Credit Analyst 2 - Exempt

advertisement

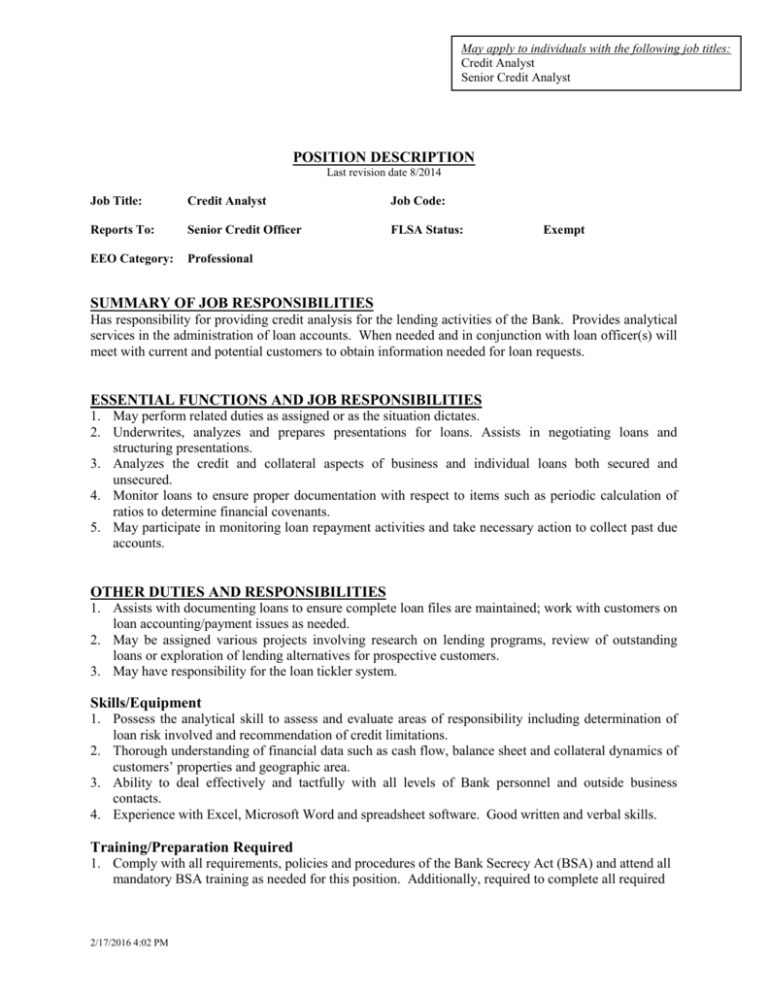

May apply to individuals with the following job titles: Credit Analyst Senior Credit Analyst POSITION DESCRIPTION Last revision date 8/2014 Job Title: Credit Analyst Job Code: Reports To: Senior Credit Officer FLSA Status: EEO Category: Professional Exempt SUMMARY OF JOB RESPONSIBILITIES Has responsibility for providing credit analysis for the lending activities of the Bank. Provides analytical services in the administration of loan accounts. When needed and in conjunction with loan officer(s) will meet with current and potential customers to obtain information needed for loan requests. ESSENTIAL FUNCTIONS AND JOB RESPONSIBILITIES 1. May perform related duties as assigned or as the situation dictates. 2. Underwrites, analyzes and prepares presentations for loans. Assists in negotiating loans and structuring presentations. 3. Analyzes the credit and collateral aspects of business and individual loans both secured and unsecured. 4. Monitor loans to ensure proper documentation with respect to items such as periodic calculation of ratios to determine financial covenants. 5. May participate in monitoring loan repayment activities and take necessary action to collect past due accounts. OTHER DUTIES AND RESPONSIBILITIES 1. Assists with documenting loans to ensure complete loan files are maintained; work with customers on loan accounting/payment issues as needed. 2. May be assigned various projects involving research on lending programs, review of outstanding loans or exploration of lending alternatives for prospective customers. 3. May have responsibility for the loan tickler system. Skills/Equipment 1. Possess the analytical skill to assess and evaluate areas of responsibility including determination of loan risk involved and recommendation of credit limitations. 2. Thorough understanding of financial data such as cash flow, balance sheet and collateral dynamics of customers’ properties and geographic area. 3. Ability to deal effectively and tactfully with all levels of Bank personnel and outside business contacts. 4. Experience with Excel, Microsoft Word and spreadsheet software. Good written and verbal skills. Training/Preparation Required 1. Comply with all requirements, policies and procedures of the Bank Secrecy Act (BSA) and attend all mandatory BSA training as needed for this position. Additionally, required to complete all required 2/17/2016 4:02 PM compliance and regulatory training, not limited to BSA. Managers are responsible to ensure staff/departmental attendance. 2. This position may meet the definition of a Mortgage Loan Originator (MLO) as defined by the SAFE Act regulation. If incumbent meets said definition they agree to comply with all required rules and regulations, including those responsibilities required by the SAFE Act, which may include obtaining a Unique Identifier. 3. Bachelors degree in finance or accounting, and/or commensurate work experience is required. 4. One to three years previous lending experiences is preferred with a diversified background in lending. Knowledge of documentation, appraisal analysis, etc is preferred and normally acquired through specialized education or experience. WORKING CONDITIONS/PHYSICAL DEMANDS Generally good. The environment for this position is non-confined office-type setting that is mostly clean and comfortable. Little discomfort caused by such factors as noise, heat or dust. The incumbent in the course of performing this position spends time writing, typing, speaking, listening, lifting (up to 20 pounds), carrying, seeing (such as close, color and peripheral vision, depth perception, and adjusted focus), sitting, pulling, walking, standing, squatting, kneeling and reaching. The above statements are intended to describe the general nature and level of work being performed. They are not intended to be construed, as an exhaustive list of all responsibilities, duties and skills required of personnel so classified. Further, they do not establish a contract for employment and are subject to change at the discretion of the employer. 2/17/2016 4:02 PM