Stice_SolutionsManual_Vol2_Ch12

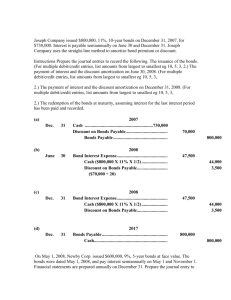

advertisement