Ch 13

advertisement

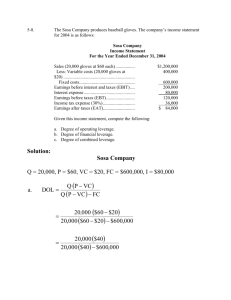

CHAPTER 13 CAPITAL STRUCTURE MANAGEMENT IN PRACTICE ANSWERS TO QUESTIONS: 1. Leverage is the use of assets and liabilities with fixed costs in order to increase the returns to a firm's common stockholders. 2. a . Fixed costs are operating costs that are independent of sales levels in the short-run. These costs are primarily related to the passage of time. Examples include depreciation, rent, insurance, lighting and heating costs, property taxes, and the salaries of management. b. Variable costs are operating costs that move in close relationship to changes in sales. Variable costs are related to the output produced and sold, rather than the passage of time. Examples include raw material costs, direct labor costs, and salespersons' commissions. 3. a. Operating leverage is the employment of assets with fixed operating costs in an attempt to increase operating income (EBIT). b. Financial leverage is the employment of funds having fixed capital costs in an attempt to increase EPS. 4. The degree of combined leverage (DCL) is equal to the degree of operating leverage (DOL) times the degree of financial leverage (DFL). This relationship shows that operating leverage and financial leverage can be combined in many different ways to achieve a given degree of combined leverage. High operating leverage can be offset with low financial leverage and vice versa. 5. Yes. The level of business risk of a firm relates to the variability of that firm's operating income. Even if a firm has a high degree of operating leverage, it is possible for it to have a stable level of operating income if prices, sales quantities, and the variable costs of production and marketing are stable over time. 6. Yes. If a firm has stable sales revenues and stable operating costs over time, the total risk of the firm will be low. The degree of combined leverage relates changes in EPS to changes in sales revenues. Thus, if sales revenues are relatively stable and variable operating costs are also stable, then EPS also will be stable. 7. Use of EBIT-EPS analysis can determine which financing alternative maximizes EPS. However, it is possible that maximizing EPS results in such a high risk level that the weighted cost of capital is not minimized, and therefore the value of the firm is not maximized. 185 186 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 8. A firm cannot tell exactly when it is at the optimal capital structure point. However, this is not a great problem because the optimal capital structure, in practice, is best depicted as a range. Many companies are able to conclude they are operating near the optimal range as a result of borrowing nearly as much as they can at reasonable interest rates. Comparison with other companies in the industry also should help the company determine whether it safely can increase its proportion of "moderate" debt and reduce its weighted cost of capital. Other techniques that can provide useful insight include EBIT-EPS analysis and cash insolvency analysis. 9. A firm should use more debt if it traditionally has been more profitable than the average firm in the industry, or if its operating income is more stable than the operating income of the average firm in the industry. If the opposite factors (i.e., less profitable and less stable) are true, the firm generally should use less debt. This answer assumes that the average firm in the industry is operating at or near an optimal capital structure. 10. Public utilities typically incur more financial risk than major oil companies because public utilities have less business risk than major oil companies. In general, the capital markets permit low business risk firms to incur a larger percentage of debt in their capital structures than high business risk firms. 