ADM - Agricultural Council of Arkansas

advertisement

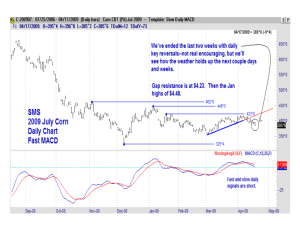

ADM Grain Market Outlook 2014 Agriculture Council of Arkansas Annual Meeting David Glidewell Mid-South Regional Manager December, 2014 Current grain market factors 1) 2) 3) 4) 5) 6) 7) 8) 9) World 2014/15 corn supply still adequate World 2014/15 wheat supply still adequate World 2014/15 soybean supply still record Lower US 2015 corn supply? Higher soybeans? US 2014 winter weather normal? Higher US dollar and lower Commodity prices? US farmer still slow in selling 2015 corn/soybean crop Grain fundamentals still suggest lower 2015 prices US Transportation cost drop in west Improving Rainfall Is Expected In Center West And Center South Brazil During November, But Some Erratic Rainfall Early To MidMonth Will Still Keep Some Of The Rain Totals Below Average. That Will Change In The December Through February Period When A More Classic El Nino Influence Is Expected. The Summer Will Bring On Some Drier Biased Conditions In Rio Grande Do Sul, Uruguay And Immediate Neighboring Areas While Argentina Sees Timely Rainfall And Warm Temperatures. The Greatest Rain In Brazil This Summer Should Be In The Same Areas That Have Been Quite Dry And Hot In The Past Couple Of Weeks. Winter Will Be Influenced By Many Different Weather Features. The Weak El Nino, 18-Year Cycle And Arctic Oscillation Will Have The Greatest Influence. However, Pacific Decadal Oscillation And The QuasiBiennial Oscillation Will Have Some Influence. Each Of These Seem To Agree That The Southeastern U.S. Will Be Colder Than And Wetter Than Usual This Winter. There Is Much Agreement About The Southwestern States Being Cool, As Well, And The Central And Southern Plains Wetter Than Usual. El Nino Will Help The Pacific Northwest And Midwest Have Some Below Average Precipitation Biases At Times During The Heart Of Winter, But Arctic Oscillation, El Nino And The 18-year Cycle Will Combine To Produce Some Infrequent, But Quite Potent Cold Surges Into The Eastern Half Of The Nation. World Agricultural Outlook Board Interagency Commodity Estimates Committee Forecasts Lockup Briefing December 10, 2014 Price Summary 2013/14 estimate Crops and products Wheat ($/bu) Rice ($/cwt) Corn ($/bu) Soybeans ($/bu) Soybean oil (¢/lb) Soybean meal ($/s.t.) Cotton (¢/lb) Livestock Steers ($/cwt) Hogs ($/cwt) Broilers (¢/lb) Turkeys (¢/lb) Dairy products Cheese Butter Nonfat dry milk Dry whey Milk classes Class III ($/cwt) Class IV ($/cwt) All milk ($/cwt) 2014/15 forecast Change from Change from November 10 2013/14 Percent Percent 6.87 16.10 4.46 13.00 38.23 489.94 77.90 6.00 14.50 3.50 10.00 34.00 360.00 61.50 1.7 -1.4 0.0 0.0 -5.6 2.9 2.5 -12.7 -9.9 -21.5 -23.1 -11.1 -26.5 -21.1 155.3 76.2 105.3 108.0 166.0 65.8 104.0 107.0 4.1 0.0 0.0 0.5 6.9 -13.7 -1.2 -0.9 2.16 2.14 1.77 0.66 1.67 1.72 1.37 0.57 -3.8 0.0 -5.1 0.0 -22.7 -19.6 -22.5 -12.7 22.35 22.15 24.10 16.95 16.90 18.85 -3.7 -3.7 -2.3 -24.2 -23.7 -21.8 December 10, 2014 Weekly nearby soybean futures chart 8 9 10 11 Big crops and strong US dollar; US exports? U.S. Soybean Supply and Demand 2013/14 estimate Planted area (million