Paper 1 Presentation Powerpoint

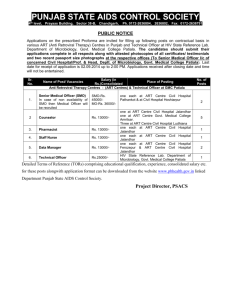

advertisement

Candidates’ Performance in the 2010 Examination – Paper 1 Mr. WAN Shiu-kee Vice Chairman Hong Kong Association for Business Education Overall Performance Satisfactory Possess required skill and knowledge in presenting financial information in logical and systematic manner Should have thorough understanding of the syllabus Able to give appropriate answers based on the scenarios given 2 Overall Performance Abbreviations are not acceptable Proper heading / title should be given to each account / statement Journal narrations should not be omitted Should show workings in their answers 3 Overall Performance Questions Popularity Performance 1 Good 2 Satisfactorily answered 3 95.6% Good 4 31.7% Satisfactorily answered 5 72.7% Poor 4 Question 1 – Consolidated financial statements Good Demonstrated an acceptable level of understanding of consolidated financial statements 5 Question 1 – Consolidated financial statements a) Well-answered Only a few candidates failed to work out the correct amount of purchase consideration A few others ignored the revaluation adjustment for land and building in calculating the net assets of Sea Ltd 6 7 Question 1 – Consolidated financial statements b) Poor Many candidates could not give appropriate explanation for negative goodwill Tended to repeat same circumstances in different wordings as two separate answers 8 9 Question 1 – Consolidated financial statements c) Not familiar with the adjustments relating to intra-group transactions Most candidates reduced turnover and cost of goods sold by the amount of intra-group sales of merchandise but some could not make the adjustment correctly Had difficulties in handling intra-group sales with 2 different profit margins normal margin treated as mark-up on costs understatement of cost of goods sold and overstatement of gross profit 10 Question 1 – Consolidated financial statements Not able to calculate and adjust depreciation overcharged arising from upstream sale of office equipment and the depreciation undercharged on the revalued land and building Debentures of Sea Ltd acquired on 1.7.2009 debenture interest for 6 months should be deducted from both the income from investment and finance costs 11 Question 1 – Consolidated financial statements Profits attributable to equity holders of the parent and MI were to be shown separately in the consolidated income statement Only amount of depreciation adjustment arising from revaluation of land and building was to be shared by MI No unrealised profits or losses arising from upstream sale of non-current assets in year 2009 12 13 Question 1 – Consolidated financial statements d) Should present the consolidated balance sheet in vertical form and classify various items under appropriate headings Not able to adjust the correct amounts of depreciation to net book values of office equipment and land and building Overlooked the amount of intra-group debenture interest did not take it away from both trade receivables and debenture interest payable 14 Question 1 – Consolidated financial statements Treated the revaluation of land and building as post-acquisition adjustment and created a revaluation reserve on the consolidated balance sheet Unrealised profit in inventory and depreciation adjustment on office equipment should be eliminated in full against retained profits 15 Question 1 – Consolidated financial statements Most candidates were able to reduce retained profits and MI with amounts of unrealised profits on intra-group sale of office equipment and depreciation adjustment on revalued land and building but some omitted the fair adjustment from MI 16 17 18 19 Question 2 – Cash flow statement Satisfactorily answered Candidates were well prepared for the question Apparently familiar with the classification of cash flows into 3 activities 20 Question 2 – Cash flow statement a) Good Some candidates did not follow the requirements of updating the cash at bank account and prepare the bank reconciliation 21 22 Question 2 – Cash flow statement b) Poor Not able to explain the accounting treatment for the returned cheque repeated the accounting entries made without considering the impact of the returned cheque on accrued expenses and prepaid insurance 23 24 Question 2 – Cash flow statement c) Satisfactorily answered Could not work out the figures for the various cash flows from operating activities Mixed up various cheques received from customers and hence could not arrive at a correct amount of cash receipts from them 25 Question 2 – Cash flow statement