casualty, and student health insurance; serve as the campus liaison for risk management services. Advise university administrators on matters relating to risk control and management. Serve as the tax reporting and compliance function. Specialized areas include sales tax and real estate tax reporting, unrelated business income tax withholding/reporting, employment tax withholding/reporting, and income tax withholding/reporting. Consult on fringe benefits, deferred taxes, qualified pension plans, and University entities (e.g. Kent Infoworks, NeoBeam). Coordinate all university debt including working with external bond counsel and underwriters in the issuance of university bonds. Coordinate the preparation of information in response to the debt rating agencies and in the preparation of the Official Statement and identifying lower cost alternatives to traditional lease financing. Serve on various university and external committees. Associate Treasurer Perform special assignments/projects as assigned by the Director of Business Operations and Management Services and the Vice President for Business and Finance. Fulfill responsibilities of human resource management including equal employment opportunity, affirmative action, and employee development. Perform related duties as assigned. REPORTS TO: Executive Director Financial Affairs. LEADERSHIP AND SUPERVISION: Leadership of a small department, unit or major function and/or direct supervision over administrative/professional employees. MINIMUM QUALIFICATIONS: Education and Experience: Bachelor’s Degree in Accounting (MS in Accounting or MBA preferred). Ten to fifteen years of experience in Treasury management, Risk Management and Tax practice/management. Typically five years experience in each of the three fields but overlapping responsibilities would reduce the minimum experience required to ten years. Other Knowledge, Skills, and Abilities: Certified Public Accountant, Certified Management Accountant or Certified Financial Analyst. Knowledge of risk management, tax reporting and compliance, and debt management. Skill in written, verbal, and interpersonal communications. Skill in personal computer applications. Page 2 Associate Treasurer PHYSICAL REQUIREMENTS: Sedentary: Exerting up to 10 pounds of force occasionally and/or negligible amount of force frequently or constantly to lift, carry, push, pull or otherwise move objects, including the human body. Typically requires sitting and occasionally requires walking, standing, bending, keying, talking, hearing, seeing and repetitive motions. Incumbent may be required to travel from building to building frequently and off campus occasionally. The intent of this description is to illustrate the types of duties and responsibilities that will be required of the positions given this title and should not be interpreted to describe all the specific duties and responsibilities that may be required in any particular position. Directly related experience/education beyond the minimum stated may be substituted where appropriate at the discretion of the Appointing Authority. Kent State University reserves the right to revise or change job duties, job hours, and responsibilities. File: AE38 Source: job description revision Analyst:: FM Department Authorization: bstaats/mfajack 10/8/07 Page 3