Legal basis of bank lending

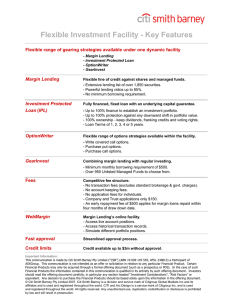

advertisement

LEGAL BASIS OF BANK LENDING Bank credit is a form of movement of loan capital. Bank lending rises economic (monetary) relationship, during which temporarily free funds of the state, businesses and individuals, accumulated credit institutions providing business entities (and citizens), the terms of repayment. Bank lending creates the conditions under which it is possible to make up for the expense of others their own lack of funds for the various needs that require additional capital investments. Emerging bank lending social relations are governed by the norms of the various branches of Tajik law, especially rules of administrative, financial and civil rights. The financial, credit control and state banks are in the jurisdiction of the Tajikistan. Legal regulation of banking activities carried out by the State Law "On the National Bank of Tajikistan", the State Law "On Banks and Banking Activity", other laws and regulations of the Bank of Tajikistan. Significant position also owns the business usages and customs of the bank. The most important principles of bank lending are: repayment, maturity, payment, security, purpose. The content of the principle of repayment of bank credit is that the funds received in the form of loans to the borrower are only a temporary source of funds and should be returned to the bank or other lending institution. From the principle of repayment of bank loan follows the principle of urgency. Loans shall be returned in a timely manner, the violation of which entails the application of established sanctions. Implementation of the principle of payment for bank lending is based on the gratuitous nature of the services provided by banks when granting loans. For the provision of a bank loan is charged as a percentage. The legislation provides for the possibility of the loan without the proper software (blank credit). Unsecured loans are generally granted to customers who have close ties with the bank, perform all of their banking transactions through the bank. Bank credit is given strictly for a specific purpose. The use of funds is not the intended purpose violates the principle focus of bank credit and involves the application of appropriate sanctions. Depending on the period for which the loan is issued, and the lending bank credit facility is divided into: - Short-term; - Long-term. Short-term loan issued for a period less than a year when an entity with a temporary need for cash. The objects are the needs of the current lending activities of the entity defined by aggregated indicators. Bank credit is issued for the collection of inventory and production costs. Long-term credit is issued for one year and longer. The objects of long-term loans are the costs of building new plants, modernization and reconstruction of existing enterprises, new products , etc.