On July 1, 2007, Iaket Equipment Inc. issued $12,500,000 of 10

advertisement

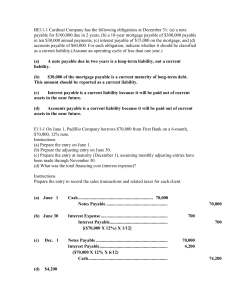

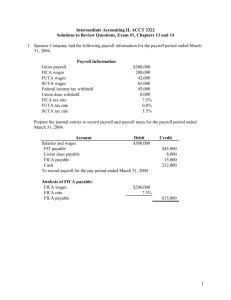

On July 1, 2007, Iaket Equipment Inc. issued $12,500,000 of 10-year, 11% bonds at an effective interest rate of 12%. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. 1. Journalize the entry to record the amount of the cash proceeds from the sale of the bonds. 2. Journalize the entries to record the following a. The first semiannual interest payment on December 31, 200, and the amortization of the bond discount, using the straight line method. (Round to the nearest dollar). b. The interest payment on June 30, 2008, and the amortization of the bond discount, using the straight line method. (Round to the nearest dollar). 3. Determine the total interest expense for 2007 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? Explain If Straight Line Method is followed for Bond amortizarion Part 1 July 1, 2007 (to record the issuance of the bonds) Cash A/c …............................................Dr. $11,783,130 Discount on Bond Payable ....................Dr. $716,870 Bond Payable..............................................Cr. $12,500,000 Part 2 Dec 31, 2007 (to pay interest and to amortize the Bond Discount) Interest Expense …...................................Dr. 723,343 Discount on Bond Payable ........................Cr. 35843 Cash A/c........................................................Cr. 687,500 June 30, 2008(to pay interest and to amortize the Bond Discount) Interest Expense …...................................Dr. 723,344 Discount on Bond Payable ........................Cr. 35844 Cash A/c........................................................Cr. 687,500 Part 3 Total interest expense for 2007 = $ 723,343 (Cash Payment + Amortizarion) Part 4 Bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest because value of bond proceed is equal to the present value (at current market rate) of future outflow interest payment and final maturity payment So if the future outflow for a company are discouted at higher rate of interest than contract rate then the PV would be less and total bond proceed would be less than the face value. Also think from investor prespective value of bond equals to the present value of future inflow (interest payment and final maturity). If an investor is getting higher return in the market then the bond contract rate then investor would be willing to invest in Bond only if they are issued at discount.