Slides - NYU Stern

advertisement

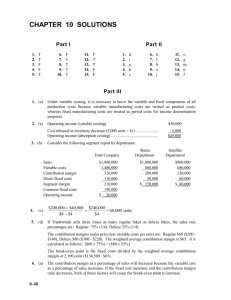

Managerial Accounting Review Session: key terms and concepts Classifications of Costs Manufacturing costs are often combined as follows: Direct Materials Direct Labor Prime Cost Manufacturing Overhead Conversion Cost Quick Check Which of the following costs would be considered manufacturing overhead at Boeing? (More than one answer may be correct.) A. Depreciation on factory forklift trucks. B. Sales commissions. C. The cost of a flight recorder in a Boeing 767. D. The wages of a production shift supervisor. Quick Check Which of the following costs would be considered manufacturing overhead at Boeing? (More than one answer may be correct.) A. Depreciation on factory forklift trucks. B. Sales commissions. C. The cost of a flight recorder in a Boeing 767. D. The wages of a production shift supervisor. Product Costs Versus Period Costs Product costs include direct materials, direct labor, and manufacturing overhead. Cost of Good Sold Inventory Period costs are not included in product costs. They are expensed on the income statement. Expense Sale Balance Sheet Income Statement Income Statement Quick Check Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. Quick Check Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. Cost Classifications for Predicting Cost Behavior How a cost will react to changes in the level of business activity. – Total variable costs change when activity changes. – Total fixed costs remain unchanged when activity changes. Cost Classifications for Predicting Cost Behavior Behavior of Cost (within the relevant range) Cost In Total Per Unit Variable Total variable cost changes as activity level changes. Variable cost per unit remains the same over wide ranges of activity. Fixed Total fixed cost remains the same even when the activity level changes. Fixed cost per unit goes down as activity level goes up. Opportunity Costs The potential benefit that is given up when one alternative is selected over another. Example: If you were not attending college, you could be earning $15,000 per year. Your opportunity cost of attending college for one year is $15,000. Sunk Costs Sunk costs cannot be changed by any decision. They are not differential costs and should be ignored when making decisions. Example: You bought an automobile that cost $10,000 two years ago. The $10,000 cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the $10,000 cost. Types of Costing Systems Used to Determine Product Costs Process Costing Job-order Costing Chapter 4 Many different products are produced each period. Products are manufactured to order. Cost are traced or allocated to jobs. Cost records must be maintained for each distinct product or job. Types of Costing Systems Used to Determine Product Costs Process Costing Job-order Costing Typical job order cost applications: Special-order printing Building construction Also used in the service industry Hospitals Law firms Application of Manufacturing Overhead The predetermined overhead rate (POHR) used to apply overhead to jobs is determined before the period begins. POHR = Estimated total manufacturing overhead cost for the coming period Estimated total units in the allocation base for the coming period Ideally, the allocation base is a cost driver that causes overhead. Application of Manufacturing Overhead Based on estimates, and determined before the period begins. Overhead applied = POHR × Actual activity Actual amount of the cost driver such as units produced, direct labor hours, or machine hours. Incurred during the period. Job-Order System Cost Flows Raw Materials Material Direct Purchases Materials Indirect Materials Mfg. Overhead Actual Applied Indirect Materials Work in Process (Job Cost Sheet) Direct Materials Job-Order System Cost Flows Salaries and Wages Payable Direct Labor Indirect Labor Mfg. Overhead Actual Applied Indirect Overhead Materials Applied to Work in Indirect Process Labor Work in Process (Job Cost Sheet) Direct Materials Direct Labor Overhead Applied If actual and applied manufacturing overhead are not equal, a year-end adjustment is required. Job-Order System Cost Flows Work in Process (Job Cost Sheet) Direct Materials Direct Labor Overhead Applied Cost of Goods Mfd. Finished Goods Cost of Goods Mfd. Cost of Goods Sold Cost of Goods Sold Cost of Goods Sold Assigning Costs Using Weighted-Average Costing Beginning Inventory 250 units 1,250 units 1,100 units completed 1,000 units started Ending Inventory 150 units Now let’s examine the five-step process. Weighted Average Example Materials Beginning Work in Process 250 Units 100% Complete 1,000 Units Started 850 Units Started and Completed 1,100 Units Completed 150 Equivalent Units 1,250 Equivalent units of production Ending Work in Process 150 Units 100% Complete 150 × 100% Weighted Average Example Conversion Beginning Work in Process 250 Units 80% Complete Work to Complete Process 20% 1,000 Units Started 850 Units Started and Completed Ending Work in Process 150 Units 33 1/3% Complete 250 Units 1,100 Units Completed 50 Equivalent Units 1,150 Equivalent units of production 150 × .333% CVP: The Profit Equation = (P × X) - [(V × X) + F] = (P – V)X – F Finding Target Volumes Target Volume (units) Fixed costs + Target profit = Contribution margin per unit Break-Even in Units Let’s use the Hap Bikes information again. Total Sales (500 bikes) $ 250,000 Less: variable expenses 150,000 Contribution margin $ 100,000 Less: fixed expenses 80,000 Net income $ 20,000 Per Unit $ 500 300 $ 200 Percent 100% 60% 40% Contribution margin ratio Using CVP to Analyze Different Cost Structures High Variable Company % (50,000 units) Sales $ 500,000 100% Variable costs 400,000 80% Contribution margin 100,000 20% Fixed costs 40,000 8% Operating profit $ 60,000 12% Break-even units Contribution margin per unit $ Hi Fixed Company % (50,000 units) $ 500,000 100% 100,000 20% 400,000 80% 340,000 68% $ 60,000 12% 20,000 2.00 42,500 $ 8.00 Margin of Safety • Excess of projected (or actual) sales over the break-even volume. • The amount by which sales can fall before the company is in the loss area of the break-even graph. Sales Break-even – volume sales volume = Margin of Safety Identifying Relevant Costs Costs that can be eliminated (in whole or in part) by choosing one alternative over another are avoidable costs. Avoidable costs are relevant costs. Unavoidable costs are never relevant and include: Sunk costs. Future costs that do not differ between the alternatives. Quick Check Colonial Heritage makes reproduction colonial furniture from select hardwoods. Chairs Selling price per unit $80 Variable cost per unit $30 Board feet per unit 2 Monthly demand 600 Tables $400 $200 10 100 The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. Is this enough hardwood to satisfy demand? a. Yes b. No Quick Check Chairs Selling price per unit $80 Variable cost per unit $30 Board feet per unit 2 Monthly demand 600 Tables $400 $200 10 100 The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. What plan would maximize profits? a. 500 chairs and 100 tables b. 600 chairs and 80 tables c. 500 chairs and 80 tables d. 600 chairs and 100 tables