Weather: Mark Russo presented the weather outlook for the US and

advertisement

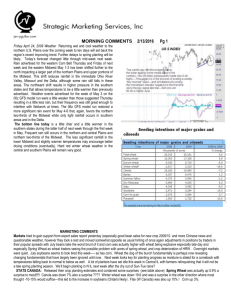

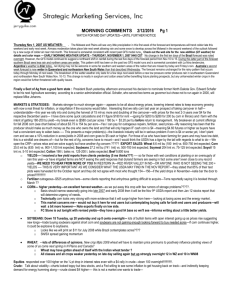

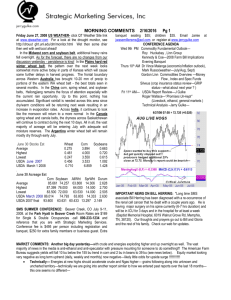

MORNING COMMENTS 2/17/2016 Pg 1 WATCH FOR MID DAY UPDATES Wednesday Dec 26, 2007 US WEATHER THE WEEK AHEAD — Check for details on our QT Weather Site link on www.jerrygulke.com For a look at the drought monitor, see http://drought.unl.edu/dm/monitor.html --5-8" of snow across eastern CO and western KS, also parts of southwest NE next few days. Light amounts further east. Balance of 10 day fairly dry but cold through early next week. The main weather feature of interest in the U.S. forecast is the advertised surge of cold that is still on the computer model charts for mid-week next week. This feature has been consistently predicted since Monday with temperatures during mid-week next week dropping well below average in the lower Midwest, southern Plains, Delta and southeastern states for a quick two to three days. The cold comes with considerable wind and cloudiness helping to prevent a serious freeze from occurring in the Gulf of Mexico Coast states, but it gets quite chilly in those areas Jan. 2-4. A dramatic return of normal to above normal temperatures occurs immediately thereafter Argentina’s forecast has turned drier since Monday. Much less rain is advertised for the nation’s summer grain and oilseed country. A large percentage of Argentina is no longer expecting significant rain tonight through Saturday morning Coverage in the south will be poor with net drying likely in most locations. Any rains scheduled for early next week has been diminished as well with the remainder of next week looking dry as well—of course that is a ways off and can change as we know. Brazil will see some net drying over the southwest areas but still frequent rains and not nearly as concerning for the market that Argentina is. Northern India’s forecast is still mostly dry for the coming week to ten days, and the lack of rains is a concern for that region as well. China’s forecast is rather benign with snow expected in the northeastern provinces later this week and into the weekend. Any precipitation that occurs in winter wheat or rapeseed areas will be brief and quite light. Australia’s forecast offers rain mostly to northeastern Queensland during the coning ten days. Some rain reaches into sorghum and cotton areas of southeastern Queensland and northeastern New South Wales, but only for a brief period of time over the next couple of days and again late in the second week of the two-week forecast. First it was dry for wheat now wet complicating quality and harvest—a la US last summer South Africa’s rainfall is restricted over the coming week with showers and thunderstorms most likely in the northeast. A boost in precipitation is advertised for the second week of the two week outlook. Net drying is quite likely through mid-week next week, especially in western parts of the summer crop region. YEAR END HOUSEKEEPING SMS is a corporation and does NOT require 1099s –Please do NOT send me personally a 1099. Let’s get your transfer forms submitted to MF or other brokerage firms if you are planning on moving your account--- MF Global has used their 3-day delay pretty successfully and reissues it if there is a trade in the account causing more delays---I doubt we will be exiting any long positions so if you have not seen the account move, give them a call of urgency. An alternative is to move just the cash balance of the account initially. Call 312-896-2080 and we will help! Please check your mailing address for SMS—it is Box 6222 Rockford, IL 61125 –we changed it over a year ago but still get mail to the old address. Reminder of the SMS Conference in Palm Springs--- Feb 25-27th Top Producer Conf Jan 16-18 Chicago—with SMS-Chicago office open house. ___________________________________________________________________________________________________________ SMS ONLINE BROKERAGE ACCOUNT FORMS: There is SMS-MANAGED BUSHELS PROGRAM: The 2007 program no longer a formal SMS-MF Memphis relationship –to open will end soon---call Jeff for extension details. If you wish to a SMS-Chicago acct click enroll in the 2008 program---it is open for a period of time---https://www.ghco.com/GHCOAccountForms/1_A.aspx?IBID=1 contact Jeff at 815-962-8860 or jeffabeal@aol.com, or Jamie 0 jwasemillersms@aol.com If you have questions on strategies and/or the morning This is an excellent time to do so as markets are volatile and comments, or opening an account, please feel free to call nervous. If you have questions, call Jeff or Jamie ASAP. See Jim Riley or Nate Smith or Jamie in our Chicago office comments below: at 312-896-2090. ____________________________________________________________________________________________________________ SMS MORNING COMMENTS Executive Marketing Seminar