View MS Word Version

advertisement

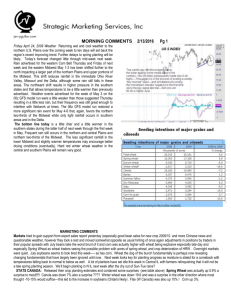

MORNING COMMENTS 2/12/2016 Pg 1 WATCH FOR MID DAY UPDATES—UNTIL FURTHER NOTICE Thursday Nov 1, 2007 US WEATHER: . The Midwest and Plains will see very little precipitation in this first week of the forecast and temperatures will trend colder late this weekend and early next week. Airmass moderation takes place late next week allowing rain and some snow to develop across the Midwest in the second weekend of the outlook followed by a new surge of colder air near mid-month. This forecast is somewhat consistent with recent past GFS model runs.. Check out the web site for the new addition (QT weather) for details and color maps --- EARLY MORNING WEATHER UPDATE – THURSDAY, NOVEMBER 1, 2007 0445 CDT No change in the first ten days of the Brazil forecast was noted overnight. However, the GFS model continued to suggest a northward shift in rainfall during the last five days of the forecast period from Nov.10 to 15. During this latter part of the forecast southern Brazil sees less rain and northern areas are wetter. This pattern shift has been on the past two GFS model runs and is somewhat consistent with La Nina tendencies. Argentina’s weather is drier today., net drying may not be welcome in some far southern and western areas of the nation that are missed by today and Friday’s rain. Australia’s second week forecast is now wetter in Queensland and northeastern New South Wales than that described Wednesday. The forecast remains unchanged for the rainy pattern that occurs today through Monday of next week. The breakdown of the wetter weather only lasts for a few days next week before a new low pressure center produces rain in southeastern Queensland and northeastern New South Wales Nov. 10-13. This change is mostly in sorghum and cotton areas further benefiting future planting prospects, but any unharvested winter crops in the region would be further threatened with quality issues. Finally a Sect of Ag from a good farm state : President Bush yesterday afternoon announced his decision to nominate former North Dakota Gov. Edward Schafer to be his next Agriculture secretary, according to a senior administration official. Schafer, who served two terms as governor but chose not to run again in 2000, will replace Mike Johanns. MARKETS & STRATEGIES: Markets stronger to much stronger again--- appears to be all about energy prices, lowering interest rates to keep economy growing with now a real threat for inflation, or stag-flation if the economy would falter. Interesting that we rally corn last year on prospect of taking carryover in half— understandable---this year we rally into and during the harvest of 15 mil-ac more and doubling of the carryover---with prices for the next 2-3 years over $4 for the respective December years--- I have done some quick calculations and if I figure $180 for rent ---(going for $200 to $280 for 200 bu corn in Illinois) and I farm with the intent of getting 180-200 bu yield---my break-even is ($580 cost per acres / 180 bu = $3.20 per bu before return to management. My breakeven at current offerings for fall 2008 corn (see chart below) of about $3.75 is 154 bu per acre---Yes I can pay for outrageous repairs, fertilizer, seed prices---My reasoning has been that the producer should make as much money as the one who owns the land and that will only happen IF cash corn is $4 –meaning $4.60 futures or higher as buyers have had a convienient way to widen basis ---- This presents a major problem(s)—the livestock industry will be in serious problem if corn is $4 or worse yet, I don’t plant corn and we see a 10% reduction in acres/yields in 2008 and corn goes to $5 cash or higher. For those of us who have been farming for years and may have low debt, this is a windfall one dreams of----but for the rest of Ag, concerns have to mount—and I would think the USDA has a tiger by the tail with regards to what to do----We open the CRP---prices relax and we solve supply but have another Ag concern ????? EXPORT SALES: Wheat 6.6 mil bu (180 tmt) vs. 650-750 tmt expected; Corn 25.0 mil bu (635 tmt) vs. 900-1,100 tmt expected; Soybeans 27.2 mil bu (741 tmt) vs. 500-700 tmt expected; Soymeal 204 tmt vs. 75-125 tmt expected; Soyoil 15 tmt vs. 5-10 tmt expected; Cotton 198 t. bales vs. 125-200 t. bales expected; Beef 9,800 tons o YIELDS---- I received a few yield reports from clients yesterday (5 me thinks???) ---- so far those with wet conditions at planting or an oversupply of rain this year---or have irrigated farms are NOT seeing the yield response that dryland farmers are seeing in fact some aren’t even close to any record yields---WE NEED TO HEAR FROM MORE OF YOU IN WESTERN IA---RED RIVER VALLEY IN ND---OR ANYONE WHO IS NOT SEEING THE 200 + YIELDS ---- THIS IS VERY IMPORTANT AS WE CONSIDER WHAT THE USDA MAY FIND IN THE NOV REPORT---they stated that 85% of their test plots were harvested for the October report and they did not agree with most who thought 154—156—if the yield drops in November—katie bar the door to prices!!!!!!!!!!!!!! o Fertilizer outrageous--$525 anydrous here---some clients reporting that anhydrous getting difficult to acquire---Terra reportedly saying it is booked through March ?? CORN--- higher yesterday---on excellent harvest weather---as we put away this crop with few rumors of storage problems?????. o Basis should narrow seasonally going into late 2007 and early 2008 then it