Study Guide Solutions -

advertisement

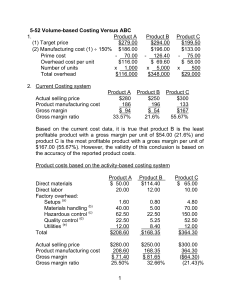

CHAPTER 10 SOLUTIONS Part I 1. 2. 3. 4. 5. T T F F T 6. 7. 8. 9. 10. F T T T T Part II 11. 12. 13. 14. 15. F T T F F 1. 2. 3. 4. 5. d i a k c 6. 7. 8. 9. 10. h l b e j 11. 12. 13. 14. 15. o g m n f Part III 1. (a) Under variable costing, it is necessary to know the variable and fixed components of all production costs because variable manufacturing costs are treated as product costs, whereas fixed manufacturing costs are treated as period costs for income determination purposes. 2. (a) Operating income (variable costing) $50,000 Cost released in inventory decrease (5,000 units × $1) ....................... Operating income (absorption costing) ................................................ 5,000 $45,000 3. (b) Consider the following segment report by department: Total Company Sales Variable costs Contribution margin Direct fixed costs Segment margin Common fixed costs Operating income 4. (c) 5. (d) $1,800,000 1,480,000 320,000 110,000 210,000 190,000 $ 20,000 Stereo Department $1,000,000 800,000 200,000 50,000 $ 150,000 Satellite Department $800,000 680,000 120,000 60,000 $ 60,000 $200,000 $40,000 $240,000 = 60,000 units $8 $4 $4 If Tradewinds sells three times as many regular bikes as deluxe bikes, the sales mix percentages are: Regular 75% (3/4); Deluxe 25% (1/4). The contribution margins (sales price less variable costs per unit) are: Regular $60 ($200 $140); Deluxe $80 ($300 - $220). The weighted average contribution margin is $65. It is calculated as follows: ($60 x 75%) + ($80 x 25%) The break-even point is the fixed costs divided by the weighted average contribution margin or 2,100 units ($136,500 / $65). 6. (a) S–38 The contribution margin as a percentage of sales will decrease because the variable cost as a percentage of sales increases. If the fixed cost increases and the contribution margin ratio decreases, both of these factors will cause the break-even point to increase. Chapter Ten Solutions 7. (b) The contribution margin ratio is needed to compute target volume sales dollars, which is obtained by dividing the sales price per unit into the contribution margin per unit (Sales price per unit – Variable cost per unit). 8. (b) Regular Sales Sales ........................................ $1,500,000* Variable costs .......................... 825,000** Contribution margin................ $ 675,000 Fixed costs .............................. Operating income.................... Special Order $1,350,000*** 825,000** $ 525,000 Total $2,850,000 1,650,000 $1,200,000 495,000 $ 705,000 * 15,000 x $100 ** 15,000 x $55; $990,000 / 18,000 = $55 *** 15,000 x $90 9. (a) 10. (c) Direct materials ..................................................................... Direct labor ........................................................................... Variable overhead (1/3 × $6) ................................................ Shipping costs ....................................................................... Minimum selling price.......................................................... $ 4 5 2 3 $14 The sales price should exceed the variable cost of making and selling the product. Part IV Highlands Manufacturing Company Income Statement For the Month Ended July 31, 20xx Sales ($40 x 4,000) ................................................................ Cost of goods sold ($30 x 4,000); ($24 x 4,000) ..................... (Underapplied)/overapplied factory overhead* ....................... Gross margin ............................................................................. Manufacturing margin .............................................................. Less: Fixed factory overhead ...................................................... Selling and administrative expenses .................................. Net income (loss) ...................................................................... Absorption Costing $160,000) (120,000) 11,000) $ 51,000) Variable Costing $160,000)** (96,000)** $ 64,000)** (25,000) $ 26,000) *Calculation of overapplied fixed factory overhead: **Fixed factory overhead per year (50,000 × $6) ............................................. **Fixed factory overhead per month ($300,000 ÷ 12)...................................... **Fixed factory overhead applied to production (6,000 × $6) ......................... **Fixed overhead per month.............................................................................. **Fixed factory overhead overapplied .............................................................. (25,000)** (25,000)** $ 14,000)** $300,000 $ 25,000 $ 36,000 25,000 $ 11,000 S–39 Solutions Chapter Ten Highlands Manufacturing Company Income Statement For the Month Ended August 31, 20xx Sales ($40 x 6,000) ................................................................. Cost of goods sold ($30 x 6,000); ($24 x 6,000) ..................... (Underapplied)/overapplied factory overhead* ....................... Gross margin ............................................................................. Manufacturing margin .............................................................. Less: Fixed factory overhead ...................................................... Selling and administrative expenses .................................. Net income (loss) ...................................................................... Absorption Costing $240,000) (180,000) (1,000) $ 59,000) Variable Costing $240,000) (144,000) $ 96,000) (25,000) $ 34,000) (25,000) (25,000) $ 46,000) *Calculation of underapplied factory overhead: Fixed factory overhead applied to production (4,000 × $6) ........................... Fixed factory overhead per month ................................................................... Fixed factory overhead underapplied .............................................................. $24,000) 25,000) $ (1,000) Part V 1. 2. $80,000 $80,000 $133,333 $60 .60 1 $150 $80,000 889 units $150 $60 3. Margin of safety 1,600 889 711 units 711 Margin of safety ratio = = 44% 1,600 4. Break-even chart on the following page $80,000 + $10,000/1 – .3 5. Target volume = $150 – $60 = 1,048 units S–40 Chapter Ten Solutions 4. Part VI 1. The company should not accept the special order because the proposed $8.00 sales price does not even cover all variable manufacturing costs per unit, which are: Direct materials .................................................. Direct labor......................................................... Variable factory overhead .................................. Total ............................................................. $4.00 2.50 2.00 $8.50 2. The company would be willing to pay an outside supplier as much as the variable manufacturing cost of $8.50 per unit plus the $.25 per unit ($2,500 ÷ 10,000) of fixed cost that would be saved, or $8.75 per unit. S–41

![Paired Problem Solving [Costs]](http://s3.studylib.net/store/data/008038173_1-a232db278f4ce2465b362708aaa8f91a-300x300.png)