Common Financial Ratios

advertisement

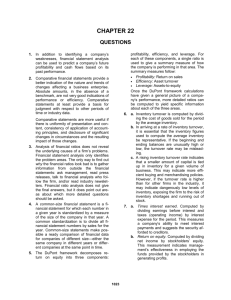

Common Financial Ratios Central to financial analysis is the calculation of financial ratios. A ratio has a numerator and a denominator, which converts the financial data to a percentage. This provides one approach to standardize financial information for useful comparisons. The major ratio categories and the questions they attempt to answer are: Liquidity Activity Leverage Performance Does the company have enough cash and current assets to pay obligations as they come due? How efficient are the operations of the company? What is the mix of equity to debt? How profitable is the company? Common liquidity ratios are: Ratio Current Quick (Acid Test) Cash Operating Cash Flow Calculation Current Assets / Current Liabilities (Cash + Marketable Securities + Net Receivables) / Current Liabilities (Cash + Marketable Securities) / Current Liabilities Cash Flows from Operations / Current Liabilities Discussion Standard ratio to evaluate working capital. This ratio eliminates inventory and other current assets from the denominator, focusing on “near cash” and receivables. Only cash and cash equivalents considered for payment of current liabilities. Evaluates cash-related performance (as measured from the Statement of Cash Flows) relative to current liabilities. Common activity ratios are: Ratio Inventory Turnover Ratio COGS / Average Inventory Receivables Turnover Sales / Average Accounts Receivables Payables Turnover Working Capital Turnover Fixed Asset Turnover Sales / Average Accounts Payables Sales / Average Working Capital Sales / Average Fixed Assets Total Asset Turnover Sales / Average Total Assets Discussion Measures inventory management. Inventory should be turned over rapidly, rather than accumulating in warehouses. Measures the effectiveness of credit policies and needed level of receivables investment for sales. (Also called the collection period). Payables represent a financing source for operations. Measures how much working (operating) capital is needed for sales. Measures the efficiency of net fixed asset (property, plant & equipment after accumulated depreciation) investments. Represents the overall (comprehensive) efficiency of assets to sales. Activity ratios can be converted to days “held,” measures that are easily compared across firms: Ratio Average Days Inventory in Stock Average Days Receivables Outstanding Average Days Payable Outstanding Length of Operating Cycle Calculation 365 / Inventory Turnover 365 / Receivables Turnover 365 / Payables Turnover 365 [(1 / Inventory Turnover) + (1 / Receivables Turnover)] ; equivalent to average days inventory + average days receivables outstanding Common leverage ratios are: Ratio Debt to Equity Calculation Total Liabilities / Total Stockholders’ Equity Debt Ratio Total Liabilities / Total Assets (Net Income + Interest Expense + Tax Expense) / Interest Expense Interest Coverage (Times Interest Earned) Long-term Debt to Equity Debt to Market Equity Long-term Liabilities / Total Stockholders’ Equity Total Liabilities at Book Value / Total Equity at Market Value Discussion Direct comparison of debt to equity stakeholders and the most common measure of capital structure. A broader definition, stating debt as a percent of assets. This is a direct measure of the firm’s ability to meet interest payments, indicating the protection provided from current operations. A long-term perspective of debt and equity positions of stakeholders Market valuation may represent a better measure of equity than book value. Most firms have a market premium relative to book value. Common profitability ratios are: Ratio Gross Margin Calculation (Sales – COGS) / Sales Return on Sales Net Income / Sales Return on Assets Net Income / Average Total Assets Pretax Return on Assets Earnings Before Interest & Taxes / Average Total Assets Net Income / Average Total Stockholders’ Equity Common Dividends / Net Income Return on Total Equity Dividend Payout Discussion This captures the relationship between sales and manufacturing (or merchandising) costs. (Also, called the gross profit margin.) Measures the relationship of the bottom line to sales and thus captures sales to total costs of sales. (Also called the net profit margin). Measures the firm’s efficiency in using assets to generate earnings. Alternatively stated, it captures earnings to all providers of capital Measures earnings from operations on a pretax and pre-interest expense basis. Measures earnings to owners as measured by net assets. Measures the percent of earnings paid out to common stockholders. Du Pont Model: Ratio Profitability (Return on Sales) x Activity (Asset Turnover) = Return on Assets x Solvency (Common Equity Leverage) = Return on Equity Calculation Net Income / Sales Sales / Average Total Assets Net Income / Average Total Assets Average Total Assets / Average Common Equity Net Income / Average Common Equity Below are some alternative ratios: Liquidity Cash to Current Assets Cash Position Current Liability Position Leverage Bonded Debt to Equity Debt to Tangible Net Worth Activity Cash Turnover Payables Turnover Profit Operating Profit Margin Pretax Profit Margin Return on Common Equity Financial Leverage Index (Cash + Marketable Securities) / Current Assets Cash / Total Assets Current Liabilities / Total Assets Bonded Debt / Stockholders’ Equity Total Liabilities / (Common Equity – Intangible Assets) Sales / Average Cash (which usually includes marketable securities) Sales / Average Accounts Payable Income From Continuing Operations (After Tax) / Sales Income Before Tax / Sales (Net Income – Preferred Dividends) / Average Common Equity Return on Equity / Return on Assets A Summary of Market Ratios Book Value Per Share Earnings- based Growth Models Market-to-book Price Earnings Ratio (PE) Price Earnings Growth Ratio (PEG) Sales-to-market Value Dividend Yield Total Stockholders’ Equity / Number of Shares Outstanding P = kE / (r-g), where E=earnings, k=dividend payout rate, r=discount rate, & g=earnings growth rate (Stock Price x Number of Shares Outstanding) / Total Stockholders’ Equity Stock Price / EPS Equity or net assets, as measured on the balance sheet Valuation models that discount earnings and dividends by a discount rate adjusted for future earnings growth Measure of accounting-based equity Measure of market premium paid for earnings and future expectations PE / Earnings Growth Rate PE compared to earnings growth rates, a measure of PE “reasonableness” Sales / (Stock Price x Number of A sales activity ratio based on Shares Outstanding) market price Dividends Per Share / Stock Direct cash return on stock Price investment