Ch4

Chapter 04 - The Value of Common Stocks

CHAPTER 4

The Value of Common Stocks

Answers to Problem Sets

1. a. True. This is a condition for equilibrium in well-functioning capital markets.

All stocks in a particular risk class must offer the same rate of return. If a certain stock, for example, is priced above others in the equivalent risk class, investors would sell their shares to buy cheaper shares from companies in the same risk class. This would force the price of that higher priced stock down to the equilibrium price. The same happens for a stock priced below equilibrium —investors would rush to buy the stock, sending its price back up. b. True. When shareholders buy a particular stock, they receive cash from the company in the form of future dividends. The rate of return that investors expect is the expected dividend per share plus the expected price appreciation for the stock: r =

DIV + ( P

1

– P

0

) / P

0

.

Est. Time: 01-05

2. Investors who buy stocks may get their return from capital gains as well as dividends. But the future stock price always depends on subsequent dividends.

There is no inconsistency.

Est. Time: 01-05

3. P

0

= (5 + 110)/1.08 = $106.48.

Est. Time: 01-05

4. r = 5/40 = .125, or 12.5%.

Est. Time: 01-05

5. P

0

= 10/(.08

− .05) = $333.33.

Est. Time: 01-05

6. First we must determine the price based on dividends per share for years 1

–4.

Then, we must account for the growth in earnings per share. Wit h next year’s EPS at $15 and EPS growing at 5% per year, the forecasted EPS at year 4 is $15 x

(1.05) 4 = $18.23. Therefore, the forecasted price per share at year 4 is $18.23/.08

= $227.91. Therefore, the current price is:

4-1

© 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 04 - The Value of Common Stocks

Est. Time: 01-05

7. Price = EPS

1

/ r + PVGO. Recall that the price = DIV

1

/( r

– g ). Therefore, price =

$10/(.08 - .05) = $333.333. Therefore, 15/.08 + PVGO = 333.33; therefore PVGO =

$145.83.

Est. Time: 01-05

8. With next year’s dividend at $10/share and next year’s price at $350/share

(calculated by taking the current year’s price of $333.33 x a 5% growth rate), Z’s forecasted dividends and prices grow as follows:

Calculate the expected rates of return:

From year 0 to 1:

10

( 350

333 .

33 )

333 .

33

.

08

From year 1 to 2:

10 .

50

( 367 .

50

350 )

350

From year 2 to 3:

11 .

03

( 385 .

88

367 .

50 )

367 .

50

.

08

.

08

As shown, all three investors expect an 8% return over their respective one-, two.-, and three-year investments.

4-2

© 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 04 - The Value of Common Stocks

Est. Time: 06-10

9. a. False. The value of a share equals the present value of the expected future dividends per share. Earnings per share are not used to calculate share price because part of earnings are used to reinvest in plant, equipment, and working capital.

b. True. The expected return is equal to the yearly dividend divided by the share price. If the firm does not grow and all earnings are paid out as dividends, then the expected return is also equal to the EPS/share price. Therefore, P

0

=

DIV1/ r = EPS1/ r . We must still account for the present value of the growth opportunities, however, so P

0

= EPS

1

/ r + PVGO.

Est. Time: 01-05

10. PVGO = 0, and EPS

1

equals the average future earnings the firm could generate

under no-growth policy.

Est. Time: 01-05

11. Free cash flow is the amount of cash left over and available to pay out to investors after all investments necessary for growth. In our simple examples, free cash flow equals operating cash flow minus capital expenditure. Free cash flow can be negative if investments are large.

Est. Time: 01-05

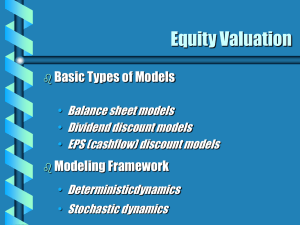

12. The value at the end of a forecast period. Horizon value can be estimated

using the constant-growth DCF formula or by using price –earnings or market–

book ratios for similar companies.

Est. Time: 01-05

13. If PVGO = 0 at the horizon date, H , horizon value = earnings forecasted for H +

1 divided by r .

Est. Time: 06-10

18. P

A

DIV

1 r

$10

0.10

$100.00.

P

B

r

DIV

1

g

0.10

$5

0 .04

$83.33.

4-3

© 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 04 - The Value of Common Stocks

P

C

DIV

1

1.10

1

DIV

1.10

2

2

DIV

3

1.10

3

DIV

4

1.10

4

DIV

5

1.10

5

DIV

1.10

6

6

DIV

7

0.10

1

1.10

6

.

P

C

5.00

1.10

1

6.00

1.10

2

7.20

1.10

3

8.64

1.10

4

10.37

1.10

5

12.44

1.10

6

12.44

0.10

1

1.10

6

$104.50.

At a capitalization rate of 10%, Stock C is the most valuable.

For a capitalization rate of 7%, The results are:

P

A

= $142.86

P

B

= $166.67

P

C

= $156.48

Therefore, Stock B is the most valuable at a 7% capitalization rate.

Est. Time: 06-10

19. a. P

0

DIV

0

r

DIV

1

g

$1.35

$1.35

0.095

1.0275

0 .0275

$21.90.

b. First, compute the real discount rate as follows:

(1 + r nominal

) = (1 + r real

)

(1 + inflation rate)

1.095 = (1 + r real

)

1.0275

(1 + r real

) = (1.095/1.0275) – 1 = .0657 = 6.57%

In real terms, g = 0. Therefore:

P

0

DIV

0

r

DIV

1

g

$1.35

$1.35

0.0657

$21.90

Est. Time: 06-10

20. a. Plowback ratio = 1 – payout ratio = 1.0 – 0.5 = 0.5.

Dividend growth rate = g = plowback ratio

× ROE

= 0.5

× 0.14 = 0.07.

Next, compute EPS

0

as follows:

ROE = EPS

0

/Book equity per share

0.14 = EPS

0

/$50

EPS

0

= $7.00

Therefore: DIV

0

= payout ratio × EPS

0

= 0.5 × $7.00 = $3.50.

EPS and dividends for subsequent years are:

Year EPS

0 $7.00

1 $7.00 × 1.07 = $7.4900

2 $7.00 × 1.07

2 = $8.0143

DIV

$7.00 × 0.5 = $3.50

$7.4900 × 0.5 = $3.50 × 1.07 = $3.7450

$8.0143 × 0.5 = $3.50 × 1.07

2 = $4.0072

4-4

© 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 04 - The Value of Common Stocks

3 $7.00 × 1.07

3 = $8.5753

4 $7.00 × 1.07

4 = $9.1756

$8.5753

$9.1756

× 0.5 = $3.50 × 1.07

× 0.5 = $3.50 × 1.07

3

4

= $4.2877

= $4.5878

5 $7.00 × 1.07

4 × 1.023 = $9.3866 $9.3866 × 0.5 = $3.50 × 1.07

4 × 1.023 = $4.6933

EPS and dividends for year 5 and subsequent years grow at 2.3% per year, as indicated by the following calculation:

Dividend growth rate = g = plowback ratio × ROE = (1 – 0.8) × 0.115 = 0.023. b. P

0

DIV

1

1.115

1

DIV

2

1.115

2

DIV

3

1.115

3

DIV

1.115

4

4

DIV

5

0.115

1

1.115

4

3.745

1.115

1

4.007

1.115

2

4.288

1.115

3

4.588

1.115

4

4.693

0.115

0.023

1

1.115

4

$45.65

The last term in the above calculation is dependent on the payout ratio and the growth rate after year 4.

Est. Time: 11-15

4-5

© 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.