Chapter 16

advertisement

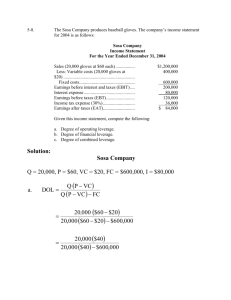

Chapter 16 FINANCIAL LEVERAGE AND CAPITAL STRUCTURE POLICY Quiz on WACC Company’s D/E ratio is 2/3, they need 5500 financing and they want to keep the same D/E ratio. How much equity they should issue? (1p.) Company’s cost of equity is 14% and cost of debt is 8%, tax is 40%; D/E ratio is ¼. What is WACC? (2p). 1 Chapter Outline The Capital Structure Decision The Effect of Financial Leverage Capital Structure and the Cost of Equity Miller&Modigliani Propositions Bankruptcy Costs Optimal Capital Structure Extended Pie Model Observed Capital Structures 2 Capital Restructuring Capital restructuring involves changing the amount of leverage a firm has without changing the firm’s assets Financial leverage = the extent to which the firm relies on debt Increase leverage by issuing debt and repurchasing outstanding shares Decrease leverage by issuing new shares and retiring outstanding debt 3 Choosing a Capital Structure What is the primary goal of financial managers? ◦ Maximize stockholder wealth Stockholders’ wealth can be maximized by maximizing firm value or minimizing WACC 4 The Effect of Leverage How does leverage affect the EPS and ROE of a firm? ◦ When we increase the amount of debt financing, we increase the fixed interest expense ◦ If we have a really good year, then we pay our fixed cost and we have more left over for our stockholders ◦ If we have a really bad year, we still have to pay our fixed costs and we have less left over for our stockholders Leverage amplifies the variation in both EPS and ROE 5 Financial Leverage, EPS and ROE, example (1) Current capital structure: No debt EBIT Interest Net income ROE EPS Recession $500,000 0 500,000 6.25% $1.25 Expected $1,000,000 0 1,000,000 12.50% $2.50 Expansion $1,500,000 0 1,500,000 18.75% $3.75 EBIT Interest Net income ROE EPS Proposed capital structure: Debt = $ 4 mln Recession Expected Expansion $500,000 $1,000,000 $1,500,000 400,000 400,000 400,000 100,000 600,000 1,100,000 2.50% 15.00% 27.50% $0.50 $3.00 $5.50 6 Financial Leverage, EPS and ROE, example (2) Variability in ROE ◦ Current: ROE ranges from 6.25% to 18.75% ◦ Proposed: ROE ranges from 2.50% to 27.50% Variability in EPS ◦ Current: EPS ranges from $1.25 to $3.75 ◦ Proposed: EPS ranges from $0.50 to $5.50 The variability in both ROE and EPS increases when financial leverage is increased 7 Degree of financial leverage Degree of financialleverage Percentagechangein EPS Percentagechangein EBIT EBIT Degree of financial leverage EBIT Interest 8 Break-Even EBIT Find EBIT where EPS is the same under both the current and proposed capital structures If EBIT is expected to be greater than the break-even point, then leverage is beneficial to stockholders If EBIT is expected to be less than the break-even point, then leverage is detrimental to stockholders 9 Financial Leverage, EPS and ROE Breakeven (indifference) EBIT solution: EBIT EBIT 400,000 400,000 200,000 400,000 EBIT 400,000 EBIT 200,000 EBIT 2EBIT 800,000 EBIT $800,000 800,000 EP S $2.00 400,000 10 Homemade Leverage and ROE Current Capital Structure ◦ Investor borrows $2000 and uses $2000 of their own to buy 200 shares of stock ◦ Payoffs: Recession: 200(1.25) .1(2000) = $50 Expected: 200(2.50) .1(2000) = $300 Expansion: 200(3.75) .1(2000) = $550 Proposed Capital Structure ◦ Investor buys $2000 worth of stock (100 shares) ◦ Payoffs: Recession: 100(0.50) = $50 Expected: 100(3.00) = $300 Expansion: 100(5.50)= $550 ◦ Mirrors the payoffs from purchasing 100 shares from the firm under the proposed capital structure 11 Homemade leverage The use of personal borrowing to change the overall amount of financial leverage to which individual is exposed The investor can both “lever” his position through borrowing or “unlever” through lending 12 Capital Structure Theory Modigliani and Miller Theory of Capital Structure ◦ Proposition I – the pie model ◦ Proposition II – WACC The value of the firm is determined by the cash flows to the firm and the risk of the assets 13 Capital Structure Theory Under Three Special Cases Case I – Assumptions (M&M) ◦ No corporate or personal taxes ◦ No bankruptcy costs Case II – Assumptions (M&M) ◦ Corporate taxes ◦ No bankruptcy costs Case III – Assumptions (Static Theory) ◦ Corporate taxes ◦ Bankruptcy costs 14 Case I – No Taxes or Bankruptcy Costs M&M Proposition I ◦ The value of