Weather: Mark Russo presented the weather

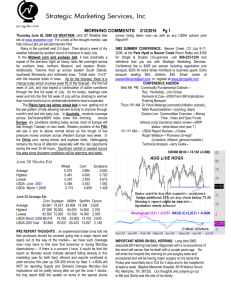

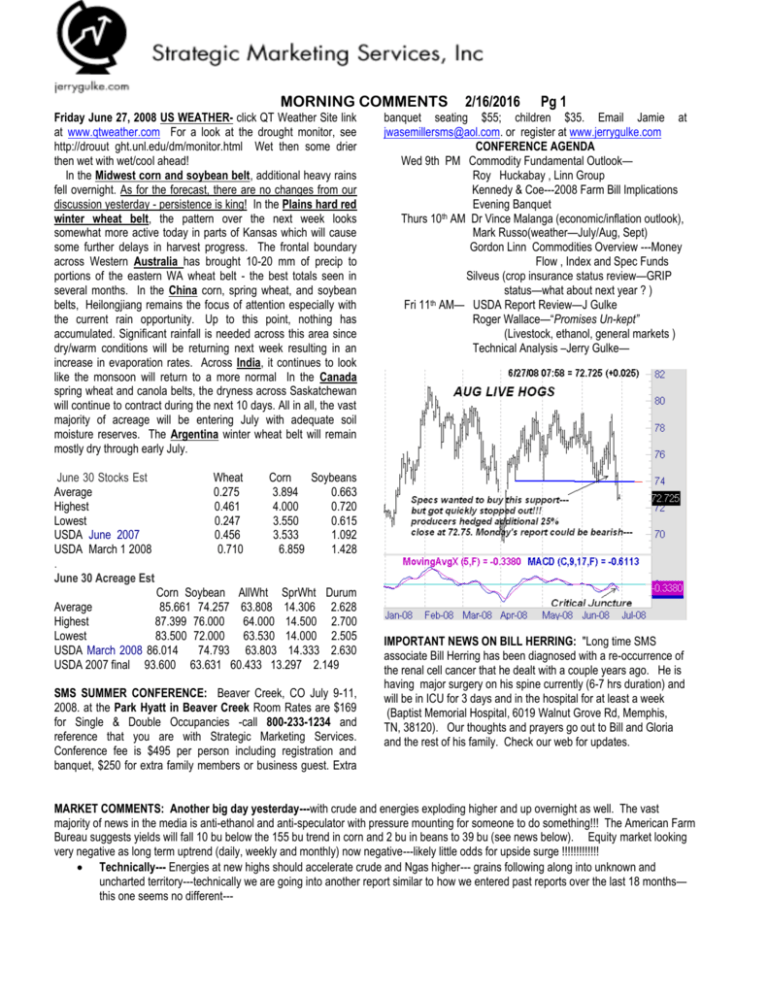

advertisement

MORNING COMMENTS Friday June 27, 2008 US WEATHER- click QT Weather Site link at www.qtweather.com For a look at the drought monitor, see http://drouut ght.unl.edu/dm/monitor.html Wet then some drier then wet with wet/cool ahead! In the Midwest corn and soybean belt, additional heavy rains fell overnight. As for the forecast, there are no changes from our discussion yesterday - persistence is king! In the Plains hard red winter wheat belt, the pattern over the next week looks somewhat more active today in parts of Kansas which will cause some further delays in harvest progress. The frontal boundary across Western Australia has brought 10-20 mm of precip to portions of the eastern WA wheat belt - the best totals seen in several months. In the China corn, spring wheat, and soybean belts, Heilongjiang remains the focus of attention especially with the current rain opportunity. Up to this point, nothing has accumulated. Significant rainfall is needed across this area since dry/warm conditions will be returning next week resulting in an increase in evaporation rates. Across India, it continues to look like the monsoon will return to a more normal In the Canada spring wheat and canola belts, the dryness across Saskatchewan will continue to contract during the next 10 days. All in all, the vast majority of acreage will be entering July with adequate soil moisture reserves. The Argentina winter wheat belt will remain mostly dry through early July. June 30 Stocks Est Average Highest Lowest USDA June 2007 USDA March 1 2008 . June 30 Acreage Est Wheat 0.275 0.461 0.247 0.456 0.710 2/16/2016 Pg 1 banquet seating $55; children $35. Email Jamie at jwasemillersms@aol.com. or register at www.jerrygulke.com CONFERENCE AGENDA Wed 9th PM Commodity Fundamental Outlook— Roy Huckabay , Linn Group Kennedy & Coe---2008 Farm Bill Implications Evening Banquet Thurs 10th AM Dr Vince Malanga (economic/inflation outlook), Mark Russo(weather—July/Aug, Sept) Gordon Linn Commodities Overview ---Money Flow , Index and Spec Funds Silveus (crop insurance status review—GRIP status—what about next year ? ) Fri 11th AM— USDA Report Review—J Gulke Roger Wallace—“Promises Un-kept” (Livestock, ethanol, general markets ) Technical Analysis –Jerry Gulke— Corn Soybeans 3.894 0.663 4.000 0.720 3.550 0.615 3.533 1.092 6.859 1.428 Corn Soybean AllWht SprWht Durum Average 85.661 74.257 63.808 14.306 2.628 Highest 87.399 76.000 64.000 14.500 2.700 Lowest 83.500 72.000 63.530 14.000 2.505 USDA March 2008 86.014 74.793 63.803 14.333 2.630 USDA 2007 final 93.600 63.631 60.433 13.297 2.149 SMS SUMMER CONFERENCE: Beaver Creek, CO July 9-11, 2008. at the Park Hyatt in Beaver Creek Room Rates are $169 for Single & Double Occupancies -call 800-233-1234 and reference that you are with Strategic Marketing Services. Conference fee is $495 per person including registration and banquet, $250 for extra family members or business guest. Extra IMPORTANT NEWS ON BILL HERRING: "Long time SMS associate Bill Herring has been diagnosed with a re-occurrence of the renal cell cancer that he dealt with a couple years ago. He is having major surgery on his spine currently (6-7 hrs duration) and will be in ICU for 3 days and in the hospital for at least a week (Baptist Memorial Hospital, 6019 Walnut Grove Rd, Memphis, TN, 38120). Our thoughts and prayers go out to Bill and Gloria and the rest of his family. Check our web for updates. MARKET COMMENTS: Another big day yesterday---with crude and energies exploding higher and up overnight as well. The vast majority of news in the media is anti-ethanol and anti-speculator with pressure mounting for