6500_zero_code

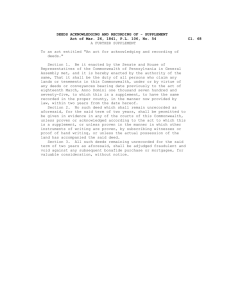

advertisement

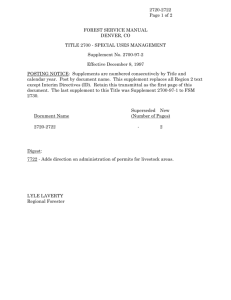

6500_Zero_Code Page 1 of 2 FOREST SERVICE MANUAL DENVER, CO FSM 6500 - FINANCE AND ACCOUNTING R2 Supplement No. 6500-92-2 Effective September 15, 1992 POSTING NOTICE. Supplements to this title are numbered consecutively. Post by document name. Remove entire document and replace with this supplement. Retain this transmittal as the first page of this document. The last supplement to this Handbook was Supplement 6500-92-1 to Chapter 10. Page Code 6506.64--1 through 6506.64--6 6506.82--1 through 6506.82--2 6507.18--1 through 6507.18--2 Superseded Sheets 3 1 1 Supplements Covered R2 Supplement 350, 9/82 R2 Supplement 345, 2/82 R2 Supplement 353, 11/82 R2 Supplement 324, 6/80 Document Name 6500 Zero Code Superseded New (Number of Pages) 2 Digest: Removes material on Irrevocable Letters of Credit and Reclamation Bonds and reissues in the FSH 6509.11k, Ch.80. Also, reissues page 6507.18--1 through --2 in the electronic format. ELIZABETH ESTILL Regional Forester R2 SUPPLEMENT 6500-92-2 EFFECTIVE 9/15/92 6500_Zero_Code Page 2 of 2 FSM 6500 - FINANCE AND ACCOUNTING R2 SUPPLEMENT 6500-92-2 EFFECTIVE 9/15/92 ZERO CODE 6506 - ERRORS, FISCAL LIABILITY, AND SHORTAGES IN ACCOUNTS. 6506.1 - Handling Errors. Units shall take appropriate action to recover liabilities assessed against employees considered as non-accountable officers. Due process as described in FSM 6570 and FSH 6509.11k for collection procedures must be followed. If the employee refuses to make restitution, the billing must remain in the unpaid file until the employee separates from Government service or until relief has been granted to the employee. Based upon Comptroller General Decision B189154 dated May 8, 1979, the Government cannot withhold current salary for offset purposes from non-accountable officers. We can take collection action against employee's annuities, payments, refunds of retirement contributions, final salary checks, and/or lump sum leave payments, upon separation. If the employee is rehired during subsequent seasons, the balance of the amount due continues to be outstanding unless the individual makes full restitution. Although we cannot take immediate collection action against a non-designated accountable employee to offset a debt, unless so directed by the Government Accounting Office or a court of law, we are able to make a variety of administrative actions available to admonish the employee for such wrongful acts which resulted in the financial damage incurred by the Government; i.e., suspension without pay, change of positions, withdrawn delegations and authorities, etc. Alternatives to retaining a bill due in our collection files would be either, (1) take court action necessary to enforce an immediate collection payment by the employee, or (2) simply write it off as a bad debt in accordance with FSM 6530 and FSM 6570. 6506.21 - Shortages or Irregularities in the Accounts of Accountable Officers. When an accountable officer is held responsible, recovery for the amount liable must be made. The accountable officer should be directed to immediately make full restitution. If the employee does not voluntarily replace the funds, then after following appropriate collection procedures, the Government can withhold salary until the employee has fully accounted for and paid into the Treasury of the United States all sums for which the employee is liable (5 U.S.C. 5512). The Government may withhold the employee's salary, with or without his/her consent, until full restitution is made. This is assuming we can establish how much is missing. Otherwise, we can only resort to a personnel action to admonish the employee. The Comptroller General, in his decision in B-189154 dated May 8, 1979, was talking to employees in general, not to employees who, by designation or work assignment, are accountable officers and can be held directly liable for their actions.