E5-26A: Cost-Method Consolidation for Majority

advertisement

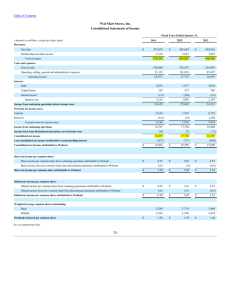

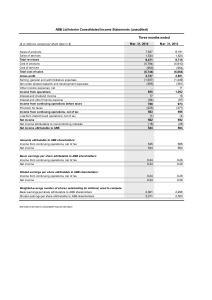

E5-26A: Cost-Method Consolidation for MajorityOwned Subsidiary Brett Bronenkamp Haoyi Du Stephen Jones Kevin McCarthy Alicia Rackers Calculations Dividends Declared - Knight Co. Percent Owned Eliminate Dividend Income from Sub. Net Income of Knight Co. Sales Depreciation Expense Other Expenses Net Income of Knight Co. Noncontrolling Percentage Income to Noncontrolling Interest 20,000 80% 16,000 200,000 -15,000 -155,000 30,000 20% 6,000 Dividends Declared - Knight Co. Noncontrolling % Assign Dividends to Noncontrolling Interest 20,000 20% 4,000 R/E Knight Co. December 31, 20X7 R/E Knight Co. January 1, 20X7 Undistributed Earnings Noncontrolling Interest Percentage Increase Assignable to Noncontrolling Interest 70,000 -50,000 20,000 20% 4,000 Elimination Entries, Dec 31, 20X7 E1 E2 E3 E4 Dividend Income Dividends Declared Eliminate Dividend Income from Subsidiary 16,000 16,000 Income to Noncontrolling Interest Dividends Declared Noncontrolling Interest Assign income to noncontrolling interest 6,000 Common Stock Knight Co. Retained Earnings, Jan 1 Investment in Knight Co. Stock Noncontrolling Interest Eliminate original investment balance 100,000 50,000 Retained Earnings, Jan 1 Noncontrolling Interest Assign undistributed prior earnings of subsidiary to noncontrolling interest. 4,000 2,000 120,000 30,000 4,000 4,000 Item Sales Dividend Income Credits Depreciation Expense Other Expenses Debits Consolidated Net Income Income to Noncontrolling Interest Income, carry forward Retained Earnings, Jan 1 Income, from above Eliminations Debit Credit Lintner Corporation Knight Company 300,000 200,000 (1) 16,000 16,000 316,000 200,000 25,000 15,000 251,000 155,000 276,000 170,000 40,000 268,000 40,000 308,000 30,000 70,000 30,000 100,000 Consolidated 500,000 500,000 40,000 406,000 446,000 54,000 -6,000 48,000 (2) 6,000 22,000 (3) 50,000 (4) 4,000 22,000 284,000 48,000 332,000 (1) 16,000 (2) 4,000 20,000 Dividends Declared Retained Earnings, Dec 31, carry forward -25,000 283,000 -20,000 80,000 Current Assets Depreciable Assets Investment in Knight Co. Stock Debits 183,000 500,000 120,000 803,000 80,000 300,000 380,000 1,063,000 Accumulated Depreciation Accounts Payable Common Stock Retained Earnigs, from above 200,000 120,000 200,000 283,000 90,000 110,000 100,000 80,000 (3) 100,000 76,000 290,000 230,000 200,000 307,000 803,000 380,000 176,000 76,000 263,000 800,000 (3) 120,000 Noncontrolling Interest Credits -25,000 307,000 20,000 (2) 2,000 (3) 30,000 (4) 4,000 176,000 36,000 1,063,000 Lintner Corp. and Subsidiary Consolidated Income Statement Year Ended December 31, 20X7 Sales Depreciation Other Expenses Total Expenses Consolidated Net Income Income to Noncontrolling Interest Income to Controlling Interest 500,000 40,000 406,000 -446,000 54,000 -6,000 48,000 Lintner Corp. and Subsidiary Consolidated Retained Earnings Statement Year Ended December 31, 20X7 Retained Earnings, Jan. 1, 20X7 Income to Controlling Interest 20X7 Dividends Declared, 20X7 Retained Earnings, Dec. 31, 20X7 284,000 48,000 332,000 -25,000 307,000 Lintner Corp. and Subsidiary Consolidated Balance Sheet December 31, 20X7 Current Assets Depreciable Assets Accumulated Depreciation Total Assets Accounts Payable Stockholders Equity Controlling Interest Common Stock Retained Earnings Total Controlling Interest Noncontrolling Interest Total Stockholders Equity Total Liabilities and Stockholders Equity 263,000 800,000 -290,000 510,000 773,000 230,000 200,000 307,000 507,000 36,000 543,000 773,000 Differences Between the Cost and Equity Method ● The choice of the cost or equity method has no effect on the consolidated financial statements. ● Under the cost method, in the year of the combination no entries are made on the parent’s books to write off the portions of the differential that expire during that year. ● Consolidation differences become more evident in the second year of ownership. ● Under the cost method, the investment elimination entry continues to be the same in each subsequent year unless there is a change in ownership level or a change in the number of subsidiary shares outstanding. Questions?