PRE-RELATIONSHIP CONTRIBUTIONS

advertisement

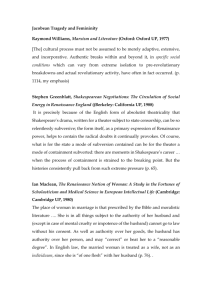

PRE-RELATIONSHIP AND EARLY CONTRIBUTIONS Paper presented at North Queensland Law Association Conference Mackay, May 2008 By Michael Fellows1 Introduction The intent of this paper is to explore the development of jurisprudence concerning significant property or other financial contributions made by one party at the commencement of a marital relationship or in the early years after its commencement sometimes characterised as ‘Pierce contributions.’ 2 As well, in order to illustrate the difficulty of decision-making (and understanding that decision-making) in this area I have specifically surveyed a group of decisions by one judge of the Family Court – Carmody J – and I have made a number of practical observations as to trial preparation and evidence. Background observation The 4-step process 3 for decision-making in property cases is well known and needs no repetition by me. There can be no assumption of equality of contributions; 4 the assessment of contributions is not a matter of mathematics; 5 the assessment of financial and domestic contributions is an assessment of fundamentally different things; 6 domestic contributions should not be under-valued merely because they are not readily expressible in dollar terms; 7 and the s. 79 process is not intended to be an exercise in social engineering. 8 Short propositions such as these, though apparently simple and unarguable, conceal a multitude of difficulties. Consider the following: 1. if you unpick s. 79(4) you find that a contribution may be: [a] 1 direct; Barrister-at-law, Sir George Kneipp Chambers, Townsville After Pierce (1999) FLC 92-844 3 Hickey (2003) FLC 93-143 4 Mallet (1984) Fam LR 449 5 Dickson (1999) FLC 92-483 6 Ferraro (1993) FLC 92-335 7 Clauson (1995) FLC 92-595 8 Kennon (1997) FLC 97-757 2 1 [b] [c] [d] [e] [f] [g] [h] 2. indirect; financial; non-financial; made by a party; made by some other person on behalf of a party; made as a homemaker; made as a parent. The contribution may be made to: [a] [b] [c] [d] the marriage; a child of the marriage; acquisition contribution or improvement of any property of either party (even if no longer property of either of them); the welfare of the family. 3. The legislation does not inform us as to the weight which is to be attached to the contribution. Nor does it guide us as to whether one or another contribution has more relative importance. That is solely a matter for the discretion of the trial judge based upon the evidence before her or him. 4. The exercise of discretion will only be disturbed where the appellate court is satisfied the trial judge is ‘clearly wrong’ 9 because the ‘generous ambit within which reasonable disagreement is possible’ is ‘wide indeed when there are a number of factors to be taken into account and the comparative weight to be attributed to those factors is not clearly indicated by uniform standards and values of the community’. 10 5. It follows that neither trial decisions nor in most cases appellate decisions can serve as guidance for how the next case is to be decided. It is neatly illustrated by one of the ‘Carmody cases’ to which I will refer in more detail later. In MH & MZ 11 the marriage was of 11 years; and at its commencement the contribution of property was about 85% by the husband and 15% by the wife. There were 2 children. Carmody J assessed contributions 75% to the husband at trial. On 12 appeal the Full Court said that an appropriate assessment ‘ought not have exceeded 67.5% on behalf of the husband’ 6. 9 Three comments immediately arise: Mallett per Wilson J at page 634 Norbis v Norbis (1986) 161 CLR 513 at 540 per Brennan J (as he then was) 11 [2005] FamCA 287 now reported as Hunt v Zuryn (2005) 34 Fam LR 169 12 Kay, May and Boland JJ 10 2 [a] As may be not infrequently observed, the Full Court did not clearly explain what factors led them to the conclusion that Justice Carmody’s decision was beyond the generous ambit of discretion. [b] I’m always puzzled by the false precision implied by the use of half percentage points. In this case, there seems no magic in 0.5%. 13 [c] More importantly, by use of the language ‘ought not have exceeded’ the Court signals that this was the upper end of the range and that the facts permitted the allocation of a lesser contribution to the husband. But was it 65% or 63.5% or 61.75%? We are not told. But we can imply that if 67.5% is the upper limit of the ‘generous ambit of discretion’ then if Justice Carmody had selected say 62.5% as the husband’s contribution then his decision would have been just as correct. The jurisprudence The starting point may be considered to be the decision of the Full Court in Lee Steere 14 where the court spoke of the ‘special difficulty’ where significant property has been brought into the marriage which ‘cannot be matched’ by the party who brings in little. The Full Court said 15 Against this of course must be set the contributions … the wife made during the marriage. The longer the duration of the marriage, depending on the quality and extent of her contributions, the more the proportionality of original contribution is reduced … the proposition that the strength of a contribution made at the inception of a marriage is eroded not by the passage of time but by the off-setting contribution of the other spouse still holds true. In subsequent decisions of the Full Court there was some disagreement. See for example Money 16 where there was a debate between Justices Lindenmayer and Fogarty as to the correct approach. For present purposes, I need only cite a short passage from Fogarty J where he said In an appropriate case in my view an initial substantial contribution by one party may be eroded to a greater or lesser extent by the later contributions of the other party even though those later contributions do not necessarily at any particular point outstrip those of the other party. I feel if I may say so with respect that (Justice Lindenmayer’s) formulation to the contrary is unrealistic and does not correspond with common experience in the court in many of these cases. 13 Even more strangely, the end result after s.75(2) factors was 37.6% to the wife (1985) 10 Fam LR 431. 15 Also at page 443 of the reasons 16 (1994) 17 Fam LR 814 14 3 I think it is legitimate for me to say, as I was a member of the Full Court in Lee Steere that His Honour has read too much into the passage to which he refers, and that the term “offsetting contribution” does not necessarily mean “greater contribution”. It simply reflects the circumstance that the respective contributions of the parties over a long period of marriage may “offset” the significance which might otherwise be attached to a greater initial contribution by one party … the original contribution should not be carried forward as a mathematical proportion; ultimately when it comes to the trial such a contribution is one of a number of factors to be considered. The longer the marriage the more likely it is that there will be later factors of significance and in the ultimate the exercise is to weigh the original contribution with all other, later, factors and those later factors whether equal or not, may in the circumstances of the individual case reduce the significance of the original contribution. 17 In Bremner 18 Nicholson CJ, Baker and Tolcon JJ preferred this view of Fogarty J, and the subsequent decision of the Full Court in Way 19 described the jurisprudence in these terms: We regard the law in this area as now settled by the statement of Fogarty J … that “an initial substantial contribution by one party may be eroded to a greater or lesser extent by the later contributions of the other party even though those later contributions do not necessarily at any particular point outstrip those of the other party.” 20 As may be not unexpected, the jurisprudence was not really “settled” for in the following decision of Pierce, 21 a decision of Justices Ellis, Baker and O’Ryan, the Court reframed the approach: In our opinion it is not so much a matter of erosion of contribution but a question of what, weight is to be attached, in all the circumstances, to the initial contribution. It is necessary to weigh the initial contributions by a party with all other relevant contributions of both the husband and the wife. In considering the weight to be attached to the initial contribution, in this case of the husband, regard must be had to the use made by the parties of that contribution. In the present case that use was a substantial contribution to the purchase price of the matrimonial home. 22 17 At page 816 of the report (1994) 18 Fam LR 407 19 (1996) FLC 92-702. 20 At paragraph 39 of the reasons. See also the analysis of the Full Court in Zyk (1995) FLC 92-644 21 (1998) 24 Fam LR 377. 22 Page 385 paragraph 28 of the report 18 4 More recently, there has been some re-consideration of this approach, arising from jurisprudence in the New Couth Wales Court of Appeal concerning de facto property cases. For present purposes, those who want to examine the matter in detail might consider Howlett v Neilson 23, Kardos v Sarbutt 24 Bilous v Mudaliar 25 Sharpless v McKibbon 26 Manns and Kennedy 27 and Baker v Towle. 28 In Kardos, Justice Brereton delivering the reasons for the Court of Appeal said that the approach of the trial judge of returning to the wife and husband their initial contributions at the original value and dividing the capital growth and assets between them equally gave manifestly inadequate weight and significance to the initial contributions of the parties in the (short) relationship. It treated the increments of capital value of an asset held at the outset of the relationship as “fruits of the relationship” when save for reduction in the mortgages they were not. It “excessively” eroded the initial contributions. 29 His Honour said: The approach which was adopted in Burgess v King is one which gives due weight to the time value of money and recognises that capital gains are the product of the initial introduction of the property rather than of ongoing contributions. On the other hand, the approach adopted in Howlett v Neilson in my respectful opinion may in at least some cases result in the serious undervaluation of initial contributions. It treats any increment in capital value of an asset held at the outset of the relationship as if were part of the fruits of the relationship when it is not; it is the result of the asset having been held by one of the parties at the commencement of the relationship and not the result of joint efforts of wage earning homemaking and parenting and mutual support … it disregards the “time value of money”. It is likely to produce erratic results because under it the significance of any particular asset in the ultimate evaluation will depend on its value when it was introduced. If one party has a house worth $250,000.00 at the outset and it appreciates during the relationship to be worth $750,000.00 the contribution is of a house which at separation is worth $750,000.0 – not of money worth $250,000.00 30 The subsequent decision of Bilous concerned a relationship of about 11 years. By trial the pool of assets had a value of approximately $1.7 million. The trial judge awarded the husband approximately 20% of the asset pool with the wife retaining the balance. The wife was a medical practitioner and had come into the relationship already owning a successful medical practice together with a house. Justice Ipp with whom Justice Giles 23 (2005) 33 Fam LR 402 (2006) 34 Fam LR 550. 25 (2006) 35 Fam LR 55 26 [2007] NSWSC 1498 27 (2007) 37 Fam LR 489 28 [2008] NSWCA 73 29 A paraphrase of paragraphs 61, 64 and 69 of the report. 30 Paragraph 61 of the report 24 5 and McColl agreed said that an important issue was the treatment of interests in property and capital increases in those interests. Justice Ipp said that in his opinion the ‘erosion principle’ of the Family Court should not be applied in cases under the NSW Legislation as it tends to distract the mind from the express wording of section 20 which provides that a court may make such order adjusting the interest of the parties in the property as to it seems just and equitable. 31 His Honour said that because the sole consideration is the justice and equity of the case, commencing the determination with an enquiry as to whether an initial contribution by one party has been made and then asking whether that contribution was eroded by later contributions of the other party appeared to cast an onus on the other party to prove that the initial contribution should be eroded. His Honour said I would add that the erosion principle if adopted would tend – in the same way – to affect the onus in regard to other property that is acquired by a party at a later time in the relationship. Consistently with that principle it might be said that once a property is registered in the name of one party that party should be entitled to the full value of that property at the date the relationship is terminated unless it can be shown that his or her right to that property was eroded by the contributions of the other party. That would plainly be inconsistent with the express words of section 20. 32 Justice Ipp expressed his disagreement with the approach taken by Justice Brereton in Kardos v Sarbutt in these terms His Honour appears to have stated a rule to the effect that for the purposes of determining what order should be made under section 20 … any increase in value in assets initially contributed should be regarded in all circumstances as entirely a contribution by the party who contributed those assets. If that is what His Honour intended, I do not agree. 33 Determinations as to what orders should be made under section 20 are to be made solely on the grounds of the justice and equity of the case. The justice and equity of the case may derive from the fact that the party who owns the family home or other property was able to retain that property while the market value increased because of joint efforts of wage earning, homemaking, and parenting and mutual support. In some instances the nonfinancial contributions of one party may result in property of the kind in question not having to be sold. In other instances the non-financial contributions of one partner may allow the other to advance his or her career and earn a high income that enables the property in question to be maintained and retained. Thus an increment in capital value may well result 31 Paragraph 55 of the report Paragraph 56 of the report 33 Paragraph 62 of the report 32 6 indirectly from joint efforts of wage earning homemaking and parenting and mutual support. 34 These disagreements in the jurisprudential approach were drawn to the attention of the Full Court of the Family Court in Williams & Williams. 35 Briefly the facts were – a 12 year relationship; throughout the marriage the parties had lived in a property that had previously been occupied by both the husband’s father and his grandfather; said to be worth $940,000.00 at the commencement of the relationship, it was subsequently sold in 2004 for $2.7 million; at trial the property pool was worth approximately $3.7 million. The trial judge had awarded some 57% of that to the husband. When the matter was argued on appeal, Page SC made specific reference to the NSW decisions that I have referred to earlier in this paper. After referring to the differences of opinion in the NSW Court of Appeal the members of the Full Court of the Family Court said this: We think that there is force in the proposition that a reference to the value of an item as at the date of the commencement of cohabitation without reference to its value to the parties at the time it was realised, or its value to the parties at the time of trial, if still intact, may not give adequate recognition to the importance of its contribution to the pool of assets ultimately available for distribution towards the parties. Thus where the pool of assets available for distribution between the parties consist of say an investment portfolio or a block of land or painting that has risen significantly in value as a result of market forces, it is appropriate to give recognition to its value at the time of hearing or the time it was realised rather than simply pay attention to is initial value at the time of commencement of cohabitation. But in so doing it is equally as important to give recognition to the myriad of other contributions that each of the parties has made during the course of their relationship. 36 Thus the members of the Full Court 37 have given some weight to the argument of Justice Brereton about the “time value in money” but also taken on board the warnings that were given by Justice Ipp as to how this might not allow for a proper recognition of other contributions. Some decisions of Justice Carmody I have chosen 7 decisions of Carmody J where consideration was given to a sizeable initial contribution. They span the period April 2005 to January 2008. Four are trial 34 Paragraph 63 of the Report (2007) FamCA 313 36 At paragraph 20 of the report 37 Kay, Coleman and Stevenson JJ. It should be noted that Justice Coleman (as a trial judge) had previously relied upon Kardos v Sarbutt in Cunoe and Cunoe and another [2006] FamCA 158 and (sitting as a single appellant judge) in W and W [2006] FamCA 1368 35 7 judgments; three are appellate decisions where His Honour’s trial decision was overturned. A brief summary of them, given in date order of the decision, is as follows: Hunt v Zuryn (2005) 34 Fam LR 169 – decision by Full Court April 2005 11 year relationship, 2 children. Asset pool grew from $303,500 to $1,183,000 at trial. Initial contribution by husband about 85%. At trial – contributions award to husband 75%. On appeal – reduced by Full Court to 67.5% Marriage of Brown (2004) 33 Fam LR 246 – decision by Full Court May 2005 32 year marriage, 2 children. In 10th year husband acquired parent’s cane farm on non-commercial terms, increasing their property pool at that time from $85,000 to $510,000. In 23rd year husband inherited $212,000. At trial the pool was about $2,400,000 – the cane farm was nearly half that value. At trial – contributions award to husband 65% On appeal – reduced by Full Court to 60% In these first 2 decisions Justice Carmody’s reasons for judgment at the trial level follow what might what be called the ‘usual’ course as to the process of judicial reasoning and writing. S & S [2005] Fam CA 1195 – trial decision November 2005 7 year marriage, 2 children. Assets at trial $1,420,000.00 almost entirely traceable to assets/business owned by husband at commencement. Husband also contributed to wife’s 2 children of earlier marriage. Contributions award to husband – 80% This decision substantially diverges from what I have termed the ‘usual’ course. Justice Carmody delivered reasons encompassing some 51 pages and 196 paragraphs, embarking upon a philosophical examination of the purposes of section 79, noting that the section 8 could be justified upon five possible grounds viz “intention, contribution, reliance, partnership and need” 38; the ‘rationale’ of section 79 “[lying] in the binding nature of the marital relationship and its hallmark features of ‘give and take’. 39 Words such as “sacred covenant” “partnership of equals” “common goals” “joint venture” are peppered though the paragraphs. 40 Referring to the problem of early contributions, His Honour said: The difficulty of reflecting substantially disproportionate contributions at the beginning of the marriage …is …still an acuate one. It is ordinarily just and equitable that that the differential is treated as significant but cases … emphasis that that the disparity may be eroded over time and/or by the contributions of the parties during the course of the marriage. How and to what extent this is done is a difficult problem … not susceptible to precise analysis. That is largely because it depends upon a number of variables such as the initial difference, the use subsequently made of those assets, whether or not they have increased in value due to the efforts of the parties or external forces, the length of the marriage and the size and impact of other contributions made in the intervening period. 41 CCD v AGMD (2006) 36 Fam LR 356 – decision by Full Court December 2006 5 year marriage, no children, she 58, he 72 at trial. Net assets in excess of $3.4M entirely sourced from husband’s contribution except for $190,000. At trial – contributions to husband 92.5% On Appeal – contributions to husband assessed at 95% In this decision, Justice Carmody had again embarked upon some philosophical discussion repeating his argument that “intention, contribution, reliance, partnership and need” are recognised justifications for the power to adjust property entitlements. 42 On appeal Justice Finn said: In relation to the assessment of contributions I suggest that in the pluralist society of present day Australia little assistance is to be gained from a search by trial judges or indeed by intermediate appellate courts for the underlying 38 At paragraph 9 of the reasons At paragraph 14 of the reasons 40 A close reading of paragraphs 5 to 56 is a most interesting exercise. 