Multinational Financial Management

Alan Shapiro

10th Edition

John Wiley & Sons, Inc.

PowerPoints by

Joseph F. Greco, Ph.D.

California State University, Fullerton

1

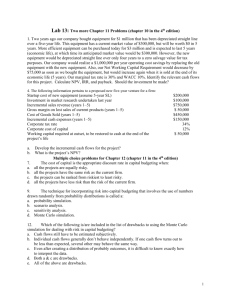

CHAPTER 17

Capital Budgeting for the

Multinational Corporation

BASICS OF CAPITAL

BUDGETING

I.

BASICS OF CAPITAL BUDGETING

A. Basic Criterion: Net Present Value

B. Net Present Value Technique:

1. Definition

The present value of future cash flows,

discounted at the project’s cost of

capital less the initial net cash outlay.

BASICS OF CAPITAL

BUDGETING

2.

NPV Formula:

n

NPV I 0

t 1

xt

t

(1 k )

where I0

xt

k

=

=

=

initial cash outlay

net cash flow at t

cost of capital

n

=

investment horizon

BASICS OF CAPITAL

BUDGETING

3. Most important property of

NPV technique:

-focus on cash flows with respect to

shareholder wealth

4. NPV obeys value additive

principle:

- the NPV of a set of projects is the

sum of the individual project NPV

BASICS OF CAPITAL

BUDGETING

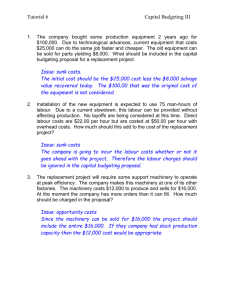

C. International Cash Flows

1. Important principle when estimating:

Use incremental basis

BASICS OF CAPITAL

BUDGETING

2. Distinguish total from incremental flows

to account for

a.

b.

c.

d.

e.

cannibalization

sales creation

opportunity cost

transfer pricing

fees and royalties

BASICS OF CAPITAL

BUDGETING

3.

Getting the base case

correct-Rule of thumb:

GlobalCorporate GlobalCorporate

Incremental

CashFlow

= CashFlow

CashFlows withProject

WithoutProject

4. Intangible Benefits:

a. Valuable learning experience

b. Broader knowledge base

ALL-EQUITY COST OF CAPITAL

II.

Alternative Capital-Budgeting

Frameworks

A. THE ALL-EQUITY COST OF CAPITAL FOR

FOREIGN PROJECTS

WACC sometimes awkward

1. To go from the parent to the project

2. Solution: Use all-equity discount rate

3. To calculate:

k* = rf + *( rm - rf )

ALL-EQUITY COST OF CAPITAL

4. β* is the all-equity beta associated with

the unlevered cash flows.

5. Unlevered beta obtained by

*

where

e

1 1 t D / E

β*

D/E

t

= the firm’s stock price beta

= the debt to equity ratio

= the firm’s marginal tax rate

FOREIGN INVESTMENT

ANALYSIS

III.

TWO ISSUES IN FOREIGN INVESTMENT

ANALYSIS

A. Issue #1

Parent v. Project Cash Flow

-the cash flows from the project may

differ from those remitted to the parent

1. Relevant cash flows become quite

important

FOREIGN INVESTMENT

ANALYSIS

2. Three Stage Approach

-to simplify project evaluation

a. compute subsidiary’s project cash flows

b. evaluate the project to the parent

c. incorporate the indirect effects

FOREIGN INVESTMENT

ANALYSIS

3. Estimating Incremental Project Flows

What is the true profitability of the project?

a. Adjust for tax effects of

1.)

transfer pricing

2.)

fees and royalties

FOREIGN INVESTMENT

ANALYSIS

4. Tax Factors:

determine the amount and timing of taxes paid

on foreign-source income

FOREIGN INVESTMENT

ANALYSIS

B. Issue #2

How to adjust for increased economic and political risk

of project?

FOREIGN INVESTMENT

ANALYSIS

1. Three Methods for Economic/Political

Risk Adjustments:

a. Shortening minimum payback period

b. Raising required rate of return

c. Adjusting cash flows

FOREIGN INVESTMENT

ANALYSIS

2. Accounting for Exchange Rate and Price

Changes (inflationary)

Two stage procedure:

a. Convert nominal foreign cash flows

into home currency terms

b. Discount home currency flows at

domestic required rate of return.

Copyright 2014

John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work

beyond that permitted in section 117 of the 1976 United

States Copyright Act without express permission of the

copyright owner is unlawful.

Request for further

information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser may

back-up copies for his/her own use only and not for

distribution or resale.

The Publisher assumes no

responsibility for errors, omissions, or damages caused by

the use of these programs or from the use of the

information herein.