Weather: Mark Russo presented the weather

advertisement

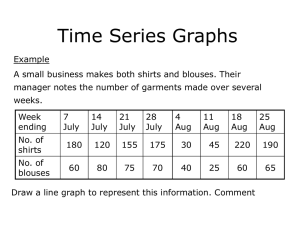

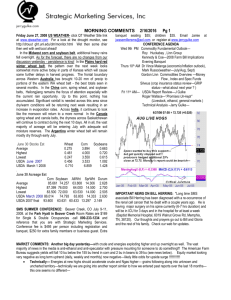

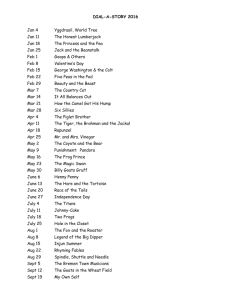

MORNING COMMENTS Thursday June 26, 2008 US WEATHER- click QT Weather Site link at www.qtweather.com For a look at the drought monitor, see http://drouut ght.unl.edu/dm/monitor.html Rainy in the cornbelt next 2-3 days. Then about a week of dry weather followed by another round of moisture in early July In the Midwest corn and soybean belt, it was practically a repeat of the previous night as heavy rains fell overnight across far southern Iowa, northern Missouri, and western Illinois. Additionally, Tstorms fired up across eastern South Dakota, southwest Minnesota and northwest Iowa. Totals were .5-4.0" with the heaviest totals in Iowa. As for the forecast, there is a change today which involves week #2 of the forecast - the first full week of July. and now expect a continuation of active conditions through the first full week of July. As for temps, readings next week and into the first full week of July will be climbing to warmer than normal levels but no problematic/extreme heat is expected. The Plains hard red winter wheat belt is now getting out of the wet pattern of late allowing harvest activity to improve through month's end and into early July. In Australia, moisture coverage across SA/Victoria/NSW looks lower this morning Across Europe, dry conditions starting today across most of Europe will last through Tuesday of next week. Western portions of the FSU will see a turn to above normal temps as the trough of low pressure moves onshore across Western Europe next week. In the China corn, spring wheat, and soybean belts, Heilongjiang remains the focus of attention especially with the rain opportunity during the next 24-36 hours. Significant rainfall is needed across this area since dry/warm conditions will be returning next week. . 2/12/2016 Pg 1 survey being taken now---as well as any USDA actions post Report!!!! SMS SUMMER CONFERENCE: Beaver Creek, CO July 9-11, 2008. at the Park Hyatt in Beaver Creek Room Rates are $169 for Single & Double Occupancies -call 800-233-1234 and reference that you are with Strategic Marketing Services. Conference fee is $495 per person including registration and banquet, $250 for extra family members or business guest. Extra banquet seating $55; children $35. Email Jamie at jwasemillersms@aol.com. or register at www.jerrygulke.com CONFERENCE AGENDA Wed 9th PM Commodity Fundamental Outlook— Roy Huckabay , Linn Group Kennedy & Coe---2008 Farm Bill Implications Evening Banquet Thurs 10th AM Dr Vince Malanga (economic/inflation outlook), Mark Russo(weather—July/Aug, Sept) Gordon Linn Commodities Overview ---Money Flow , Index and Spec Funds Silveus (crop insurance status review—GRIP status—what about next year ? ) Fri 11th AM— USDA Report Review—J Gulke Roger Wallace—“Promises Un-kept” (Livestock, ethanol, general markets ) Technical Analysis –Jerry Gulke— June 30 Stocks Est Wheat Corn Soybeans Average 0.275 3.894 0.663 Highest 0.461 4.000 0.720 Lowest 0.247 3.550 0.615 USDA June 2007 0.456 3.533 1.092 USDA March 1 2008 0.710 6.859 1.428 . June 30 Acreage Est Corn Soybean AllWht SprWht Durum Average 85.661 74.257 63.808 14.306 2.628 Highest 87.399 76.000 64.000 14.500 2.700 Lowest 83.500 72.000 63.530 14.000 2.505 USDA March 2008 86.014 74.793 63.803 14.333 2.630 USDA 2007 final 93.600 63.631 60.433 13.297 2.149 PRE REPORT THOUGHTS : an experienced trader once told me that producers should be covered going into a major report and specs out of the way of the market--- we have such coverage now---may have to fine tune that tomorrow or during Mid-Day observations---- If there is a concern I have, it would be that the report on Monday would indicate demand falling already in this marketing year for both feed, ethanol and exports combined to yield carryout this year up 200-250 mil-bu by Sept 1---USDA will NOT be reporting Supply and Demand changes Monday---but implications will be pretty strong after we get the June 1 stocks, the hog report AND the update on acres in the special phone IMPORTANT NEWS ON BILL HERRING: Long time SMS associate Bill Herring has been diagnosed with a re-occurrence of the renal cell cancer that he dealt with a couple years ago. He will enter the hospital this morning for pre-surgery tests and procedures and will be having major surgery on his spine this Friday and most likely be in ICU for 3 days and in the hospital for at least a week (Baptist Memorial Hospital, 6019 Walnut Grove Rd, Memphis, TN, 38120). Our thoughts and prayers go out to Bill and Gloria and the rest of his family. SMS MORNING COMMENTS 2/12/2016 Page 2 MARKET COMMENTS: Above is the market estimates for