someone to do something!!! The American Farm Bureau suggests yields will fall 10 bu below the 155 bu trend in corn and 2 bu in beans to 39 bu (see news below). Equity market looking very negative as long term uptrend (daily, weekly and monthly) now negative---likely little odds for upside surge !!!!!!!!!!!!! Technically--- Energies at new highs should accelerate crude and Ngas higher--- grains following along into unknown and uncharted territory---technically we are going into another report similar to how we entered past reports over the last 18 months— this one seems no different--- SMS MORNING COMMENTS 2/16/2016 Page 2 Fundamentals - The supply side of the equation now may be falling faster than demand with ethanol profitability setting the bar. It seems corn prices rally to the point where profitability of ethanol is squeezed—higher crude and products influences corn prices as well. Wheat…Black Sea undercuts others, as seen in recent sales to Egypt. Higher prices recently don’t help our competitive edge, unless the US market is focused on feeding wheat ??? Beans…PNW enjoying less advantage due MUCH narrow GulfPNW freight spread. Perhaps part of why Gulf prems strong lately. But bottom line is China continues to buy US and shun Argentina. Indonesia will raise the export tax on palm from 15 pct to 20 pct starting July 1. China has impounded 75 TMT of palm oil? Corn…BlkSea feed wheat should be working to Korea, displacing some corn---key item to watch. According to G Rasko from Hungary, a past presenter at our conferences, reports excellent crops in E Europe with some up 40% over last year---wheat exceptionally good as is Rapeseed—internal prices have fallen 20-30% last few months. Livestock feeding suffering while dairy prospering. DEMAND: Just about every thing I read agrees that demand is being or starting to be reduced---however to what extent is the question along with the perception that supplies of corn and beans may be falling faster than demand requiring additional price rationing. Some feel that if the report Monday is sufficiently bullish, it will require much higher prices to insure the release of viable CRP acres as well as encourage more production world wide---price is a great fertilizer!!!!! Technically--- The grains dodged a bullet this week, reversing just in time to thwart off a convincing sell signal headed into the report. USDA JUNE 30 REPORT Monday 7 am: Also the end of the month and quarter ! . NEWS: The American Farm Bureau Federation said it estimates the current U.S. corn crop will fall 8 to 10 bushels per acre below the trend yield of 155 bushels per acre due to inclement weather across the country ranging from flooding in the Midwest to drought in California. In a news release, AFBF Senior Economist Terry Francl said he expects Iowa corn yields to be reduced 16 percent this year. He further estimated that 1.5 million to 2 million acres of corn and soybeans in Iowa that farmers intended to plant this spring will likely remain fallow. AFBF predicted that across the country, soybean yields will be down one to two bushels per acre from USDA's projected 42 bushels per acre. AFBF said U.S. crops have incurred more than $8 billion in estimated weather-related damage thus far in 2008, with severely flooded Iowa accounting for about half that damage. These damage estimates relate only to crop production as of the last week of June. They do not include livestock, infrastructure, building and equipment losses. Additionally, the estimates assume normal weather conditions for the remainder of the growing season. Buyers in China, the world's biggest soybean importer, may have purchased seven to nine cargoes of the oilseed this week, Shanghai JC Intelligence Co. said. The soybeans bought this