will be the Nov 9th USDA report and then Jan 12 stocks report that will determine urgency of needs. o Technically corn looks very strong with more evidence that it will surge higher from here--- looking at losing acres and the energy market . o This market concerns me--- would not buy it here for end users but contemplating buying calls for both end users and producers—will wait a bit more however--- Note exports finally on low side. o FC Stone is out tonight with revised yields---they have a good IA base so we’ll see –Informa writing about a little better yields. SOYBEANS: Down 18 Tuesday, up 20 yesterday and up 8 cents overnight--- lots of bullish items with open interest going up as prices rise suggesting new longs---trade buying soybeans against short corn and soybeans are not gaining enough looking forward to buy needed acres---If corn continues higher, it could be explosive to soybeans. o Looks like we will print an $11 for July 2008 while Brazil contemplates acres???? o SN/SX spread gaining momentum WHEAT: ---lots of differences of opinions, New crop Mpls 2008 wheat will have to maintain price premiums to positively influence planting views of some of us come next spring in N Plains and Canada? o Wheat may have gotten ahead of itself with the Indian wheat tender ? o All classes and all crops weaker yesterday on late day selling again but up strongly overnight 12 in WZ and 10 in WN08 Equities responded over 100 higher on the ¼ pt drop in interest rates even with a $4 rally in crude—down 100 overnight!!!!!!!!!!!!. Crude: Talk about volatility---charts looked toppy but less stocks, and a Fed willing to see some inflation to get housing back on track---and indirectly keeping demand for energy humming along----crude closed $4 higher---- this is not a market one wants to trade--- SMS MORNING COMMENTS 2/12/2016 Page 2 MARKET STRATEGIES AND ADVICECorn: Technically strong. TODAY: 75% sold in the cash market (or hedged if you prefer)---for the carry . We’ll hold 25% for now in the bin. If you are willing to buy back in futures--- increase or certainly get caught up with forward sales—no formal recommendation however Exports poor today. Soybeans: May be the only story out there. However, the current economic environment and the odds that Brazil and/or US will increase acres is concerning. MBP clients only make your first 25% sale in the cash last week for the carry to July---at about $10-- $10.17 based on the futures closing prices. TODAY: No new adviceWheat: 100% covered for 2008 in SRW Chicago by adding 10 % hedge at $6.71 or higher yesterday. Balance sold $6.69--$6.95 . Today: Hard wheat classes should do better than the soft SRW over time (spread) –new hard wheat biz might catch wheat on fire again—overnight up strongly---wheat seems to weaken late day??? We will hold 2008 at 100% coverage subject to mid-day updates if any—but admittedly concerned with strength in July 2008!!!! L CATTLE:. Coverage at 25% again as we lifted 25% at 95.35 basis Dec futures on 10-29-07 -TODAY: With cash prices expected to be in the mid $90's this winter, Dec futures may be cheap enough. We lifted 25% at 95.35 basis Dec futures on 10-29-07 LIVE HOGS: 75% hedged in Oct and Dec----hedged in Oct and Dec ($67). More at Oct at 67.40 earlier . We rehedged 20% on the close below 59.70 on Friday Oct 12 basis the Dec futures— Thoughts more pork coming this fall was proven in the Hog Pig report TODAY -Lift 1/3 if LHZ trading above $55.25 after 11 am. COTTON: Still trading sideways, we’ll go long again and protect our CCP with buy stops at 65.50, with sell stops at 62.25. RICE: Rice broke out to the upside, we should have gone long the march contract at 12.35, use a close below 12.25 to exit. ENERGY: One has to wonder if we are not already seeing some affects of high crude, finally—yet gasoline is below $3 in most areas except CA—I filled my pickup with E-85 at 70 cents a gallon less than regular. I could see the gas gauge move however---indicating E-85 may not be all that it is reported to being however I did have the “feel good” mode of saving $15 per tank---maybe that is the key -=--and it is $15 that the A-rabs won’t ever see !!!!!!!!! Now if I could just save on repairs for John Deere Equipment???? The long term problem is that crude will need to be priced at $100--$200 over the next 10 yrs in order to attract capital to that industry and to keep alternative fuels coming---Alternative fuels may only be able to keep up with part of the “increase” in energy usage---not eliminate fossil fuels appreciably. Local Bids (20 mile radius) location 1 (container) Cash Jan July Oct 08 333 ½ 357 ¾ 3.89 3.76 location 2 (rail-export) 3.37 3.48 3.67 3.74 location 3 (ethanol) 3.42 3.67 3.86 3.72 This copyrighted report is intended for the use of clients of SMS, Inc only and may not be reproduced or electronically transmitted to other companies or individuals, in whole or in part, without the prior written permission of SMS, Inc, Strategic Marketing Services. The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. SMS, Inc. does not guarantee that such information is accurate or complete and it should not be relied upon as such. Opinions expressed reflect judgments at this date and are subject to change without notice. There is risk of loss in trading futures and options and is not suitable for all investors. Please carefully consider your financial condition prior to investing. MORNING COMMENTS 2/12/2016 Pg 3