Brief description of the modern wind turbine industry. Wind turbine

advertisement

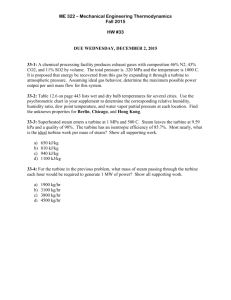

1. Brief description of the modern wind turbine industry. Wind turbine industry undergone drastic changes since its interception several years ago. Because of technology and wind energy demand, the modern wind turbine is based on manufacturing of large turbines. In 1980, the hub height and rotor were 30 m and 15 m respectively. In 2005, both hub height and rotor diameter were 120 m and 115 m respectively. This is showing how the turbine industry changed over the last two decades. Describe the industry’s competitive structure, i.e.: fragmented or consolidated. The firm competitive structure is intense in a way that few firms operate in the industry. According to Wikipedia, there are fifteen wind turbine manufacturers in the industry. Until more firms enter into the industry, the turbine industry is consolidated and may remain consolidated for sometime. This is because the cost of entry is high, preventing firms with low capital from entering into the industry. Which theoretical market structure does it approximate? The wind turbine industry approximates oligopoly market structure. We arrived into this conclusion because the top four firms control more than 40% of the market share. Because concentration ratio for top four firms is more than 60%, the industry is not only has oligopoly structure, but tight oligopoly market structure. In addition, there are few firms in the industry with the top five controlling larger (82%) market share. Calculate the four firm concentration ratios and the Herfindahl index. Accord to 2006 Merrill Lynch research article, the four firms (Vestas, Gamesa, GE Wind and Enercon) concentration ratio constitutes 74%. The Herfindahl index of the same year equals 1664. See the table below. Firm 2006 Market Share (%) Contration Ratio Herfindal index Vestas 28 28% 784 Gamesa 16 16% 256 GE Wind 15 15% 225 Enercon 15 15% 225 SuZlon 8 64 Siemens 7 49 Nordex 3 9 Repower 3 9 Acciona 3 9 Goldwind 3 9 Other 5 25 Total 74% 1664 What are the prospects for growth and their ability to earn profits in both the short run and long run? The prospect for growth in the industry is high. It is projected that the world market for turbines is to increase 4.9 percent annually to $106b in 2012, especially the large turbine engine. The ability to earn profits in the short run is promising. This is because there are no many firms in the industry. However, this profitability may change in the long run when firms which are not yet in the industry realizes how profitable the industry is and would be and may wish to inter into the market. In short, profitability would be competed away in the long run, but long run is still decades away because the large wind turbine industry is in the development/young stage. Below is another source projecting demand for wind turbines to 2015 What are the financial opportunities for investors in the wind turbine industry? The financial opportunities for investors are many. First, the world is prospecting on alternative energy, which wind energy is the main focus. The development of large turbines to generate wind energy is and will be of high demand. Please see the chart below. It is showing the demand for turbines sales to 2015. Also, investing in turbine part supplies is another area of financial opportunity for investors. In addition, installation expertise is required, and firms specializing in this area may as well be another source of investment. What is the role of government policy in promoting this industry and identify the causes of potential risks to investors. The role of government is increasing in promoting the industry. The US department of energy, with the US as high consumer of wind energy, has a goal of 20% Wind Energy by 2030. One factor for government support is environmental concern such as Global Warming. The current source of energy is associated with harm (C02) to the environment and pressure is increasing to move away from coal and oil as the main source of energy supply. Second is scarcity of the current sources of energy. Oil could be depleted in some decades to come and the world needs to find alternative source of energy as a back up before oil is completely deleted. Third is security concern of the nations. For example, US depend large on oil in Middle East. This is threatening US economy as oil producing countries uses oil supply to leverage their political gain. The causes of potential risks to investors include: Government taxation Unforeseen impact on industry Future demand Alternative source of energy such as solar hydraulic energy Reference http://www.windharvest.com/ World Demand for Turbines to Reach $106b in 2012: Power Engineering www.power-eng.com Wind Energy-Phoenix 2008 U.S. Department of Energy www.energy.gov Merrill Lynch’s research article: Wind turbine manufactures; here comes pricing power