FBT Year End Report (PDF 24k)

advertisement

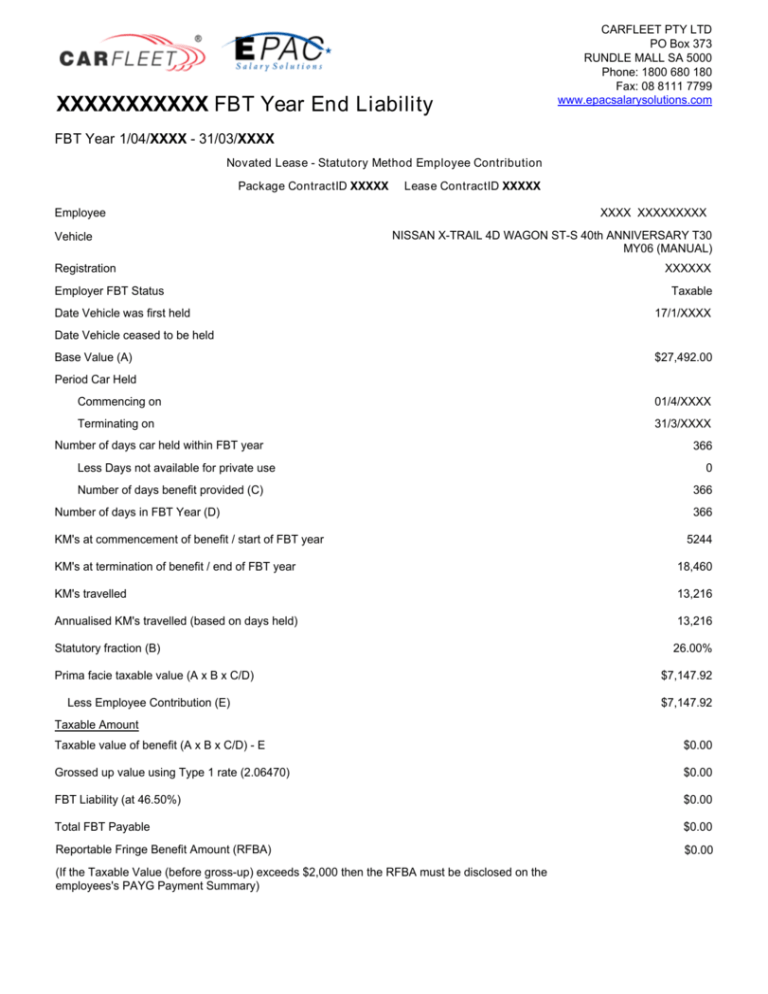

XXXXXXXXXXX FBT Year End Liability CARFLEET PTY LTD PO Box 373 RUNDLE MALL SA 5000 Phone: 1800 680 180 Fax: 08 8111 7799 www.epacsalarysolutions.com FBT Year 1/04/XXXX - 31/03/XXXX Novated Lease - Statutory Method Employee Contribution Package ContractID XXXXX Lease ContractID XXXXX Employee Vehicle XXXX XXXXXXXXX NISSAN X-TRAIL 4D WAGON ST-S 40th ANNIVERSARY T30 MY06 (MANUAL) Registration Employer FBT Status Date Vehicle was first held XXXXXX Taxable 17/1/XXXX Date Vehicle ceased to be held Base Value (A) $27,492.00 Period Car Held Commencing on 01/4/XXXX Terminating on 31/3/XXXX Number of days car held within FBT year Less Days not available for private use Number of days benefit provided (C) Number of days in FBT Year (D) KM's at commencement of benefit / start of FBT year 366 0 366 366 5244 KM's at termination of benefit / end of FBT year 18,460 KM's travelled 13,216 Annualised KM's travelled (based on days held) 13,216 Statutory fraction (B) Prima facie taxable value (A x B x C/D) Less Employee Contribution (E) 26.00% $7,147.92 $7,147.92 Taxable Amount Taxable value of benefit (A x B x C/D) - E $0.00 Grossed up value using Type 1 rate (2.06470) $0.00 FBT Liability (at 46.50%) $0.00 Total FBT Payable $0.00 Reportable Fringe Benefit Amount (RFBA) $0.00 (If the Taxable Value (before gross-up) exceeds $2,000 then the RFBA must be disclosed on the employees's PAYG Payment Summary) XXXXX XXXXXXXX FBT Year End Liability CARFLEET PTY LTD PO Box 373 RUNDLE MALL SA 5000 Phone: 1800 680 180 Fax: 08 8111 7799 www.epacsalarysolutions.com FBT Year 1/04/XXXX - 31/03/XXXX Disclaimer CarFleet has relied on a number of assumptions and has estimated the taxable value of the benefit based on information provided by employees and makes no assurance as to the accuracy of the information. Employers should not rely on the FBT Year End Liability Report calculations and should perform their own calculations to verify the taxable value of the benefit provided to the employee. With regard to the calculation of the Employee Contribution it should be noted that CarFleet does not confirm such figures with the Employer's payroll records and that it is the responsibility of the Employer to confirm such details. The payroll records will determine the correct employee contribution, not CarFleet's calculations or package information. The calculations contained in the FBT Year End Liability Report have been compiled in good faith. No warranty or representations as to the accuracy of the calculations are made and liability for any loss or damage resulting from any reliance on the information or for any errors in calculation or any omissions is expressly excluded. The FBT Year End Liability Report should be used as a guide only. Assumptions In preparing the FBT Year End Liability Report we have relied on a number of assumptions including, but not limited to, the following: Employers meet all running costs of the vehicle. Any FBT liability of the Employer as a result of providing benefits to the Employee is normally reduced to nil by employee benefits. CarFleet has assumed that the Employee is not entitled to any other fringe benefits (this impacts whether the relevant PBI exemption or rebate is available, and whether there is a reportable benefits amounts above the $2000 threshold) The Employer is a Company and can claim full input tax credits against vehicle expenses. CarFleet has assumed that the Employer is entitled to GST input tax credits for the cost of the benefit (this may impact the gross up rate) Vehicle Leases are fully novated from the employer to the employee pursuant to Ruling TR 1999/15 ‘Income tax and fringe benefits tax: taxation consequences of certain motor vehicle lease novation arrangements'. Vehicle Leases are not hire purchase transactions for the purpose of Division 240 of the Income Tax Assessment Act 1997. Motor vehicles are available for the private use of Employees every day of the relevant FBT year. All calculations are based on FBT rates for the year ending 31/03/XXXX