41 See paragraph 45 of the report – the emphasis is by the author of this paper 42 See paragraph 47 of the trial decision reported at D & D [2006] FamCA 245 39 9 philosophy or values of the provisions of s. 79. The task – not itself always easy – is to apply those provisions to the facts of the particular case. 43 By contrast Justice Warnick was prepared to undertake a discussions of ‘values’ referring to his own decision (as a trial judge) in SL and EHL. 44 In that case His Honour spoke of the ‘value’ given to a role in the marriage and the assessment of the quality with which a particular role was performed – His Honour said that “within the concept of value of a role is the idea of the reach of that role, particularly where a variety of assets has been acquired”. 45 However, His Honour went on to say that “intention” and “compensation” are not factors which ought influence alteration of property interests. 46 Murphy and Murphy [2007] Fam CA 795 – trial decision July 2007 6 year relationship, 2 children. Husband’s initial contribution was of home with significant equity, a car, cash, and 8 years superannuation – about $160,000 all up. Pool at trial was $596,000. Significant post-separation contribution by wife to children. Wife’s contribution finding to superannuation – 25% Wife’s contribution finding to other assets – 40% The interest in this case is the emphasis that can be put upon differential results arising from the ‘two-pools’ approach we are obliged (or at least encouraged) to take with superannuation and non-superannuation assets. Dylan and Dylan [2007] FamCA 842 – trial decision August 2007 13 year marriage, 2 children. Net pool at trial $1M. Husband contributed 90% of initial pool of $350,000 Husband’s contribution – 65% 43 In the Appeal report at paragraph 12 [2005] FamCA 132 45 See the report at paragraphs 233 to 237; and paragraph 293. 46 CCD v AGMD at paragraphs 40 - 46 44 10 In this decision His Honour referred to the decision of the Full Court in Williams 47 as supporting the proposition that an early contribution is the appreciated not the initial value 48 commenting as follows: The increase should normally be credited solely or mainly to the contributor rather than equally shared because it cannot properly be regarded as the ‘fruits of the relationship’ . These cases suggest that … a childless couple who make roughly equally contributions during the marriage will usually see a property order made leaving the bulk of assets remaining with the party contributing them. 49 Brodie and Brodie [2008] FamCA 26 11 year relationship – property pool now in excess of $4m - $1.35M of that a house introduced by husband. He also brought in other property and his interest in a professional practice. Contribution at the beginning was 90% of the pool then existing – these assets now represented 35% of the pool at trial. Husband’s contribution at trial – 75% His Honour embarked upon a 150 paragraph assessment of what he described as “Resolving the problem of passive growth on non-marital assets”. I cannot conveniently summarise this discussion – and it is well worth reading. His Honour particularly recites the criticism made by Professor Parkinson that the Family Court’s approach to initial contribution assessment is incoherent and irrational 50 and goes on to say that [there are] legitimate questions about the validity of the current Australian family law approach to dividing so called matrimonial and nonmatrimonial property between former spouses 51 His Honour later describes the approach arising from cases such as Money, Kennon and Figgins as 47 See footnote 35 Op cit at 336 49 Op cit at paragraph 336 50 Parkinson P ‘The diminishing significance of initial contributions to property’ (1999) 13 AFLJ 1 51 Brodie at paragraph 129 48 11 unprincipled 52 It is perhaps of particular interest that, on the same day 53 as His Honour delivered judgement in Brodie His Honour delivered an even more detailed critique of the general approach of the Family Court in s.79 cases in reasons for judgment which encompassed 152 pages, 853 paragraphs and 625 footnotes. 54 Comparative table Case Relationship Initial contribution Special factors Trial contribution Appeal contribution Hunt 11 years 85% husband 2 children 75% husband 67.5% husband Brown 32 years Virtually 100% by husband 2 children 65% husband 60% husband S&S 7 years Virtually 100% by husband 2 children – husband also supported wife’s other 2 children 80% husband N/A CCD v AGMD 5 years Virtually 100% by husband N/A 92.5% husband 95% Murphy 6 years Virtually 100% by husband 2 children – post separation contribution by wife 75% husband N/A for super 60% for other assets Dylan 13 years 90% husband 2 children 65% N/A Brodie 11 years 90% husband N/A 75% N/A Brodie at paragraph 140 – see also the whole discussion at paragraphs 140 to 211 25/1/08 54 See Moore and Moore [2008] FamCA 32 52 53 12 Looked at in tabular form one strives to find any practical guidance – any common factual thread. That Justice Carmody was ‘wrong’ in three cases out of seven 55 points to the difficulty in advising clients as to the potential outcome in these cases. If our approach can be neither mathematical nor philosophical, and assuming that Justice Carmody is correct in the criticisms he advances in Brodie then for practicing lawyers it means only that we must return to what has