Intermediate Accounting II

advertisement

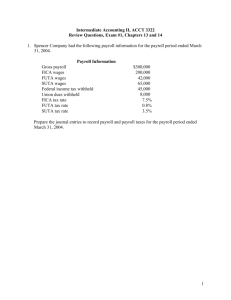

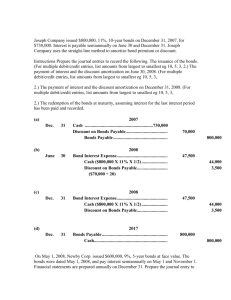

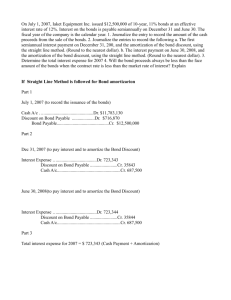

Intermediate Accounting II, ACCT 3322 Solutions to Review Questions, Exam #1, Chapters 13 and 14 1. Spencer Company had the following payroll information for the payroll period ended March 31, 2004. Payroll Information Gross payroll FICA wages FUTA wages SUTA wages Federal income tax withheld Union dues withheld FICA tax rate FUTA tax rate SUTA tax rate $300,000 200,000 42,000 65,000 45,000 8,000 7.5% 0.8% 3.5% Prepare the journal entries to record payroll and payroll taxes for the payroll period ended March 31, 2004. Account Debit Salaries and wages $300,000 FIT payable Union dues payable FICA payable Cash To record payroll for the pay period ended March 31, 2004 Analysis of FICA payable: FICA wages FICA rate FICA payable Credit $45,000 8,000 15,000 232,000 $200,000 7.5% $15,000 1 Account Debit Credit Payroll taxes $17,611 FICA payable $15,000 FUTA payable 336 SUTA payable 2,275 To record payroll taxes for the pay period ended March 31, 2004 Analysis of FUTA payable: FUTA wages FUTA rate FUTA payable $42,000 0.8% Analysis of SUTA payable: SUTA wages SUTA rate SUTA payable $65,000 3.5% $336 $2,275 2. Spencer Company borrowed $100,000 at Bank of the West on October 31, 2004. The note was discounted at 8% and due on August 30, 2005. a. Prepare the journal entry to record the note on Spencer Company’s books at October 31, 2004. Date 11/1/04 Account Debit $93,333 6,667 Credit Cash Discount on notes payable Notes payable $100,000 To record the issuance of a 10-month $100,000 note discounted at 8% Analysis of discount: Face amount Annual interest rate Annual interest Length of the note Discount on notes payable $100,000 8% 8,000 10/12 $6,667 2 b. Calculate the effective rate of interest that Spencer Company paid on the discounted note. Analysis of effective interest rate: Discount Principal Discount for the short period Number of months in short period Monthly interest rate Annualized (multiply by 12 months) Annualized effective interest rate $6,667 $93,333 7.14% 7.14% 10 0.71% 12 8.57% 3. Spencer Company sells pet entertainment centers for $2,500 per unit. The entertainment centers carry a three warranty covering parts and labor. The company has been in business for 25 years and has established a stable pattern of warranty expense. On average the company incurs $50 in labor costs and $25 in parts for each entertainment center sold. During 2005 the company sold 1,000 entertainment centers and incurred warranty costs of $80,000 ($55,000 in labor and $25,000 in parts). On January 1, 2005 the balance in the “Estimated Liability under Warranties” account was $95,000. a. Prepare the journal entry required to record warrant expense for 2005. Account Warranty Expense Estimated Liability under Warranties To record warranty expense for 2005 Analysis of warranty expense: Units sold Warranty expense per unit Warranty expense Debit $75,000 Credit $75,000 1,000 $75 $75,000 b. Prepare the journal entry to record warranty costs incurred during the year of 2005. Account Estimated Liability under Warranties Inventory-parts Labor expense To record warranty costs incurred during 2005 Debit $80,000 Credit $25,000 55,000 3 c. Prepare a t-account analysis of the “Estimate Liability under Warranties” account for the year of 2005. T-Account: Estimated Liability under Warranties Description Debit Credit Beginning balance $95,000 Warranty expense for 2001 75,000 Warranty costs incurred in 2001 $80,000 Ending balance $90,000 4. May 1, 2002, Spencer Company issued $2,000,000, 8%, 5-year bonds dated January 1, 2002. Interest is paid on January 1 and July 1. The bonds were sold to yield 10% interest (the current market rate of interest). Bond issue costs were $120,000. a. Calculate the issue price of the bonds Issue Price of Bonds Payable Principal $2,000,000 PV of $1, n=10, i=5% 0.61391 PV of principal Interest Face value of bonds 2,000,000 Stated annual interest rate 8% Annual interest 160,000 Payments per year 2 Annuity 80,000 PVOA, n=10, i=5% 7.72173 PV of annuity Issue price of bonds $1,227,820 617,738 $1,845,558 b. Calculate the accrued interest on the date of the sale of the bonds. Accrued Interest Face amount Stated interest rate Annual interest Number of payments during year Interest per payment Short period Accrued Interest $2,000,000 8% 160,000 2 80,000 4/6 $53,333 4 c. Prepare the journal entry to record the sale of the bonds. Date 5/1/02 Account Cash Discount on bonds payable Interest expense Bonds payable To record the sale of the bonds on May 1, 2002. Debit $1,898,891 154,442 Credit $53,333 2,000,000 d. Prepare the journal entry to record bond issue costs on May 1, 2002. Date 5/1/02 Account Debit $120,000 Bond issue costs Cash To record bond issue costs Credit $120,000 e. Prepare an amortization table through January 1, 2006. Date 1/1/02 7/1/02 1/1/03 7/1/03 1/1/04 7/1/04 1/1/05 7/1/05 1/1/06 7/1/06 1/1/07 1/1/07 Payment $80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 80,000 2,000,000 $2,800,000 Interest Expense Amortization of Discount $92,278 92,892 93,536 94,213 94,924 95,670 96,454 97,276 98,140 99,059 $12,278 12,892 13,536 14,213 14,924 15,670 16,454 17,276 18,140 19,059 $954,442 $154,442 Balance $1,845,558 1,857,836 1,870,728 1,884,264 1,898,477 1,913,401 1,929,071 1,945,525 1,962,801 1,980,941 2,000,000 0 f. Prepare the journal entry to record the first payment of interest and amortization of discount. Date 7/1/02 Account Debit $92,278 Credit Interest expense Amortization of discount $12,278 Cash 80,000 To record interest expense, amortization of discount and the payment on July 1, 2002. 