Exam One Pre-Test - Eastern Illinois University

advertisement

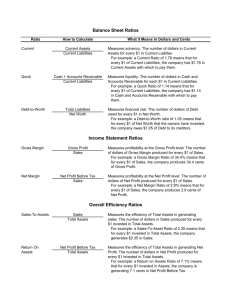

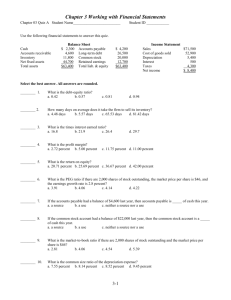

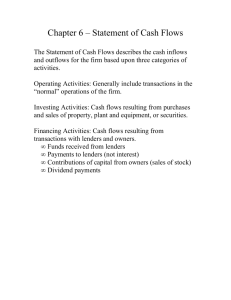

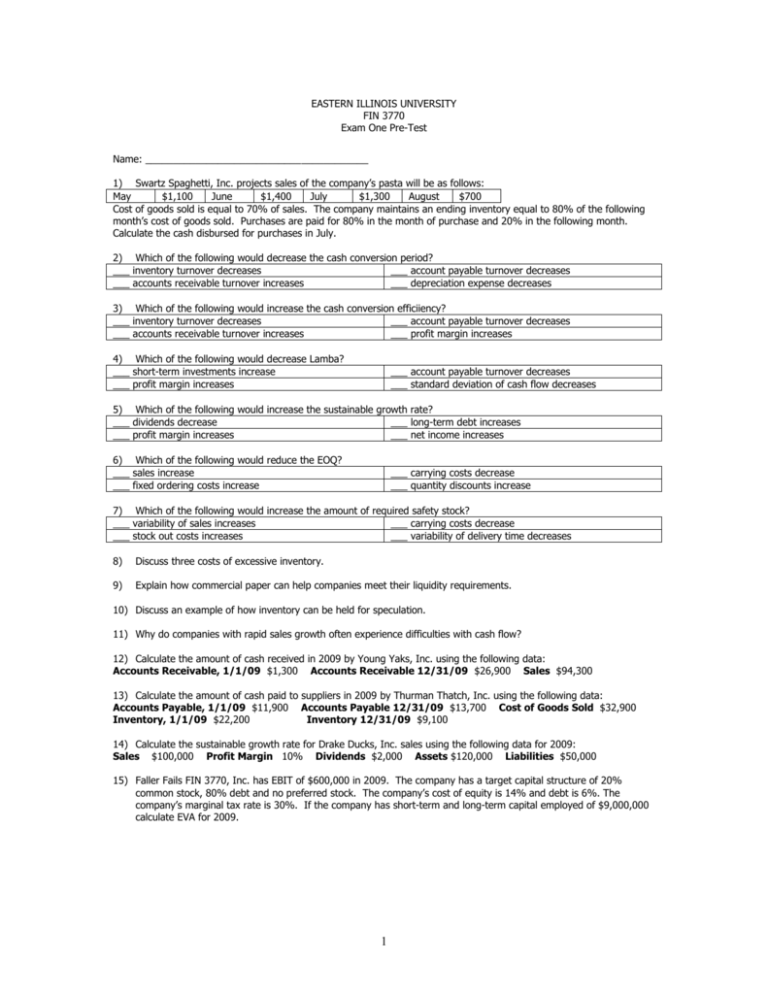

EASTERN ILLINOIS UNIVERSITY FIN 3770 Exam One Pre-Test Name: ________________________________________ 1) Swartz Spaghetti, Inc. projects sales of the company’s pasta will be as follows: May $1,100 June $1,400 July $1,300 August $700 Cost of goods sold is equal to 70% of sales. The company maintains an ending inventory equal to 80% of the following month’s cost of goods sold. Purchases are paid for 80% in the month of purchase and 20% in the following month. Calculate the cash disbursed for purchases in July. 2) Which of the following would decrease the cash conversion period? ___ inventory turnover decreases ___ account payable turnover decreases ___ accounts receivable turnover increases ___ depreciation expense decreases 3) Which of the following would increase the cash conversion efficiiency? ___ inventory turnover decreases ___ account payable turnover decreases ___ accounts receivable turnover increases ___ profit margin increases 4) Which of the following would decrease Lamba? ___ short-term investments increase ___ profit margin increases ___ account payable turnover decreases ___ standard deviation of cash flow decreases 5) Which of the following would increase the sustainable growth rate? ___ dividends decrease ___ long-term debt increases ___ profit margin increases ___ net income increases 6) Which of the following would reduce the EOQ? ___ sales increase ___ fixed ordering costs increase ___ carrying costs decrease ___ quantity discounts increase 7) Which of the following would increase the amount of required safety stock? ___ variability of sales increases ___ carrying costs decrease ___ stock out costs increases ___ variability of delivery time decreases 8) Discuss three costs of excessive inventory. 9) Explain how commercial paper can help companies meet their liquidity requirements. 10) Discuss an example of how inventory can be held for speculation. 11) Why do companies with rapid sales growth often experience difficulties with cash flow? 12) Calculate the amount of cash received in 2009 by Young Yaks, Inc. using the following data: Accounts Receivable, 1/1/09 $1,300 Accounts Receivable 12/31/09 $26,900 Sales $94,300 13) Calculate the amount of cash paid to suppliers in 2009 by Thurman Thatch, Inc. using the following data: Accounts Payable, 1/1/09 $11,900 Accounts Payable 12/31/09 $13,700 Cost of Goods Sold $32,900 Inventory, 1/1/09 $22,200 Inventory 12/31/09 $9,100 14) Calculate the sustainable growth rate for Drake Ducks, Inc. sales using the following data for 2009: Sales $100,000 Profit Margin 10% Dividends $2,000 Assets $120,000 Liabilities $50,000 15) Faller Fails FIN 3770, Inc. has EBIT of $600,000 in 2009. The company has a target capital structure of 20% common stock, 80% debt and no preferred stock. The company’s cost of equity is 14% and debt is 6%. The company’s marginal tax rate is 30%. If the company has short-term and long-term capital employed of $9,000,000 calculate EVA for 2009. 1 16) Ratliff Radishes is purchasing a computer system to track inventory in an effort to reduce the amount of spoilage expense for the company. The cost to install the system is $170,000 and it is expected to have a useful life of 20 years. The company’s financial analyst, Soo Soo Strole, feels the project should have a risk premium of four percent above the risk-free rate of return. Mr. Strole determines the company’s cost of debt is 8%, the company’s cost of equity is 12%, the company’s tax rate is 40% and treasury bills currently yield 1%. What is the annual reduction in spoliage expense necessary to justify the $170,000 cost of the computer system if the company estimates they can sell the system for $25,000 twenty years from now? County Seat, Inc. Financial Statements 7/31/96 Cash 110,603 Accounts receivable 11,486 Inventory 32,580 Prepaid Expenses 3,915 Net Fixed Assets 60,223 Total Assets 218,807 Accounts payable Current maturity longterm debt Accrued expenses Long-term debt Common stock Retained earnings Total Debt and Equity 7/31/95 8,125 2,778 143,474 23,377 151,824 329,578 147,397 81,826 65,472 43,729 23,825 34,606 132,418 -201,265 21,451 163,851 113,879 -78,804 218,807 329,578 1996 1995 Sales $243,331 $254,299 Cost of goods sold 195,812 190,061 Administrative expense 54,990 62,094 Depreciation expense 5,915 6,787 Net Income $-13,386 $-4,643 17) Calculate the quick ratio for County Seat as of 7/31/96 18) Calculate the amount of working capital requirements for County Seat as of 7/31/96. 19) Calculate the amount of net liquid balance for County Seat as of 7/31/96. 20) Calculate the days inventory held for County Seat as of 7/31/96. 21) Calculate the days sales outstanding for County Seat as of 7/31/96. 22) Calculate the days payable outstanding for County Seat as of 7/31/96. 23) Calculate the cash conversion period for County Seat as of 7/31/96. 24) Martin Minced Mice (MMM) sells minced mice to French restaurants for $100 per mouse. It costs the company $60 to place an order for mice and holding costs per unit average $21. The company produces and sells 200,000 mice every 365 days. The company currently orders lots of 10,000 mice at a price of $3 per mouse. Calculate the EOQ. EOQ (2 xTxF) / H 25) Calculate the difference in inventory costs between the EOQ and the current order quantity of 10,000 mice. 26) If it takes four days to receive an order from a supplier and the company desires safety stock of 500 mice, at what inventory level is the reorder point? Questions from the readings will appear on the exam! 2