Jan 8-11, 2008. Website is www.executivemarketingplans.com Jeff will be presenting. Delaware Seminar: Jerry will be presenting at the "Grain Marketing Strategies Conference" being held in Harrington, DE on Wednesday, January 9, 2008 as part of the DE Ag Week program. If you live in the area, call Carl German ph. 302-831-1317 email clgerman@udel.edu cell 302-690-1878 Top Producer Seminar: Top Producer Seminar in Chicago January 15-18th SMS clients will receive a $325 rate. 312-5463236 ext. 803 and mention you are with Jerry Gulke’s SMS. 2/17/2016 Page 2 SMS WINTER CONFERENCE: Feb. 25-27. Wyndham Hotel, Palm Springs, CA. Reservation number is 760-322-6000. Room rate is $189 plus tax. Please mention you are with Strategic Marketing Services. Conference fee is $450 per client --$150 for partner. Speakers include: Gordon Linn, Vince Malenga, Roger Wallace and others—plus golf If you have questions contact Jamie at 707-365-0601. There is an antique car auction the prior weekend! Rooms are limited. HOUSEKEEPING---- We are still getting mail addressed to 5717 Fitz Rd---we changed the mailing address a year ago so please revise your accounting bookkeeping to reflect P.O. Box 6222 Rfd, IL 61125 Also December invoices are due---if you are due in Dec you should have one--- Please check your mail—Also, if you wish to pay a year in advance due to tax reasons, there is the $200 deduction for yearly payments. OPEN HOUSE---We are scheduling another open house at SMSChicago CBOT Bldg Suite 1255A the afternoon of Wed Jan 16th to coincide with the TP Visit to the CBOT --- If you already visited the mock CBOT session, and do not wish to attend again, you are invited to come directly to the 12th Floor of CBOT SMS/LinnGroup Offices for a social time---others may stop in after the mock session. If you are planning to attend, send Jamie a note or call Nate 312-896-2090 ____________________________________________________________________________________________________________ MARKETS AND STRATEGIES--- If you are planning to attend the Palm Springs Conference, UAL and AA has flights from Chicago to Psprings (ORD to PSP) for $300 and less in a year end sale. There is also an antique auto auction the weekend prior that you might want to attend Market calling beans 10-15 higher, corn 3-5 higher, wheat 3-5 higher—pipeline explosion in Nigeria— Rapeseed closed today. There is a growing concern by the market of higher than expected corn usage in 2008 such that the ability of corn to “give up” acres to soybeans may not be as easy to accommodate as once thought. Already corn carryover is down to 1.8 bilbu according to the USDA, NOT the 2.2 bil-bu. S Korea bought corn overnight from US. The market has to either pull enough acres out of hay, pasture, possible CRP or out of other crops to accommodate the need or a significant price increase ration demand sufficiently to match expected production. A series of three USDA report will give the market further direction: 1. The January 11 Stocks report will show usage for the first three months of the marketing year (Sept 1---Dec 1). That usage will then be extrapolated through the year to determine just how critical the Dec 1 stocks are to total remaining demand. It will also be the last chance for the USDA to revise yields and harvested acres for 2007. You will recall that although SMS and USDA agreed exactly on planted acres of corn (close on soybeans as well) –we do not yet agree with harvested acres. There remains a chance therefore for the USDA to agree with SMS and increase harvested acres of corn but could also decrease yield of corn slightly. This report will also be the first winter wheat estimate by the USDA 2. The Feb 21 Ag Outlook Forum in Washington DC will show how the USDA economists deal with acreage assumptions, and subsequent Supply and Demand tables going forward. 3. The March 30 Planted Acreage Survey Report threatens to be another block buster report. The US needs 10 mil more soybean acres in 2008, and if we don’t come close in the intentions, markets could explode as there would be little time left to change farmers minds in any significant manner--- It would be up to April/May weather to influence plantings thereafter. Hard spring wheat faces a near impossible task of buying enough acres to offset a very tight S/D outlook--4. Private Reports will be watched closely in the interim to get a heads up on acreage, ours included. We will be sending out our client survey questionnaire shortly! In the Background with some commodity prices reflecting a “catch-up” with inflation, traders are well aware that the inflation adjusted price for soybeans is something over $20 per bushel. Index rebalancing will take place next week with thoughts funds will be selling wheat, perhaps some beans and buying corn eying those commodities which have not had a huge rally this year--- Corn is actually not that much higher than