Had difficulties in computing the amount for purchase of office equipment not able to exclude it from cash paid to suppliers Non-cash items should not be included in cash paid for operating expenses Other income should not be grouped under investing activities 26 Question 2 – Cash flow statement NBV of the new office equipment should be calculated by taking into account the NBV of the disposed office equipment and depreciation on the old office equipment Depreciation + NBV = Cost of the new office equipment Trade-in allowance should be excluded in computing the amount of cash paid for purchase of office equipment 27 Question 2 – Cash flow statement Fixed deposits already included as cash and cash equivalents should not be classified as as item under investing activities Proceeds from issuance of ordinary shares should not be divided into par value and share premium and disclose separately 28 29 30 31 Question 3 – Partnership Good Quite familiar with the preparation of various accounts for a partnership 32 Question 3 – Partnership a) Good. Should adopt the account names as given in the question 33 Question 3 – Partnership b) Fair NO goodwill account maintained in the books amount of goodwill should be written off through the partners’ capital accounts using the old and new profit and loss sharing ratios Many ignored that all non-current assets, except goodwill, had to be recorded back to their original NBVs basing on the new sharing ratios 34 35 Question 3 – Partnership c) Good Required to transfer book values of various assets to the realisation account Some failed to show net amount of motor vehicles and plant and machinery Others forgot to include cash at bank and deduct allowance for doubtful debts from trade receivables 36 Question 3 – Partnership Amount of trade receivables collected by Kam did not include discounts allowed and uncollectible debts Commission to be credited to the capital acoount of Kam should be based on the amount collected Interest on capital and share of profit should NOT be credited to partners’ capital accounts 37 38 Question 4 – Ratios analysis and Valuation of inventories Satisfactorily answered Weak in answering conceptual questions 39 Question 4 – Ratios analysis A. Could not interpret dividend cover correctly only able to describe how the ratio was to be calculated Able to state 3 limitations of using ratio analysis in assessing financial position of a company 40 Question 4 – Ratios analysis B. Could NOT calculate the 3 ratios correctly forgot to deduct amount of preference dividend from profits after tax took an incorrect number of ordinary shares as the denominator Did NOT present ‘earnings per share’ in dollars 41 42 Question 4 – Valuation of inventories C. Not aware of the adoption of perpetual inventory system and FIFO method Not familiar with journal entries relating to sales, returns inwards, abnormal inventory loss and inventory written-down 43 Question 4 – Valuation of inventories Could NOT work out the right amounts of sales and cost of goods sold on 20.1.2010 and 31.1.2010 Did Not prepare journal entries to update cost of goods sold and inventory for sales and returns inwards Could state 1 or 2 situations in which NRV of inventory was less than cost 44 45 Question 5 – Errors and Control accounts Poor NOT aware that sales ledger control account was kept as part of double entry system while sales ledger was kept on a memorandum basis Ignored that the books had not been closed 46 Question 5 – Errors and Control accounts a) Many recorded the corrections or omissions directly to P&L instead of various revenues and expenses accounts Sales ledger control account should be adjusted instead of debtors’ account 47 Question 5 – Errors and Control accounts Performance in item (iii) was poor Careless in missing the fact that a uniform markup of 25% was maintained on all goods sold Could NOT differentiate entries relating to sales and goods sent on sale-or-return basis Mistakenly debited stock and credited sales ledger control with cost of goods to be returned by customers 48 Question 5 – Errors and Control accounts Did NOT possess sufficient understanding of finance lease Could NOT show journal entries relating to acquisition of leased office equipment, payments made and lease interest for year 2009 49 Question 5 – Errors and Control accounts b) Well-answered Some prepared an account instead of a statement in columnar form to update the totals of the extracted sales ledger balances 50 Question 5 – Errors and Control accounts c) Could NOT point out when a credit note was to be used by a company 51 Thank you !