week will be shipped from Brazil and the U.S. in July and August, the market researcher said today in an e-mail. Buyers didn't order from Argentina because a labor conflict, which disrupted shipping, hasn't been resolved, it said. The order this week compared with between four to five cargoes ordered last week, according to Shanghai JC. Each ship carries about 60,000 metric tons. PRE REPORT THOUGHTS : an experienced trader once told me that producers should be covered going into a major report and specs out of the way of the market--- yesterday we suggested rolling out of short hedges into put spreads or just out of the way. This is a pure money management situation. My guess, based on our survey, is that the USDA will report that intended will not have changed much on June 1 as many were still “intending” to plant both corn and beans---however floods have changed intentions to reality and there lies the rub. Not only are analysts, including some in the administration suggesting 2 mil acres or more in both beans and corn were lost to water damage and the rest of the stuff growing will likely be well under trendline yields. The market price action is reflecting this fact and also suggesting that a much bigger job of rationing is needed and price pressure to be such that the USDA, and the Administration pull out all stops to prevent food inflation, and massive liquidation of the livestock. I would expect such action to happen with odds of the CFTC doing something negative to the spec trading a 50-50 proposition. The recent debacle in financials and now the equity market certainly has a lot of those in power now, hoping to hold things together long enough to pass it off to the next administration and Congress. No one currently in office will want to be accused of making radical changes that turn out more destructive than doing nothing!! On the chance that we get an explosive report Monday, and thus some quick action or reaction from the Bush Administration, we have rolled our risk into put options and let the rest of what we have unsold run its course for a few days/week etc. So to recap and make final adjustments: We moved outright short futures into Sept put spreads---End users long corn/meal through 2008 minimum. Roll ALL long July futures (if you have them) into Aug or beyond--- first notice coming and you do not want to have to deliver Anyone who is in jeopardy of not producing a corn/bean crop---needed or needs long Aug or Sept call spreads Cross hedges are still held in soybeans---long BOQ, SQ , SMQ against short SX futures or out of short SX futures. Consider cross hedges against short wheat or reduce wheat hedge exposure Livestock--- hedged in 2009 June and Aug 2008 OPTION IDEA: For your consideration (experienced traders) and to take advantage of volatility currently in options and with the idea that government or the market will not allow extremely higher prices to last long barring further catastrophic developments in weather--o Sell both the December $7.80 calls AND puts (straddle)--- AND buy the $6 puts AND the $10 calls--- max risk is dollar per bushel--- could collect $1.20 to $1.30 on the straddle—If prices explode, we’ll lift the short put---if prices collapse on some kind of intervention or negative USDA report or collapse in usage---we take profits on the short call---if prices go to $10 quickly---the $10 call should appreciate as well as there is a lot of time to Dec--- known risk! o Producers--- put spreads give us some downside protection with minimum cost/risk o End Users--- the straddle is a consideration or outright long call spreads in Sept or Dec options--- This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing. MORNING COMMENTS 2/16/2016 Pg 3 STRATEGIES/POSITIONS Watch for