Accounting 115 Review Sheet - Financial Statements & Transactions

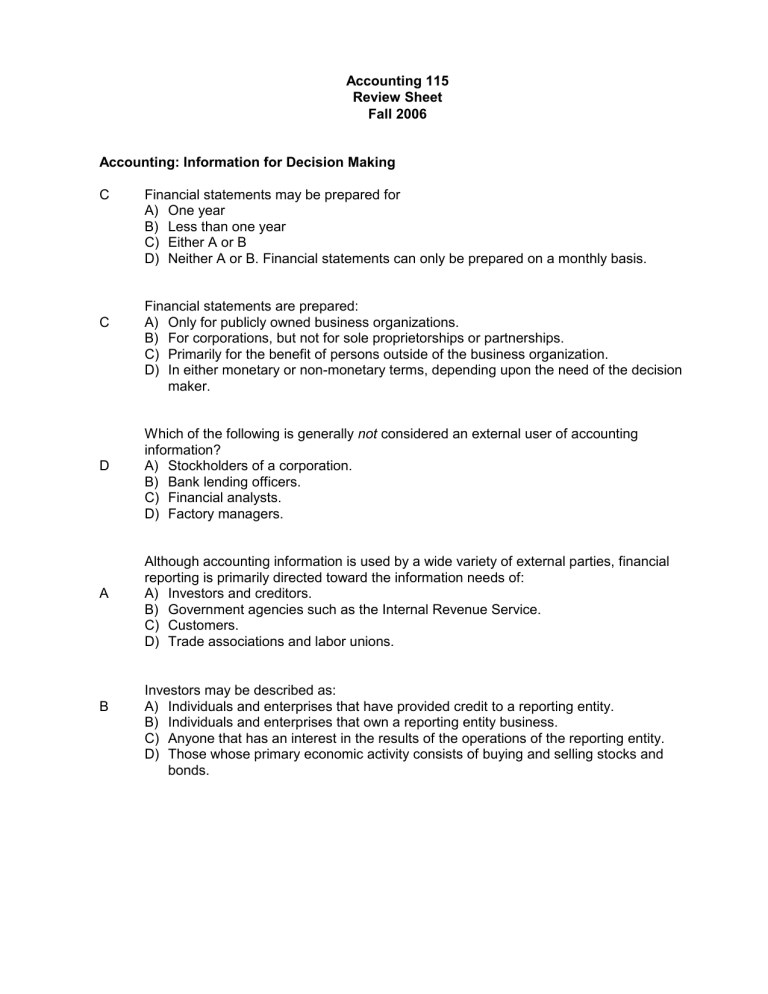

Accounting 115

Review Sheet

Fall 2006

B

A

D

C

Accounting: Information for Decision Making

C Financial statements may be prepared for

A) One year

B) Less than one year

C) Either A or B

D) Neither A or B. Financial statements can only be prepared on a monthly basis.

Financial statements are prepared:

A) Only for publicly owned business organizations.

B) For corporations, but not for sole proprietorships or partnerships.

C) Primarily for the benefit of persons outside of the business organization.

D) In either monetary or non-monetary terms, depending upon the need of the decision maker.

Which of the following is generally not considered an external user of accounting information?

A) Stockholders of a corporation.

B) Bank lending officers.

C) Financial analysts.

D) Factory managers.

Although accounting information is used by a wide variety of external parties, financial reporting is primarily directed toward the information needs of:

A) Investors and creditors.

B) Government agencies such as the Internal Revenue Service.

C) Customers.

D) Trade associations and labor unions.

Investors may be described as:

A) Individuals and enterprises that have provided credit to a reporting entity.

B) Individuals and enterprises that own a reporting entity business. bonds.

C) Anyone that has an interest in the results of the operations of the reporting entity.

D) Those whose primary economic activity consists of buying and selling stocks and

D

C

C

A complete set of financial statements for Blue Water Company, at December 31, 2007, would include each of the following, except :

A) Balance sheet as of December 31, 2007.

B) Income statement for the year ended December 31, 2007.

C) Statement of projected cash flows for 2008.

D) Notes containing additional information that is useful in interpreting the financial statements.

Which of the following events is not a transaction that would be recorded in a company's accounting records?

A) The purchase of equipment for cash.

B) The purchase of equipment on account.

C) The investment of additional cash in the business by the owner.

D) The death of a key executive.