acres) Harvested area (million acres) Yield (bushels per acre) Beginning stocks Production Imports Total supply Crush Seed and residual Domestic use Exports Total use Ending stocks Stocks to use ratio Average market price 2014/15 forecast 76.8 84.2 76.3 83.4 44.0 47.5 Million bushels 141 92 3,358 3,958 72 15 3,570 4,065 1,734 1,780 98 115 1,832 1,895 1,647 1,760 3,478 3,655 92 410 Percent 2.6 11.2 Dollars per bushel 13.00 9.00/11.00 Change from Change from November 10 2013/14 Percent Percent 0.0 0.0 0.0 9.6 9.4 7.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2.3 1.1 -8.9 -34.6 17.9 -79.1 13.9 2.7 17.9 3.5 6.9 5.1 346.1 0.0 -23.1 December 10, 2014 14 15 Monthly soybean futures chart 16 Soybean - Farmer Percent Marketing’s 30 25 20 15 2011/12 2012/13 10 5 0 Sep Oct Nov Dec Jan Feb Mar Month of Crop Year Apr May Jun Jul Aug Monthly US Soybeans Exports 360 330 300 270 Million Bushels 240 210 180 150 120 90 60 30 0 Sep Oct Nov Dec Jan 2012-2013 Feb 2013-2014 Mar Apr 2014-2015 May Jun Jul Aug July,2015-Nov, 2015 soybean spread chart 21 23 USDA SUPPLY/DEMAND Hightower 2015/16 Estimates US SOYBEANS Nov Nov Nov USDA USDA USDA Changes in Planted Acres Est. 15 Yr. Trend Line Yield 08-09 09-10 10-11 11-12 12-13 13-14 14-15 Planted Area (M Acres) 75.7 77.5 77.4 75.0 77.2 76.8 84.2 85.2 86.2 87.2 Harvested Area (Acres) 74.7 76.4 76.6 73.8 76.1 76.3 83.4 84.3 85.3 86.3 Yield (Bu/Acre) 39.7 44.0 43.5 41.9 40.0 44.0 47.5 45.1 45.1 45.1 Beginning Stocks (M Bu) 205 138 151 215 169 141 92 450 450 450 2,967 3,359 3,329 3,094 3,042 3,358 3,958 3,804 3,849 3,893 13 15 14 16 41 72 15 15 15 15 3,185 3,512 3,494 3,325 3,252 3,570 4,065 4,269 4,314 4,358 Crushings 1,662 1,752 1,648 1,703 1,689 1,734 1,780 1,810 1,785 1,810 Exports 1,279 1,499 1,505 1,365 1,317 1,647 1,720 1,770 1,695 1,770 Seed 90 90 87 90 89 98 92 92 92 92 Residual 16 20 43 -2 16 0 23 22 22 22 3,047 3,361 3,279 3,155 3,111 3,478 3,615 3,694 3,694 3,694 138 151 215 169 141 92 450 575 620 664 4.5% 4.5% 6.6% 5.4% 4.5% 2.6% 12.4% 15.6% 16.8% 18.0% Production Im ports Supply,Total Use, Total Ending Stocks Stocks/Use Ratio Weekly nearby corn futures chart 25 26 These estimates assume good weather in next several months 28 U.S. Corn Supply and Demand 2013/14 estimate 2014/15 forecast Change from Change from November 10 2013/14 Percent Planted area (million acres) Harvested area (million acres) Yield (bushels per acre) Beginning stocks Production Imports Total supply Feed and residual Food, seed, and industrial Ethanol Domestic use Exports Total use Ending stocks Stocks to use ratio Average market price 95.4 90.9 87.7 83.1 158.8 173.4 Million bushels 821 1,236 13,925 14,407 36 25 14,782 15,668 5,132 5,375 6,497 6,545 5,134 5,150 11,629 11,920 1,917 1,750 13,546 13,670 1,236 1,998 Percent 9.1 14.6 Dollars per bushel 4.46 3.20/3.80 Percent 0.0 0.0 0.0 -4.7 -5.2 9.2 0.0 0.0 0.0 0.0 0.0 0.2 0.0 0.1 0.0 0.1 -0.5 50.5 3.5 -30.1 6.0 4.7 0.7 0.3 2.5 -8.7 0.9 61.7 0.0 -21.5 December 10, 2014 U.S. Meat Production and Prices Production Beef Pork Broilers Turkey Total meat Prices Steers Hogs Broilers Turkey 2014 2015 estimate forecast Billion pounds 24.25 23.67 22.79 23.62 38.49 