the June 30 Stocks and Acreage Report---note the average guess has the corn planted acres down 400,000, with soybeans down 500,00 There is a hogs and pigs report as well a stocks report as of June 1 which will update usage through the third quarter of 2007/08 marketing year. Based on recent export sales report, including the disappointing report today, one may conclude that higher prices have affected future shipments---(see freight matrix below as well) with a disappointing report today as well . Export sales are disappointing today but fickle weather, with maps varying past 24 hrs, now has significant rains called for over IA/MO again totaling from 4-8 inches with significant coverage over a lot of the corn belt then again first week of July--- which is another change in models from ridging to wet flow--- flip flopping as usual as we go from spring to summer ---it happens every year----those trying to trade on weather alone are in for a wild ride---- However one has to conclude that we are a long way from seeing normal weather or trading for some time. Using options the safest bet--- an experienced trader once told me that producers should be covered going into a major report and specs out of the way of the market--- we have such coverage now---may have to fine tune that tomorrow or during Mid-Day observations---- If there is a concern I have, it would be that the report on Monday would indicate demand falling already in this marketing year for both feed, ethanol and exports combined to yield carryout this year up 200-250 mil-bu by Sept 1---USDA will NOT be reporting Supply and Demand changes Monday---but implications will be pretty strong after we get the June 1 stocks, the hog report AND the update on acres in the special phone survey being taken now---as well as any USDA actions post Report!!!! Export Sales: Corn : 402,900 (171,600 – 08/09), est. – 500,000 to 750,000 Wheat : 503,300 (4,300 – 08/09), est. – 350,000 to 550,000 Soybeans : 2.02 mil (-268.1-07/08, 2289.4 – 08/09), est. – 1.90 mil to 2.25 mil Meal : 73,000 (38,400 – 08/09), est. – 75,000 to 150,000 Oil : 20,200 (0.0 – 08/09), est. – 0.0 to 10,000. Analysis: Corn : net sales of 231,300 down 33% vs. last week, down 51% vs. 4-week ave, Meal : net sales of 34,600 down 63% vs. last week, down 78% vs. 4-week ave, Beans : net reductions by China offset any new sales for a negative(reduction) of 268,100. 08/09 sales to China were 2.240 mil. Fundamentals - Middle of wheat harvest with huge yields being reported in soft wheat. Sure there are some problems in hard wheat harvest but US wheat is so far from competitive that we will continue to lose out on export trades. Egypt bot Black Sea origins overnight at $18 to 19 discounts to US offers? Corn inventories will be so tight that the need to feed wheat goes up---this rally in wheat/corn relationships does not help? Note freight origin to destination matrix below: Wheat…Black Sea undercuts others, as seen in recent sales to Egypt. Optional sales based on BlkSea. Beans…PNW enjoying less advantage due MUCH narrow Gulf-PNW freight spread. Perhaps part of why Gulf prems strong lately. China interest in US beans off the PNW continues.. China oil futures were quiet today as beans and meal rallied sharply. Indonesia will raise the export tax on palm from 15 pct to 20 pct starting July 1. China has impounded 75 TMT of palm oil? Corn…BlkSea feed wheat should be working to Korea, displacing some corn---key item to watch.. CNF Corn to S.Korea Aug Sep US PNW 392 US Gulf 405 Brazil 397 399 Arg 394 B.Sea Fdwht 368 Oct Nov Dec 394 393 392 404 401 397 400 396 365 365 Jan 392 395 Feb 392 394 364 Beans to China US PNW US Gulf Brazil Arg Aug Sep 660 658 678 644 662 627 Oct Nov Dec 326 328 330 303 304 305 294 262 262 Oct Nov Dec 68 65 62 98 93 90 102 98 95 102 98 95 103 102 100 30 28 28 Jan Feb 60 58 88 85 93 91 93 91 95 93 28 27 Oct Nov Dec 660 659 658 679 676 672 676 670 670 Jan 658 670 Feb 669 Jul Aug Sep 590 582 577 560 567 566 544 549 Oct Nov Dec 592 594 596 578 579 580 568 572 Jan Feb size Jul Aug Sep 598 55 76 75 70 581 582 55 108 76 102 55 118 77 110 55 118 78 110 gx-pnw 32 1 32 Oct Nov Dec 68 65 62 98 93 90 102 98 95 102 98 95 30 28 28 Jan Feb 60 58 88 85 93 91 93 91 28 27 Jul Aug Sep Oct Nov Dec 101 96 92 88 83 80 121 118 114 110 105 100 101 96 92 88 83 80 55 53 50 47 44 42 122 120 117 113 108 105 54 52 51 50 48 47 all values fob/cnf/frt are usd/mt Jan Feb 77 75 95 93 77 75 40 40 103 97 45 45 Wheat Aug Sep 376 380 463 455 469 465 378 377 349 Jul Aug Sep 322 300 302 280 285 290 277 260 260 FREIGHT mt Jan Feb size Jul Aug Sep 332 334 55 76 74 70 306 308 55 107 105 102 55 117 114 110 55 117 114 110 50 108 108 105 gx-pnw 31 31 32 Beans Wheat to Egypt US srw US sww US hrw French Arg Bl.Sea FOB Corn Oct Nov Dec 387 397 