Chapter 01 Quiz A

advertisement

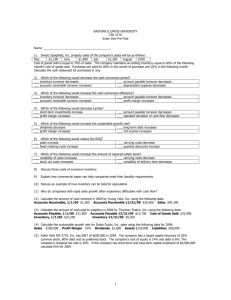

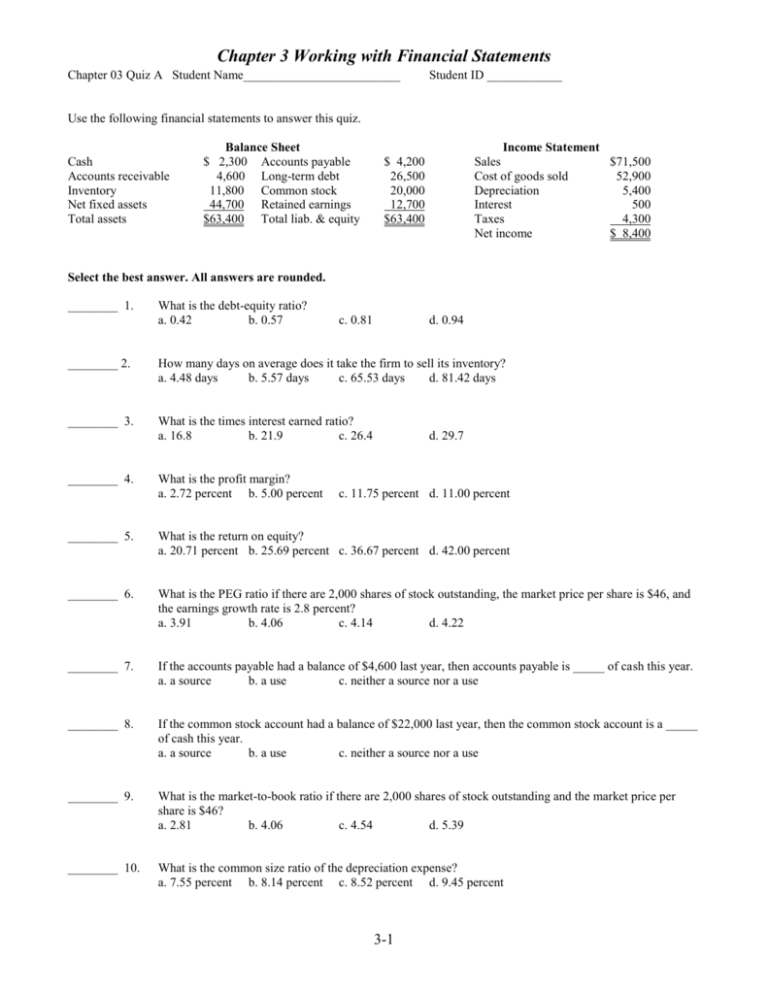

Chapter 3 Working with Financial Statements Chapter 03 Quiz A Student Name_________________________ Student ID ____________ Use the following financial statements to answer this quiz. Cash Accounts receivable Inventory Net fixed assets Total assets Balance Sheet $ 2,300 Accounts payable 4,600 Long-term debt 11,800 Common stock 44,700 Retained earnings $63,400 Total liab. & equity Income Statement Sales $71,500 Cost of goods sold 52,900 Depreciation 5,400 Interest 500 Taxes 4,300 Net income $ 8,400 $ 4,200 26,500 20,000 12,700 $63,400 Select the best answer. All answers are rounded. ________ 1. What is the debt-equity ratio? a. 0.42 b. 0.57 c. 0.81 d. 0.94 ________ 2. How many days on average does it take the firm to sell its inventory? a. 4.48 days b. 5.57 days c. 65.53 days d. 81.42 days ________ 3. What is the times interest earned ratio? a. 16.8 b. 21.9 c. 26.4 ________ 4. What is the profit margin? a. 2.72 percent b. 5.00 percent d. 29.7 c. 11.75 percent d. 11.00 percent ________ 5. What is the return on equity? a. 20.71 percent b. 25.69 percent c. 36.67 percent d. 42.00 percent ________ 6. What is the PEG ratio if there are 2,000 shares of stock outstanding, the market price per share is $46, and the earnings growth rate is 2.8 percent? a. 3.91 b. 4.06 c. 4.14 d. 4.22 ________ 7. If the accounts payable had a balance of $4,600 last year, then accounts payable is _____ of cash this year. a. a source b. a use c. neither a source nor a use ________ 8. If the common stock account had a balance of $22,000 last year, then the common stock account is a _____ of cash this year. a. a source b. a use c. neither a source nor a use ________ 9. What is the market-to-book ratio if there are 2,000 shares of stock outstanding and the market price per share is $46? a. 2.81 b. 4.06 c. 4.54 d. 5.39 ________ 10. What is the common size ratio of the depreciation expense? a. 7.55 percent b. 8.14 percent c. 8.52 percent d. 9.45 percent 3-1 Chapter 3 Working with Financial Statements Chapter 03 Quiz A 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. d d c c b a b b a a Answers Debt-equity ratio = ($4,200 + $26,500) / ($20,000 + $12,700) = $30,700 / $32,700 = .94 Inventory turnover ratio = $52,900 / $11,800 = 4.48305 Days’ sales in inventory = 365 / 4.48305 = 81.42 days Times interest earned = ($71,500 − $52,900 − $5,400) / $500 = 26.4 Profit margin = $8,400 / $71,500 =.11748 = 11.75 percent Return on equity = $8,400 / ($20,000 + $12,700) = .25688 = 25.69 percent PEG = [$46 / ($8,400 / 2,000)] / 2.8 = 10.95238 / 2.8 = 3.91 A decrease in a liability account is a use of cash. A decrease in an equity account is a use of cash. Market-to-book ratio = $46 / [($20,000 + $12,700) / 2,000] = $46 / $16.35 = 2.81 Common size ratio of depreciation = $5,400 / $71,500 = .0755 = 7.55 percent 3-2 Chapter 3 Working with Financial Statements