11. Cash insolvency analysis is a tool that can be used to analyze the effects of a proposed capital structure change. Cash insolvency analysis looks at the effects of a worst-case scenario of a firm’s cash balances and net cash flows when a firm is faced with a major recession, or downturn in its business. Cash insolvency analysis permits a manager to compute the probability of the firm running out of cash in a recession, given the fixed financial charges the firm faces with alternative capital structures. CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 187 SOLUTIONS TO PROBLEMS: 1. a. Sales $6,000,000 $6,600,000 Less: Variable operating costs $4,500,000 $4,950,000 Fixed operating costs 800,000 800,000 Total operating costs $5,300,000 $5,750,000 EBIT $700,000 $850,000 Less: Interest expense 60,000 $60,000 Earnings before taxes $640,000 $790,000 Less: Income taxes (40%) 256,000 316,000 Earnings after taxes $384,000 $474,000 Less: Preferred stock dividends 60,000 60,000 $324,000 $414,000 $5.40 $6.90 Earnings available to common stockholders Earnings per share (60,000 shares) b. i. DOL at "X" = (EBIT/EBIT)/(Sales/Sales) DOL at $6,000,000 = [($850,000-$700,000) / $700,000] /[($6,600,000 $6,000,000)/$6,000,000] = 2.143 ii. DOL at "X" = (Sales - Variable cost)/EBIT DOL at $6,000,000 = ($6,000,000 - $4,500,000)/$700,000 = 2.143 iii. From a base sales level of $6 million, each one percent change in sales results in a 2.143 percent change in EBIT, in the same direction as the sales change. 188 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE c. i. DFL at "X" = (EPS/EPS)/(EBIT/EBIT) DFL at $700,000 = [($6.90 - $5.40)/$5.40]/[($850,000 - $700,000) / $700,000] = 1.2963 ii. DFL at "X" = EBIT/[EBIT - I - Dp/(1 - T)] DFL at $700,000 = $700,000/[$700,000 - $60,000 - $60,000/(1-.4)] = 1.2963 iii. From a base EBIT level of $700,000, each one percent change in EBIT results in a 1.2963 percent change in EPS, in the same direction as the EBIT change. d. i. DCL = (EPS/EPS)/(Sales/Sales) DCL = [($6.90-$5.40)/$5.40]/[($6,600,000 - $6,000,000) / $6,000,000] = 2.778 ii. DCL = (Sales - Variable costs) / [EBIT - I - Dp/(1 - T)] DCL = ($6,000,000-$4,500,000) / [($700,000 - $60,000 -$60,000)/(1-.4)] = 2.778 iii. DCL = DOL x DFL = 2.143 x 1.2963 = 2.778 iv. From a base sales level of $6,000,000, each 1 percent change in sales results in a 2.778 percent change in EPS, in the same direction as the sales change. 2. a. Fixed operating costs = Depreciation + .75(General, administrative, and selling expenses) = $1,500,000 + .75($1,500,000) = $2,625,000 Variable operating costs = Total operating costs minus fixed operating costs = $12,000,000 - $2,625,000 = $9,375,000 Variable cost ratio = $9,375,000 / $15,000,000 = 0.625 b. (i) DOL at $15 million = ($15,000,000 - $9,375,000) / (ii) DFL at $3,000,000 = $3,000,000 / [($3,000,000 - $750,000 - $250,000) / (1 - .444444)] = 1.67 $3,000,000 = 1.875 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 189 (iii) DCL = 1.875 x 1.67 = 3.13 c. DCL = 3.13, therefore a 15% increase in sales will yield a 15% x 3.13 = 47% increase in Alexander's EPS next year. Next year's EPS is forecast to be (1 + .47) x $4 = $5.88. d. Sales ($15,000,000 x 1.15) = $17,250,000 Less: Variable operating costs 0.625 x $17,250,000 = $10,781,250 Fixed operating costs 2,625,000 Total operating costs $13,406,250 EBIT $3,843,750 Less: Interest Earnings before taxes Less: Income taxes (T = .444444. . . ) Earnings after taxes 750,000 $3,093,750 1,375,000 $1,718,750 Less: Preferred dividends Earnings available to common stockholders 250,000 $1,468,750 Earnings per share (250,000 shares) e. No solution provided 3. a. Sales = $3,000,000 Variable costs = 0.5 x $3,000,000 = $1,500,000 EBIT = Sales - Variable costs - Fixed costs = $3,000,000 - $1,500,000 - $900,000 = $600,000 Interest = .125($2,400,000) = $300,000 DCL = ($3,000,000 - $1,500,000) / ($600,000 - $300,000) $5.88 190 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE = 5.0 b. Sales = 1.1 x $3,000,000 = $3,300,000 Variable costs = .475 x $3,300,000 = $1,567,500 EBIT = $3,300,000 - $1,567,500 - ($900,000 +$150,000) = $682,500 Interest = $300,000 + .125($500,000) = $362,500 DCL = ($3,300,000 - $1,567,500) / ($682,500 - $362,500) = 5.41 c. 5.0 = ($3,300,000 - $1,567,500) / ($682,500 - .125X) X = $2,688,000 Gibson would have to reduce debt by ($2,900,000 - $2,688,000 or $212,000 in order to maintain a DCL at 5.0 in 19x2. 4. Sales = P x Q EBIT = P x Q - F - V x Q, where P = price/unit; F = fixed cost; V = variable cost/unit Sales = Sales2 - Sales1 = PQ2 - PQ1 = P(Q2 - Q1) EBIT = EBIT2 - EBIT1 = (PQ2 - F - VQ2) - (PQ1 - F - VQ1) = (P - V)(Q2 - Q1) DOL @ "Sales1" = (EBIT/EBIT1) / (Sales/Sales1) = [(P - V)(Q2 - Q1) / (PQ1 - F - VQ1)] / [P(Q2 - Q1) / PQ1] = (P - V)Q1 /(PQ1 - F - VQ1) = (PQ1 - VQ1)/(PQ1 - F - VQ1) = (Sales1 - Variable cost1)/EBIT1 5. a. Sales = $8,000,000 Variable costs = .2($8,000,000) = $1,600,000 Fixed costs = $5,800,000 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 191 EBIT = $8,000,000 - $5,800,000 - $1,600,000 = $600,000 DOL @ $8,000,000 = ($8,000,000 - $1,600,000)/$600,000 = 10.67 b. DFL @ $600,000 = $600,000 / [($600,000 - $160,000 - $60,000)/(1 - .4)] = 1.765 c. DCL = DOL x DFL = 10.67 x 1.765 = 18.8 A DCL of 18.8 indicates that, from a base sales level of (decrease) in sales will yield an 18.8% $8,000,000, each 1% increase increase (decrease) in EPS. 6. DCL @ $500,000 = [($1.56 - $1.00)/$1.00] / [($570,000 - $500,000)/($500,000)] = 4.0 7. a. EBIT = $80,000,000 - .65($80,000,000) - $10,000,000 = $18,000,000 DOL @ $80 million = [($80,000,000 - .65($80,000,000)] / ($18,000,000) = 1.56 b. Interest = .1($20 million) + .12($6 million) = $2.72 million DFL @ $18 million = $18,000,000 / [$18,000,000 - $2,720,000 - $5,000,000/(1-.4)] = 2.59 c. DCL = 1.56 x 2.59 = 4.04 A sales decline to $76 million represents a 5 percent sales decline. Earnings per share can be expected to decline by 4.04 x 5% or 20.2%. Current earnings per share are: EPS = (Sales - Variable operating cost - Fixed operating cost - Interest - Taxes - Preferred dividends) / Number of common shares EPS = [($80,000,000 - $52,000,000 - $10,000,000 - $2,720,000)(1 - .4) - $5,000,000] / 2,000,000 = $2.08 Forecast EPS = $2.08 (1 - .202) = $1.66 192 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 8. DCL = DOL x DFL = 3.0 x 5.5 = 16.5 EPS can be expected to decline by 2% x 16.5 = 33% Forecast EPS = $2.60 (1 - .33) = $1.74 9. Loss level of EBIT = Interest plus pretax preferred stock dividends = $700,000 + $240,000/(1 - .4) = $1,100,000 The probability of negative earnings per share is the probability of having operating income less than the loss level. z = ($1,100,000 - $1,500,000)/$300,000 = -1.33 standard deviations From Table V, p(z < -1.33) = 9.18% 10. a. DCL = (Sales - Variable cost)/[EBIT - Interest - Dp/(1-T)] 3.0 = ($10M - $5M) / ($2M - Interest) Interest = $333,333 b. 2.5 = ($10M - $5M) / ($2M - Interest) Interest = $0 11. DCL = DOL x DFL 6 = DOL x 2 DOL = 3 3 = %EBIT/+15% %EBIT = +45% 12. Values in millions of dollars a. VC = 0.4($30) = $12 EBIT = $30 - $12 - $10 = $8 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 193 DOL = ($30 - $12)/$8 = 2.25 b. Interest = [(0.1 x $2) + (0.12 x $10)] = $1.4 DFL = $8/ [$8 - $1.4 - ($0.96/(1 - 0.4)] = 1.6 c. DCL = DOL x DFL = 2.25 x 1.6 = 3.6 d. Current EPS: EBIT $8.00 Interest 1.40 EBT $6.60 Tax 2.64 EAT and before preferred dividends $3.96 Preferred dividends Earnings available to C.S. EPS 0.96 $3.00 (million) $3.00 3.6 = %EPS/-5% %EPS = -18% New EPS = $3.00(1 - 0.18) = $2.46 13. Values in millions of dollars a. VC = 0.65 ($40) = $26 DOL @ $40 = ($40 - $26)/($40 - $26 - $5)= 1.556 b. Interest expenses = (0.10 x $10) + (0.12 x $3) = $1.36 DFL = $9/[$9 - $1.36 - ($2.5/(1 - 0.35)] = 2.37 194 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE c. DCL = DOL x DFL = 3.69 Current EPS: EBIT $9.000 Interest 1.360 EBT $7.640 Tax (@ 35%) 2.674 EAT and before preferred dividends $4.966 Preferred dividends Earnings available to C.S. 2.500 $2.466 (million) EPS $2.47 A sales decline to $38 is a 5 percent decline from $40 New EPS = $2.47 x (1 - (0.05 x 3.69)) = $2.01 Note: The use of the average tax rate in this solution assumes that this average rate does not change with a change in sales and EBIT. 14. DCL = DOL x DFL 8.0 = 2.0 x DFL DFL = 4.0 = %EPS/ +3% %EPS = +12% New EPS = $3.00 x 1.12 = $3.36 15. DOL = 2.5 = %EBIT/+5% %EBIT = +12.5% New EBIT = $450,000 x 1.125 = $506,250 Fixed financial charges = $200,000 + $60,000/(1 - 0.4) = $300,000 Therefore, EPS = $0 at an EBIT level of $300,000 z = ($300,000 - $506,250)/$300,000 = -0.69 From Table V, the probability of z<-0.69 24.51% CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 195 16. The probability that EPS will be less than $5 per share is equal to the probability that sales will be less than $10,000,000: z = ($10,000,000 - $11,000,000)/$500,000 = -2.0 p(z<-2.0) = 2.28% from Table V 17. Fixed financial charges to cover: $1,000,000 + $600,000/(1 - 0.4) = $2,000,000 The probability of negative EPS is the probability of not covering fixed financial charges, or: z = ($2,000,000 - $4,000,000)/$2,000,000 = -1.0 p(z<-1.0) = 15.87% 18. a. Emco Products EPS (debt financing) = EPS (equity financing) (EBIT - interest)(1 - tax rate) (EBIT)(1 - tax rate) = (No. of common shares for debt (No. of common shares for equity alternative) alternative) [(EBIT - 5)(0.6)]/10 = [(EBIT)(0.6)]/15 9 EBIT - 45 = 6 EBIT 3 EBIT = 45 EBIT* = $15 b. Equity Financing: EBIT = $10 EBIT = $15 EBIT = $25 EBIT $10 $15 $25 I 0 0 0 EBT 10 15 25 T @ 40% 4 6 10 196 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE EAT 6 9 15 Shares Outstanding 15 15 15 EPS $0.40 $0.60 $1.00 EBIT = $10 EBIT = $15 EBIT = $25 EBIT $10 $15 $25 I 5 5 5 EBT $5 $10 $20 T @ 40% 2 4 8 EAT $3 $6 $12 Shares Outstanding 10 10 10 EPS $0.30 $0.60 $1.20 Debt Financing: Indifference point = $15 million c. Indifference point moves to right, i.e., higher EBIT. d. Indifference point moves to right, i.e., higher EBIT. 19. a Expansion: Rock Island Davenport CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 197 EBIT $100 $100 I 32 8 EBT $ 68 $ 92 T @ 40% 27.2 36.8 EAT $ 40.8 $ 55.2 Shares outstanding 30 45 EPS $1.36 $1.23 Rock Island Davenport EBIT $ 60 $ 60 I 32 8 EBT $ 28 $ 52 T @ 40% 11.2 20.8 EAT $16.8 $31.2 Shares outstanding 30 45 EPS $0.56 $0.69 Recession: b. Rock Island is riskier because of its financial risk. The two stocks have identical business risk. Rock Island would be expected to have a higher beta. c. EPS (Rock Island) = EPS (Davenport) [(EBIT - interest)(1 - T)]/No. of C.S. (Rock Island) = [(EBIT - interest)(1 - T)]/No. of C.S. (Davenport) 198 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE [(EBIT - 32)(1 - .4)]/30 = [(EBIT - 8)(1- .4)]/45 EBIT* = $80 million d. Price = (EPS)(P/E ratio) Rock Island: Price = (1.36)(9) = $12.24 Davenport: Price = (1.23)(10) = $12.30 This example gives approximately equal stock prices for the two companies. Rock Island's higher EPS is offset by its lower P/E ratio. 20. a. EPS (Plan 1) = EPS (Plan 2) [(EBIT - 0)(1 - .4)]/2 = [(EBIT - 1.2)(1 - .4)]/1 EBIT* = $2.4 million b. Plan 1 Plan 2 EBIT $6.0 $6.0 I 0 1.2 EBT $6.0 $4.8 T @ 40% 2.4 1.92 EAT $3.6 $2.88 Shares Outstanding 2.0 1.0 EPS $1.80 $2.88 c. The factors the company should consider include the following: 1. The plan's effect on the company's stock price (difficult to determine in practice). CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 199 2. The capital structure of the parent company. 