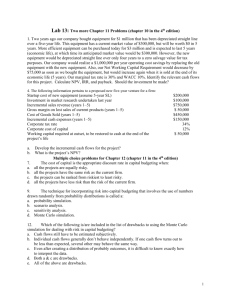

Exam 3, spring 2010

advertisement

AGEC 424 Third Hour Exam 4-19&21-2010 (100 points) Name___________________________ To receive credit you must show all work (calculator inputs/output when appropriate). 1. 1. a. b. c. d. (2 points) Scenario/Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the _____ is to changes in a particular variable. probability return distribution net present value standard deviation 2. (2 points) The __________ method consists of regressing historical values of a division’s return on equity against the return on a major stock market index. a. accounting beta model b. CAPM c. overlay d. pure play 3. (2 points) When a similar company can’t be found to use in estimating a divisional beta, the division’s own records can sometimes be used instead. This method is called: a. pure play. b. CAPM. c. accounting beta. d. financial accounting. 4. (2 points) A company is evaluating a capital project on a new line of business for the firm. The firm’s current cost of equity capital is 12%. However, another firm, whose principal focus is in the same field, is publicly traded and has a beta of 1.6. The market is currently yielding 12% and the yield on short-term treasury bills is 6%. The appropriate cost of equity for this project is: a. 12% b. 18% c. 25.2% d. 15.6% 5. ( 4 points) Hudson Furniture specializes in office furniture for self-employed individuals who work at home. Hudson’s furniture emphasizes style rather than utility, and has been quite successful. The firm is now considering entering the more competitive industrial furniture market where volumes are higher but pricing is more competitive. A $10 million investment is required to enter the new market. Management anticipates positive cash flows of $1.7 million annually for eight years if Hudson enters the field. An average stock currently earns 8%, and the return on treasury bills is 4%. Hudson’s beta is .5 while that of an important competitorthat operates solely in the industrial marketis 1.5. Should Hudson consider entering the industrial furniture market? 1 6. (9 points) Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin’s cost of capital is 12%. The initial cost of the project will be $275,000, and it is expected to generate the following cash flows over its five-year life: Year $ 1 $60,000 2 $60,000 3 $60,000 4 $90,000 5 $90,000 a. What is the payback period for the expansion project? b. What are the net present value (NPV) and internal rate of return (IRR) of the expansion project? 7. (12 points) The projected cash flows for two mutually exclusive projects are as follows: Year 0 1 2 3 4 5 6 Project A ($150,000) 80,000 60,000 50,000 Project B ($200,000) 40,000 50,000 50,000 60,000 50,000 53,000 If the firm’s cost of capital is 10% and the equivalent annual annuity method is used to eliminate the disparity between the projects’ lives, which project should be undertaken? a. Project A b. Project B c. either because the difference in lives makes a comparison meaningless d. Project A but the EAAs are so close that either is probably ok 2 New Investment 8. (30 points) Mars Inc. is considering the purchase of a new machine, which will reduce manufacturing costs by $25,000 annually. Mars will use 3-year MACRS (.33, .45, .15, .07) to depreciate the machine, and it expects to sell the machine at the end of its 3-year operating life for $3,000. The firm expects to be able to reduce net working capital by $15,000 when the machine is installed, but required working capital will return to the original level when the machine is sold after 3 years. Mars' marginal tax rate is 40 percent, and it uses a 12 percent required rate of return to evaluate projects of this nature. If the machine costs $60,000, what is the NPV of the project? Should Mars Inc. purchase the machine? Replacement Problem: 9. (37 points) Atlantic Control Company purchased a machine two years ago at a cost of $70,000. At that time, the machine’s expected economic life was six years and its salvage value at the end of its life was estimated to be $10,000. It is being depreciated using the straight line method so that its book value at the end of six years is $10,000. The old machine can be sold today for $20,000, but would be worth only $10,000 in four years. A new machine can be purchased for $80,000, including shipping and installation costs. The new machine has an economic life estimated to be four years. Five-year MACRS depreciation will be used (percentages are 20, 32, 19, 12, 11, 6). During its four-year life, the new machine will reduce cash operating expenses by $40,000 per year. Sales are not expected to change. But the new machine will require net working capital to be increased by $4,000. At the end of its useful life, the machine is estimated to have a market value of $5,000. The firm’s marginal tax rate is 40 percent. The appropriate required rate of return is 10 percent. Determine the cash flows, NPV, and IRR on the attached sheet. Recommend either acceptance or rejection and say why. 3 Question 8 Initial Outlay Depreciation [initial basis = ] Operating Cash flow minus deprec. EBT less taxes EAT Dep. addback OCF Terminal CF Timeline and calculator inputs/outputs and investment decision TCF workspace 4 Question 9 Initial Outlay Depreciation [initial basis = ] Work space Operating Cash flow minus deprec. EBT less taxes EAT Dep. addback OCF Terminal CF Timeline and calculator inputs/outputs and investment decision TCF workspace 5