LEUKEMIA SOCIETY OF AMERICA - Leukemia & Lymphoma Society

advertisement

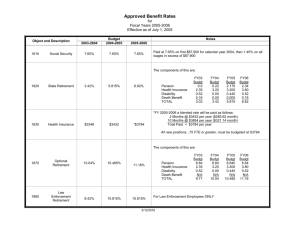

THE LEUKEMIA & LYMPHOMA SOCIETY, INC. 1311 Mamaroneck Avenue White Plains, NY 10605 MEETING OF THE FINANCE COMMITTEE Minutes of a meeting of the Finance Committee of The Leukemia & Lymphoma Society, Inc. held Saturday, June 25, 2005 at 11:30 a.m. at the Marriott Financial Center Hotel in New York City. Members Present Thomas L. Fitzpatrick, Chair Paul J. Cienki, Vice Chair Michael C. Copley Paul Frimmer John A. Geoghegan (by phone) Lynn C. Hoover Thomas Hunter John B. Kelly (by phone) Richard H. Michalik Fred Parvey William H. Reimers Norbert Sieber Jay L. Silver Thomas R. Snyder (by phone) Also Present Margaret H. Anderson, National Trustee Leslie Chambers, SVP-Field Development Louis Degennaro. Vice President-Research Dave Frantze, Vice Chairman Larry Hausner, COO John Kamins, Chairman of the Board Robin Kornhaber, SVP-Patient Services Marshall Lichtman, EVP-Research & Medical Programs Jon Lowell, CIO Jimmy Nangle, SVP-Finance Marcie Rehmar Rogell, National Trustee Beverly Sherbondy, SVP-Human Resources James J. Stephanak, National Trustee John Walter, EVP & CFO Members Absent Charles F. Inglefield Mr. Fitzpatrick began the meeting by calling for and receiving approval of the current meeting agenda, and the Minutes of the March 7, 2005 meeting. May 2005 Mr. Fitzpatrick reviewed financial statement highlights through May 2005. Combined Cash and Investments were $132.5 million, or $29.0 million higher than last year at this time. Net Assets were $84.7 million, or $17.2 million greater than the previous year. Net Revenue was greater than budget by $15.4 million, and $29.6 million greater than prior year. Net Income was $9.0 million higher than budget and $8.7 million greater than prior year. Mr. Fitzpatrick pointed out that $1.1 million of the May year-todate budget variances in Net Revenue and Net Income were attributable to a positive mark-to-market adjustment. Fiscal Year 2005 (FY05) Annual Forecast Mr. Fitzpatrick reported that Net Revenue is forecasted at a record breaking $209.5 million. This is $17.8 million better than budget, and $20.0 million greater than last year (excluding last year’s mark-to market adjustment). Primary contributors to this positive variance are TNT $5.9 million, LTN $2.6 million, Investment Income $2.6 million, Bequests $2.4, and pharmaceutical sponsorships $1.6 million. Expenses are forecasted at $198.5 million, or $8.2 million over budget. This variance is primarily composed of additional mission related expenditures of $5.3 million for Grants and $.3 million for Patient Aid. Also contributing to the expense variance is over budget spending on the Professional Fees line of $2.9 million which is related to pharmaceutical sponsorships $1.6 million, chapter support for increased revenue generation $.6 million and Direct Response $.3 million. Finance Committee Minutes June 25, 2005 Page 2 Overall, Net Assets are expected to increase by $9.6 million in FY05. This will result in a 31.7% Net Asset Ratio, which is 3.7% better than budget and 1.4% better than the previous year. Mr. Fitzpatrick noted that due to stock market volatility no provision for the mark-to-market adjustment is included in the forecast, but that current estimates indicate a positive adjustment for the fiscal year in the $1.0 million range. Fiscal Year 2006 (FY06) Annual Budget Mr. Fitzpatrick reported that Net Revenue is budgeted to reach $229.5 million or 9.5% more than FY05’s Forecast. Expenses are budgeted at $226.8 million or 14.3% greater than FY05, and the Net Asset Ratio is budgeted at 29.0%. Mr. Fitzpatrick and Mr. Walter then discussed and responded to questions related to the line item variance analysis and other support schedules that were previously distributed to Committee members and incorporated as part of the Committee’s financial package. They noted that new funding requests totaled approximately $5.6 million and were primarily driven by the need to invest in revenue generating capacity and infrastructure in order to continue to exceed the Society’s Strategic Plan goals. The Committee voted to approve the FY06 budget as submitted. Mr. Walter then presented the proposed Canadian annual FY06 budget. Net revenue is budgeted at $4.4 million. This is $1.2 million, or 38.7% greater than FY05. Expense is budgeted at $4.4 million or $.7 million greater than FY04. The Committee voted to approve the Canadian FY06 budget as submitted. Investment Subcommittee Mr. Snyder reported the PIMCO Commodity Real Return Fund would be liquidated and the proceeds invested in the Lehman Brothers Strategic Commodities Offshore Fund. This action was taken to reduce the Society’s exposure to TIPS (Treasury Inflation Protected Securities) which the Investment Committee feels are currently overvalued. Mr. Synder explained the Offshore fund was chosen to reduce the Society’s exposure to Unrelated Business Income Tax (UBIT). Funds will also be shifted from the FAM Global Onshore Fund to the FAM Global Offshore Fund, for the same reason. Mr. Snyder reported on investment results as of 3/31/05. The Operating fund returned -.58% and outperformed its tactical index, which returned -1.05%. Since inception, the Operating fund has returned 4.97% vs. 4.58% for the tactical index. The Pooled Endowment fund returned -1.83% and thus, underperformed its tactical index which returned -1.59% for the quarter. Since inception, the Pooled Endowment fund has returned 8.39% vs. 9.08% for its tactical index. While the Pooled Endowment returns are below benchmark, the Society’s investment advisor ComstockCo does not recommend changing any managers at this time. Finance Committee Charter and Checklist The Committee voted to approve the Finance Charter and Responsibilities Checklist that were distributed prior to the meeting, subject to moving item nine on the Checklist from the Fall to the Spring. FY06 Targets Mr. Walter reviewed the three FY06 financial targets as follows: a) Total Public Support & Revenue $229.5 million, b) Net Asset Ratio 29.0%, and c) Allocation of Program Services Expenses 75%. The Committee voted to approve the targets as submitted. Finance Committee Minutes June 25, 2005 Page 3 Audit Committee Ms. Anderson reported that KPMG presented, and the Audit Committee approved, an audit plan for FY05. The scope of services includes: - Audit of the Society’s consolidated financial statements and supplementary chapter information as of and for the year ending 6/30/05. - Audit of the financial statements of The Leukemia and Lymphoma Society of Canada as of and for the year ending 6/30/05. - Review of the 2005 Annual Report prior to its release. - Review of Federal Form 990 for the year ending 6/30/05. - Audit of the Society’s Tax Deferred Annuity Retirement Plan as of and for the year ending 12/31/05. The fees for the above services are $195,500 plus out-of-pocket expenses, and include consolidation of the Canadian audited financial statements. Ms. Anderson also reported the Audit Committee approved the following: - 12/31/04 audited pension plan statements - Ten year audit partner rotation policy, with a two year minimum rotation out before a subsequent ten year period can begin. - Independent Auditor Evaluation policy - Audit Committee Self-Evaluation policy - Policy requiring Audit Committee approval prior to the performance of non-audit work by the Society’s external auditors. Mr. Fitzpatrick announced the next Finance Committee meeting would be held in Atlanta Georgia on October 27, 2005. With no further business to discuss, the meeting was adjourned at 1:10 p.m.