3. The probability distribution of expected EBIT. d. Adopt plan 2 if the company can be reasonably sure that EBIT will not drop too much in a recession. Otherwise, plan 1 appears better. (See Parts e and f below ). e. T.I.E. = (EBIT/I) = (6.0/1.2) = 5 times Note: This calculation assumes no short-term debt, either permanent or seasonal. f. Required EBIT level = (Interest)(Required T.I.E.) = (1.2)(3.5) = $4.2 million Therefore, EBIT could drop by $6.0 - $4.2 = $1.8 million, and the company would still be in compliance with the loan agreement. Note: In practice, the lenders also likely would require the parent company to guarantee the loan. g. z = (0 - $6,000,000)/$3,000,000 = -2.0 From Table V, the probability of a value greater than 2.0 standard deviations to the left of the mean is 2.28%, i.e., small. 21. a. (EBIT - 60,000)(1 - .4) = (EBIT - 60,000 - 66,000)(1 - .4) 100,000 + 150,000 100,000 EBIT* = $170,000 b. Compute the probability that the actual EBIT will be greater than $170,000. z = ($170,000 - $240,000)/$50,000 = -1.4 From Table V, the probability of a value less than 1.4 standard deviations to the left of the mean is 8.08%. This is the probability that the equity alternative is superior to the debt alternative. Thus, the probability that the debt alternative is superior is 91.92% (1.0 - .0808). 200 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE c. The probability of negative earnings is the probability that actual EBIT will fall below the loss level ($126,000). z = ($126,000 - $240,000)/$50,000 = -2.28 The probability of EBIT falling below the $126,000 loss level is 1.13% from Table V. 22. a. [(EBIT - 46.2)(0.6)]/30 = [(EBIT - 37.5)(0.6)]/33 EBIT* = $133.2 million b. The debt financing alternative should be selected because its average cost is 14.5% pretax, compared to the 16% after-tax cost of the preferred stock alternative. In other words, the debt financing alternative results in higher EPS values than the preferred stock financing alternative at all EBIT levels. The two functions do not cross each other, and, as a result, no indifference point exists. 23. a. The probability that the equity financing option will result in a higher EPS is equal to the probability that the EBIT level will be less than $4.0 million. The probability that EBIT will be less that $4.0 million is computed, as follows: z = (4.0 - 4.5)/0.6 = -0.83 From Table V, the probability of a value less than 0.83 standard deviations to the left of the mean is 20.33%. b. The probability of losing money is the probability that the actual EBIT will fall below the $3 million level. z = ($3.0 - $4.5)/$0.6 = -2.50 From Table V, the probability of EBIT falling below the $3.0 i.e., quite low. 24. a. [(EBIT - 6.3)(0.6)]/10 = [(EBIT - 5)(0.6)]/11 million level is 0.62%, CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 201 EBIT* = $19.3 million b. [(EBIT - 5)(0.6) - 1.4]/10 = [(EBIT - 5)(0.6)]/11 EBIT* = $30.67 million c. The debt financing alternative results in higher EPS values than the preferred stock alternative for all EBIT levels. Thus, the two functions do not cross each other, and no indifference point exists. 25. a. The probability that the equity financing option will result in a higher EPS is equal to the probability that the EBIT level will be less than $500,000. The probability that EBIT will be less than $500,000 is computed, as follows: z = ($500,000 - $620,000)/$190,000 = -0.63 From Table V, the probability of a value less than 0.63 standard deviations to the left of the mean is 26.43%. Thus, the probability that the equity alternative will be superior to the debt alternative is about 26%. b. The probability that the firm will incur losses is the probability that the actual EBIT will fall below the $200,000 level. z = ($200,000 - $620,000)/$190,000 = -2.21 From Table V, the probability of EBIT falling below the $200,000 level is 1.36%. 