Top Ten Things to Look for in an Agency

advertisement

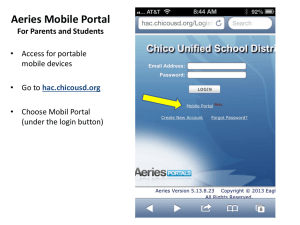

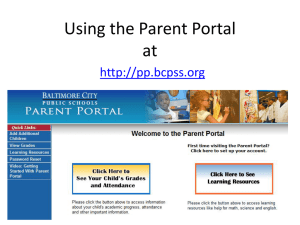

Top 10 Attributes of a Successful Collection Agency Presented by: Mike Korte The Affiliated Group You know the feeling … • Am I making the right choice? How do I know? • How do I know they are right for my organization? • Do they understand the values and philosophies of my organization and can they mirror them? • Did I check enough references? • What do I track going forward to gain confidence that I chose the right company to work with? TAG’s Top 10 Attributes of an Awesome Collection Agency People • Positive attitude • Professional/Integrity • Collections with Empathy • ACA-certified collectors • Problem-solving mentality • Active in the industry • Dependable, knowledgeable sales representatives who truly know how to serve • Involved ownership and management • Do you like them? Results • Not the lowest fee What kind of netback do you see? • Better than national average recoveries • Good, conservative legal council • Does the agency share their work standards? Do they ask for your input? • Are work standards tailored to your kind of debt and your philosophical views? Technology • Is your data safe? • Does the company have an adequate disaster recovery plan? • Is redundancy built into their system? • Do they provide a web portal to access reports, review data, place accounts, etc.? • Can they satisfy HIPAA concerns? • Is predictive dialing important from an efficiency standpoint? Customer Service • Do the CSR’s understand your business and how you want things done? • Are they available? Responsive? Accurate in their information and advice? Flexible? • Do they have the proper service mentality? • Do they care about your business? • Are they easy to do business with? Compliance • Do they have proven processes that abide by HIPAA, FDCPA, FCRA, etc.? • Do collectors utilize specific scripts while remaining conversational? Are they monitored and graded on a regular basis? Compliance … continued •Are complaints kept to a minimum? How are complaints followed through upon? Are you allowed to view the complaint log? • Does the agency behave in a manner consistent with your service philosophies? • Have you toured their facility to get a feel for how things really get done? Collection Processes •Are all processes available in picture form so you can see exactly what will be done with your accounts and when? •Are work standards created that are unique to your debt when deviations from generic work standards make sense? •Do you get the feeling that your accounts are being worked diligently or in the agency’s “spare” time? Collection Processes … continued • What skip-trace processes are utilized? • How does the agency determine when legal action might be required? Is there a specific process employed? Are sound, conservative attorneys used by the agency? Reporting • Are you able to get the information you need it and in a timely manner? • Can you get customized reports when needed? • Do they have an online web portal? • Is their web portal easy to use and capable of providing decision-ready information immediately?? Auxiliary Services • Is the agency experienced and talented at serving your needs in other areas of the revenue cycle? Early-stage delinquencies First party outsourcing Credit policy review Purchasing debt • The trend is to work with business partners who can bundle several talents. In Accounts Receivable Management, this starts when the customer walks in the door and doesn’t end until you are paid. References Have you checked references that the agency has provided? •Gives a chance to probe on some of these other attributes. •Do the references like the agency people? •Are the references similar in size and scope to your needs, to demonstrate that the agency is experienced in your needs? Trust •It all adds up to trusting that the agency is a true business partner •Are you confident of their honesty and integrity? •Do they do what they say they are going to do, when they say they are going to do it? It is better to under promise and over deliver Trust … continued • A/R is always the first or second largest asset on the balance sheet … have they earned the right to work with yours? • Do you feel that their sales people are in concert with operations people? Does everyone understand the agency’s capabilities … no more, no less? Picking an Accounts Receivable Management partner is not easy … • There are thousands of them • They all say they are the best • They all collect the most money • They all provide the best customer service • You’ve heard every pitch in the book! But, which ones have earned the right to serve you? Following these guidelines will give you confidence that you’ve found the right match. Thank You … … For allowing us to address this issue with you today. Best wishes for continued success! Mike Korte Greg Young mkorte@theaffiliatedgroup.com gyoung@theaffiliatedgroup.com The Affiliated Group 1-800-223-0290 www.theaffiliatedgroup.com