FAQ: - University of Wisconsin

FAQ:

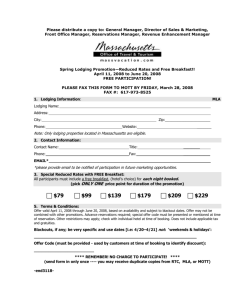

What is the maximum lodging rate for Wisconsin?

Maximum rate is $62.00 (tax exempt) for all cities in Wisconsin with the exception of Milwaukee,

Racine, and Waukesha counties where the rate is $72.00. Only hotel contract vendors may be used. There is the exception when a conference site is being used.

What is a conference site?

A conference site is where the conference is actually being held - not where the organizer recommends a hotel.

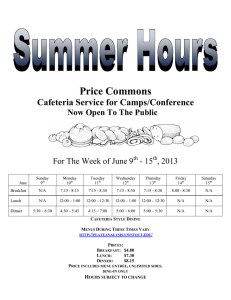

What are the meal maximums for in state and out of state?

All meal maximums are including tax and tip.

In state: Breakfast $8.00 - Lunch $9.00 - Dinner $17.00

Out of state: Breakfast $10.00 - Lunch $10.00 - Dinner $20.00

On one day meetings or conferences: departure must be before 6:00 a.m. to claim breakfast.

Departure must be before 10:30 a.m. to claim lunch and return after 2:30 p.m. To claim dinner, return must be after 7:00 p.m.

What is the mileage rate reimbursement?

On a per trip basis, per day, mileage LESS THAN 100 miles (round trip) is .425 per mile when using personal vehicle.

When using a personal vehicle and a fleet waiver is not issued - OVER 100 miles (round trip) is

.32 per mile.

Who is our contract vendor for rental cars?

In state is Enterprise - booking code is State Rate - phone 800-736-8227

Out of state is National (UW Business) - booking code 5004463 - phone 800-227-7368

National when travel is for part business - booking code 5766241 - phone 800-227-7368

What is needed for reimbursement?

Original receipts only. Lodging folios with the breakdowns. Airline boarding passes. Conference registration forms and conference brochures. Any expenses that are claimed in excess of $25.00 requires an original receipt.

If meals are purchased from someone else - original ITEMIZED receipts are required along with the names of the people the meal is purchased for.

Diane Eastman, Program Assistant

UW Green Bay

Phone: 920-465-2227; Fax: 920-465-2032