the firm is NOT affected by changes in the capital structure ◦ The cash flows of the firm do not change, therefore value doesn’t change Proposition II ◦ The WACC of the firm is NOT affected by capital structure 15 Case I WACC = RA = (E/V)RE + (D/V)RD RE = RA + (RA – RD)(D/E) ◦ RA is the required return on the firm’s assets ◦ (RA – RD)(D/E) is the additional return required by stockholders to compensate for the risk of leverage 16 Case I, example Data ◦ Required return on assets = 16%, cost of debt = 10%; percent of debt = 45% What is the cost of equity? Suppose instead that the cost of equity is 25%, what is the debt-to-equity ratio? Based on this information, what is the percent of equity in the firm? 17 The CAPM, the SML and Proposition II CAPM: RA = Rf + A(RM – Rf) ◦ Where A is the firm’s asset beta and measures the systematic risk of the firm’s assets Proposition II ◦ RE = Rf + A(RM – Rf)(1+D/E) 18 Business Risk and Financial Risk RE = Rf + A(1+D/E)(RM – Rf) CAPM: RE = Rf + E(RM – Rf) ◦ E = A(1 + D/E) Therefore, the systematic risk of the stock depends on: ◦ Systematic risk of the assets, A, (Business risk) ◦ Level of leverage, D/E, (Financial risk) 19 Case II – With Corporate Taxes Interest is tax deductible Interest tax shield = The tax saving attained by a firm from interest expense The reduction in taxes increases the cash flow of the firm 20 Case II, example (1) EBIT Unlevered Levered Firm Firm 5000 5000 Interest 0 500 Taxable Income Taxes 5000 4500 1700 1530 Net Income 3300 2970 CFFA 3300 3470 21 Case II, example (2) Assume the company has $6,250, 8% coupon debt and faces a 34% tax rate. Annual interest tax shield ◦ Tax rate times interest payment: ◦ Annual tax shield = Present value of annual interest tax shield: 22 Case II – Proposition I The value of the firm increases by the present value of the annual interest tax shield ◦ Value of a levered firm = value of an unlevered firm + PV of interest tax shield ◦ Value of equity = Value of the firm – Value of debt ◦ VU = EBIT(1-T) / RU ◦ VL = VU + DTC 23 Case II – Proposition I, example ◦ EBIT = $25 million; Tax rate = 35%; Debt = $75 million; Cost of debt = 9%; Unlevered cost of capital = 12% VU VL E 24 Case II – Proposition II The WACC decreases as D/E increases because of the government subsidy on interest payments ◦ WACC = (E/V)RE + (D/V)(RD)(1-TC) ◦ RE = RU + (RU – RD)(D/E)(1-TC) Example ◦ RE = .12 + (.12-.09)(75/86.67)(1-.35) = 13.69% ◦ WACC = (86.67/161.67)(.1369) + (75/161.67)(.09) (1-.35) WACC = 10.05% 25 Case II – Proposition II, example Suppose that the firm changes its capital structure so that the D/E ratio = 1. What will happen to the cost of equity under the new capital structure? What will happen to the weighted average cost of capital? 26 Case III – with Bankruptcy Costs As the D/E ratio increases, the probability of bankruptcy increases At some point, the additional value of the interest tax shield will be offset by the expected bankruptcy cost At this point, the value of the firm will start to decrease and the WACC will start to increase as more debt is added 27 Bankruptcy Costs (Financial distress costs) Direct costs ◦ Legal and administrative costs ◦ Ultimately cause bondholders to incur additional losses ◦ Disincentive to debt financing Indirect costs ◦ The difficulties of running business that is experiencing financial distress ◦ Examples: potentially fruitful programs are dropped, employees are leaving the company 28 Static Theory of Capital Structure A firm borrows up to the point where the tax benefit from an extra dollar in debt is exactly equal to the cost that comes from the increased probability of financial distress At this point the firm’s WACC is minimized 29 Static Theory and Firm Value 30 Extended Pie Model 31 The Value of the Firm Value of the firm = marketed claims + non-marketed claims ◦ Marketed - claims of stockholders and bondholders ◦ Non-marketed - claims of the government and other potential stakeholders The overall value of the firm is unaffected by changes in capital structure The division of value between marketed claims and non-marketed claims may be impacted by capital structure decisions 32 Observed Capital Structures Capital structure differ by industry There is a connection between different industry’s operating characteristics and capital structure Firms and lenders look at the industry’s debt/equity ratio as a guide 33