Chapter 03 Quiz B Student Name _________________________ Student ID ____________ Use the following financial statements to answer this quiz. Cash Accounts receivable Inventory Net fixed assets Total assets Balance Sheet 980 Accounts payable 4,160 Long-term debt 11,750 Common stock 32,500 Retained earnings $49,390 Total liab. & equity $ Income Statement Sales $52,600 Cost of goods sold 40,960 Depreciation 4,610 Interest 1,260 Taxes 1,970 Net income $ 3,800 $ 3,610 15,740 18,400 11,640 $49,390 Select the best answer. All answers are rounded. ________ 1. What is the quick ratio? a. 0.10 b. 0.27 c. 1.42 d. 4.68 ________ 2. On average, how long does it take the firm to collect payment from a customer? a. 12.64 days b. 16.28 days c. 22.42 days d. 28.87 days ________ 3. What is the price-sales ratio if there are 2,500 shares of stock outstanding at a price per share of $72? a. 3.42 b. 3.87 c. 4.14 d. 4.20 ________ 4. What is the profit margin? a. 6.67 percent b. 7.22 percent c. 7.69 percent d. 8.03 percent What is the cash coverage ratio? a. 8.67 b. 9.24 c. 10.31 d. 10.59 What is the total asset turnover? a. 0.42 b. 0.57 c. 0.84 d. 1.06 ________ 5. ________ 6. ________ 7. If the accounts payable had a balance of $4,210 last year, then accounts payable is ____ of cash this year. a. a source b. a use c. neither a source nor a use ________ 8. The average inventory turnover rate for the industry best related to this firm is 3.6. This indicates that this firm is selling its inventory _____ its peers on an average basis. a. faster than b. slower than c. at the same pace as ________ 9. What is the PEG ratio if there are 2,500 shares of stock outstanding with a market price of $18.40 per share? The expected earnings growth rate is 3.4 percent. a. 3.56 b. 4.27 c. 4.41 d. 4.90 ________10. What is the common size ratio for long-term debt? a. 24.08 percent b. 27.79 percent c. 31.87 percent d. 34.20 percent 3-3 Chapter 3 Working with Financial Statements Chapter 03 Quiz B 1. 2. c d 3. 4. 5. 6. 7. 8. a b b d b b 9. 10. a c Answers Quick ratio = ($980 + $4,160) / $3,610 = 1.42 Accounts receivable turnover = $52,600 / $4,160 = 12.64423; Days sales in receivables = 365 / 12.64423 = 28.87 days Price-sales ratio = $72 / ($52,600 / 2,500) = $72 / $21.04 = 3.42 Profit margin = $3,800 / $52,600 = .07224 = 7.22 percent Cash coverage ratio = ($52,600 − $40,960) / $1,260 = 9.24 Total asset turnover = $52,600 / $49,390 = 1.06 Accounts payables decreased which is a use of cash. Inventory turnover = $40,960 / $11,750 = 3.49. The lower the turnover rate, the slower the pace at which the inventory is selling. PEG =[ $18.40 / ( $3,800 / 2,500)] / 3.4 = 12.10526 / 3.4 = 3.56 Common size ratio for long-term debt = $15,740 / $49,390 = .31869 = 31.87 percent 3-4 Chapter 3 Working with Financial Statements Chapter 03 Quiz C Student Name _________________________ Student ID ____________ Use the following financial statements to answer questions 1 through 8. Cash Accounts