a year ago (still at 11 yr highs however) , while soybeans and wheat have accelerated to new highs. Soybeans have not been this high for 34 years. As price increases for fertilizer continue to surface, the acreage battle intensifies. Bean Meal firm--- good crush margins world wide means good off-take of soybeans. The passing of the energy bill taking the corn based ethanol mandates to 15 bil gal also gave the corn market a push this week. A 1 bil gal mandate on bio-diesel had the same affect on soyoil futures. Early thoughts that the bil would be vetoed fell to the side once the penalties on the petroleum firms were removed. This implies a growing demand base for both beans and corn---acre fight goes on. May help some if other producing nations take a less restrictive view of GMO seed? Talk surfaced again this week that the USDA just does not yet see a need to press for release of the CRP acres---may take a much bigger reduction in the ending stocks to turn their head in that direction? This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing. MORNING COMMENTS 2/17/2016 Pg 3 COF Report: Cattle on feed up 1 pct, placements up 12 pct. Marketings were near expectations at 1.738 million head. Placements were much higher than expected, up 12%. All of the increase was in lightweight animals. Apparently we would rather feed $4 corn than graze $8 wheat Looking ahead, Dec and Jan placements are likely to be higher than a year ago due to problems with winter weather last year. We're still on track for a mid $90's average in the 1st quarter and lower $90's for the 2nd quarter. This week's livestock slaughter was huge- 663,000 head of cattle and 2,449,000 of hogs. Yes there are a lot of cattle out there. May be a few more in pens than on pasture. Leaves more wheat to be marketed as wheat. Is also a little bullish corn for feed. Is bearish summer cattle MARKETING ADVICE/TRADING Previous Advice Corn: 2007 100% covered either in the cash market (or hedged if you prefer)---for the carry—covered partially with long oilseeds and beans if inclined to do so . 2008 15% sold in the cash market for July 2009 ($4.49 futures $4.25 cash) . End Users of corn --- Hold short CH $3.80 puts sold at 14 cents – Producers bought March Soy Oil 1 oil for each 5 corn on 25% of 2007 and 2008 crops this week. Hold long SN and previous long SOH as well . Make sure you have covered short corn per advice above or just get out of 15% of hedges! If you have questions call 312-896-2080 – S Korea bought corn!!!!! __________________________________________________________________________________________________________________ PREVIOUS ADVICE/POSITIONS End users long 100% meal for 2008--- Producers are holding SOYBEANS: 75% sold (futures and/or cash) in 2007 crop for the carry significant long and SN . Specs: Long Soy oil –risk is 100 into 2008- 40% sold (cash or hedges) for 2008 on total expected pts –add to the long position on a close over 47.40 BO soybean production—and to 75% on any ADDED acres for 2008. March End users: 75% covered for 2008 in the Jan Soymeal at $286 Long TODAY : CONTINUE to hold Long March Soyoil 1:1 one $11 SF put for each long meal contract as an offset. ratio Hold long SN and previous long SOH as well—stretch Producers: We bought the rapeseed (Canola) sufficient to offset 15% your comfort zone!!! Rapeseed trading closed—holiday 2007 production and we still have a positive bias. Bull spread SN/SX . (Recommend re-owning 25% of previous sales in cash or futures for 2007 and 2008 in SN08) ______________________________________________________________________________________________________ PREVIOUS ADVICE/POSITONS Wheat: 70% --100% covered. We exited all long July premium wheat and any long March Mpls against July 2008 hedges---hold for now--70--100% hedged in 2008 production minimum. The Japanese purchases of spring and white this week has put that market back in the front of everyone’s attention. TODAY: New Advice Offset short WN with long Mpls March wheat 1 MWH for every 3 short if MWH trading higher early this morning—risk 20 cents on the MWH Alternative—long BOH for ever short WN—or get out of 25% of short WN if it closes 17 higher using buy stops. __________________________________________________________________________________________________________________ L CATTLE:. TODAY: 40% hedge on the move below 95.80—Hold for now! LIVE HOGS: We were 25% hedged—increased hedges to 40% at 59.75 Dec 17—LH possibly pausing before another leg Feb broke under $95, key support area. Downside lower risk to $92 With the potential for winter weather at some point in the future we should see a recovery. . Equities—No futures positions US $ Still long—Exit on a close 30 or more lower COTTON: No change should have added to longs already and kept the March calls. Exit futures on a close below 64.50. RICE: . We should be long and willing to risk a move below 13.45.