Lab 13 problems.

advertisement

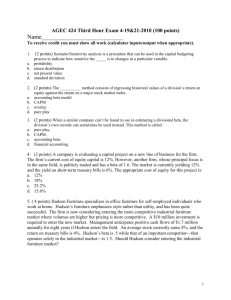

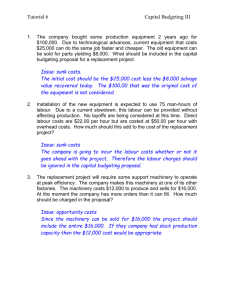

Lab 13: Two more Chapter 11 Problems (chapter 10 in the 4th edition) 1. Two years ago our company bought equipment for $1 million that has been depreciated straight line over a five-year life. This equipment has a current market value of $300,000, but will be worth $0 in 5 years. More efficient equipment can be purchased today for $3 million and is expected to last 5 years (economic life), at which time its anticipated market value would be $300,000. However, the new equipment would be depreciated straight line over only four years to a zero salvage value for tax purposes. Our company would realize a $1,000,000 per year operating cost savings by replacing the old equipment with the new equipment. Also, our Net Working Capital Requirement would decrease by $75,000 as soon as we bought the equipment, but would increase again when it is sold at the end of its economic life (5 years). Our marginal tax rate is 30% and WACC 10%. Identify the relevant cash flows for this project. Calculate NPV, IRR, and payback. Should the investment be made? 4. The following information pertains to a proposed new five-year venture for a firm: Startup cost of new equipment (assume 5-year SL) Investment in market research undertaken last year Incremental sales revenue (years 1–5) Gross margin on lost sales of current products (years 1–5) Cost of Goods Sold (years 1–5) Incremental cash expenses (years 1–5) Corporate tax rate Corporate cost of capital Working capital required at outset, to be restored to cash at the end of the project’s life a. b. 7. a. b. c. d. $200,000 $100,000 $750,000 $ 50,000 $450,000 $150,000 34% 12% $ 50,000 Develop the incremental cash flows for the project? What is the project’s NPV? Multiple choice problems for Chapter 12 (chapter 11 in the 4th edition) The cost of capital is the appropriate discount rate in capital budgeting when: all the projects are equally risky. all the projects have the same risk as the current firm. the projects can be ranked from riskiest to least risky. all the projects have less risk than the risk of the current firm. 9. The technique for incorporating risk into capital budgeting that involves the use of numbers drawn randomly from probability distributions is called a: a. probability simulation. b. scenario analysis. c. sensitivity analysis. d. Monte Carlo simulation. 12. Which of the following is/are included in the list of drawbacks to using the Monte Carlo simulation for dealing with risk in capital budgeting? a. Cash flows still have to be estimated subjectively. b. Individual cash flows generally don’t behave independently. If one cash flow turns out to be less than expected, several other may behave the same way. c. Even after creating a distribution of probably outcomes, it is difficult to know exactly how to interpret the data. d. Both a & c are drawbacks. e. All of the above are drawbacks. 1 13. a. b. c. d. Monte Carlo simulations are so named because it is the name of: a famous European gambling casino. a popular brand of automobile. the first individual to develop an automated simulation machine. the person who discovered the necessary algebraic computations. 14. Scenario/Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the _____ is to changes in a particular variable. a. probability b. return distribution c. net present value d. standard deviation 32. The appropriate interest rate to use in capital budgeting is: a. always the company’s cost of capital. b. the company’s cost of capital if the project’s risk is about the same as the company’s. c. the cost of capital plus any additional risk premium required to compensate for the project’s higher risk. d. both b & c 33. The __________ method consists of regressing historical values of a division’s return on equity against the return on a major stock market index. a. accounting beta model b. CAPM c. overlay d. pure play 38. When a similar company can’t be found to use in estimating a divisional beta, the division’s own records can sometimes be used instead. This method is called: a. pure play. b. CAPM. c. accounting beta. d. financial accounting. 39. A project’s possible outcomes are summarized as follows. NPV Probability Worst case ($1,000) .2 Most likely case $300 .3 Best case $600 .5 The expected NPV for the project is approximately: a. $190 b. ($190) c. ($100) d. none of the above 44. A company is evaluating a capital project on a new line of business for the firm. The firm’s current cost of equity capital is 12%. However, another firm, whose principal focus is in the same field, is publicly traded and has a beta of 1.6. The market is currently yielding 12% and the yield on short-term treasury bills is 6%. The appropriate cost of equity for this project is: 2 a. 12% b. 18% c. 25.2% d. 15.6% Two Chapter 11 problems from the book 6. Sanville Quarries is considering acquiring a new drilling machine which is expected to be more efficient than their current machine. The project is to be evaluated over four years. The initial outlay required to get the new machine operating is $675,000. Incremental cash flows associated with the machine are uncertain, so management developed the following probabilistic forecast of cash flows by year ($000). Sanville’s cost of capital is 10%. Year1 Prob $150 .30 $175 .40 $300 .30 a. b. 15. Year2 $200 $210 $250 Prob .35 .45 .20 Year3 $350 $370 $400 Prob .30 .25 .45 Year4 $300 $360 $375 Prob .25 .35 .40 Calculate the project’s best and worst NPVs. What is the NPV of the expected (mean) cash flows? Hudson Furniture specializes in office furniture for self-employed individuals who work at home. Hudson’s furniture emphasizes style rather than utility, and has been quite successful. The firm is now considering entering the more competitive industrial furniture market where volumes are higher but pricing is more competitive. A $10 million investment is required to enter the new market. Management anticipates positive cash flows of $1.7 million annually for eight years if Hudson enters the field. An average stock currently earns 8%, and the return on treasury bills is 4%. Hudson’s beta is .5 while that of an important competitorthat operates solely in the industrial marketis 1.5. Should Hudson consider entering the industrial furniture market? 3 4