1 5-52 Volume-based Costing Versus ABC 1. Product A Product B

advertisement

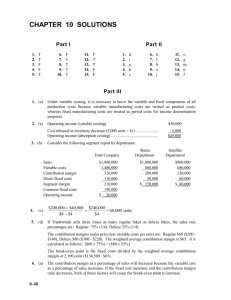

5-52 Volume-based Costing Versus ABC 1. Product A (1) Target price $279.00 (2) Manufacturing cost (1) ÷ 150% $186.00 Prime cost - 70.00 Overhead cost per unit $116.00 Number of units x 1,000 Total overhead $116,000 Product B $294.00 $196.00 - 126.40 $ 69.60 x 5,000 $348,000 Product C $199.50 $133.00 - 75.00 $ 58.00 x 500 $29,000 2. Current Costing system Actual selling price Product manufacturing cost Gross margin Gross margin ratio Product A $280 186 $ 94 33.57% Product B $250 196 $ 54 21.6% Product C $300 133 $167 55.67% Based on the current cost data, it is true that product B is the least profitable product with a gross margin per unit of $54.00 (21.6%) and product C is the most profitable product with a gross margin per unit of $167.00 (55.67%). However, the validity of this conclusion is based on the accuracy of the reported product costs. Product costs based on the activity-based costing system Direct materials Direct labor Factory overhead: Setups (a) Materials handling (b) Hazardous control (c) Quality control (d) Utilities (e) Total Actual selling price Product manufacturing cost Gross margin Gross margin ratio Product A $ 50.00 20.00 Product B $114.40 12.00 Product C $ 65.00 10.00 1.60 40.00 62.50 22.50 12.00 $208.60 0.80 5.00 22.50 5.25 8.40 $168.35 4.80 70.00 150.00 52.50 12.00 $364.30 $280.00 208.60 $ 71.40 25.50% $250.00 168.35 $ 81.65 32.66% $300.00 364.30 ($64.30) (21.43)% 1 5-52 (continued) Notes: (a) Setups: Cost per setup: $8,000 / (2 + 5 + 3) = $800 per setup Product A = 2 x $800 = $1,600; $1,600 /1,000 = $1.60 per unit Product B = 5 x $800 = $4,000; $4,000 /5,000 = $0.80 per unit Product C = 3 x $800 = $2,400; $2,400 /500 = $4.80 per unit (b) Materials handling: Cost per pound = $100,000 / (400 + 250 + 350) = $100 per pound Product A = 400 x $100 = $40,000; $40,000/1,000 = $40.00 per unit Product B = 250 x $100 = $25,000; $25,000/5,000 = $ 5.00 per unit Product C = 350 x $100 = $35,000; $35,000/500 = $70.00 per unit (c) Waste and hazardous disposals: Cost per disposal: $250,000/(25 + 45 + 30) = $2,500 per disposal Product A = 25 x $2,500 = $ 62,500; $ 62,500/1,000 = $ 62.50/unit Product B = 45 x $2,500 = $112,500; $112,500/5,000 = $ 22.50/unit Product C = 30 x $2,500 = $ 75,000; $ 75,000/500 = $150.00/unit (d) Quality inspections: Cost per inspection = $75,000/(30 + 35 + 35) = $750 per inspection Product A = 30 x $750 = $22,500; $22,500/1,000 = $22.50 per unit Product B = 35 x $750 = $26,250; $26,250/5,000 = $ 5.25 per unit Product C = 35 x $750 = $26,250; $26,250/500 = $52.50 per unit (e) Utilities: Cost per MH = $60,000 / (2,000 + 7,000 + 1,000) = $6.00 per MH Product A = 2,000 x $6 = $12,000; $12,000/1,000 = $12.00 per unit Product B = 7,000 x $6 = $42,000; $42,000/5,000 = $ 8.40 per unit Product C = 1,000 x $6 = $ 6,000; $ 6,000/500 = $12.00 per unit 2 5-52 (continued-2) 3. Comparison of reported product costs, new target price, actual selling price, and gross margin (loss): Product A Product B Product C Product costs: 1. Direct-labor based system $186.00 $196.00 $133.00 2. Activity-based system $208.60 $168.35 $364.30 ABC-based product costs: Target price (150%) Actual selling price Difference in price $312.90 $252.53 $280.00 $250.00 <$32.90> <$2.53> $546.45 $300.00 <$246.45> Direct-labor based costing system Gross margin