Sample Exercises Chapter 10

advertisement

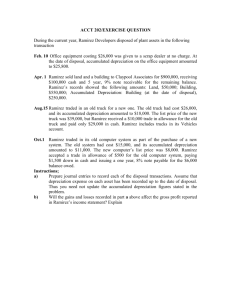

Sample Exercises Chapter 10 1) The following expenditures were incurred by Osley Co. in purchasing land: cash price $70,000, accrued taxes $3,000, attorney’s fees $2,500, real estate broker’s commission $2,000, and clearing and grading $3,500. What is the cost of the land? All of the expenditures should be included in the cost of the land. Therefore, the cost of the land is $81,000, or ($70,000 + $3,000 + $2,500 + $2,000 + $3,500). 2) Nelson Co. incurs the following expenditures in purchasing a truck: cash price $40,000, accident insurance $4,000, sales tax $1,500, motor vehicle license $100, and painting and lettering $400. What is the cost of the truck? The cost of the truck is $41,900 (cash price $40,000 + sales tax $1,500 + painting and lettering $400). The expenditures for insurance and motor vehicle license should not be added to the cost of the truck. 3) Crest Co. acquires a delivery truck at a cost of $42,000. The truck is expected to have a salvage value of $6,000 at the end of its 4-year useful life. Compute annual depreciation for the first and second years using the straight line method. Depreciable cost of $36,000, or ($42,000 – $6,000). With a four-year useful life, annual depreciation is $9,000, or ($36,000 ÷ 4). Under the straight-line method, depreciation is the same each year. Thus, depreciation is $9,000 for both the first and second years. Assuming the declining balance depreciation rate is double the straight line rate, compute annual depreciation for the first and second years under the declining balance method. The declining balance rate is 50%, or (25% X 2) and this rate is applied to book value at the beginning of the year. The computations are: Book Value Year 1 Year 2 $42,000 ($42,000 – $21,000) X Rate 50% 50% = Depreciation $21,000 $10,500 4) Keys Co. exchanges old delivery equipment for new delivery equipment. The book value of the old delivery equipment is $31,000 (cost $61,000 less accumulated depreciation $30,000). Its fair market value is $19,000, and cash of $5,000 is paid. Prepare the entry to record the exchange, assuming the transaction has commercial substance. Delivery Equipment (new) ................................................................ 24,000 Accumulated Depreciation—Delivery Equipment .......................... 30,000 Loss on Disposal .............................................................................. 12,000 Delivery Equipment (old) ......................................................... Cash .......................................................................................... 61,000 5,000 Fair market value of old delivery equipment Cash Cost of new delivery equipment $19,000 5,000 $24,000 Fair market value of old delivery equipment Book value of old delivery equipment ($61,000 – $30,000) Loss on disposal $19,000 31,000 $12,000 Using the same information, except with a fair market value of the old delivery equipment of $38,000, prepare the entry to record the exchange. Delivery Equipment (new) ................................................................ Accumulated Depreciation—Delivery Equipment .......................... Gain on Disposal...................................................................... Delivery Equipment (old) ......................................................... Cash .......................................................................................... Fair market value of old delivery equipment Cash Cost of new delivery equipment Fair market value of old delivery equipment Book value of old delivery equipment ($61,000 – $30,000) Gain on disposal $38,000 5,000 $43,000 $38,000 31,000 $ 7,000 43,000 30,000 7,000 61,000 5,000