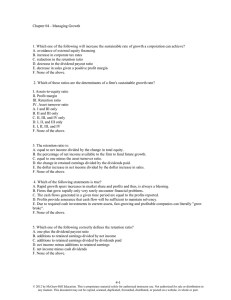

Ch 4 Problems

advertisement

Chapter 4 Problems 1- Given the following information:sales = $450; costs = $400; tax rate = 34%. Assuming costs run at a constant percentage of sales, if sales rise by 10% next year, what will net income be? ($36.3) 2- A firm earns net income of $25,000 in a given year and the firm's retained earnings increase $15,000 for that same year. The retention ratio is: (60%) 3- Given the following information: sales = $450, costs = $350, tax rate = 34%, retention ratio = 30%, production = 95% of capacity, sales increase = 10%. What is the expected addition to retained earnings? (Assume costs change directly with sales.) ($21.78) 4- Given the following information: assets = $900; accounts payable = $110; notes payable = $100; long-term debt = $150; equity = $540; sales = $450; costs = $400; tax rate = 34%; dividends = $16. 50. Costs, assets, and accounts payable maintain a constant ratio to sales. How much external financing is needed if sales increase 15% and the dividend payout ratio is constant? ($100) 5- Suppose a firm has net income of $100 and a profit margin equal to 14%. If the firm is working at 2/3 capacity, then full capacity sales are: ($1,071) 6- Knudsen, Inc. 's firm's full-capacity sales level is $3,000,000. If the firm is currently operating at 80% of capacity, what is the current level of sales? ($2,400,000) 7- Given the following information: current assets = $400; fixed assets = $500; accounts payable = $100; notes payable = $45; long-term debt = $455; equity = $300; sales = $450; costs = $400; tax rate = 34%. Suppose that current assets, costs, and accounts payable maintain a constant ratio to sales. If the firm is producing at 80% capacity, what is the total external financing needed if sales increase 25%? Assume the firm pays no dividends. ($33.75) 8- Moore Money Inc has a profit margin of 11% and a retention ratio of 70%. Last year, the firm had sales of $500 and total assets of $1,000. What is the internal growth rate? (4%) 9- Given the following information: profit margin = 10%; sales = $100; retention ratio = 40%; assets = $200; equity multiplier = 2.0. If the firm maintains a constant debt-equity ratio and no new equity is used, what is the maximum growth rate? (Assume a constant profit margin.) (4.17%) 10- Simply Red, Inc. has a return on equity of 14%, a dividend payout ratio of 20%, an equity multiplier of 1.4, and a profit margin of 1.2%. What is the sustainable growth rate? (12.6%) Use the following to answer problems 11 and 12 Net income = $150; Total assets = $1,000; Total liabilities = $400; Total asset turnover = 4. 0 11- What is the capital intensity ratio assuming dividends paid total $100? (0.25) 12- What is the internal growth rate assuming dividends paid total $100? (5.3%)