5 g. Prepare the journal entry on December 31, 2002 to record the accrual of interest, amortization of discount and accrual of interest payable. Date Account Debit Credit 12/31/02 Interest expense $92,892 Amortization of discount $12,892 Interest payable 80,000 To record interest expense, amortization of discount and the accrual of interest payable on December 31, 2002. h. Prepare the journal entry to record the amortization of bond issue costs for 2002. Date Account Debit 12/31/02 Bond issue expense $24,000 Bond issue costs To record the amortization of bond issue costs for 2002. Analysis of amortization of bond issue costs: Bond issue costs Months bonds are outstanding Monthly amortization Months in 2002 Bond issue expense Credit $24,000 $120,000 60 2,000 12 $24,000 i. On September 1, 2005 Spencer Company retired the bonds at 102. Prepare the journal entry to record interest expense, amortization of discount and accrued interest payable through September 1, 2005. Date 9/1/05 Account Interest expense Discount on bonds payable Accrued interest Debit $32,426 Credit $5,759 26,667 To record interest expense, amortization of discount and accrual of interest through September 1, 2005. 6 Interest expense: Interest expense, 1/1/06 Short period Amortization of discount $97,276 2/6 Amortization of discount: Amortization of discount, 1/1/06 Short period Amortization of discount $17,276 2/6 Accrued interest: Interest payment, 1/1/06 Short period Accrued interest $80,000 2/6 $32,425 $5,759 $26,667 j. Prepare the journal entry to amortize bond issue costs through September 1, 2005. Date 9/1/05 Account Debit Bond issue expense $16,000 Bond issue costs To record amortization of bond issue costs through September 1, 2005 Amortization of bond issue costs: Annual amortization Short period Bond issue expense Credit $16,000 $24,000 8/12 $16,000 k. Prepare the journal entry to record the loss on the early retirement of the bonds. Date 9/1/05 Account Debit $2,000,000 26,667 120,716 Bonds payable Accrued interest Loss on retirement of bonds Discount on bonds payable Bond issue costs Cash To record the early retirement of bonds payable on September 1, 2005. Credit $48,716 32,000 2,066,667 7 Unamortized discount on bonds payable: Face amount Carrying amount, 7/1/05 Short period amortization Carrying amount, 9/1/05 Unamortized discount Unamortized bond issue costs: Bond issue costs 2002 amortization 2003 amortization 2004 amortization 2005 amortization Amortization through 9/1/05 Bond issue costs Analysis of cash paid: Face amount of bonds Retirement rate Cost of retired bonds Accrued interest Cash paid Loss on retirement of bonds: Cost of retired bonds Less: Face amount Unamortized discount Carrying amount Unamortized bond issue costs Net carrying amount Loss on retirement of bonds $2,000,000 $1,945,525 5,759 1,951,284 $48,716 $120,000 $24,000 24,000 24,000 16,000 88,000 $32,000 $2,000,000 102 $2,040,000 26,667 $2,066,667 $2,040,000 $2,000,000 48,716 1,951,284 32,000 1,919,284 $120,716 8 5. Spencer Company sold a piece of equipment that originally cost $1,000,000 and had accumulated depreciation of $400,000. The contract terms were as follows: Cash down payment $70,000 $700,000, 10-year, 5% note receivable with interest paid at the end of each year. The market rate of interest on a comparable note would be 8% per annum. a. In the space provided calculate the selling price of the piece of equipment. Analysis of Selling Price Principal Principal PV of 1, n=10, i=8% PV of principal Interest Face amount Stated interest rate Annual interest payments PVOA, n=10, i=8% Present value of interest payments Present value of contract Cash down payment Selling price of equipment $700,000 0.46319 $324,233 $700,000 5% 35,000 6.71008 234,853 559,086 70,000 $629,086 b. In the space provided calculate the gain on the sale of the equipment. Gain on Sale of Equipment Selling price Original cost Accumulated depreciation Book value Gain on Sale of Equipment $629,086 $1,000,000 400,000 600,000 $29,086 c. In the space provided prepare the journal entry to record the sale of the piece of equipment. 9 Account Cash Note receivable Accumulated depreciation Equipment Discount on note receivable Gain on sale of equipment To record the sale of equipment. Debit $70,000 700,000 400,000 Credit $1,000,000 140,914 29,086 d. In the space provided prepare the journal entry to record interest revenue, amortization of the discount and collection of the first interest payment. Account Cash Discount on note receivable Interest revenue Debit $35,000 9,727 Credit $44,727 To record the receipt of the first payment and the amortization of the discount Analysis of amortization: Carrying value of note Effective interest rate Interest revenue Interest received Amortization of discount $559,086 8% 44,727 35,000 $9,727 10