26. a. Equity Alternative Debt Alternative (EBIT - 1.2 - 2.8)(1-0.4) / 4.5 = (EBIT - 1.2 - 2.8 - 1.5)(1-0.4) / 4.0 EBIT* = $17.5 million b. The probability that Alternative II will result in higher EPS than Alternative I is the probability that EBIT will be above the indifference point, or: 202 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE z = (17.5 - 20)/ 5 = -0.5 p(z < - 0.5 ) = 30.85% Hence the probability that Alternative II will yield higher EPS than Alternative I equals: 100% - 30.85% = 69.15% 27. a CB0 = $50 million; FCFR = $70 million; __= $60 million CBR = $50 million + $70 million = $120 million z = ($0 - $120) / $60 = -2.0 From Table V: p(z < - 2.0 ) = 2.28% b. CBR = $50 million + $70 million - $60 million = $60 million z = ($0 - $60) / $60 = -1.0 From Table V: p(z < - 1.0 ) = 15.87% The expansion should not be undertaken because the risk of running out of cash (15.87%) exceeds the level of risk the firm is willing to assume (10%). 28. a. EBIT = $8.0 million; _ = $5 million z = ($1.5 - $8.0)/$5 = -1.30 From Table V: p(z < - 1.30) = 0.0968 or 9.68% b. 1 - p(z < -1.30) = 1 - 0.0968 = 0.9032 or 90.32% 29. a CB0 = $150 million; FCFR = $200 million; __= $200 million CBR = $150 million + $200 million = $350 million z = ($0 - $350)/$200 = -1.75 From Table V, p(z < - 1.75) = 4.01% b. CBR = $150 million + $200 million - $50 million = $300 million z = ($0 - $300)/$200 = -1.50 From Table V, p(z < - 1.50) = 6.68% CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE 203 c. From Table V, p(z < zo) = 5.0% for zo = -1.65 -1.65 = (0 - CBR)/$200 CBR = $330 million $330 million = $150 million + ($200 million - x) x = $20 million The company can incur additional fixed financial charges of $20 million. 30. a. [(EBIT - $26.0 - $30.0)(1 - 0.4) - $2.0]/10 = [(EBIT - $26.0)(1 - 0.4) - 2.0]/14 EBIT* = $134.33 b. z = ($134.33 - $150)/$20 = -0.78 From Table V: p(z < -0.78) = 21.77% 31. Debt = 0.6 ($20 million) = $12 million Preferred = 0.1($20 million) = $2 million Current interest = $12 million x 0.09 = $1.08 million Current preferred dividends = $2 million x 0.12 = $0.24 million Tax-adjusted preferred dividends = $0.24 million/(1 - 0.4) = $0.4 million Current loss level = $1.08 million + $0.4 million = $1.48 million z = ($1.48 million - $1.7 million)/$0.2 million = -1.1 standard deviations From Table V, the probability of a value less than -1.1 standard deviations from the mean is about 13.57%. New loss level = $1.48 million + $0.1 million = $1.58 million z = ($1.58 million - $1.7 million)/$0.2 million = -0.6 standard deviations. From Table V, the probability of a value less than -0.6 standard deviations from the mean is about 27.43%. 204 CHAPTER 13/CAPITAL STRUCTURE MANAGEMENT IN PRACTICE Hence the increase in the probability of incurring a loss is 27.43% - 13.57 % = 13.86% 32. a. Equity Alternative Debt Alternative [(EBIT - $18)(1 - 0.4) - $5] / (4 + 1) = [(EBIT - $18 - $9.5)(1 - 0.4) - $5]/ 4 EBIT* = $73.83 million EPS @ EBIT* = $5.70 b. z = ($73.83 million - $100 million) / $20 million = -1.31 From Table V: p(z < -1.31) = 9.51% 33. a z = (0 – 1.5) / 1 = -1.5 p (z < -1.5) = 6.68% c. Interest = 0.10 x $ 10 million = $1 million Loss level = $1 million z = (1 – 1.5) / 1 = -0.5 p (z < -0.5) = 30.85% 34. a. [(EBIT – 0)(1 – 0.4)] / 600,000 = [(EBIT – 800,000)(1 – 0.4)] / 200,000 EBIT* = $1,200,000 b. z = (1.2 – 1.0) / 0.4 = 0.5 p ( z > 0.5) = 30.85% p (unfavorable leverage) = 100% - 30,85% = 69.15%