39.63 5.74 5.93 92.04 93.63 Dollars/cwt 155.29 166.00 76.22 65.75 Cents/lb 105.3 104.0 108.0 107.0 Change from November 10 Change from 2014 Percent Percent 0.0 0.0 0.0 0.0 0.0 -2.4 3.6 3.0 3.2 1.7 4.1 0.0 6.9 -13.7 0.0 0.5 -1.2 -0.9 December 10, 2014 31 32 Corn - Farmer Percent Marketing’s 18 16 14 12 10 2011/12 8 2012/13 6 4 2 0 Sep Oct Nov Dec Jan Feb Mar Month of Crop Year Apr May Jun Jul Aug Monthly US Corn Exports 240 210 180 Million Bushels 150 120 90 60 30 0 Sep Oct Nov Dec Jan 2012-2013 Feb 2013-2014 Mar Apr 2014-2015 May Jun Jul Aug 38 USDA SUPPLY/DEMAND Hightower 2015/16 Estimates US CORN Nov Nov Nov USDA USDA USDA Changes in Planted Acres Est. If 163 Yield 08-09 09-10 10-11 11-12 12-13 13-14 14-15 Planted Area (M Acres) 86.0 86.4 88.2 91.9 97.3 95.4 90.9 88.9 86.9 84.9 Harvested Area (Acres) 78.6 79.5 81.4 84.0 87.4 87.7 83.1 81.3 79.4 77.6 Yield (Bu/Acre) 153.9 164.7 152.8 147.2 123.1 158.8 173.4 163.0 163.0 163.0 Beginning Stocks (M Bu) 1,624 1,673 1,708 1,128 989 821 1,236 2,008 2,008 2,008 12,092 13,092 12,447 12,360 10,755 13,925 14,407 13,247 12,949 12,651 14 8 28 29 160 125 25 25 25 25 Supply, Total 13,729 14,774 14,182 13,517 11,904 14,782 15,668 15,280 14,982 14,684 Feed & Residual 5,182 5,126 4,798 4,566 4,315 5,132 5,375 5,460 5,460 5,460 Food, Seed & Industry 5,025 5,961 6,425 6,421 6,038 6,497 6,535 6,550 6,550 6,550 Ethanol for Fuel 3,709 4,591 5,019 5,000 4,641 5,134 5,150 5,165 5,165 5,165 Domestic Total 10,207 11,087 11,224 10,987 10,353 11,629 11,910 12,010 12,010 12,010 Total Exports 1,849 1,979 1,831 1,541 730 1,917 1,750 1,850 1,850 1,850 Use, Total 12,056 13,066 13,055 12,528 11,083 13,546 13,660 13,860 13,860 13,860 Ending Stocks 1,673 1,708 1,128 989 821 1,236 2,008 1,420 1,122 824 13.9% 13.1% 8.6% 7.9% 7.4% 9.1% 14.7% 10.2% 8.1% 5.9% Production Imports Stocks/Use Ratio U.S. Rice Supply and Demand December 10, 2014 41 42 Monthly Chicago wheat futures chart 43 44 45 CURRENT TOTAL USDA PROJECTED EXPORT SALES CORN SOYBEANS ALL WHEAT 44,450.00 MMT 47,900.00 MMT 32,006.00 MMT WEEKLY SALES TO DATE ELAPSED: 13 WKS CORN/BEANS, 27 WKS WHEAT CORN SOYBEANS WHEAT TOTAL AVG/WEEK % OF PROJECTED SALES 23,712.80 1,824.06 53.35% 40,460.60 3,112.35 84.47% 17,375.30 643.53 54.29% REMAINING SALES NEEDED TO MEET PROJECTIONS REMAINING: 39 WKS CORN/BEANS, 25 WKS WHEAT CORN SOYBEANS WHEAT % SALES OF CURRENT TOTAL AVG/WEEK PROJ. 20,737.20 531.72 46.65% 7,439.40 190.75 15.53% 14,630.70 585.23 45.71% 47 Marketing Partners Advisory Recommendations CORN: 2014-crop – We are 70% sold at Chicago March 2015 $4.60 Recommendation: sell 10% at Chicago March 2015 $4.22 2015-crop – We are 25% sold at Chicago December 2015 at $4.34 SOYBEANS: 2014-crop – We are 85% sold at Chicago January 2015 $11.66 Recommendation: Sell 10% at January 2015 at $11.00 2015-crop – We are 30% sold at Chicago November 2015 $10.27 Recommendation: Sell 5% at November 2015 at $11.00 WHEAT: 2014-crop SRW – We are 60% sold at Chicago March 2015 $6.88 Recommendation: sell 10% at Chicago March 2015 $6.25 2015-crop SRW – We are 40% sold at Chicago July 2015 $7.18 Recommendation: sell 10% at Chicago July 2015 $6.25 48 PRESERVING WEALTH! 49 50