receivable Inventory Net fixed assets Total assets Balance Sheet 2006 2007 $ 2,100 $ 1,800 3,700 4,400 14,500 16,700 41,300 45,800 $61,600 $68,700 Accounts payable Long-term debt Common stock Retained earnings Total liab. & equity 2006 $ 6,300 26,400 18,000 10,900 $61,600 2007 $ 5,900 26,300 21,000 15,500 $68,700 Income Statement Sales $66,900 Cost of goods sold 50,700 Depreciation 5,600 Interest 2,300 Taxes 2,900 Net income $ 5,400 Select the best answer. All answers are rounded. ________ 1. What is the current ratio for 2007? a. 0.92 b. 1.05 c. 3.22 d. 3.88 ________ 2. What is the accounts receivable turnover rate? Use the average receivables for 2006 and 2007. a. 14.87 b. 16.52 c. 22.10 d. 24.55 ________ 3. What is the profit margin for 2007? a. 7.23 percent b. 7.45 percent ________ 4. c. 7.86 percent What is the common size ratio for retained earnings for 2007? a. 22.56 percent b. 26.93 percent c. 27.65 percent d. 8.07 percent d. 28.49 percent ________ 5. What is the price-sales ratio if there are 4,000 shares of stock outstanding and the market price per share is $37.50? a. 2.24 b. 2.99 c. 3.07 d. 3.80 ________ 6. What is the return on equity based on 2007 values? a. 13.33 percent b. 14.14 percent c. 14.79 percent d. 16.78 percent ________ 7. What are the dividends per share if there are 4,000 shares of stock outstanding? a. $0.02 b. $0.15 c. $0.20 d. $0.35 ________ 8. What is the common size ratio for the inventory for 2007? a. 21.08 percent b. 21.17 percent c. 23.54 percent d. 24.31 percent Which one of the following accounts represents an investment activity? a. inventory b. accounts payable c. cost of goods sold d. net fixed assets ________ 9. ________ 10. Which of the following are correct formulas for computing the return on equity? I. ROE = Net income / Total equity II. ROE = Return on assets × (1 + Debt-equity ratio) III. ROE = Profit margin × Total asset turnover × Equity multiplier IV. ROE = Return on assets × (1 + Equity multiplier) a. I and III only b. II and IV only c. I, II, and III only d. I, III, and IV only 3-5 Chapter 3 Working with Financial Statements Chapter 03 Quiz C 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. d b d a a c c d d c Answers Current ratio for 2007 = ($1,800 + $4,400 + $16,700) / $5,900 = 3.88 Average A/R = ($3,700 + $4,400) 2 = $4,050 ; A/R turnover = $66,900 / $4,050 = 16.52 Profit margin = $5,400 / $66,900 = .0807 = 8.07 percent Common size ratio for retained earnings for 2007 = $15,500 / $68,700 = .2256 = 22.56 percent Price-sales ratio = $37.50 / ($66,900 / 4,000) = $37.50 / $16.725 = 2.24 Return on equity based on 2007 equity = $5,400 / ($21,000 + $15,500) = .1479 = 14.79 percent Dividends per share = [$5,400 − ($15,500 − $10,900)] / 4,000 = $800 / 4,000 = $0.20 Common size ratio for inventory for 2007 = $16,700 / $68,700 = .2431 = 24.31 percent Net fixed assets is the investment activity account. Options I, II, and III are correct formulas for computing the return on equity. 3-6