Long-term Liabilities

advertisement

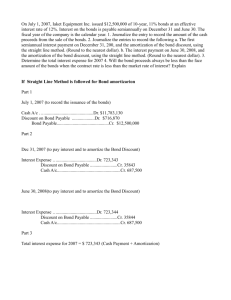

Long-term Liabilities ACCTG 5120 David Plumlee 1 Overview – L-t liabilities Terminology Conceptual issues Bond Valuation Examples Par, below par and above par Journal entries Interest methods Between interest dates page2 How are L-t Liabilities Measured? How are l-t liabilities valued on the balance sheet? What interest rate is used to find the bond’s value? page3 Bond Terminology Serial vs. term Deep discount Debenture Bearer or coupon Callable Convertible page4 Bond Interest Interest Payments equal…. Interest Expense equals…. page5 Data for Example face value = $1,000,000 term = 5 years issued January 1, year 1 interest paid semi-annually, June 30 and December 31 annual coupon rate = 10% annual market (or effective) rate: Case: A = 10% B = 8% C = 12% page6 Bond Issue-Time line page7 Case A: Market = 10% Price = PV of Maturity Value + PV of Interest Annuity page8 Entry to Record Bond Issue page9 Discount or premium? Discounts or Premia arise if the stated interest rate differs from the market rate when the debt is issued page10 Case B: Market = 8% Price = PV of Maturity Value + PV of Interest Annuity page11 Entry To Record Bond Issue page12 Case C: Market = 12% Price = PV of Maturity Value + PV of Interest Annuity page13 Entry To Record Bond Issue page14 What do you do with the discount or premium? Discounts and premia are amortized over the remaining life of the debt Two amortization methods are possible straight-line effective interest page15 Straight-line Amortization Total discount or premium divided by the number of remaining interest periods is expensed each period Interest expense is a constant amount each period Easy to use page16 Effective Interest Amortization Discount or premium is amortized over remaining life of bond Interest Expense is a constant % of carrying value More representationally faithful Required under GAAP, if materially different page17 A Bond Example Alpha Corp. issued $100,000 of 8% (payable semi-annually on June 30 and December 31), 5 year bonds. The bonds were dated and sold on January 1, 1998, at an effective rate of 10 percent. page18 Compute the price of the bond Maturity value of bonds payable PV of $100,000 5 years at 10% 100,000 *.61391 (PVIF 10,5%) PV of $4,000 at 10% annually 4000*7.72173 (PVOA 10,5%) Proceeds from sale of bonds Discount on bonds payable page19 Bond Discount Amortization-SL Cash Date Paid 1-1-00 7-1-00 1-1-01 7-1-01 1-1-02 -0- Interest Expense -0- Discount Amortized Carrying Amt of Bonds -0- 1-1-05 page20 Bond Discount Amortization-EI Cash Date Paid 1-1-00 7-1-00 1-1-01 7-1-01 1-1-02 -0- Interest Expense -0- Discount Amortized Carrying Amt of Bonds -0- 1-1-05 page21 Bond Discount Amortization-EI Cash Date Paid 1-1-00 7-1-00 1-1-01 7-1-01 1-1-02 -04,000 1-1-05 4,000 Interest Expense -0- Discount Amortized Carrying Amt of Bonds -0- 4,000 4,000 4,000 page22 Journal entries - for sale and first interest payment page23 Other issues- Interest period and accounting period do not coincide Apportion interest/discount or premium amounts to proper accounting periods page24 Year end 10/31 instead of 12/31 page25 Extinguishment of debt Retirement of debt before maturity In-substance defeasance Defeasance Irrevocably transfers assets sufficient to retire debt Debtor is legally released from payments GAAP requires gain or loss to be reported as EXTRAORDINARY item if material reported separately on the income statement reported net of related taxes page26 Long-term notes payable Issued for cash and other rights Issued for property, goods…. Need to record the discount and ‘rights’ Use present value of note or goods, whichever is more ‘determinable’ Mortgage notes payable pledges title to property as security page27 Off-balance-sheet financing Obligations that do not meet the strict definition of debt Leases prior to FABS 13 page28 Balance sheet presentation Long term debt-often single line item Disclose next five years of debt payments Off-balance sheet items... Debt Extinguishment--income statement Describe transaction Tax effect per share gain/loss Analysis of debt Times interest earned Debt to total assets page29 Appendix 14 A -- FAS 114 Loan Impairments Creditors perspective Inability to collect loan and interest amounts Creditor determines WHEN and in WHAT amount loan is impaired based on present value of expected future payments and recorded carrying value Journal entries Uncollectible accounts expense Allowance account DR CR page30