Budget

advertisement

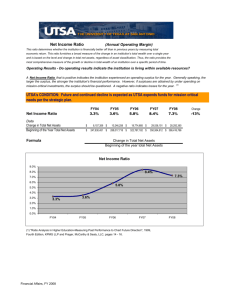

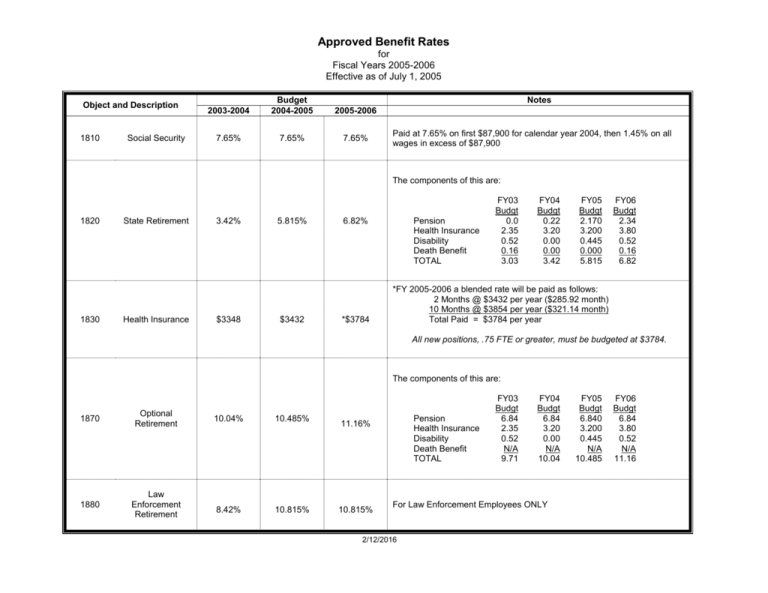

Approved Benefit Rates for Fiscal Years 2005-2006 Effective as of July 1, 2005 Object and Description 1810 Social Security 2003-2004 Budget 2004-2005 2005-2006 7.65% 7.65% 7.65% Notes Paid at 7.65% on first $87,900 for calendar year 2004, then 1.45% on all wages in excess of $87,900 The components of this are: 1820 1830 State Retirement Health Insurance 3.42% $3348 5.815% $3432 6.82% *$3784 Pension Health Insurance Disability Death Benefit TOTAL FY03 Budgt 0.0 2.35 0.52 0.16 3.03 FY04 Budgt 0.22 3.20 0.00 0.00 3.42 FY05 Budgt 2.170 3.200 0.445 0.000 5.815 FY06 Budgt 2.34 3.80 0.52 0.16 6.82 *FY 2005-2006 a blended rate will be paid as follows: 2 Months @ $3432 per year ($285.92 month) 10 Months @ $3854 per year ($321.14 month) Total Paid = $3784 per year All new positions, .75 FTE or greater, must be budgeted at $3784. The components of this are: 1870 Optional Retirement 1880 Law Enforcement Retirement 10.04% 10.485% 8.42% 10.815% Pension Health Insurance Disability Death Benefit TOTAL 11.16% 10.815% FY03 Budgt 6.84 2.35 0.52 N/A 9.71 FY04 Budgt 6.84 3.20 0.00 N/A 10.04 For Law Enforcement Employees ONLY 2/12/2016 FY05 Budgt 6.840 3.200 0.445 N/A 10.485 FY06 Budgt 6.84 3.80 0.52 N/A 11.16 2/12/2016