Mid-Day Update GENERAL: Markets tough to trade here--- ignoring normally reliable technical signals and in wheat basic fundamentals of improving harvest conditions and increases in world supply. CORN: for end users long coverage into 2009 first qtr—Long call spreads (Sept) option spreads---—exited 40% of any excess long spec positions a week or so ago. Market seems very supportive going into report. End users if long our recommended 100% usage into first quarter of 2009---bought the Sept $7.20 puts and sell the $6.50 puts for a net cost of about 30 cents---or rolled out of 50% of long futures and bought the $7.20 and sell the $8.20 CU calls for a cost of 33 cents net---if you are planning to feed your locked in corn---it is not the next 30 cents that will kill you ---it is the next $1 or so----at $8 corn you might want to just sell the corn and the feeders? Producers: We sold an additional 5% in the futures Monday night/Tuesday --- in addition bought put insurance on another 15% of your production for 2008 in the CU $7.80/$6.50 CU Put spread--Today: Mid day update yesterday had us roll out of any short futures into Long Put Spreads in September $7.60/$6.90 for net cost of about 31 cents! SOY COMPLEX: 100% long meal for remaining 2008--- Producers sold another 5% in SX futures this week–--TODAY: the soy complex is a world problem (corn is a US problem)--- we have no choice but to neutralize ANY short SX with either long August futures or with August soymeal (1.5 meal for each SX) – or merely exit SX short futures. The risk is to great as we made new highs for November--- The soybean complex is looking very dynamic---with new highs and new upside targets! WHEAT TODAY: wheat looks the weakest fundamentally---increase coverage to 70-80% if wheat is trading down on the day by 10 cents by after 12:30 noon –the close over 9.13 yesterday in July is bullish but report and world wheat bearish Wheat is defying fundamentals! thus long corn, or BO or Beans against short wheat eases the margin pain—have some cross hedges in place or reduce hedge exposure to no more than 30% of production plus the 25% in cash sales The International Grains Council on Thursday raised its estimate for world wheat production in 2008/09 by 8 million tonnes to a record 658 million tonnes. The IGC put the 2007/08 wheat crop at 608 million. World maize production in 2008/09 was projected at 756 million tonnes, down from a previous forecast of 763 million and well below the prior season's 786 million. Natural Gas and Crude---- No positions---energy exploding--Lcattle Continues stronger last week---may have bullish COF discounted??? Update—we are basically flat with no positions---we’ll cautiously watch the trade for now--- breakeven now likely $120 for 2009 take a look at far out 2009 prices---getting near breakeven---Cautious here as LC momentum slowing! Hedge 20% of 2008 in Oct 08 or Dec 08 and for 2009 in April 09 and June 09 on straight sell stops 80 pts lower from yesterday’s closes! Hogs: hedged 25% or less for third quarter---still concerned that there is a lot of pork to move! --- 2009 futures hedged 20% June 2009 96.75. and hedged within your comfort zone in August 2008 as a hedge against liquidation—if not, do so in October if not higher by 11:40 am this morning. Expectations are for less kept for breeding—higher kept for marketing—suggesting more pork to get rid of, while far out supplies dwindle in 2009 Cotton: Specs are long again. Use a close below 79.50 to exit. Producers should start hedging again with a close below 79.50. Rice: We began hedging again below 19---don’t get overly aggressive until after we see the report numbers on Monday. SMS MORNING COMMENTS 2/16/2016 Page 4 This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing.