P6.6 Comprehensive Problem: Consolidation Working Paper and

advertisement

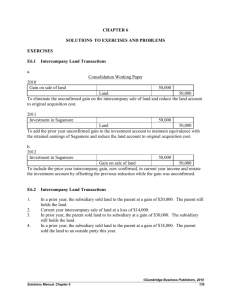

CHAPTER 6 SOLUTIONS TO MULTIPLE CHOICE QUESTIONS, EXERCISES AND PROBLEMS MULTIPLE CHOICE QUESTIONS 1. c Only the expenses related to provision of services are transactions with outside parties. The $3,000,000 revenue reported by Suzlon and the $3,000,000 expense reported by Patni are eliminated. 2. d Eliminating entries remove the intercompany asset (loan receivable) and liability (loan payable) and the interest revenue and interest expense. There is no effect on timing of income recognition, and therefore no adjustment is made to the investment account or beginning retained earnings. 3. a Downstream sales only affect equity in net income. The effect is [($540,000 - $480,000) - ($540,000 - $480,000)/1.2] = increase of $10,000. 4. d Only the adjustment to 2013 depreciation affects equity in net income and noncontrolling interest in net income. It is an upstream sale, so the increase of $2,000,000/10 = $200,000 is shared 80% - 20%. 5. b From the consolidated company’s perspective, it paid $35,000 for the land and sold it for $85,000. Therefore the consolidated gain is $50,000. 6. a The intercompany gain, recognized by the subsidiary in 2010, is $400,000. In 2013, the parent sells the land to an outside party for $550,000, reporting a loss of $850,000 (= $1,400,000 - $550,000). The consolidated loss is $450,000 (= $1,000,000 - $550,000). The 2013 eliminating entry adjusts the reported $850,000 loss to $450,000, and reclassifies it from the subsidiary’s beginning retained earnings. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 1 7. a The consolidation working paper for 2013 is: Parent Subsidiary Dr Cr Consolidated Inventory $100,000 -20,000 (I-2) $80,000 Sales 450,000 500,000 (I-1) 500,000 450,000 CGS 400,000 400,000 (I-2) 20,000 500,000 (I-1) 320,000 8. d Eliminating entries are: Sales 30,000,000 CGS Investment in subsidiary 30,000,000 200,000 CGS CGS 200,000 225,000 Inventory 9. 225,000 b Eliminating entries are: Patent 600,000 Investment in subsidiary 600,000 Unconfirmed downstream loss at the beginning of 2013 is [($1,000,000/5) x 3)] = $600,000. Amortization expense 200,000 Patent To correct the amortization expense for 2013. 10. 200,000 c Eliminating entries are: Retained earnings, subsidiary 1,700,000 Equipment, net 1,700,000 Unconfirmed upstream gain at the beginning of 2012 is [($2,000,000/20) x 17)] = $1,700,000. Equipment, net Depreciation expense To correct the depreciation expense for 2013. ©Cambridge Business Publishers, 2013 2 100,000 100,000 Advanced Accounting, 2nd Edition EXERCISES E6.1 Intercompany Land Transactions a. Consolidation Working Paper 2012 Gain on sale of land 150,000 Land 150,000 To eliminate the unconfirmed gain on the intercompany sale of land and reduce the land account to original acquisition cost. 2013 Investment in Sunnyvale 150,000 Land 150,000 To add the prior year unconfirmed gain to the investment account to maintain equivalence with the retained earnings of Sunnyvale and reduce the land account to original acquisition cost. b. 2014 Investment in Sunnyvale 150,000 Gain on sale of land 150,000 To include the prior year intercompany gain, now confirmed, in current year income and restate the investment account by offsetting the previous reduction while the gain was unconfirmed. E6.2 Intercompany Land Transactions 1. In a prior year, the subsidiary sold land to the parent at a gain of $20,000. The parent still holds the land. Current year intercompany sale of land at a loss of $14,000. In prior year, the parent sold land to its subsidiary at a gain of $30,000. The subsidiary still holds the land. In a prior year, the subsidiary sold land to the parent at a gain of $18,000. The parent sold the land to an outside party this year. 2. 3. 4. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 3 E6.3 Intercompany Merchandise Transactions (in thousands) Consolidation Working Paper Retained earnings, Converse -1/1 15,000 Investment in Converse 27,000 Cost of goods sold 42,000 To eliminate the intercompany profit on upstream intercompany sales, assumed confirmed during 2013, from the beginning inventory. Prior year profits on upstream sales are removed from Converse’s beginning retained earnings; $15,000 = $75,000 x 20%. Prior year profits on downstream sales are added to Nike’s Investment in Converse as they had been removed from the Investment account via the 2013 equity accrual; $27,000 = $117,000 - 117,000/1.3. Sales 1,150,000 Cost of goods sold To eliminate intercompany merchandise sales made during 2013. 1,150,000 Cost of goods sold 41,500 Inventory 41,500 To eliminate unconfirmed intercompany profit from ending inventory; $41,500 = ($80,000 x 20% = $16,000) + [110,500 - (110,500/1.3) = $25,500]. E6.4 Analysis of Land Sale Alternatives Under a direct sale of the land by Sawyer to the developer, Sawyer reports a gain of $3,900,000. The noncontrolling interest in net income is $780,000 (= .2 x $3,900,000) and the distribution to the noncontrolling shareholder is $390,000 (= .5 x $780,000). Under the intercompany sale, even though the gain is larger, it is eliminated in consolidation, and does not enter into the noncontrolling interest in net income. As long as the parent holds the land (which it plans to do under a long-term lease), the gain is not reflected in noncontrolling interest in net income. Moreover, the income from the lease is the parent’s income, so the noncontrolling interest is unaffected. Under this approach, the noncontrolling stockholder receives nothing. Hence, the direct sale of the land by Sawyer to the developer generates the most dividends for the noncontrolling stockholder. ©Cambridge Business Publishers, 2013 4 Advanced Accounting, 2nd Edition E6.5 Intercompany Equipment Transactions a. 2013 Consolidation Working Paper Gain on sale of equipment 250,000 Equipment 250,000 To eliminate the gain on intercompany sale of equipment; $250,000 = $800,000 – ($750,000 - $200,000). Accumulated depreciation 50,000 Depreciation expense To eliminate the excess depreciation recorded by Sawyer in 2013 ($250,000/5). Equipment 50,000 200,000 Accumulated depreciation 200,000 To restate the equipment and accumulated depreciation accounts to their original acquisition cost basis. b. 2014 Consolidation Working Paper Investment in Sawyer Accumulated depreciation 200,000 50,000 Equipment 250,000 To eliminate the amount of intercompany gain unconfirmed in prior years, remove the excess depreciation recorded in prior years and reduce the equipment to its net book value at date of intercompany sale. Accumulated depreciation 50,000 Depreciation expense To eliminate the excess depreciation recorded by Sawyer in 2014. Equipment 50,000 200,000 Accumulated depreciation 200,000 To restate the equipment and accumulated depreciation accounts to their original acquisition cost basis. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 5 E6.6 a. Various Intercompany Transactions Consolidation Working Paper (Upstream) Retained earnings – Sand Hill Land 2,500,000 2,500,000 Retained Earnings – Sand Hill 1,400,000 Cost of goods sold 1,400,000 Cost of goods sold 3,200,000 Inventory 3,200,000 Retained earnings – Sand Hill Accumulated depreciation 800,000 400,000 Equipment 1,200,000 Accumulated depreciation 200,000 Depreciation expense 200,000 Equipment 2,000,000 Accumulated depreciation b. 2,000,000 Consolidation Working Paper (Downstream) Investment in Sand Hill 2,500,000 Land Investment in Sand Hill 2,500,000 1,400,000 Cost of goods sold Cost of goods sold 1,400,000 3,200,000 Inventory Investment in Sand Hill Accumulated depreciation 3,200,000 800,000 400,000 Equipment Accumulated depreciation 1,200,000 200,000 Depreciation expense Equipment 2,000,000 Accumulated depreciation ©Cambridge Business Publishers, 2013 6 200,000 2,000,000 Advanced Accounting, 2nd Edition E6.7 Intercompany Transactions, Equity Method Income and Noncontrolling Interest a. Total Swaraj reported net income $7,000,000 Amortization of identifiable intangibles (1,750,000) Upstream loss on land 300,000 Unconfirmed profit in end. inventory - upstream (600,000) Confirmed profit in beg. inventory - upstream 350,000 Confirmed profit on downstream equipment sale 100,000 (= $1,000,000/10) $5,400,000 b. Equity Noncontrolling in NI Interest in NI $5,600,000 $1,400,000 (1,400,000) (350,000) 240,000 60,000 (480,000) (120,000) 280,000 70,000 100,000 $4,340,000 _______ $1,060,000 Consolidation Working Paper Land 300,000 Loss on sale of land To eliminate the unconfirmed loss on upstream land sale. Cost of goods sold 300,000 600,000 Inventory To eliminate the unconfirmed profit in ending inventory due to upstream sales. Retained earnings—Swaraj, beg. 350,000 Cost of goods sold To recognize the confirmed profit in beginning inventory due to upstream sales Investment in Swaraj Accumulated depreciation 600,000 350,000 700,000 300,000 Equipment 1,000,000 To eliminate the unconfirmed profit as of the beginning of the year on downstream equipment sales (=7/10 x $1,000,000). Accumulated depreciation 100,000 Depreciation expense To eliminate intercompany profit from depreciation expense (= $1,000,000/10). Solutions Manual, Chapter 6 100,000 ©Cambridge Business Publishers, 2013 7 E6.8 Item 1. 2. 3. 4. E6.9 Income Effects of Unconfirmed Intercompany Profits Decrease in consolidated net Decrease in noncontrolling income to the controlling interest interest in net income $ 200,000 -240,000 $ 60,000 800,000 -520,000 130,000 $1,760,000 $190,000 Consolidated Income Statement—Intercompany Transactions (in thousands) a. Total SCO’s reported net income Amortization of identifiable intangibles Unconfirmed profit in end. inv. - downstream Unconfirmed profit in end. inv. - upstream b. $200,000 (36,000) (50,000) (40,000) $ 74,000 Equity in NI $ 150,000 (27,000) (50,000) (30,000) $ 43,000 PCO and SCO Consolidated Income Statement Sales ($2,000,000 + $1,200,000 - $400,000) Cost of goods sold ($1,000,000+$700,000-$400,000+$50,000+$40,000) Other expenses ($600,000 + $300,000 + $36,000) Consolidated net income Noncontrolling interest in net income Consolidated net income to controlling interest ©Cambridge Business Publishers, 2013 8 Noncontrolling Interest in NI $ 50,000 (9,000) (10,000) $ 31,000 $2,800,000 (1,390,000) (936,000) $ 474,000 (31,000) $ 443,000 Advanced Accounting, 2nd Edition E6.10 Consolidated Income Statement, Intercompany Transactions a. Star’s reported net income Amortization of identifiable intangibles Goodwill impairment loss Confirmed profit in beg. inv. - upstream Unconfirmed profit in end. inv. - downstream b. Total $ 900,000 (100,000) (200,000) 110,000 (60,000) $ 650,000 Equity Noncontrolling in NI Interest in NI $ 720,000 $ 180,000 (80,000) (20,000) (160,000) (40,000) 88,000 22,000 (60,000) -$ 508,000 $ 142,000 Pon and Star Consolidated Income Statement Sales ($9,000,000 + $4,000,000 – $1,000,000) Cost of goods sold ($6,000,000+$2,500,000–$1,000,000– $110,000+$60,000) Other expenses ($2,000,000 + $600,000 + $100,000 + $200,000) Consolidated net income Less consolidated net income attributed to noncontrolling interest Consolidated net income attributed to controlling interest $ 12,000,000 ( 7,450,000) ( 2,900,000) 1,650,000 ( 142,000) $ 1,508,000 E6.11 Ratio Analysis of Enron-Type Intercompany Transactions (all dollar amounts in millions) a. 1. ROA = ($9,000 - $8,000 + $500)/($10,000 + $500) = $1,500/$10,500 = .143 ROS = $1,500/($9,000 + $3,000) = $1,500/$12,000 = .125 2. ROA = ($9,000+$2,000-$8,000-$1,900)/($10,000+$4,000) = $1,100/$14,000 = .079 ROS = $1,100/($9,000 +$2,000) = .10 Consolidation (2) eliminates the intercompany revenue and the unconfirmed intercompany gain, voiding the internal transaction for financial reporting purposes. Ratios look better when the transaction with the SPE is considered to be arm’s length and consolidation is avoided (1). Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 9 b. 1. TL/TA = $6,000/($10,000 + $3,500) = $6,000/$13,500 = .444 2. TL/TA = ($6,000 + $3,600 + $3,500)/($10,000 + $4,000 + $3,500) = $13,100/$17,500 = .749 Without consolidation (1) Sponsor recognizes the $3,500 cash but not the liability, but in consolidation (2) the liability is also counted along with Sponsoree’s assets and liabilities. Sponsoree is more leveraged than Sponsor; Sponsoree’s separate TL/TA = $3,600/$4.000 = .9, while Sponsor’s separate TL/TA = $6,000/$10,000 = .6. Therefore consolidating Sponsoree causes consolidated TL/TA to be higher than Sponsor’s separate TL/TA. c. 1. ROA = [$9,000 - $8,000 + .25 ($4,300 - $3,500)]/($10,000 + $3,500) = $1,200/$13,500 = .089 2. ROA = ($9,000 + $2,000 – $8,000 – $1,900)/($10,000 + $4,000 + $3,500) = $1,100/$17,500 = .063 Enron apparently used this technique to recognize gains on its own stock as income, something not permitted by GAAP. Without consolidation (1), Sponsor’s income includes 25% of the “gain” on its stock recognized in Sponsoree’s income and booked by Sponsor via the equity method. With consolidation (2) the “stock issuance” is voided and neither entity recognizes income on the appreciation of Sponsor’s stock. E6.12 Comprehensive Consolidated Net Income Schedule to determine consolidated net income (in thousands) Brown’s net income from its own operations Shoes.com’s net income from its own operations Decrease in cost of goods sold from sale of overvalued inventory Depreciation expense reduction from overvaluation adjustment Increase in fair value of contingent consideration liability Amortization of discount on long-term debt (increase in interest expense) Impairment loss on capitalized in-process R&D Increase in cost of goods sold due to eliminated upstream ending inventory profit Eliminated loss on downstream sale of patent Increase in patent amortization expense on the patent ($500/5) Consolidated net income Less consolidated net income attributed to noncontrolling interest* Consolidated net income attributed to controlling interest $ 50,000 20,000 900 300 (200) (100) (600) (400) 500 (100) 70,300 (2,010) $ 68,290 * $2,010 = .1 x ($20,000 + $900 + $300 – $100 – $600 – $400) ©Cambridge Business Publishers, 2013 10 Advanced Accounting, 2nd Edition PROBLEMS P6.1 Consolidation Working Paper, Noncontrolling Interest, Intercompany Inventory Transactions a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Seaport Previously unrecorded intangibles Goodwill $ 3,000,000 275,000 3,275,000 $ 2,000,000 __500,000 Allocation of goodwill between controlling and noncontrolling interests: Total goodwill Peninsula’s goodwill: $3,000,000 – 90%($2,500,000) Goodwill to noncontrolling interest Proportions: $750/$775 to controlling interest and $25/$775 to the noncontrolling interest b. 2,500,000 $ 775,000 $ $ 775,000 750,000 25,000 Calculation of 2013 Equity in Net Income and Noncontrolling Interest in Net Income (in thousands): Equity in Noncontrolling Total NI interest in NI Seaport Company reported net income ($6,000,000 – 3,170,000 – 1,930,000) $ 900,000 $ 810,000 $ 90,000 Upstream markup, beginning inventory 100,000 90,000 10,000 Downstream markup, beg. inventory 60,000 60,000 Upstream markup, ending inventory (80,000) (72,000) (8,000) Downstream markup, ending inventory (75,000) (75,000) ______ $ 905,000 $ 813,000 $ 92,000 Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 11 c. Consolidation Working Paper, December 31, 2013 (in millions) Trial Balances Eliminations Taken From Books Dr (Cr) Consolidated Peninsula Seaport Current assets Investment in Seaport Property, plant and equipment, net Intangibles Goodwill Liabilities Capital stock Retained earnings, Jan. 1 $ 1,950 4,183 $ 980 -- 5,810 4,270 5,120 -- (4,900) (3,000) (6,700) (2,100) (1,200) (2,300) Dr (I-2) 60 Sales Equity in net income of Seaport Cost of goods sold Operating expenses Noncontrolling interest in net income ©Cambridge Business Publishers, 2013 12 1,000 (15,000) (813) 9,050 4,150 ______ $ 0 340 45 52 360 40 3,170 1,930 _____ $ 0 (I-1)5,900 (C) 813 (I-3) 155 $ 2,775 -- 10,930 4,570 475 (7,000) (3,000) (6,700) (E) 1,200 (I-2) 100 (E) 2,200 400 (6,000) 155 (I-3) 453 (C) 3,060 (E) 730 (R) (R) 300 (R) 475 Noncontrolling interest Dividends Balances Cr (E) (R) (N) (C) (N) 160 (I-2) 5,900 (I-1) (N) 92 ______ $ 11,295 $ 11,295 (437) 1,000 (15,100) -6,315 6,080 92 $ 0 Advanced Accounting, 2nd Edition P6.2 Consolidation Working Paper, Noncontrolling Interest, Intercompany Merchandise Transactions (in thousands) a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Wholesome Revaluations: Plant and equipment, net Intangibles Long-term debt Goodwill $ 120,000 35,000 $ 155,000 $ 74,000 (15,000) 25,000 (4,000) Allocation of goodwill between controlling and noncontrolling interest: Total goodwill Kellogg’s goodwill: $120,000 – 75%($80,000) Goodwill to noncontrolling interest Proportions: $60,000/$75,000 = 80% to controlling interest and 20% to the noncontrolling interest 80,000 $ 75,000 $ 75,000 60,000 $ 15,000 b. Wholesome’s reported net income for 2013 Revaluation write-offs for 2013: Plant & equipment ($15,000/10) Intangibles ($25,000/10) Goodwill (80/20 split) Intercompany sales adjustments: Upstream beg. inventory profit confirmed Upstream end. inventory profit unconfirmed Total Total $ 5,000 Equity in Noncontrolling net income interest in net of income of Wholesome Wholesome $ 3,750 $ 1,250 1,500 (2,500) (1,000) 1,125 (1,875) (800) 375 (625) (200) 2,400 1,800 600 (3,000) $ 2,400 (2,250) $ 1,750 $ (750) 650 Note: The long-term debt premium is completely amortized by 2013. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 13 c. Consolidation Working Paper, December 31, 2013 Trial Balances Taken From Books Dr (Cr) Eliminations Consolidated Kellogg’s Wholesome Current assets Plant and equipment, net Investment in Wholesome $ 35,000 262,650 131,100 $ 20,000 192,000 -- Identifiable intangibles Goodwill Current liabilities Long-term debt Capital stock Retained earnings, Jan. 1 100,000 -(30,000) (350,000) (80,000) (60,000) Noncontrolling interest Sales revenue Equity in NI of Wholesome Cost of goods sold Operating expenses Noncontrolling interest in NI -- (400,000) (1,750) 250,000 143,000 _____-$ 0 ©Cambridge Business Publishers, 2013 14 10,000 -(25,000) (100,000) (54,000) (38,000) Dr (O) Cr 1,500 (R) 12,500 (R) 73,000 (E) 54,000 (I-2) 2,400 (E) 35,600 -- (140,000) -65,000 70,000 _____-$ 0 3,000 (I-3) 7,500 (R) 1,750 (C) 67,200 (E) 62,150 (R) 2,500 (O) 1,000 (O) $ 52,000 448,650 -120,000 72,000 (55,000) (450,000) (80,000) (60,000) 22,400 (E) 15,850 (R) 650 (N) (I-1) 60,000 (C) 1,750 (I-3) 3,000 Balances 2,400 (I-2) 60,000 (I-1) (O) 2,000 (N) 650 _______ $ 246,400 $246,400 (38,900) (480,000) -255,600 215,000 650 $ 0 Advanced Accounting, 2nd Edition P6.3 Intercompany Transfers of Depreciable Assets a. Consolidation Working Paper Transaction (1) Investment in Smart (2.5 x ($80,000/8)) 25,000 Accumulated depreciation (5.5 x $80,000/8)) 55,000 Plant assets 80,000 To eliminate the intercompany gain unconfirmed in prior years, remove the excess depreciation recorded in prior years and reduce the asset account to its net book value at date of intercompany sale. Accumulated depreciation 10,000 Depreciation expense To eliminate the excess annual depreciation expense recorded by Smart in 2012. 10,000 Plant assets 20,000 Accumulated depreciation 20,000 To restate the asset and accumulated depreciation accounts to their original acquisition cost basis. Transaction (2) Retained earnings-Smart (6 x ($50,000/10)) Accumulated depreciation (4 x ($50,000/10)) 30,000 20,000 Plant assets 50,000 To eliminate the intercompany gain unconfirmed in prior years, remove the excess depreciation recorded in prior years and reduce the asset account to its net book value at date of intercompany sale. Accumulated depreciation 5,000 Depreciation expense To eliminate the excess depreciation recorded by Pert in 2012. Plant assets 5,000 300,000 Accumulated depreciation 300,000 To restate the asset and accumulated depreciation accounts to their original acquisition cost basis. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 15 Transaction (3) Plant assets 40,000 Investment in Smart (4 x $40,000/5)) 32,000 Accumulated depreciation ($40,000/5) 8,000 To eliminate the intercompany loss unconfirmed in prior years, add back the reduced depreciation recorded in prior years and increase the asset account to its book value at date of intercompany sale. Depreciation expense 8,000 Accumulated depreciation 8,000 To add back the reduced depreciation recorded by the purchasing affiliate (Smart) in 2012. Plant assets 360,000 Accumulated depreciation 360,000 To restate the asset and accumulated depreciation accounts to their original acquisition cost basis. b. Consolidation Working Paper Retained earnings-Smart 30,000 Gain on sale of plant assets 30,000 To include in current year income the portion of the original intercompany gain of $50,000 which had not been confirmed through depreciation as of the beginning of the year. This remaining portion, which would have reduced depreciation over the next six years (including 2012), has now been fully confirmed by an external sale in 2012. NOTE: If there is a noncontrolling interest in Smart, it shares in this $30,000 gain but not in the gain of $280,000 recorded by Pert on the external sale; $280,000 = $400,000 – [$200,000 – 4 x ($200,000/10)]. ©Cambridge Business Publishers, 2013 16 Advanced Accounting, 2nd Edition P6.4 Consolidated Income Statement—Intercompany Transactions a. Sow's reported net income Plus intercompany profit in Pow's beginning inventory, now assumed confirmed Less unconfirmed intercompany profit in Sow's ending inventory Plus Sow's unconfirmed loss on an intercompany sale of land Less Pow's unconfirmed gain on intercompany sale of machinery at beginning of year [$250,000 - $250,000/5)] Plus Pow's gain on prior year intercompany sale of land, confirmed through external sale Net equity method income accrual b. Total $ 800,000 Equity in Noncontrolling net interest in net income income $ 760,000 $ 40,000 400,000 380,000 (200,000) (200,000) 100,000 95,000 (200,000) (200,000) 60,000 $ 960,000 60,000 $ 895,000 20,000 5,000 ______ $ 65,000 Pow Company and Sow Company Consolidated Statement of Income and Retained Earnings Sales $ 32,000,000 (1) Other income 1,510,000 (2) Total revenue 33,510,000 Cost of goods sold 23,400,000 (3) Operating expenses 5,850,000 (4) Other expenses 1,000,000 (5) Total expenses 30,250,000 Consolidated net income 3,260,000 Noncontrolling interest in net income 65,000 Consolidated net income to parent 3,195,000 Consolidated retained earnings, January 1 15,700,000 Dividends (1,000,000) Consolidated retained earnings, December 31 $ 17,895,000 (1) $32,000,000 = $25,000,000 + $10,000,000 - $3,000,000 (intercompany sales). (2) $1,510,000 = $1,200,000 + $500,000 - $250,000 (unconfirmed gain on machinery) + $60,000 (prior period gain on land now confirmed). (3) $23,400,000 = $19,000,000 + $7,600,000 - $3,000,000 (intercompany purchases) $400,000 (intercompany profit in beginning inventory assumed confirmed) + $200,000 (unconfirmed intercompany profit in ending inventory) (4) $5,850,000 = $4,100,000 + $1,800,000 - $50,000 (excess depreciation) (5) $1,000,000 = $800,000 + $300,000 - $100,000 (unconfirmed loss on land) Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 17 P6.5 Equity Accrual and Eliminating Entries—Intercompany Asset Transfers and Services (in thousands) a. Suro’s net income Plus intercompany profits in Suro’s beginning inventory (downstream sales); ($50,000 $50,000/1.25) Less intercompany profits in Pohang’s ending inventory (upstream sales); ($80,000 $80,000/1.25) Less unconfirmed gain on upstream intercompany sale of machinery; [$25,000 ($25,000/5)] b. Total $ 200,000 Equity in net income $ 160,000 Noncontrolling interest in net income $ 40,000 10,000 10,000 (16,000) (12,800) (3,200) (20,000) $ 174,000 (16,000) $ 141,200 (4,000) $ 32,800 Consolidation Working Paper (C) Income from Suro 141,200 Dividends - Suro (.8 x .4 x $200,000) Investment in Suro To eliminate the current year equity method entries made by Pohang. (I-1) Stockholders’ equity (RE), 1/1 Suro 64,000 77,200 15,000 Land 15,000 To eliminate the unconfirmed gain from the prior year upstream transfer of land and reduce the land account to original acquisition cost. (I-2) Sales 350,000 Cost of goods sold To eliminate intercompany merchandise sales. (I-3) Investment in Suro 350,000 10,000 Cost of goods sold 10,000 To eliminate unconfirmed intercompany profit on downstream sales from beginning inventory. ©Cambridge Business Publishers, 2013 18 Advanced Accounting, 2nd Edition (I-4) Cost of goods sold 16,000 Inventory 16,000 To eliminate unconfirmed intercompany profit on upstream sales from ending inventory. (I-5) Gain on sale of machinery 25,000 Machinery To eliminate the gain on the intercompany sale of machinery. 25,000 (I-6) Accumulated depreciation 5,000 Depreciation expense 5,000 To eliminate excess depreciation on the machinery acquired from Suro; this is the portion of the $25,000 gain confirmed to Singular in 2012. (I-7) Machinery 40,000 Accumulated depreciation To restate the machinery and accumulated depreciation accounts to their original acquisition cost basis. (I-8) Computer service revenue 20,000 Computer service expense To eliminate intercompany revenue and expense. (I-9) Accounts payable 20,000 3,000 Accounts receivable To eliminate intercompany receivables and payables. (E) Stockholders’ equity – Suro (1) 40,000 3,000 1,575,000 Investment in Singular 1,260,000 Noncontrolling interest in Suro 315,000 To eliminate the remaining beginning stockholders= equity of Suro against the investment and establish the book value of noncontrolling interest as of 1/1/12. (1) $1,575,000 = $1,500,000 + $150,000 - .4 x $150,000 - $15,000, where $1,500,000 = $1,250,000 + $300,000 – $50,000 Goodwill = Stockholders’ equity—Suro at 1/2/11. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 19 (R) Goodwill 50,000 Investment in Suro To establish goodwill as of the beginning of the year. 50,000 Note: Goodwill is attributed only to the controlling interest: Acquisition cost $ 1,250,000 Fair value of noncontrolling interest 300,000 Total fair value 1,550,000 Book value of Suro, 1/2/11 1,500,000 Goodwill $ 50,000 Goodwill attributed to the controlling interest = $1,250,000 – 80% x $1,500,000 = $50,000; no goodwill is attributed to the noncontrolling interest. Note that the above entries eliminate the Investment in Suro balance of $1,377,200, calculated as follows: January 2, 2011 balance Equity in income of Suro, 2011 (2) Dividends, 2011 December 31, 2011 balance Equity in income of Suro, 2012 Dividends, 2012 December 31, 2012 balance (2) $1,250,000 98,000 (48,000) 1,300,000 141,200 (64,000) $1,377,200 Equity in net income for 2011 calculation: 80% x Suro’s book income of $150,000 unconfirmed upstream land profit (80%) unconfirmed downstream profit in ending inventory (100%) Equity in net income of Suro, 2011 (N) Noncontrolling interest in net income 32,800 Dividends—Suro (.2 x .4 x $200,000) Noncontrolling interest in Suro To record the change in the noncontrolling interest during 2012. ©Cambridge Business Publishers, 2013 20 $ 120,000 (12,000) (10,000) $ 98,000 16,000 16,800 Advanced Accounting, 2nd Edition P6.6 Comprehensive Problem: Consolidation Working Paper and Financial Statements (in thousands) a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Selene Previously unrecorded intangibles Goodwill Consideration paid 75% x $14,000 Goodwill to parent Goodwill to noncontrolling interest b. $ 20,100 5,900 26,000 $ 10,000 4,000 $ 20,100 10,500 $ 9,600 $ 2,400 14,000 $ 12,000 80% 20% Calculation of 2014 Equity in Net Income and Noncontrolling Interest in Net Income (in thousands): Equity Noncontrolling Total in NI interest in NI Selene’s reported net income ($50,000 – 35,000 – 8,000) $ 7,000 $ 5,250 $ 1,750 Amortization, developed tech ($4,000/5) (800) (600) (200) Confirmed downstream gain on equipment (excess depreciation) ($2,000/10) 200 200 Upstream markup, beg. inv. ($1,800 – $1,800/1.2) 300 225 75 Upstream markup, end. inv. ($2,400 – $2,400/1.2) (400) (300) (100) Downstream markup, beg. inv. ($3,000 x 20%) 600 600 Downstream markup, end. inv. ($2,800 x 20%) (560) (560) _____ $ 6,340 $ 4,815 $ 1,525 Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 21 c. Consolidation Working Paper, December 31, 2014 (in thousands) Trial Balances Eliminations Taken From Books Dr (Cr) Consolidated Cash Receivables Inventories Plant and equipment, net Investment in Selene Intangibles Goodwill Current liabilities Long-term debt Capital stock Retained earnings, January 1 Pierre Selene $ 1,000 5,600 70,000 460,000 25,040 $ 2,500 10,000 30,000 150,000 Dr $ (I-2) 200 (I-1) 1,600 (I-4) 600 (R) 1,600 (R) 9,000 (4,000) (2,800) (489,825) (163,700) (5,000) (2,000) (90,000) (20,000) Sales revenue Equity in income of Selene Cost of sales Operating expenses Noncontrolling interest in net income 40,000 (150,000) (4,815) 100,000 42,000 _____ $ -0- 960 (I-5) 1,600 (I-1) 2,565 (C) 16,275 (E) 8,400 (R) 800 (O) (E) 2,000 (I-4) 300 (E) 19,700 Noncontrolling interest Dividends Balances Cr (50,000) (I-3) 35,000 (C) 4,815 35,000 (I-5) 960 -800 9,000 (6,800) (653,525) (5,000) (90,000) 5,425 2,200 775 2,250 750 3,000 3,500 15,600 99,040 608,600 (E) (R) (N) (C) (N) 35,000 (I-3) 900 (I-4) 8,000 (O) 800 200 (I-2) _____ (N) 1,525 _______ $ -0- $ 78,100 $ 78,100 (8,400) 40,000 (165,000) -100,060 50,600 1,525 $ -0- d. Consolidated Statement of Income and Retained Earnings For the Year 2014 Sales $ 165,000 Costs of goods sold (100,060) Gross margin 64,940 Operating expenses (50,600) Consolidated net income 14,340 Noncontrolling interest in income (1,525) Consolidated income to controlling interest 12,815 Retained earnings, January 1 90,000 Dividends (40,000) Retained earnings, December 31 $ 62,815 ©Cambridge Business Publishers, 2013 22 Advanced Accounting, 2nd Edition Consolidated Balance Sheet, December 31, 2014 Assets Current assets: Cash Receivables Inventories Total current assets Plant and equipment, net Intangibles Goodwill Total assets Liabilities and Stockholders’ Equity Current liabilities Long-term debt Total liabilities Stockholders’ equity Capital stock Retained earnings Equity to Pierre Noncontrolling interest Total stockholders’ equity Total liabilities and stockholders’ equity P6.7 $ 3,500 15,600 99,040 118,140 608,600 800 9,000 $ 736,540 $ 6,800 653,525 660,325 5,000 62,815 67,815 8,400 76,215 $ 736,540 Calculation of Investment and Consolidated Accounts Several Years After Acquisition (in millions) a. Pentland’s retained earnings from its own operations Equity in net income, 2011 – 2014: 75 % of Sketchers’ total net income since acquisition (75% x $140) Less 75% of amortization on asset revaluation [75% x (($60/5) x 4)] Less 80% of goodwill impairment loss (80% x $5) (Note 1) Less 75% of unconfirmed gain on upstream land sale (75% x $30) Less unconfirmed gain on downstream patent sale [$10 – (($10/10) x 3)] Less 75% of unconfirmed profit on upstream ending inventory (75% x 20) Less unconfirmed profit on downstream ending inventory Equity in net income, 2011 – 2014 Consolidated retained earnings, December 31, 2014 Solutions Manual, Chapter 6 $ 55 105 (36) (4) (22.5) (7) (15) (17) 3.5 $ 58.5 ©Cambridge Business Publishers, 2013 23 Note 1: Goodwill is shared in a 80:20 ratio, calculated as follows: Acquisition cost Fair value of noncontrolling interest Total fair value Book value Revaluation of intangibles $ 180 50 230 $ 20 60 Goodwill 80 $ 150 Goodwill to controlling interest [180 – (75% x 80)] Goodwill share to controlling interest (120/150) $ 120 80% b. Investment in Sketchers, January 2, 2011 Plus equity in net income, 2011 - 2014 Less 75% of Sketchers’ dividends, 2011 – 2014 (12 x 75%) Investment in Sketchers, December 31, 2014 $ 180 3.5 (9) $174.5 c. Fair value of noncontrolling interest, January 2, 2011 Plus noncontrolling interest in net income, 2011 – 2014: 25 % of Sketchers’ total net income since acquisition (25% x $140) Less 25% of amortization on asset revaluation [25% x (($60/5) x 4)] Less 20% of goodwill impairment loss (20% x $5) (Note 1) Less 25% of unconfirmed gain on upstream land sale (25% x $30) Less 25% of unconfirmed profit on upstream ending inventory (25% x 20) Noncontrolling interest in net income, 2011 – 2014 Less 25% of Sketchers’ dividends, 2011 – 2014 (12 x 25%) Consolidated noncontrolling interest, December 31, 2014 ©Cambridge Business Publishers, 2013 24 $ 50 35 (12) (1) (7.5) (5) 9.5 (3) $ 56.5 Advanced Accounting, 2nd Edition P6.8 Bonus Based on Adjusted Subsidiary Income Net income before taxes Adjustment for unconfirmed intercompany inventory profits: Increase in inventory Percent acquired from parent Increase in intercompany inventory Gross margin percentage Increase in unconfirmed intercompany inventory profit Plus interest paid to parent (= $600,000 x .10) Revised income base Less 40% for corporate costs and income taxes Base for bonus $150,000 $380,000 x .8 304,000 x .35 (106,400) 60,000 103,600 (41,440) 62,160 x .15 $ 9,324 Bonus P6.9 Consolidated Income Statement—Intercompany Transactions a. Salem reported net income Confirmed profit in BI-downstream Unconfirmed profit in EI-upstream Unconfirmed loss on asset sale-downstream Confirmed loss on asset sale-downstream = $360,000/6 Unconfirmed gain on land sale-upstream Confirmed gain (excess amortization) on patent sale-upstream = $250,000/5 Unconfirmed gain on prior year patent sale, as of beg.of year-upstream = $250,000/5 x 2 Solutions Manual, Chapter 6 Total $6,200,000 650,000 (500,000) 360,000 Equity in NI $4,960,000 650,000 (400,000) 360,000 Noncontrolling Interest in NI $1,240,000 (60,000) (190,000) (60,000) (152,000) (38,000) 50,000 40,000 10,000 100,000 $6,610,000 80,000 $5,478,000 20,000 $1,132,000 (100,000) ©Cambridge Business Publishers, 2013 25 b. Portland Company and Salem Company Consolidated Income Statement Sales ($40,000,000 + 25,000,000 - 4,000,000) Other income ($6,000,000 + 2,000,000 - 190,000 + 100,000) Total revenue Cost of goods sold ($28,000,000 + 15,000,000 - 4,000,000 650,000 + 500,000) Operating expenses ($7,000,000 + 5,000,000 + 60,000 - 50,000) Other expenses ($1,000,000 + 800,000 - 360,000) Total expenses Consolidated net income Noncontrolling interest in net income Net income to the controlling interest $61,000,000 7,910,000 68,910,000 38,850,000 12,010,000 1,440,000 52,300,000 16,610,000 1,132,000 $15,478,000 Check: Consolidated net income to the controlling interest must equal Portland’s reported net income, including the equity income accrual. $15,478,000 = $10,000,000 + $5,478,000. NOTE ON THE PATENT: The patent acquired internally from Salem had a net book value of $200,000 [= $500,000 - (3/5) X 500,000] when sold by Portland for $420,000. The $220,000 (= $420,000 - 200,000) external gain reported in other income is fully confirmed and does not affect the consolidation. This year’s $50,000 (= $250,000/5) excess amortization is eliminated—increasing income—because the patent was held internally for the entire year. Moreover, the remaining $100,000 upstream intercompany gain is now fully confirmed by the external sale and is added to this year’s income. The $100,000 is the original $250,000 intercompany gain reduced by three years of excess amortization at $50,000 a year. ©Cambridge Business Publishers, 2013 26 Advanced Accounting, 2nd Edition P6.10 Comprehensive Intercompany Eliminations Consolidation Working Paper (E) Stockholders' equity – MC Shops 7,000,000 Investment in MC Shops (I) Sales 7,000,000 60,000,000 Cost of goods sold Investment in MC Shops 60,000,000 2,000,000 