B

B

The FASB takes on a responsibility to do the following, except:

A) Set the objectives of financial reporting.

B) Describe the elements of financial statements.

C) Judge disputes between management and the CPA.

D) Determine the criteria for deciding what information to include in financial statements.

The principal difference between management accounting and financial accounting is that financial accounting information is:

A) Prepared by managers.

B) Intended primarily for use by decision makers outside the business organization.

C) Prepared in accordance with a set of accounting principles developed by the Institute of Certified Management Accountants.

D) Oriented toward measuring solvency rather than profitability.

Which organization best serves the professional needs of a CPA?

A) FASB.

B) AICPA.

C) SEC.

D) AAA.

Financial Statements

Presented below is the balance sheet for Blues Clues, Inc. on January 1 of the current year.

BLUES CLUES, INC.

Balance Sheet

January 1, 20__

Assets Liabilities & Stockholders’ Equity

Cash .............................. $ 20,000 Liabilities:

Accounts receivable ........ 31,000 Accounts payable ............................ $ 45,000

Land .............................. 190,000 Total liabilities ............................... $ 45,000

Building ........................... 225,000 Owners’ equity:

Equipment ...................... 35,000 Capital stock ................................. 456,000

Total liabilities and

Total assets .................... $501,000 owners’ equity .................................... $501,000

During the first few days of January, the following transactions occurred:

Jan 2 Equipment was purchased for $50,000 on credit.

2 The business collected $16,000 of its accounts receivable and paid off $23,000 of its accounts payable.

3 The business borrowed $65,000 from the bank, giving a note payable due in 90 days.

3 Additional capital stock was issued in exchange for $27,000 cash.

Complete the following balance sheet for Blues Clues, Inc. on January 4 of the current year.

BLUES CLUES, INC.

Balance Sheet

January 4, 20__

Assets Liabilities & Owners’ Equity

Cash .............................. $ 105,000 Liabilities:

Accounts receivable ....... 15,000 Notes payable ................................. $ 65,000

Land ............................. 190,000 Accounts payable ........................ 72,000

Building .......................... 225,000 Total liabilities .......................... $137,000

Equipment ..................... 85,000

Owners’ equity:

Capital stock ............................... 483,000

Total liabilities and

Total assets .................... $620,000 owners’ equity ................................ $620,000

9

8

8

4

Capturing Economic Events

Enter the following transactions in the two-column journal of Heavenly Dry Cleaners.

Include a brief explanation of the transaction as part of each journal entry.

Mar 1 Borrowed $70,000 cash from the bank by signing a 90-day note payable.

3 Issued an additional 6,000 shares of capital stock in exchange for $30,000 cash.

4 Purchased an adjacent vacant lot for use as parking space.

The price was $55,000, of which $15,000 was paid in cash; a note payable was issued for the balance.

8 Acquired shop equipment from Top-Notch for $3,300 cash.

8 Collected an account receivable of $1,850 from a customer,

Madison Art Shoppe.

9 Issued a check for $870 in full payment of an account payable to Houston Industries, Inc.

Date General Journal

20__

Mar 1 Cash

Notes Pay

3 Cash

C/ Stock

70,000

30,000

70,000

30,000

Land

Cash

Notes Pay

Equip

Cash

Cash

A/R

A/P

Cash

870

55,000

3,300

1,850

15,000

40,000

3,300

1,850

870

D

C

A

C

Capturing Economic Events

The following transactions occurred during June, the first month of operations for Superior

Engineering, Inc.:

* Issued 70,000 shares of capital stock to the owners of the corporation in exchange for

$700,000 cash.

* Purchased a piece of land for $300,000, making a $90,000 cash down payment and signing a note payable for the balance.

* Made a $110,000 cash payment on the note payable from the purchase of land.

* Purchased equipment on credit from HiTech for $45,000.

1 Refer to the above data. The balance in the Cash account at the end of June: a $500,000.

c $590,000. b $610,000.

d $455,000.

2 Refer to the above data. What are total assets of Superior Engineering at the end of June? a b

$955,000.

$935,000.

c d

$845,000.

$800,000.

3 Refer to the above data. What is the total of Superior’s liabilities at the end of

June? a b

$100,000.

$845,000.

c d

$145,000.

$255,000.

4 Refer to the above data. a b

$845,000.

$955,000.

What is the total owners’ equity at the end of June? c d

$745,000.

$700,000.