Fringe Benefits Tax (“FBT”) Guidelines – Meal Entertainment

advertisement

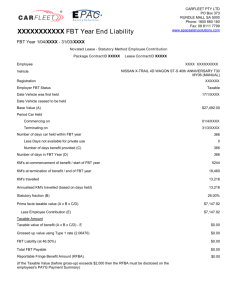

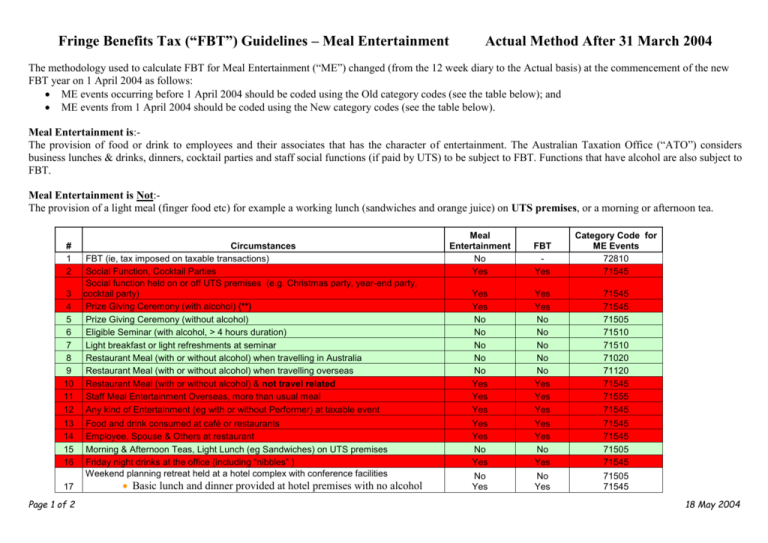

Fringe Benefits Tax (“FBT”) Guidelines – Meal Entertainment Actual Method After 31 March 2004 The methodology used to calculate FBT for Meal Entertainment (“ME”) changed (from the 12 week diary to the Actual basis) at the commencement of the new FBT year on 1 April 2004 as follows: ME events occurring before 1 April 2004 should be coded using the Old category codes (see the table below); and ME events from 1 April 2004 should be coded using the New category codes (see the table below). Meal Entertainment is:The provision of food or drink to employees and their associates that has the character of entertainment. The Australian Taxation Office (“ATO”) considers business lunches & drinks, dinners, cocktail parties and staff social functions (if paid by UTS) to be subject to FBT. Functions that have alcohol are also subject to FBT. Meal Entertainment is Not:The provision of a light meal (finger food etc) for example a working lunch (sandwiches and orange juice) on UTS premises, or a morning or afternoon tea. # 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Page 1 of 2 Circumstances FBT (ie, tax imposed on taxable transactions) Social Function, Cocktail Parties Social function held on or off UTS premises (e.g. Christmas party, year-end party, cocktail party) Prize Giving Ceremony (with alcohol) (**) Prize Giving Ceremony (without alcohol) Eligible Seminar (with alcohol, > 4 hours duration) Light breakfast or light refreshments at seminar Restaurant Meal (with or without alcohol) when travelling in Australia Restaurant Meal (with or without alcohol) when travelling overseas Restaurant Meal (with or without alcohol) & not travel related Staff Meal Entertainment Overseas, more than usual meal Any kind of Entertainment (eg with or without Performer) at taxable event Food and drink consumed at café or restaurants Employee, Spouse & Others at restaurant Morning & Afternoon Teas, Light Lunch (eg Sandwiches) on UTS premises Friday night drinks at the office (including “nibbles” ) Weekend planning retreat held at a hotel complex with conference facilities Basic lunch and dinner provided at hotel premises with no alcohol Meal Entertainment No Yes FBT Yes Category Code for ME Events 72810 71545 Yes Yes No No No No No Yes Yes Yes Yes Yes No No No No No Yes Yes Yes 71545 71545 71505 71510 71510 71020 71120 71545 71555 71545 Yes Yes No Yes Yes Yes No Yes 71545 71545 71505 71545 No Yes No Yes 71505 71545 18 May 2004 Fringe Benefits Tax (“FBT”) Guidelines – Meal Entertainment Actual Method After 31 March 2004 Basic dinner with no alcohol but with entertainment (live band or show) 18 19 20 21 22 23 24 25 Farewell staff member, finger food & no alcohol Gifts purchased for Clients/customers Gifts purchased for Staff or Associates (if less than $300 gst inc value then no FBT) Employee Benefits (taxable & salary packaged) Christmas Party on or off UTS premises (even if <$300 / head, taxable) Alcohol & finger food at the of Continuing Professional Development session Conference Dinner at Restaurant Overseas Alumni Graduation Dinner (**) No No No No Yes No Yes Yes No No Yes/No Yes Yes No Yes No 71505 71520 71518 71530 71545 71510 71545 71550 Note (**) If staff are required to attend Alumni and Graduation dinners, FBT does not apply as the “otherwise deductible” rule applies. That is, the expense would be otherwise income tax deductible to the staff member, if they were required by their employer to attend the function. FBT Meal Entertainment (only) calculation applicable after 31 March 2006 - For Example: A UTS employee take two externals for a meal at a restaurant and spends $110 (including GST). Total Cost of meal (GST excluded) Taxable component (after completing the Meal Entertainment form) = 33.3% Grossed up for GST * 1.1 Grossed up for FBT purposes * 2.0647 Multiplied by the FBT rate FBT applicable $100.00 = $ 33.33 = $ 36.67 = $ 75.69 = * 46.5% = $ 35.19 This calculation will be made on the new Meal Entertainment form. Page 2 of 2 18 May 2004