Cost of goods sold $2,000,000 = 20% x $10,000,000 beginning inventory. Cost of goods sold All other assets $2,600,000 = 20% x $13,000,000 ending inventory. Franchise fee revenue 2,000,000 2,600,000 2,600,000 8,000,000 Franchise fee expense Interest revenue 8,000,000 4,000,000 Interest expense Liabilities 43,000,000 All other assets Solutions Manual, Chapter 6 4,000,000 43,000,000 ©Cambridge Business Publishers, 2013 27 P6.11 Consolidation of Equity Method Investments a. Consolidation Working Paper, October 3, 2010 Current assets Equity investments Other noncurrent assets Goodwill Current liabilities Noncurrent liabilities Shareholders’ equity, beg Noncontrolling interest Trial Balances Taken From Books Dr. (Cr.) Seven Starbucks Companies $ 2,756,400 $ 390,100 308,100 3,321,400 570,300 (1,779,100) (924,500) (2,734,000) (260,600) (70,500) (603,416) Dividends Revenues Equity method income Cost of sales and other operating expenses Other expenses, net Noncontrolling int. in NI Eliminations Consolidated Dr (C) Balances Cr 43,200 31,400 (I-2) 307,742 (E) 43,558 (R) (R) 85,408 (I-2) 31,400 (E) 603,416 179,216 (10,707,400) (108,600) (2,128,000) (I-1) 125,700 (a) 60,400 (C) 48,200 9,396,600 471,100 ________ $ -0- 1,882,700 40,200 ________ $ -0- (a) 65,300 295,674 41,850 12,683 91,400 87,816 125,700 (E) (R) (N) (C) (N) (a) 125,700 (I-1) (N) 100,499 ________ $ 1,163,523 $1,163,523 $ 3,115,100 -3,891,700 85,408 (2,008,300) (995,000) (2,734,000) (350,207) -(12,835,400) -- 11,218,900 511,300 100,499 $ -0- Eliminating entries: (a) Removes equity investees’intercompany revenues and cost of sales from the equity method income account and assigns them to revenues and cost of sales. (C) Removes the remaining equity method income balance, 51% of investee dividends, and adjusts the investment by the difference. (I-1) Removes intercompany revenues generated from investees. (I-2) Removes intercompany receivables and payables. (E) Eliminates investee beginning equity against the investment (51%) and noncontrolling interest (49%). (R) Recognizes the beginning-of-year goodwill balance. The remaining balance in the investment ($43,558) represents 51% of the total goodwill balance of $85,408 (= $43,558/.51). The remainder is credited to noncontrolling interest. (N) Recognizes $100,499 noncontrolling interest in investee income (= 49% x $205,100), eliminates the noncontrolling interest’s dividends and updates the noncontrolling interest for the current year. ©Cambridge Business Publishers, 2013 28 Advanced Accounting, 2nd Edition b. Consolidated amount Starbucks’ reported Increase Total Assets $ 7,092,208 6,385,900 $ 706,308 Revenues $ 12,835,400 10,707,400 $ 2,128,000 11.06% 19.87% Percentage increase P6.12 Evaluation of Eliminations Disclosures a. Machinery & Engines is the parent company. Its records show an “Investment in Financial Products” account. We also observe that the income and stockholders’ equity of Machinery & Engines equal the consolidated amounts, a characteristic that is true of parent companies of wholly-owned subsidiaries that use the complete equity method on their own books. b. The fact that no goodwill arises in the consolidation of Machinery & Engines with Financial Products suggests that Financial Products was formed as a subsidiary company by Machinery & Engines, rather than acquired in a business combination. Goodwill arises when the acquisition cost exceeds the fair value of the subsidiary’s identifiable net assets. When a parent company forms a subsidiary, there is no goodwill. Another possible explanation is that the excess of acquisition cost over the acquisitiondate fair value of identifiable net assets acquired is fully explained by revaluations of identifiable net assets. A third explanation is that the acquired goodwill has been completely written off as impairment loss (or amortization prior to 2002) in previous years. c. The goodwill on the books of Machinery & Engines suggests that Machinery & Engines acquired other companies in the past, and merged them into the parent. Because the other companies are no longer separate legal entities, Machinery & Engines reports their assets and liabilities directly on its own books, as discussed in Chapter 2 of this text. d. Financial Products earned $400 million in revenue from Machinery & Engines; there was no intercompany revenue in the other direction. Solutions Manual, Chapter 6 ©Cambridge Business Publishers, 2013 29 e. Eliminating entry (in millions): Common stock, FP Profit employed in the business, FP Accumulated other comprehensive income, FP 860 2,566 522 Investment in Financial Products f. 3,948 The main intercompany activity involves financing of customer receivables. Over $3 billion was added to current trade receivables and subtracted from current finance receivables, and over $550 million is added to long-term trade receivables and subtracted from long-term finance receivables, suggesting that Financial Products finances a significant amount of the sales made to Machinery & Engines customers. ©Cambridge Business Publishers, 2013 30 Advanced Accounting, 2nd Edition