I. Ratio Analysis

advertisement

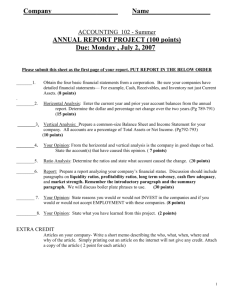

Chapter 13: Financial Statement Analysis Outline: I. II. III. Ratio Analysis Du Pont Identity Caveats Motivation: - A picture of financial health of a firm. - Widely available and used information. I. Ratio Analysis Four major uses: 1. Stock valuation. 2. The identification of internal corporate variables affecting a stock’s systematic risk (beta). 3. Assigning credit ratings on bonds. 4. Predicting bankruptcy. Financial ratios need to be compared to some benchmarks over time. A financial number or ratio is of little use itself. Typically we have two types of comparison: 1. Cross-sectional analysis: compared to peers. 2. Time-series analysis: compared to the firm’s historical performance. Common size statements: a common size balance sheet (income statement) expresses all balance sheet (income statement) account as a percentage of total assets (sales). These ratios are useful to quickly compare two different-size firms and to examine trends over time within a single firm. Opinion: Ratio analysis is more useful for identifying bad companies. Six internal liquidity (solvency) ratios: indicate the ability of the firm to meet future short-term (usually within 1 year) financial obligations. 1. Current ratio = current assets / current liabilities - You do not want it to be too below the norm (industry average, sometimes the aggregate economy average). 2. Quick ratio = (cash + marketable securities + receivables) / current liabilities - You do not want it to be too below the norm. 3. Cash ratio = cash and marketable securities / current liabilities - You do not want it to be too below the norm. - The most conservative liquidity ratio. 4. Receivables turnover = net annual sales / average receivables where, average receivables = (year-beginning receivables + year-end receivables) / 2 Average receivable collection period = 365 / annual receivables turnover - This collection period should be related to the firm’s credit policy. Typically, you want this number to be slightly below the norm. - You do not want this number to deviate too much from the norm. If this number is too high, (1) too much capital ties up in receivables, and (2) the possibility of bad debts. If this number is way too low, credit terms may be too stringent and it may hurt sales. 5. Inventory turnover = cost of good sold / average inventory where, average inventory = (year-beginning inventory + year-end inventory) / 2 Average inventory processing period = 365 / annual inventory turnover - You want this processing period to be slightly lower than the norm. 6. Cash conversion cycle = average receivables collection period + average inventory processing period payables payment period where, payable payment period = 365 / payable turnover, payable turnover = cost of goods sold / average trade payables, average trade payables = (year-beginning payables + year-end payables) / 2. - Cash conversion cycle measures the number of days in which cash is tied up in assets. - You want this number to be slightly lower than the norm. Three sets of financial risk measures: 1. Proportion of debt (balance sheet) ratios (1) Debt-equity ratio = total long-term debt / total equity (2) Long-term debt/total capital ratio = total long-term debt / total long-term capital (3) Total debt ratio = total liabilities / total liabilities and equity 2. Earnings flow ratios - Example: interest coverage = operating profit (EBIT) / debt interest charges - Relates the flow of earnings that is available to meet the required interest and lease payments. 3. Cash flow ratios - Relates the cash flow available from operations to either interest expenses, total fixed charges or the face value of outstanding debt. Two subcategories of operating performance measures: 1. Operating Efficiency Ratios: (1) Total asset turnover = net sales / average total net assets where, net assets = gross assets depreciation - The effectiveness of the firm’s use of its total asset base. - Typically, you want it a little bit higher. But, there is a range of optimal turnover values: you do not want it too high. (2) Net fixed asset turnover = net sales / average net fixed assets - The firm’s utilization of fixed assets. - Typically, you want it a little bit higher. But, there is a range of optimal turnover values: you do not want it too high. (3) Equity turnover = net sales / average equity 2. Operating Profitability Ratios: (1) Gross profit margin = gross profit / net sales, where gross profit = net sales costs of goods sold. - It reveals cost structure. (2) Operating profit margin = operating profit (EBIT) / net sales - It takes sales, general, and administrative expenses into consideration. - The variability of the operating profit margin over time is a prime indicator of the business risk for a firm. (3) Net profit margin = net income / net sales - It takes interest expenses and taxes into consideration. (4) Return on total capital = (net income + interest expense) / average total capital where, total capital is total liabilities and equity. The interest expense is added because it is the return to debt-holders. - This rate of return should match or exceed the perceived risk of the firm. (5) Return on owner’s equity = net income / average total equity - ROE is the bottom-line ratio to the owners. - This ratio reflects the rate of return on the equity capital provided by the owners. II. The Du Pont Identity net income net sales total assets net sales total assets equity = profit margin total asset turnover financial leverage ROE = In other word, there are three potential sources to enhance ROE. III. Caveats 1. Financial ratios are subject to accounting manipulation, e.g., earnings management and earnings quality. 2. Differences in (international) accounting principles make comparison difficult. 3. The usual benchmark (e.g., industry average) can be meaningless. 4. The reliability of financial statements can be a concern. 5. The process is backward looking, while investment is about future. End-of-chapter problem sets: #1, #3, #5