College of Arts and Social Sciences

advertisement

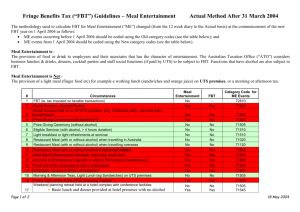

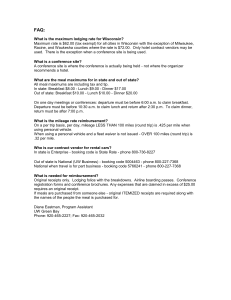

College of Arts and Social Sciences FBT Entertainment Frequently Asked Questions Question What is the definition of infrequent? What does the term incidental to entertaining clients mean? What is the dollar cut off to be considered a light lunch? For example would $30 per person constitute a light lunch? Is a set course lunch at Vivaldis or Boffins including a glass of wine (but where no alcohol is shown on the invoice), acceptable as a light lunch? Answer There is no definition of infrequent in the Fringe Benefits Tax Assessment Act 1986 (FBTAA). TR 2007/12 uses the Macquarie dictionary definition which is: 1. happening or occurring at long intervals or not often 2. not constant, habitual or regular The practical application of infrequent is not easy. As a result we need to use commonsense in applying the meaning. The main purposes of the event needs to be the entertainment of clients. Such an event at the ANU would be a graduation cocktail party for students that have just graduated. The main purpose of the event is the entertainment of students. Where staff attend the event, they are considered incidental and not subject to FBT. Another example would be an alumni dinner where staff attend. There is no definition of what constitutes a light meal. Practically though, around $20 to $30 per person would be reasonable. Does a conference dinner have to be documented as part of the conference program to count as an eligible training seminar? The definition of light meal is limited to sandwiches, other hand foods, salads, etc. A sit down meal starts to move into the entertainment sphere, especially when more than 1 course is included. The provision of alcohol constitutes entertainment and is subject to FBT as the consumption of alcohol has social connotations. Not showing the alcohol on the invoice is dishonest. No. However it is worth noting that entertainment provided at an eligible seminar is limited to light meals and some alcohol. A formal dinner will give rise to entertainment and will be subject to FBT for employees that attend. Should an FBT form be used for conference morning/afternoon teas and lunches, or can a light meal stamp be used? A light meal stamp can be used. This is the case whenever a light meal is provided. However a note must be included as to how it was determined that it was appropriate to use the Light Meal Stamp. A Light Meal Stamp cannot be used for a conference dinner. When a light meal stamp is used what other documentation is required to demonstrate it is a light meal? When employees are travelling on ANU business and take colleagues (usually from other institutions) out to dinner, can that still be regarded as a meal while travelling? A conference program/brochure would be appropriate, together with a note about how it was determined that a light meal stamp was appropriate. The characteristics of the attendees are not required. The meal will be exempt from FBT for the employee travelling. Where the colleagues are paid for by the ANU they will be treated as clients and not subject to FBT and no GST can be claimed. Where the colleagues are from ANU but are not travelling (such as staff at NARU) then the non-travelling employee will be subject to FBT. What is a moderate amount of alcohol? A moderate amount of alcohol is a glass or two of wine with the evening meal.