Chapter10

advertisement

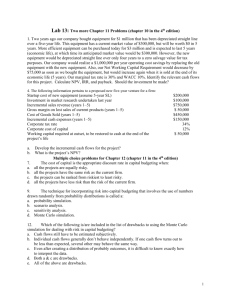

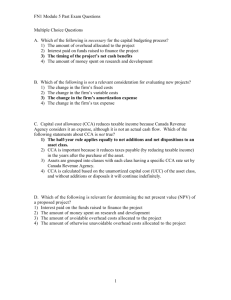

1 Learning Outcomes Chapter 10 Describe the relevant cash flows that must be forecast to make informed capital budgeting decisions. Identify the relevant cash flows and perform a capital budgeting analysis for: (a) an expansion project and (b) a replacement project Describe how the riskiness of a capital budgeting project is evaluated and how the results are incorporated in capital budgeting decisions. Describe how capital budgeting decisions differ for firms that have foreign operations and for firms that only have domestic operations 2 Cash Flow Estimation Most important and most difficult step in the analysis of a capital project Financial staff’s role includes: Coordinating other departments’ efforts Ensuring that everyone uses the same set of economic assumptions Making sure that no biases are inherent in forecasts 3 Relevant Cash Flows Cash Flow Versus Accounting Income Incremental Cash Flows 4 Unilate’s Accounting Profits Versus Cash Flows 5 Unilate’s Accounting Profits Versus Cash Flows 6 Incremental Cash Flows An Incremental Cash Flow is the change in a firm’s net cash flow attributable to an investment project. 7 Problems in Determining Incremental Cash Flows Sunk Cost: A cash outlay that already has been incurred and cannot be recovered Opportunity Cost: The return on the best alternative use of an asset Externalities: The effect of accepting a project on the cash flows in other parts of the firm Shipping and Installation Costs Inflation 8 Identifying Incremental Cash Flows Initial Investment Outlay: the incremental cash flows associated with a project that will occur only at the start of a project’s life Incremental Operating Cash Flow: the changes in day-to-day cash flows that result from the purchase of a capital project and continue until the firm disposes of the asset Terminal Cash Flow: the net cash flows that occur only at the end of a project’s life 9 Incremental Operating Cash Flow 10 Capital Budgeting Project Evaluation Expansion Project: A project that is intended to increase sales; provides growth to the firm Replacement Analysis: An analysis involving the decision of whether to replace an existing, still productive asset with a new asset 11 Expansion Project Analysis of the Cash Flows Initial Investment Outlay Cost of new asset $( 9,500) Shipping and installation ( 500) Increase in net working capital ( 4,000) Initial investment $(14,000) 12 Expansion Project Analysis of the Cash Flows 13 Expansion Project Net Salvage Value 14 Expansion Project Analysis of the Cash Flows 15 Expansion Project Cash Flow Time Line Replacement Project Analysis of the Cash Flows 17 Replacement Project Cash Flow Time Line 18 Incorporating Risk in Capital Budgeting Analysis Stand-Alone Risk: the risk an asset would have if it were a firm’s only risk Measured by the variability of the asset’s expected returns Corporate (Within-Firm) Risk: risk not considering the effects of stockholder’s diversification Measured by a project’s effect on the firm’s earnings variability Beta (Market) Risk: part of a project’s risk that cannot be eliminated by diversification Measured by the project’s beta coefficient 19 Techniques for Measuring Stand-Alone Risk Sensitivity Analysis: Key variables are changed and the resulting changes in the NPV and the IRR are observed. Scenario Analysis: “Bad” and “good” sets of financial circumstances are compared with the most likely situation. Monte Carlo Simulation: Probable future events are simulated on a computer. 20 Sensitivity Analysis Graph 21 Scenario Analysis A risk analysis technique in which “bad” and “good” sets of financial circumstances are compared with a most likely, or base case, situation. 22 Scenario Analysis 23 Monte Carlo Simulation A risk analysis technique in which probable future events are simulated on a computer, generating a probability distribution that indicates the most likely outcomes. 24 Advantages/Disadvantages of Simulation Analysis Advantages Reflects probability of each input Shows range of NPVs, expected NPV, σNPV, and CVNPV Disadvantages Difficult to specify probability distributions and correlation If inputs are bad, output will be bad: GIGO = Garbage In, Garbage Out! 25 Corporate (Within-Firm) Risk Risk that does not take into consideration the effects of stockholders’ diversification, it is measured by a project’s effect on the firm’s earnings variability. 26 Beta (or Market) Risk and Required Rate of Return for a Project Security Market Line equation: rS = rRF + (rM - rRF)βS Erie Steel is all equity financed, so cost of equity is also its averaged required rate of return, or cost of capital. Erie’s β = 1.1; rRF = 8%; and rM = 12% rS = 8% + (12% - 8%)1.1 = 12.4% = Erie’s cost of equity Investors should be willing to give Erie money to invest in average-risk projects. 27 Required Rate of Return for a Project rproj = the risk-adjusted required rate of return for an individual project rproj = rRF + (rM - rRF)proj 28 Measuring Beta Risk for a Project Pure Play Method: 1. Identify companies whose only business is the project in question. 2. Determine the beta for each company. 3. Average the betas to find an approximation of proposed project’s beta. 29 How Project Risk Is Considered in Capital Budgeting Decisions Most firms use: Risk-Adjusted Discount Rate Discount rate that applies to particularly risky stream of income It is equal to the risk-free rate of interest plus a risk premium. 30 Multinational Capital Budgeting Repatriation of Earnings: The process of sending cash flows from a foreign subsidiary back to the parent company Exchange Risk Rate: The uncertainty associated with the price at which the currency from one country can be converted into the currency of another country Political Risk: The risk of seizure of a foreign subsidiary’s assets by the host country or unanticipated restrictions on cash flows to the parent company 31