Gross margin ratio $ 94 33.57% $ 54 21.6% $167 55.67% Activity-based costing system: Gross margin Gross margin ratio $71.40 25.50% $81.65 32.66% $(64.30) <21.43%> 4. Strategic and Competitive Analysis 1. Emphasizing Product C as suggested by the current directlabor-cost based overhead costing system is likely to harm the firm’s competitiveness. The activity-based costing system shows that the manufacturing cost of Product C is $364.30 per unit and, at the current selling price, the firm suffers a $64.30 loss for each unit it manufactures and sells. 2. If the actual selling prices of products A & B are fair market prices for these products and a markup of 150% is a common industry practice, the firm needs to examine the manufacturing cost of product A. The fact that the firm’s target price, determined using 150% of the manufacturing cost, is more than 10 percent over the fair market price of the product suggests possible wastes and inefficiencies in the manufacturing of product A. 3 5-54 Volume-Based Costing Versus ABC 1. Current costing system (direct-labor hour) Deluxe % Speedy Price $475 100 $300.00 Prime Cost 180 38 110.00 Overhead 20 4 153.60 Unit gross profit $275 58 $ 36.40 % 100 37 51 12 2. Multiple drivers costing system Calculation of unit overhead costs - Deluxe: Setups Machine costs Engineering Packing Total overhead Number of Units Overhead per unit $2,800 x 200 = $100 x 100,000 = $40 x 45,000 = $20 x 50,000 = Deluxe $ 560,000 10,000,000 1,800,000 1,000,000 $13,360,000 ÷ 50,000 $267.20 Calculation of unit overhead costs - Speedy: Setups Machine costs Engineering Packing Total overhead Number of Units Overhead per unit $2,800 x 100 = $100 x 400,000 = $40 x 120,000 = $20 x 200,000 = Price Cost Prime cost $180.00 Overhead 267.20 Unit gross profit Speedy $ 280,000 40,000,000 4,800,000 4,000,000 $49,080,000 ÷ 400,000 $122.70 Deluxe % $475.00 100 447.20 $27.80 4 94 6 $110.00 122.70 Speedy $300.00 % 100 232.70 $67.30 78 22 5-54 (continued) 3. Using the activity-based costing, a much different picture on profitability of the Deluxe and Speedy models emerges. The Speedy model is actually more profitable than the Deluxe model. The revised cost data suggests that shifting the emphasis to the Deluxe model may very well be a mistake. The Deluxe printer is a much heavier user of overhead resources as can be seen in the table below that compares uses of overhead. Overhead Activity Activity Consumption Deluxe Speedy Setups Machine costs Engineering Packing 250 units per setup 4,000 units per setup 2 MH per unit 1 MH per unit 0.9 Engr. Hr. per unit 1 unit per packing order 0.3 Engr. Hr. per unit 2 units per packing order Supporting calculations Activity Consumption Deluxe Total Per Activity Measure Units Setups Machine costs 50,000 400,000 200 250 units per setup 100,000 2 MH per unit Engineering 45,000 0.9 Engineering Hours per unit Packing 50,000 Speedy Total Per Activity Measure 100 4,000 units per setup 400,000 1 MH per unit 120,000 0.3 Engineering hours per unit 1 unit per packing 200,000 order 2 units per packing order 4. The ABC method is likely to provide Gorden Company a more accurate product cost picture. It also directs the management’s attention to the high volume, more profitable Speedy printers. Given the low profit margin of the Deluxe, the firm may want to investigate the feasibility of raising the price, the possibility of reducing product cost, or both. 5