Missing Solutions BMA Chapter 4 18. a. Plowback ratio = 1 – payout

advertisement

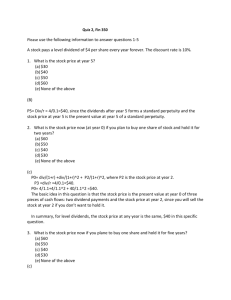

Missing Solutions BMA Chapter 4 18. a. Plowback ratio = 1 – payout ratio = 1.0 – 0.5 = 0.5 Dividend growth rate = g= Plowback ratio × ROE = 0.5 × 0.14 = 0.07 Next, compute EPS0 as follows: ROE = EPS0 /Book equity per share 0.14 = EPS0 /$50 EPS0 = $7.00 Therefore: DIV0 = payout ratio × EPS0 = 0.5 × $7.00 = $3.50 EPS and dividends for subsequent years are: Year 0 1 2 3 4 5 EPS $7.00 $7.00 × 1.07 = $7.4900 $7.00 × 1.072 = $8.0143 $7.00 × 1.073 = $8.5753 $7.00 × 1.074 = $9.1756 $7.00 × 1.074 × 1.023 = $9.3866 DIV $7.00 × 0.5 = $3.50 $7.4900 × 0.5 = $3.50 × 1.07 = $3.7450 $8.0143 × 0.5 = $3.50 × 1.072 = $4.0072 $8.5753 × 0.5 = $3.50 × 1.073 = $4.2877 $9.1756 × 0.5 = $3.50 × 1.074 = $4.5878 $9.3866 × 0.5 = $3.50 × 1.074 × 1.023 = $4.6933 EPS and dividends for year 5 and subsequent years grow at 2.3% per year, as indicated by the following calculation: Dividend growth rate = g = Plowback ratio × ROE = (1 – 0.08) × 0.115 = 0.023 b. P0 DIV 3 DIV1 DIV 2 DIV 4 1 DIV 5 1 2 3 4 4 1.115 1.115 1.115 1.115 0.115 1.115 3.745 4.007 4.288 4.588 4.693 1 $45.65 1 2 3 4 4 1.115 1.115 1.115 1.115 0.115 - 0.023 1.10 The last term in the above calculation is dependent on the payout ratio and the growth rate after year 4. 19. DIV1 8.5 g 0.075 0.1175 11.75% P0 200 a. r b. g = Plowback ratio × ROE = (1 − 0.5) × 0.12 = 0.06 = 6.0% The stated payout ratio and ROE are inconsistent with the security analysts’ forecasts. With g = 6.0% (and assuming r remains at 11.75%) then: P0 DIV1 8.5 147.83 pesos r g 0.1175 - 0.06 Chapter 5 12. a. Because Project A requires a larger capital outlay, it is possible that Project A has both a lower IRR and a higher NPV than Project B. (In fact, NPVA is greater than NPVB for all discount rates less than 10 percent.) Because the goal is to maximize shareholder wealth, NPV is the correct criterion. b. To use the IRR criterion for mutually exclusive projects, calculate the IRR for the incremental cash flows: C0 C1 C2 IRR A-B -200 +110 +121 10% Because the IRR for the incremental cash flows exceeds the cost of capital, the additional investment in A is worthwhile. c. NPVA $400 $250 $300 $ 81.86 1.09 (1.09) 2 NPVB $200 $140 $179 $79.10 1.09 (1.09) 2