always been the task. What are the facts? What matters will most attract the exercise of judicial discretion? Some practical tips for conducting trials May I commence with an observation made by the Full Court in Williams. Court refused to interfere in the trial judge’s decision on this basis: 56 The Full Whilst it remains arguable that the trial judge did not give ample weight to the husband’s contributions when measured not in terms of their initial value but in terms of their ultimate value to the parties, given the myriad of other contributions identified by the trial judge, the lack of evidence that would point clearly to the growth in the asset being attributed to forces other than the mutual effort of the parties … we cannot say that this case falls outside of the acceptable range …57 The money at stake and the resources available to litigate will always have an influence upon the way in which a trial is conducted but assuming that there are no practical or financial impediments to trial preparation I suggest that the following matters bear consideration when you act for the person who introduced wealth early in the relationship: 1. though we most commonly adopt a global approach to contribution assessment, an asset by asset approach is permissible and may be especially useful where one party has introduced 2 or more significant assets at the commencement of the relationship. An investment property (or superannuation as in Murphy) may be treated differently to the property that became ‘the family home’; 2. in any event the assets brought into the relationship should, wherever possible be valued – too often our trial preparation concentrates on current value as distinct from past value; 3. more importantly, an analysis should be made of the reason why a particular asset has increased in value from the commencement to the end of the relationship viz [a] 55 has the increase in value simply been market driven? And arguably wrong in S v S as the reasoning process used there was the same as that criticised in CCD v AGMD 56 See footnote 35 57 At paragraph 36 – the emphasis is by the author 13 [b] was it due to a combination of market forces and joint efforts of the parties? Can these be differentiated? 4. how was the asset ‘used’ in the relationship? To apply Justice Warnick’s term – what was it’s ‘reach’? If it is intended to argue that an initial asset was the ‘stepping stone’ to further asset acquisition then prove it – show the chronology of asset disposal and/or acquisition. If the initial asset was income producing what was the benefit gained from that income – did it support further investment? Show how this occurred. 5. Don’t forget mathematics. Whilst the decisions of the Court state that the s. 79 process is not an exercise in mathematics powerful support for an argument can be gained by simple mathematical examples – if the asset introduced at the commencement of a marriage is still worth 50% of the asset pool at trial it will be difficult for a trial judge to ignore that. In particular note what was said by Campbell JA 58 in Manns v Kennedy 59 … the holistic value judgment is the final step in the process of arriving at an order namely deciding what adjustment of property seems just and equitable …Further, even in carrying out that final step “there is no warrant for ignoring the rigour that mathematics can provide”: Ross v Elderfield [2006] NSWCA 192 at [49] … as Hodgson JA said in Howlett “… mathematical calculations are of some use in guiding and testing conclusions about what is just and equitable and also in promoting transparency and consistency in decision making” 60 And when on the other side – the person who contributed little in the way of assets in the early years of the relationship: 6. if your client earned an income which supported ‘family finances’ give good particulars of that – can you advance an argument that this income, however modest, gave a sufficient buffer as enabled the other spouse to hold onto the investment property or other asset which has featured so large in the case? 7. where the major early asset has become the home (or source of the home through sale) give good particulars of the things your client did to maintain, preserve or enhance the home. Your need to ‘erode’ the early contribution as much as possible – to use an analogy of Justice Carmody demonstrate the ‘dripping of water on a stone’ to erode the value of the early contribution. 61 58 With whom Santow JA agreed (2007) 37 FamLR 489 at 499 60 For those interested in trivia Justice Hodgson’s is author of the book “The Mind Matters” OUP 1993 which is an examination by His Honour of the mathematical structure of quantum mechanics 61 See Brodie at paragraph 207 59 14 8. the value of subsequent financial contributions needs to be adequately particularised – even relatively small capital amounts (the $15,000 inheritance, the $25,000 redundancy) received during the later years of the relationship can become part of the off-setting equation. 9. most often we concede (quite properly) that domestic contributions are equal – but do you have special facts allowing you to argue otherwise? Entrepreneurial spouses (as with mere barristers) spend a lot of time away from home – was there an added ‘burden’ upon your client by virtue of that? M.A. Fellows Chambers 26/5/08 15