399 462 463 459 463 464 461 377 378 377 Jan 400 456 460 377 347 346 345 344 346 cnf dates are arrival Feb 401 460 378 Jul Aug Sep 275 284 295 342 337 348 368 369 371 323 324 327 295 295 Oct Nov Dec 309 316 320 353 354 356 376 378 380 331 333 335 Jan Feb size 324 327 55 55 383 385 55 338 342 25 25 295 295 296 299 25 fob dates are time of load DEMAND: Demand may have started to subside during this quarter---the extent of which may or may not be reflected in the June 1 stocks next week. The extent of any livestock cutbacks is debatable. Ethanol continues profitable for existing with most cancellations being by those in planning stages not current plants in operation or under construction. Technically--- The markets seemingly are dodging a bullet as just in time, markets rallied to thwart off a convincing sell signal headed into the report USDA JUNE 30 REPORT Next Week: Will have significant implications --- USDA re-surveying by phone some of the original participants of the June 1 survey to get an update--- USDA needs critical acreage estimates refined along with yield estimates to help make decisions post June 30 Survey. This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing. MORNING COMMENTS 2/12/2016 Pg 3 STRATEGIES/POSITIONS Watch for Mid-Day Update GENERAL: Markets tough to trade here--- ignoring normally reliable technical signals and in wheat basic fundamentals of improving harvest conditions and increases in world supply. CORN: for end users long coverage into 2009 first qtr—Long call spreads (Sept) option spreads---—exited 40% of any excess long spec positions a week or so ago. Market seems very supportive going into report. End users if long our recommended 100% usage into first quarter of 2009---buy the Sept $7.20 puts and sell the $6.50 puts for a net cost of about 30 cents---or roll out of 50% of long futures and buy the $7.20 and sell the $8.20 CU calls for a cost of 33 cents net---if you are planning to feed your locked in corn---it is not the next 30 cents that will kill you ---it is the next $1 or so----at $8 corn you might want to just sell the corn and the feeders? Producers: We sold an additional 5% in the futures Monday night/Tuesday --- in addition bought put insurance on another 15% of your production for 2008 in the CU $7.20/$6.50 CU Put spread--- added another 10% hedge this week at $ 7.52 –$7.54 Dec Today: Use late day sell stops late in the day below last night’s low of $7.42 to get caught up and to begin hedging 10% in 2009 and 2010 production----End users have upside coverage while producers using long put spreads and limited futures hedges. Our recent Dec hedges carry about a 10 cent risk---a close above $7.75 will be cause for another bullish leg higher---SOY COMPLEX: 100% long meal for remaining 2008--- Producers sold another 5% in SX futures this week–--TODAY: Exited 50% of long BO and the long side of Aug spread---continue to hold remaining long BO against short SX futures----pending mid day--- Meal has the best looking chart with upside significant with risk at this week’s lows thus far--WHEAT back to 70---80% covered TODAY: wheat looks the weakest fundamentally---increase coverage to 70-80% if wheat is trading lower 10 cents by after 12:30 noon –a close over 9.13 today in July will force us to re-evaluate futures coverage! Wheat is defying fundamentals! HRW, SRW, French, BlSea usd/mt Delivered Egypt 500 480 460 440 420 400 380 360 340 320 300 Sep Oct Nov Dec Jan Feb US hrw 472 471 473 474 474 474 US srw 387 391 401 404 407 409 French 375 375 377 377 378 379 Bl.Sea 347 346 346 345 Interesting that Blk.Sea wheat is holding steady while US values are rising, putting US soft wheat that much further out of the running. Where are we going to sell our srw? This is why fundamentally traders are so bearish wheat, but of the moment the momentum is moving against them. Cotton: Specs are long again. Use stops below 78.80 to exit. Producers should start hedging at 78.80 as well. Rice: Use a move below 19.00 in Nov contract to begin hedging. SMS MORNING COMMENTS 2/12/2016 Page 4 Natural Gas and Crude---- No positions--Lcattle Continues stronger last week---may have bullish COF discounted??? Update—we are basically flat with no positions---we’ll cautiously watch the trade for now--- breakeven now likely $120 for 2009 take a look at far out 2009 prices---getting near breakeven---Cautious here as LC momentum slowing! Hedge 20% of 2008 in Oct 08 or Dec 08 and for 2009 in April 09 and June 09 on straight sell stops 80 pts lower from yesterday’s closes! Hogs: hedged 25% or less for third quarter---still concerned that there is a lot of pork to move! --- 2009 futures hedged 20% June 2009 96.75. This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing. MORNING COMMENTS 2/12/2016 Pg 5